albert Chan

https://youtu.be/5C-QkqXGmJQ

Introduction: BOPIS

Retailers need to constantly adapt to consumer trends and shopping habits to survive in the fast-changing competitive retail landscape. Retailers are investing in omnichannel fulfillment to keep up with consumer demand for convenience and flexibility in product fulfillment options.

Buy online pick up in store (BOPIS) is one omnichannel retail strategy that is gaining momentum among consumers and retailers across the globe. BOPIS is a merger between a retailer’s online and physical storefronts, which makes it different from other shipping options that have emerged in recent years.

The offering lets shoppers browse or shop products online and pick them up at physical stores, allowing them to both save on shipping costs and avoid waiting for delivery. BOPIS gives retailers an opportunity to optimize the in-store experience and leverage upselling opportunities.

Many shoppers buy additional items when picking up the original order. According to a December 2018 survey of more than 2,000 US shoppers by return technology provider Doodle, about 85% of BOPIS customers said they had made additional in-store purchases when picking up an online order.

BOPIS is also a strategic weapon for physical retailers to compete with pure-play online retailers: Brick and mortar retailers can leverage their extensive store estates to reach customers in a way online-only rivals cannot.

Retailers Are Also Considering BOPUM and BORIS

BOPIS adoption is growing, but so are various iterations such as buy online, pick up in mall (BOPUM) and buy online, return in store (BORIS).

BOPUM offers consumers an option to shop the product online and pick it up at a mall. Malls and landlords are looking for innovative solutions to keep up with fast-shifting consumer preferences, and BOPUM could support mall traffic.

BORIS lets customers return online orders delivered to the home in store. Many large retailers offer this service. Similar to BOPIS, BORIS offer opportunities for retailers to scale operations by connecting online and offline channels and ensuring flexibility in inventory systems.

This report focuses on BOPIS: We will cover BORIS in more detail in our next report.

Approaches to BOPIS Order Fulfillment

In the BOPIS model, retailers can fulfil online orders at physical stores using two major approaches:

1. Pick orders from store inventory. Retailers turn stores into order-fulfillment centers, fulfilling orders from in-store inventory – but retailers need systems that give them an accurate, real-time store-level view of inventory.Fulfilling online orders from a store enables same-day pick up and optimizes in-store inventory. This method also cuts return costs as returned products can be kept in store instead of being shipped back to a distribution center.

Fulfillment from store inventory makes more sense for retailers who have large stores – but BOPIS creates operational challenges for specialist formats, which may have smaller backrooms and fewer store associates to pick and pack inventory.

The timeliness for BOPIS order fulfillment using in-store inventory varies. For example, Macy’s, Kohl’s and Home Depot offer in-store pick up services within two hours if products are available in stores, while Walmart takes around four hours to get the order ready.

When fulfilling BOPIS orders from store inventory, the biggest challenge for any retailer, large or small, is inventory accuracy. Retailers using this method are moving to a unified commerce model with end-to-end, digital and physical visibility of merchandise, shoppers and store associates.

2. Ship to store from a distribution center (DC) fills BOPIS orders from a DC to the store, pre-labeled with the customer’s information. With the DC managing and filling the order, store associates are freed from picking and packing items. Large retailers such as Nordstrom, Macy’s and Target use both in-store and from DC to fulfill BOPIS orders.The downside (from the buyer’s point of view) is that US retailers generally take several days to fulfill a BOPIS order from DC. Walmart takes three to five business days to ship items to a store for pick up, while Macy’s takes five to eight days.

DC fulfillment enables operational efficiencies in picking and packing orders and does not require an accurate view of in-store inventory. This method also allows BOPIS orders to be picked in batches so shipments can be combined or sent with regular inventory replenishment shipments.

However, the DC model also creates operational challenges. Economies of scale are lost if retailers need to make single-item shipments to fill BOPIS orders.

Shipping from a DC is also wasted effort if the item is available in the store from which it is being collected – plus, shoppers need to wait longer.

