Bosideng International Holdings

Sector: Apparel and footwear

Countries of operation: Mainly operates in China and has businesses in Europe, including in Switzerland

Key product categories: Apparel, especially down apparel

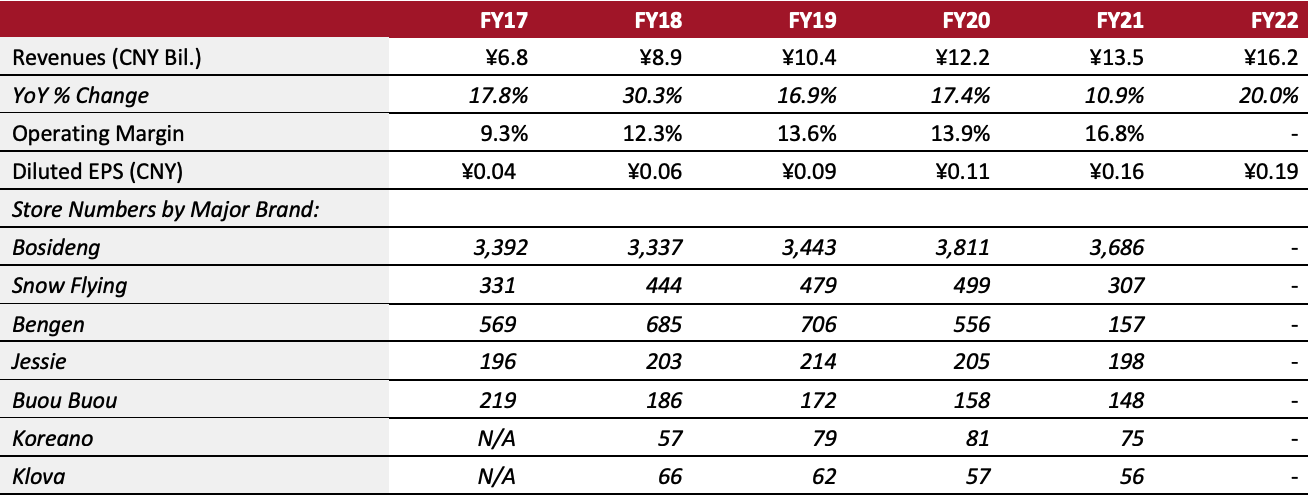

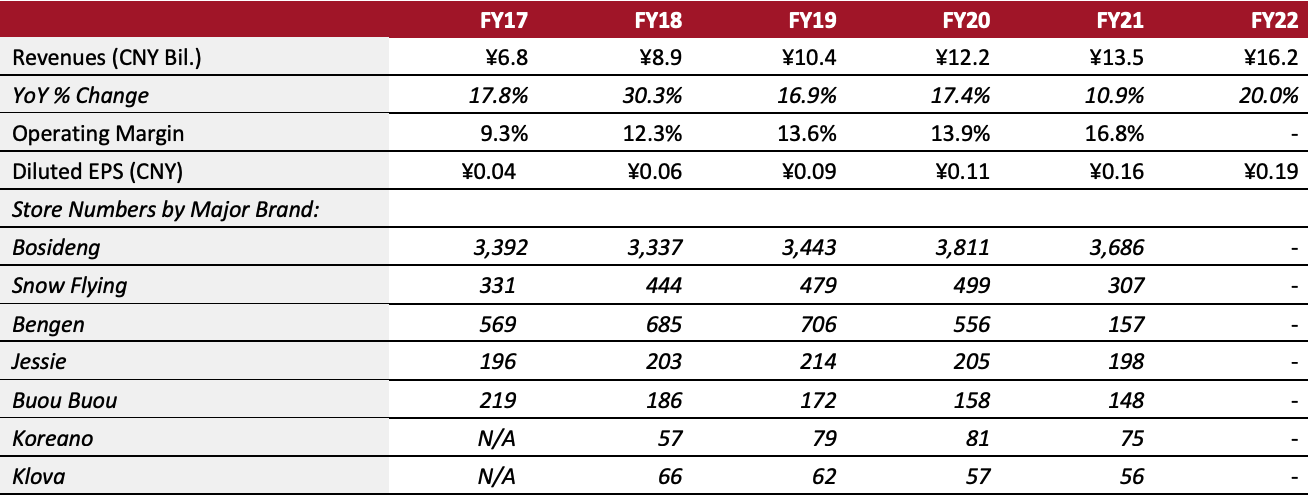

Annual Metrics

[caption id="attachment_153502" align="aligncenter" width="700"]

