Web Developers

From October 13–15, London’s Olympia became a vivid blend of animated characters, creative designers, lifestyle brands, and film studios and game companies promoting future blockbuster characters and brands at Brand Licensing Europe 2015. At this year’s event, exhibitors were divided into three different zones: Art, Design & Image, Brands & Lifestyle, and Character & Entertainment.

Brand licensing is the transaction whereby manufacturers, retailers or service providers pay the owner of a brand for the right to use that brand on their products or services. Here, we outline some top-line figures on the industry and discuss some of our key takeaways from Brand Licensing Europe 2015.

Overview of the Brand-Licensing Market

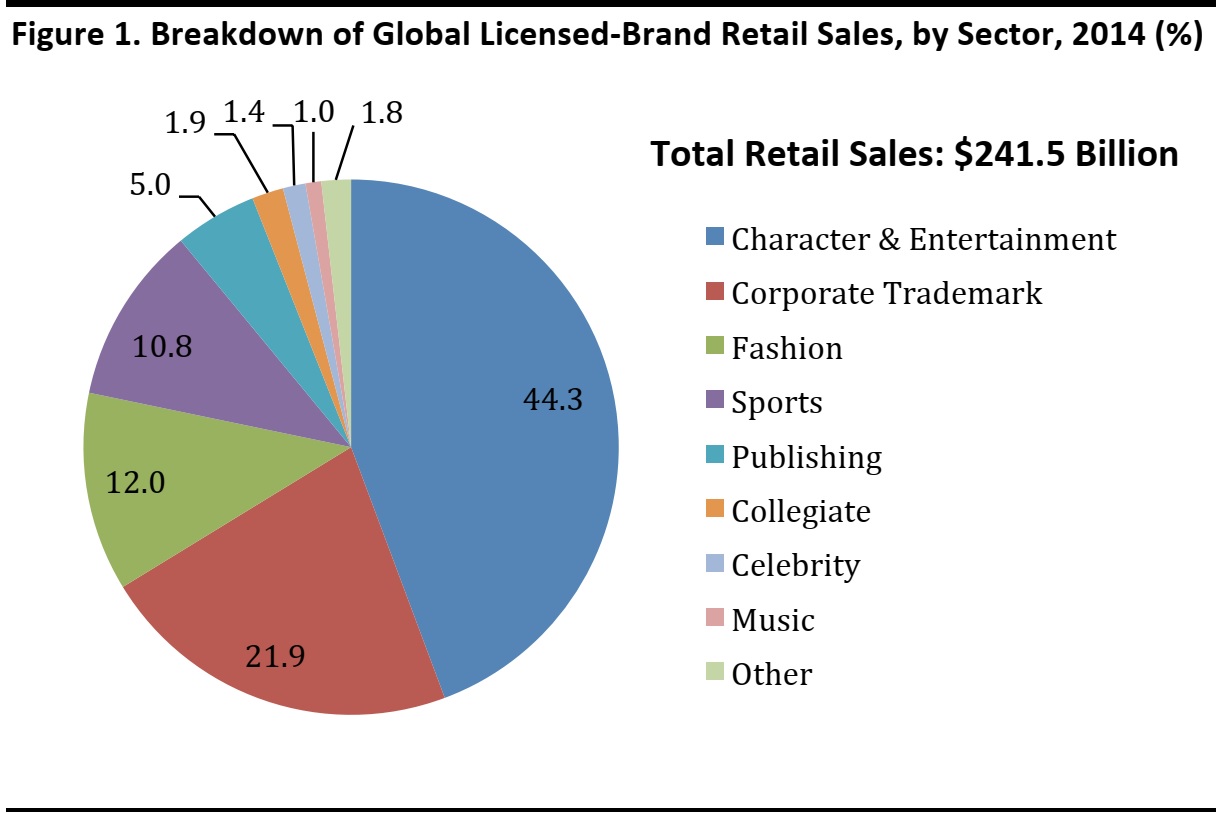

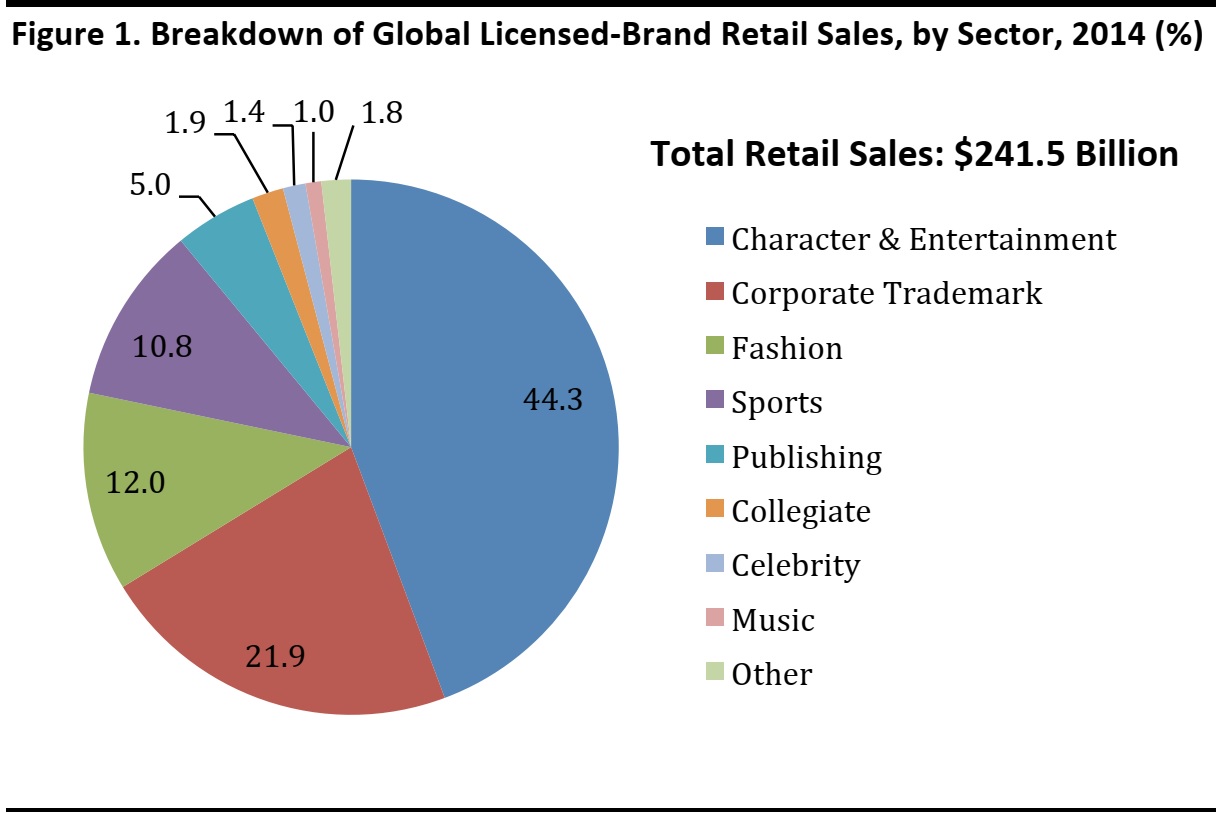

The market for licensing brands, including celebrities and characters, is huge, for both licensors (those who own a brand) and licensees (those who pay to use a licensor’s brand). Licensees gained from an estimated $241.5 billion in retail sales of licensed products in 2014, according to LIMA’s Annual Global Licensing Study. Meanwhile, licensed brands gained from an estimated $13.4 billion in royalty revenues in 2014, LIMA says. By 2014 retail revenues:- The US and Canada were the dominant regions globally, with a combined share of nearly 60% of the total market and $144 billion in retail sales. Europe was the second-biggest region for sales of licensed-brand products, at 23.6% of the global total, and Asia accounted for under 10%.

- Character and entertainment was the dominant brand-licensing sector, at $107 billion, with 44.3% market share of the global total last year.

- The second-largest sector, corporate trademark, was valued at $53 billion, followed by fashion at $29 billion and sports at $26 billion.

Source: LIMA (International Licensing Industry Merchandisers’ Association)/FBIC Global Retail & Technology

What Is Brand Licensing?

Kelvyn Gardner from LIMA UK outlined the basics in brand licensing as he emphasized that intellectual property has become a multibillion-dollar industry in the 21st century:- Manufacturers buy a license from the creators of films or TV shows, sports teams, celebrities or other brand owners—with “brand” being widely defined.

- The licensee gains an additional revenue stream from the intellectual property.

- The key benefit for a manufacturer buying a license is increased sales due to brand recognition. Another benefit is that buying a license provides the manufacturer with an alternative to developing its own brand.