Key Things to Consider When Implementing BOPIS

When integrating BOPIS into omnichannel strategies, retailers should consider the following factors:

1. Integrate and ensure the accuracy of inventory systems. Before BOPIS, retailers often had two different inventory systems: one for distribution centers used to fulfill online orders and another for the physical store, used to manage in-store inventory. With BOPIS fulfilled from stores, retailers need to know (and be able to show customers) whether products are available in a particular store at the particular moment a customer wants to order. This requires retailers to merge inventory systems. With integrated inventory management, retailers can identify the closest location (store or DC) an item is available and pull from that location to fill an order.Home Depot is one retailer that has successfully integrated its inventory systems. The company has developed several distribution centers that fulfill both online purchase and store replenishment orders. When shopping online for in-store pickup, Home Depot’s system will let shoppers see if the item is available in the local store, or if not, the closest location that does have it.

Inventory accuracy is crucial for a successful BOPIS rollout. In a survey of 30 c-suite retail executives conducted by HRC Retail Advisory in 2018, about 66% said inventory inaccuracies are making their BOPIS service offerings inconsistent. To ensure inventory accuracy, retailers need to invest in inventory tagging technology that tracks the process from the placement of customer’s orders until fulfillment, bringing together information about sales, inventory, customer and employees. They also need to ensure in-store inventory systems track in-store purchases so that when a customer looks for an item in store, the site can deliver accurate information about availability.

Radio frequency identification (RFID) is one technology that has the potential to transform the way retailers track the location and movement of items in-store. This Internet of Things (IoT) system can identify whether an item is lost, sold out or still in the warehouse. RFID can provide in-store inventory accuracy (as measured by gross unit variance) up to 98%, according to SML-RFID, an RFID technology provider.

RFID tagging helped Macy’s maintain its gross unit variance in a 2% to 4.5% range and allowed the company to count items 30 times faster than with traditional barcodes and scanners, according to the Platt Retail Institute’s analysis of Macy’s data in 2017. Using RFID, Macy’s had tagged individual apparel items at 900 retail locations as of December 2018.

2. Investment in technologies that facilitate the end-to-end customer experiences. BOPIS touches nearly every facet of the business, from inventory systems to payment solutions: Retailers may have to invest in order management systems (OMS) that offer a single view of orders and inventory to ensure they do not offer for sale products that are not available. An OMS determines the order fulfillment cycle time, adding certainty and predictability by estimating time to fulfill every order.A store can also use an interface between OMS and point of sale (POS) terminals to speed in-store pick up. Similarly, investing in a payment processor can avoid challenges in payment, swaps, returns or cancellations.

In recent years, several US retailers have invested in technologies to enhance their BOPIS offerings. In March, apparel retailer rue21 partnered with technology firm Mastek to launch BOPIS capabilities in over 700 stores. The partnership saw collaboration between rue21’s e-commerce team and Mastek’s digital commerce team. According to rue21 Chief Analytics Officer Mark Chrystal, rue21 and Mastek will work on website design and integration, order management systems, fulfillment options and customer service tools. With this technology partnership, Mark Chrystal said rue21 customers will be able to use their mobile device or computer to check the availability of stock of any product in the nearest stores, buy it online and pick up from the store.

Similarly, in December 2018, Petco enhanced its BOPIS offering by entering into a partnership with technology firm Yantriks to incorporate a personalized fulfillment platform that provides a single view of available stock to support online order processing and fulfillment. According to Petco, the new system has increased e-commerce revenues and customer acquisition by 5%.

3. Getting the store operations right. The challenges associated with integrating e-commerce and physical stores is not just technological: Retailers also need to define the customer experience before jumping into the functional requirements of BOPIS.One risk is that retailers make promises of simpler and speedier pick up options of online orders without first ensuring the in-store workflows are in place, turning shopper convenience into frustration – potentially losing customer loyalty.

The role of the store associate is key. With BOPIS, stores will see a rise in customers, parcels and deliveries. Store associates are responsible for tracking, picking and packing online orders (where they are fulfilled from store inventory). Retailers must ensure store associates are trained and empowered with the right information about customer order submission and fulfillment.