Fiscal year ends on March 31 of the same calendar year

Fiscal year ends on March 31 of the same calendar year[/caption]

Summary

Founded in 1975 and headquartered in Suzhou, China, Bosideng International Holdings is a clothing company specializing in down apparel. The company’s primary market is China, but it also operates businesses in Europe, including in Switzerland. The company’s business segments include: branded down apparel (with brands including Bengen, Bosideng and Snow Flying), diversified apparels (brands including Sameite), ladieswear (brands including Buou Buou, Jessie, Klova and Koreano) and original equipment manufacturing management. As of September 2021, the company operates 3,654 Bosideng stores, 297 Snow Flying stores, 187 Jessie stores, 143 Buou Buou stores, 80 Koreano stores, 56 Klova stores and 50 Bengen stores.

Company Analysis

Coresight Research insight: In recent years, Bosideng International’s revenue has grown steadily—and its innovation and improvements for its brands, designs, products and sales channels have proven fruitful. The company has benefitted from the trend of Chinese consumers gravitating toward “light” fashion amid the pandemic, given its focuses on down apparel—the segment accounted for over 80% of the company’s revenues in fiscal 2021 (ended March 31, 2021). The company has also been expanding its European market—however, not always successfully. The company opened stores in the UK, but withdrew from the country in 2017. While we believe that Bosideng International is influential in China, its globalization strategy still needs to be refined.

| Tailwinds |

Headwinds |

- Chinese consumers’ shift toward “light” fashion, benefitting the company due to its focus on down jackets

- The Chinese government’s policy to expand domestic apparel production and demand

|

- A challenging overall environment as the pandemic continues to disrupt operations and manufacturing velocity

- Pressure from competitors such as Eral, Junyu and Uniqlo

|

Strategy

Bosideng International Holdings mainly focuses on the following three strategies goals:

1. Become a top brand in China and expand globally

- Continue to enhance brand presence both domestically and internationally. For example, the company made an appearance at the international Fashion Weeks in London, Milan, and New York in late 2020 and early 2021. The company also participated in the “China Brand Day” in late 2020 and was listed in “Strong Country Brand Project” by CCTV, a Chinese state-owned broadcaster.

- Publicize brands in various platforms of new media and We Media to enhance brand presence.

2. Focus on well-designed, high-quality products backed by innovation

- Create well-designed products. For example, the brand Bosideng has been collaborating with French designer Jean Paul Gaultier and other global designers.

- Create high-quality products. For example, with its collection of winter products, the company supported Mount Everest climbers to reach the summit and facilitated scientific investigations in the Antarctic. The collection also won the Golden Award for Excellent Industrial Design in China 2020 and the Global Design Award of ISPO Award 2021.

3. Enhance transformation into new retail and upgrade channels

- Make persistent efforts to move into new retail, particularly promoting integrated commodity operations and nationwide inventory management, to effectively support store-level operations and improve efficiencies.

- Grow store estate. The company has opened outlet stores in CapitaLand, Intime and Wanda, among other shopping malls, and established flagship stores in Beijing, Chengdu, Hangzhou, Shanghai and other first-and-second-tier cities over the past few years.

- Upgrade channel mix. The company has used effective precision marketing through livestreaming e-commerce. Bosideng’s Tmall flagship store took the lead in Singles Day and 12.12 Shopping Day’s massive promotional activities, ranking high in the domestic apparel category in terms of sales from 2019 to 2021.