- Royalties paid for licenses vary from 3%–30% of the value of each sale. Most royalties paid are in the range of 10%–14%.

Brand Licensing at the Category Level

Max Templeman from market research firm GfK focused on a number of product categories and took us through some snapshots of different market segments:- In UK headphone sales, some 65% of licensed brands are in the celebrity category, with character (27%) and sport (6%) brands their closest rivals.

- In the £18 million fashion eyeglass frames segment, Boss Orange, Ralph Lauren and Tiffany are by far the most valuable licensed brands in the UK, accounting for more than £12 million of segment sales.

- In watches, some 56% of branded goods are under fashion-brand licenses, with 10% featuring character brands and 6% sport brands. Licensed brands remain a small part of the watch market, according to Templeman; other brands generate sales of around five times the value of the licensed-brand watch segment.

Brand Licensing at the Retail Level

We also stopped by to hear from Nick Everitt, Global Insight and Strategy Director at research firm Planet Retail, who talked about trends and the opportunities for licensing at the retail level. The growth of discount retailers such as Aldi and Lidl is a big story in grocery retail across a number of countries, but especially in the UK. Everitt highlighted the growing potential of licensing brands to these retailers:- Some of the discounters are moving upmarket, Everitt said, suggesting opportunities to bring more branded lines into their stores.

- Discounters are more willing to acquire brand licenses to put on their private label lines than they used to be. For instance, Lidl France has put the Finding Nemo brand on its Cien kids’ toiletries line.

- Development of tiered private label ranges, including more premium or niche brands, can offer more potential for licensing. For instance, the REMA 1000 supermarket chain in Norway features the licensed image of a celebrity chef on some of its private label food lines.

Key Takeaways

- The market for licensed brands is big, but there are opportunities to grow it further.

- Brands remain key drivers in consumers’ decisions about where to shop, even as no-frills, discount retailing grows.

- Opportunities lie in spotting the possibilities and potential specific to each retailer, retail sector, category segment and national market.