According to a 2017 study by Kibo, a provider of a cloud commerce platforms, only 11% of store associates have access to mobility platforms to check order status and inventory. A well-designed mobile platform that connects all employees with enterprise systems in real time helps retailers manage the process – making it faster and boosting pick rates.

Key Challenges US Retailers Face in Managing BOPIS

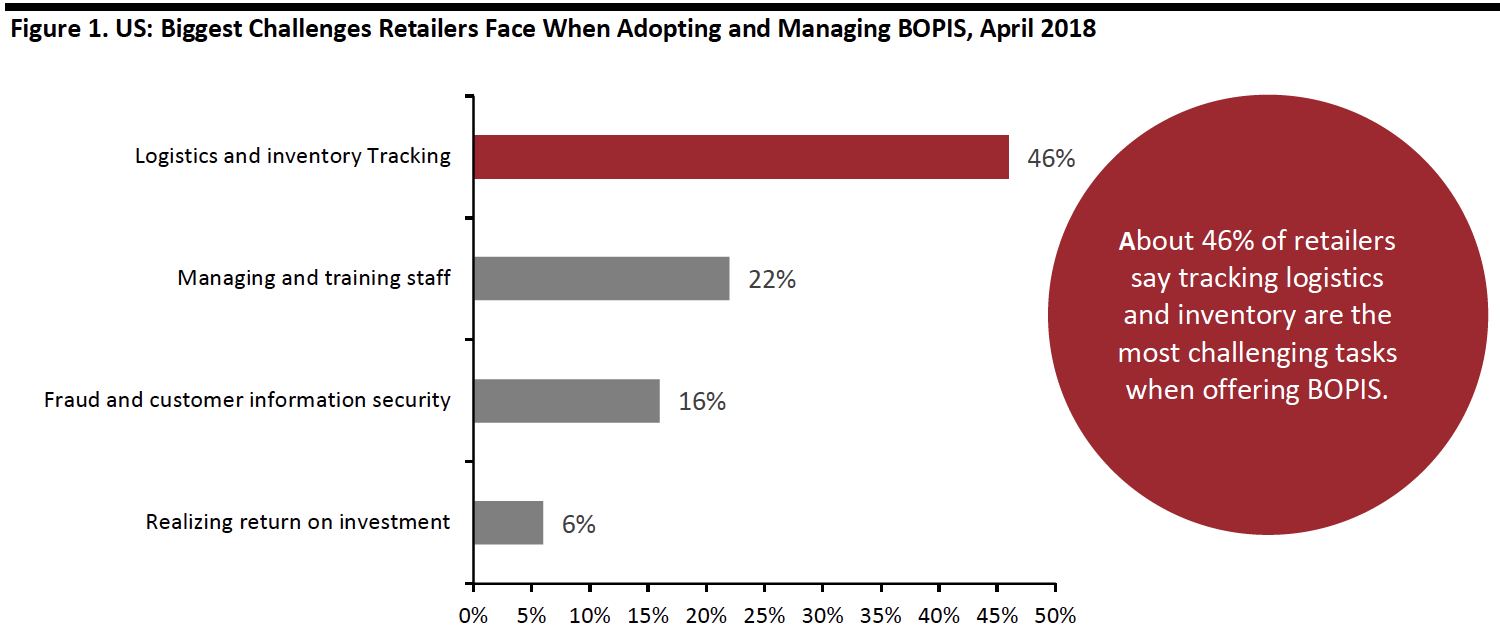

Inventory management and staff training are the most significant issues for retailers in implementing and managing BOPIS, according to an April 2018 Signifyd survey of 250 BOPIS retailers with annual revenues of $100 million or more. The study indicated that about 46% of retailers find tracking logistics and inventory the most challenging task when offering BOPIS, while nearly 22% consider staff management and training their biggest problem. About 16% of retailers believe fraud and customer information security are the most challenging problems. Only 6% of retailers believe actually generating a return on investment is the biggest challenge.