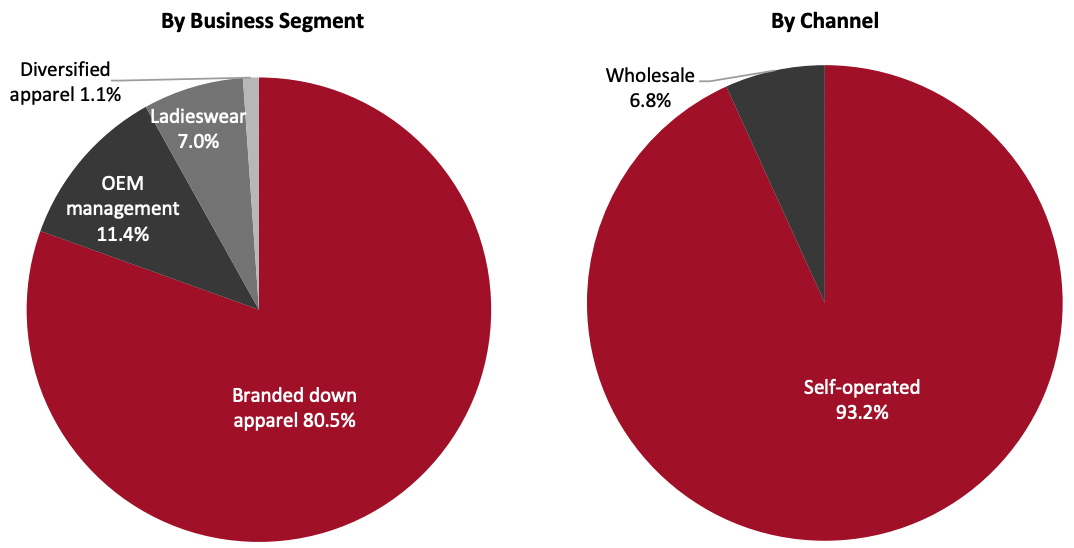

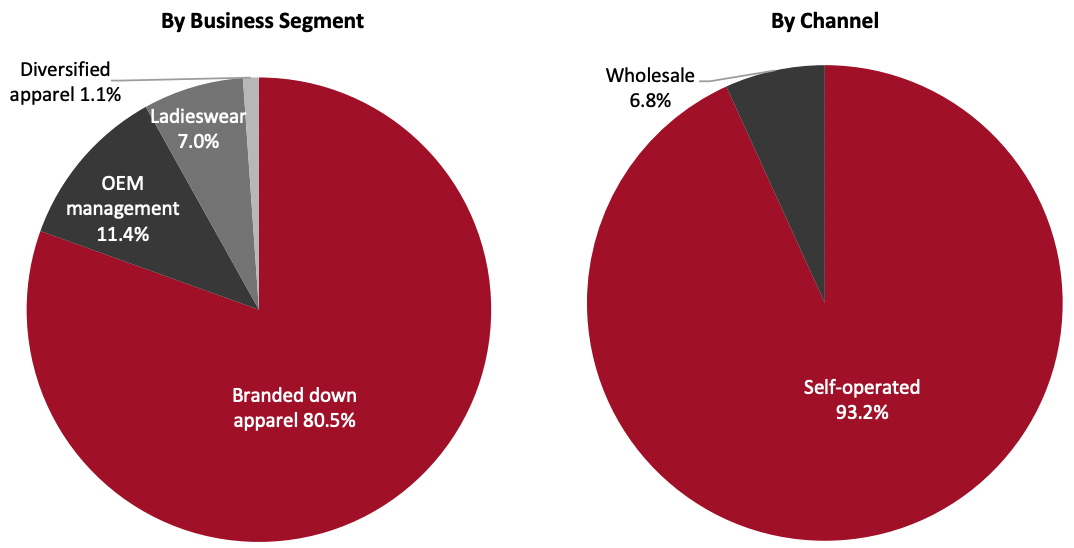

Revenue Breakdown (FY21)

[caption id="attachment_148666" align="aligncenter" width="700"]

Source: Bosideng International Holdings Limited

Source: Bosideng International Holdings Limited[/caption]