[caption id="attachment_92174" align="aligncenter" width="700"] Base: 250 retail professionals from BOPIS retailers will annual revenues of at least $100 million

Base: 250 retail professionals from BOPIS retailers will annual revenues of at least $100 millionSource: Signifyd Survey[/caption]

In BOPIS Deployment, US Retailers Trail Behind the Retailers in UK, Germany and France

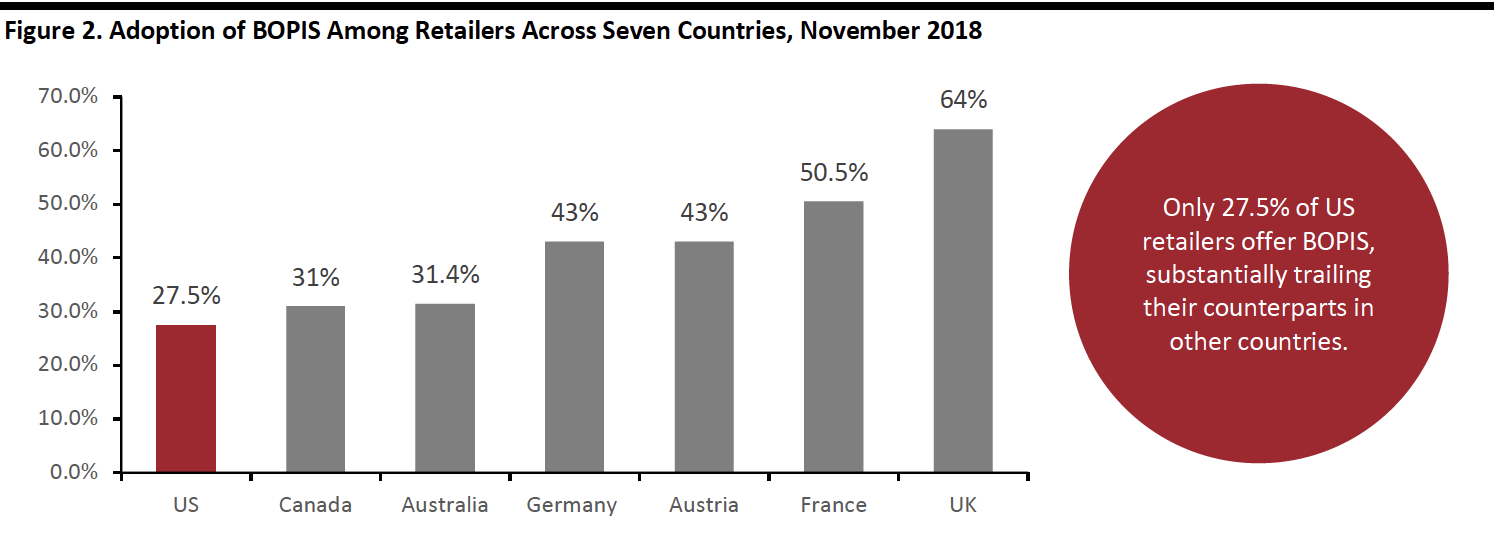

The BOPIS model is gaining traction across the globe. However, US retailers have some work to do in catching up in BOPIS as they substantially trail retailers in other countries. Only 27.5% of US retailers offer BOPIS, according to a 2018 OrderDynamics survey of retailers in seven countries.

While the US lags many countries in BOPIS adoption, the study found the number of US retailers offering BOPIS increased 5.7 percentage points year over year in 2018, marginally ahead of the 5.6 percentage point average growth for global retailers.

That said, smaller retailers pulled down the national averages. According to OrderDynamics, about 43% of enterprise-sized chains in the US offered BOPIS service in 2018. When benchmarked against the largest non-food retailers in the US, such as department stores and mass merchandisers, most of which now offer BOPIS services, even this 43% penetration rate looks surprisingly low: The BOPIS rate recorded by OrderDynamics has likely been impacted by a slower rollout of BOPIS in the grocery and discount sectors and at some non-food specialist retailers.

[caption id="attachment_92175" align="aligncenter" width="700"] Base: 2,000 international retailers, including a subset of 753 US retailers

Base: 2,000 international retailers, including a subset of 753 US retailersSource: OrderDynamics[/caption]

About half of US online shoppers use BOPIS, according to an April 2019 survey by Coresight Research. The study found nearly 46% of US consumers have picked up one or more online purchases from a store in the past year.

Factors Driving Adoption of BOPIS Among Consumers and Retailers

For Consumers

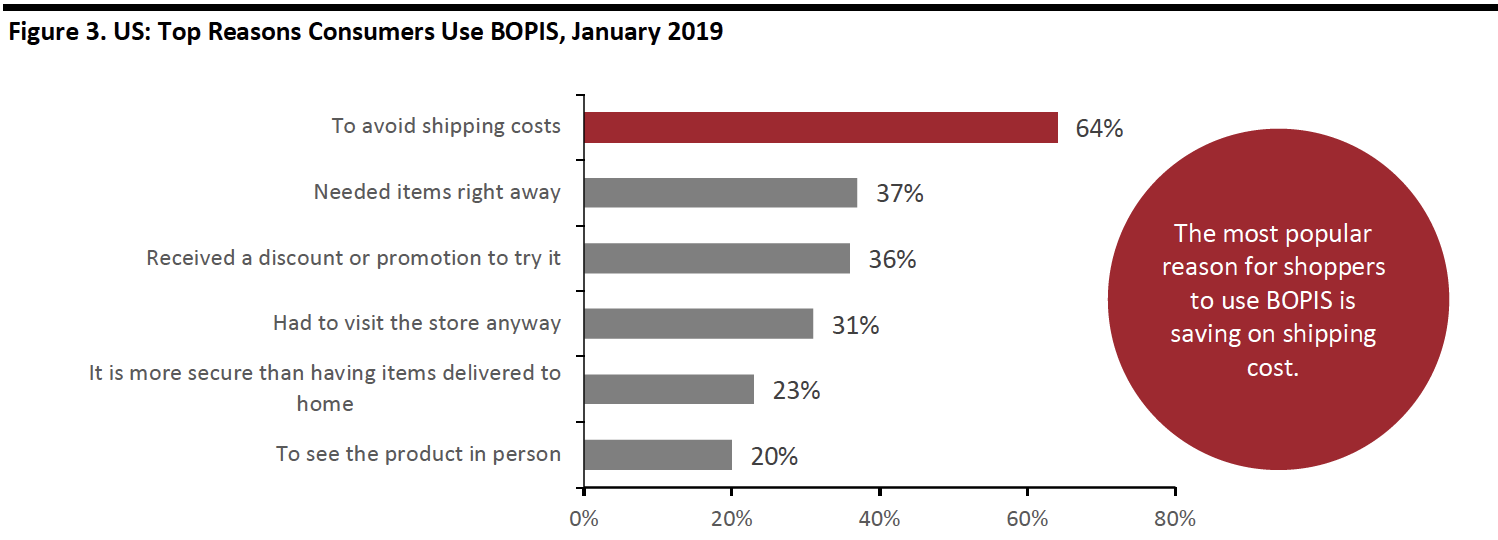

The most popular reason for shoppers to use BOPIS is saving on shipping cost, according to the NRF’s 2018/2019 Winter Consumer View report.

The NRF study found nearly 64% of consumers said free shipping for online orders was a high priority, and so are willing to pick up items from stores to avoid shipping charges. About 37% of buyers choose BOPIS to reduce delivery wait time, while nearly 36% say they use it to get a discount or promotional offer. The study says about 31% of shoppers would choose to pick up online orders in store if they have to visit stores anyway for other purchases or returns.

Other reasons shoppers choose BOPIS include the desire to see the product before the actual purchase and the perception that pick up at counter is more secure than home delivery.