Company Developments

| Date |

Development |

| April 19, 2022 |

Moody's and S&P assign credit ratings of "Baa3 /Stable" and "BBB- / Stable)" to Bosideng, respectively. |

| February 18, 2022 |

MSCI upgrades Bosideng's ESG Rating to "BBB", demonstrating the capital market’s affirmation of Bosideng’s sustainable performance. |

| December 2, 2021 |

Bosideng announces that its wholly owned subsidiary Bosideng and Willy Bogner have entered into a joint venture (JV) agreement, setting up a JV company on December 1, 2021. The JV company will bring the brands Bogner and Fire+Ice to the Greater China Area (Hong Kong, Macao, Mainland China and Taiwan). |

| November 25, 2021 |

Bosideng announces fiscal 2022 interim results, consolidating its objective to become “a World Leading Expert in Down Apparel.” |

| October 26, 2020 |

Bosideng acquires 100% of equity interest of Suzhou Bosideng Logistics Co at the consideration of approximately ¥560 million ($88 million). |

Management Team

- Dekang Gao— Chairman and Chief Executive Officer

- Mei Dong— Executive Director and Executive President

- Qiaolian Huang— Executive Director and Vice President

- Jinsong Rui— Executive Director and Senior Vice President

- Gaofeng Zhu—Chief Financial Officer

Source: Bosideng International Holdings Limited

Fiscal year ends on March 31 of the same calendar year[/caption]

Summary

Founded in 1975 and headquartered in Suzhou, China, Bosideng International Holdings is a clothing company specializing in down apparel. The company’s primary market is China, but it also operates businesses in Europe, including in Switzerland. The company’s business segments include: branded down apparel (with brands including Bengen, Bosideng and Snow Flying), diversified apparels (brands including Sameite), ladieswear (brands including Buou Buou, Jessie, Klova and Koreano) and original equipment manufacturing management. As of September 2021, the company operates 3,654 Bosideng stores, 297 Snow Flying stores, 187 Jessie stores, 143 Buou Buou stores, 80 Koreano stores, 56 Klova stores and 50 Bengen stores.

Company Analysis

Coresight Research insight: In recent years, Bosideng International’s revenue has grown steadily—and its innovation and improvements for its brands, designs, products and sales channels have proven fruitful. The company has benefitted from the trend of Chinese consumers gravitating toward “light” fashion amid the pandemic, given its focuses on down apparel—the segment accounted for over 80% of the company’s revenues in fiscal 2021 (ended March 31, 2021). The company has also been expanding its European market—however, not always successfully. The company opened stores in the UK, but withdrew from the country in 2017. While we believe that Bosideng International is influential in China, its globalization strategy still needs to be refined.

Fiscal year ends on March 31 of the same calendar year[/caption]

Summary

Founded in 1975 and headquartered in Suzhou, China, Bosideng International Holdings is a clothing company specializing in down apparel. The company’s primary market is China, but it also operates businesses in Europe, including in Switzerland. The company’s business segments include: branded down apparel (with brands including Bengen, Bosideng and Snow Flying), diversified apparels (brands including Sameite), ladieswear (brands including Buou Buou, Jessie, Klova and Koreano) and original equipment manufacturing management. As of September 2021, the company operates 3,654 Bosideng stores, 297 Snow Flying stores, 187 Jessie stores, 143 Buou Buou stores, 80 Koreano stores, 56 Klova stores and 50 Bengen stores.

Company Analysis

Coresight Research insight: In recent years, Bosideng International’s revenue has grown steadily—and its innovation and improvements for its brands, designs, products and sales channels have proven fruitful. The company has benefitted from the trend of Chinese consumers gravitating toward “light” fashion amid the pandemic, given its focuses on down apparel—the segment accounted for over 80% of the company’s revenues in fiscal 2021 (ended March 31, 2021). The company has also been expanding its European market—however, not always successfully. The company opened stores in the UK, but withdrew from the country in 2017. While we believe that Bosideng International is influential in China, its globalization strategy still needs to be refined.

Source: Bosideng International Holdings Limited[/caption]

Company Developments

Source: Bosideng International Holdings Limited[/caption]

Company Developments