[caption id="attachment_92176" align="aligncenter" width="700"] Base: 3,002 US Shoppers aged 18+

Base: 3,002 US Shoppers aged 18+Source: NRF[/caption]

For Retailers

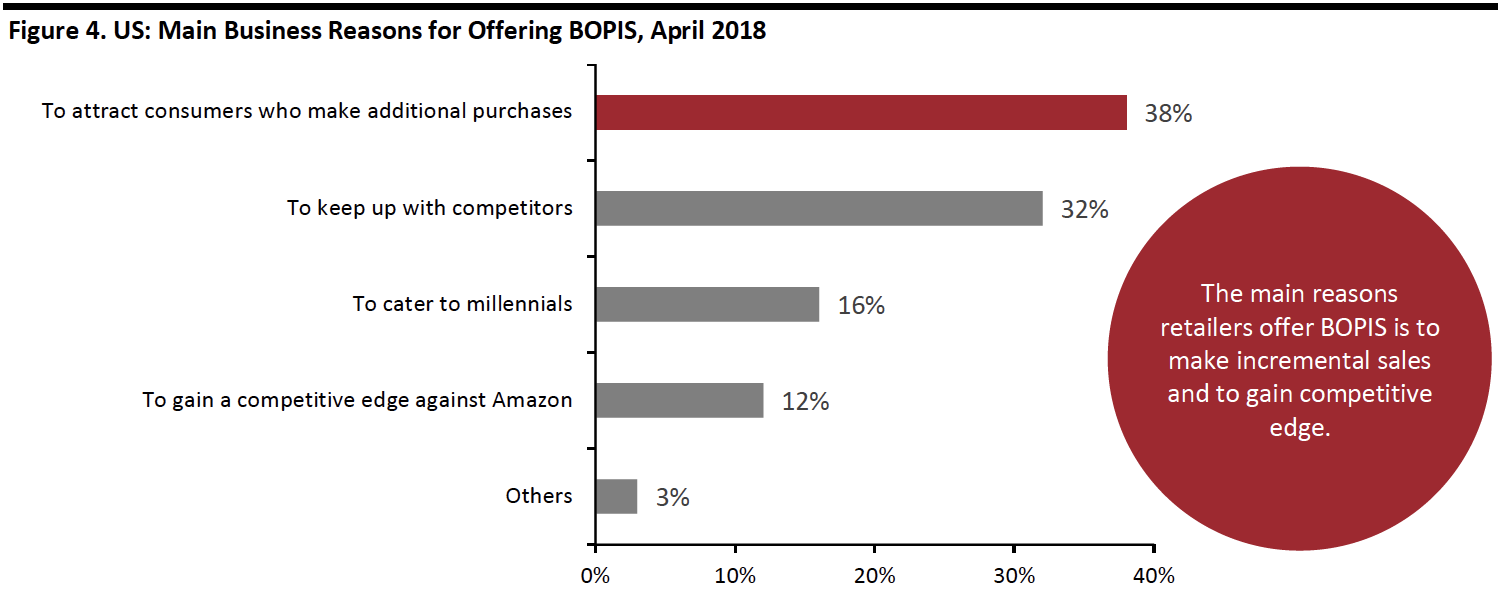

BOPIS has gained momentum with retailers because the offering eliminates the cost of last-mile delivery and drives traffic to the physical locations, allowing retailers to improve customer engagement and sell additional products.

In April 2018, Signifyd, a provider of enterprise-grade fraud technology solutions for online stores, conducted a survey of 250 professionals from BOPIS retailers with annual revenues of $100 million or more. In the study, about 38% of retail professionals said the main reason to offer BOPIS is to bring shoppers into the store, as they often make additional purchases once there. Nearly 32% of retail professionals agreed BOPIS helped them keep up with competitors, while about 12% offer it to compete with Amazon. The study also found nearly 15% of retailers consider attracting millennials the main reason for offering BOPIS.

[caption id="attachment_92177" align="aligncenter" width="700"] Base: 250 professionals representing BOPIS retailers will annual revenues of at least $100 million

Base: 250 professionals representing BOPIS retailers will annual revenues of at least $100 millionSource: Signifyd Survey[/caption]

Most Popular Variations of BOPIS

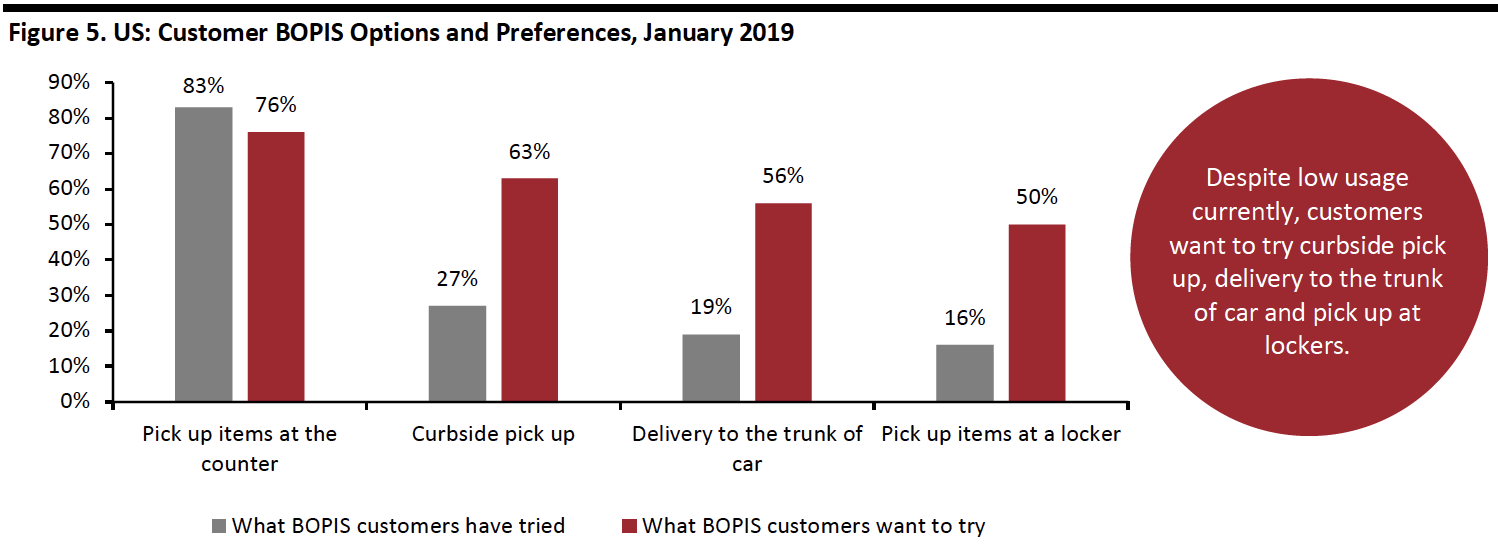

Retailers across the US provide multiple BOPIS fulfilment options, such as pick up at the counter, curbside pick up and pick up at smart lockers. Pick up at store counter remains the most-used, according to the NRF’s) 2018/2019 Winter Consumer View report, which surveyed more than 3,000 US shoppers in January 2019.

The NRF survey found more than 80% of US BOPIS customers pick up items at the store counter, while only 27% pick up at curbside and 16% at lockers.

Despite current low usage, shoppers are interested in curbside pick up, pick up at locker and delivery to the trunk of the car. Nearly 63% of customers look for curbside pick up, 56% want items delivered to the trunk of the car and about 50% are interested in picking up online orders from lockers, according to the NRF.

[caption id="attachment_92178" align="aligncenter" width="700"] Base: 3,002 US Shoppers ages 18+

Base: 3,002 US Shoppers ages 18+Source: NRF[/caption]

US Retailers Are Leveraging BOPIS Retail Strategies

Large US retailers have been refining their approaches for store design and transforming store operations around BOPIS. In 2018, a combined 27% of order volume for large retailers, including Nordstrom, Walmart, Home Depot, Target, Best Buy, Old Navy, Costco, Apple and Kohl’s, was picked up in store, compared to 22% in 2017, according to market research firm Rakuten Intelligence.

US retailers saw a boost in BOPIS orders during the holiday season (November 1–December 31) last year. According to a report from AdobeAnalytics in January 2019, BOPIS for US retail orders grew 50% year over year in the holiday season.

Below, we assess the BOPIS retail strategies of some leading US retailers.

Nordstrom

BOPIS launch: 2008.

Number of pick up locations: 115 full-line stores and three Nordstrom Locals.

Category serviced: Apparel, toys and cosmetics, among others.

Nordstrom became one of the pioneers of BOPIS with the launch of the platform in 2008. The company’s omnichannel efforts have gained steam with BOPIS over the years. At the Shoptalk 2019 conference in March, Nordstrom Co-President Erik Nordstrom said about 50% of shoppers’ in-store visits begin with an online session and nearly 35% of online sessions are led by an in-store visit. In 2018, the company’s digital sales (including online sales, BOPIS, ship to store and its digital selling tool Style Board) grew 7% year over year and accounted for 31% of total revenues, up from 28% in 2017.

In 2017, Nordstrom expanded its BOPIS program in Los Angeles (its largest market) with the opening of small, inventory-free Nordstrom Local stores, and expanded to three locations since then. The company says BOPIS customers at Nordstrom Local spend over twice as much as other customers who order online and shop in-store. About one-third of the company’s BOPIS services are filled in its three Nordstrom Local stores. As of March 18, 2019, Nordstrom offered BOPIS service in all its 115 full-line stores and three Nordstrom Local stores in the US. In September, the company plans to open two Nordstrom Local shops in New York City.

In April 2019, Nordstrom joined the Narvar Concierge platform to enhance its BOPIS retail strategy. With this partnership, BOPIS shoppers can select a Narvar Concierge location to pick up online orders (in addition to existing pick up options).

Walmart

BOPIS launch: 2010.

Number of pick up locations for groceries: 1,000.

Number of pick up towers for non-grocery/general merchandise: 700.

Category serviced: Grocery, apparel and others.

Walmart was also an early BOPIS adopter when it launched the offering in 2010. The company is one of the few retailers that offer additional discounts on orders fulfilled by BOPIS. Walmart offers BOPIS options for grocery products (perishable and frozen items) through its grocery pick up sites, while its pick-up towers (giant self-service kiosks) focus on general merchandise.

At the end of 2018, Walmart had 1,000 pick up locations for online grocery orders and the company remains on track to offer 3,100 online grocery pick up sites by the end of 2019, covering more than 70% of US households. According to Cleveron, a provider of robotics-based parcel terminals and BOPIS solutions, Walmart has successfully integrated its online and physical assets over the years and reduced last-mile delivery costs by leveraging its fleet of more than 6,700 trucks for delivering items directly from fulfilment centers to its stores. Walmart has heavily promoted its grocery pick up services in the past year. According to Numerator Ad Intelligence data, which accounts for TV, online video and display advertising, about 67% of Walmart’s ad spend in January and February of 2019 was to promote grocery pick up services. And, grocery pick up has attracted new shoppers: According to Cowen and Company, some 40% to 60% of Walmart’s grocery pick up orders come from first-time shoppers.

In recent years, Walmart has aggressively expanded its pick up tower program to various locations across the US. The company installed about 700 pick up towers by the end of 2018, making them available to about 40% of the US population. As of April 2018, Walmart had fulfilled more than half a million BOPIS orders through pick up towers. The company plans a total of around 1,600 pick up towers by the end of 2019, making this general merchandise BOPIS service available to over half of the US population. According to Cleveron, Walmart’s pick up towers are 80% more cost-effective than manual pick up.

In fiscal 2019, Walmart reported revenue growth of 4.6% year over year. Management said the revamping of about 500 shops throughout 2018, along with BOPIS offerings, has helped the company to create more engaging shopping experiences for its customers, leading to a higher footfall.

Home Depot

BOPIS launch: 2011.

Number of pick up locations: 2,200.

Number of pick up lockers: 1,000.

Category serviced: Home appliances, furniture and others.

Home Depot launched its BOPIS offering in 2011 and now offers the service at all its locations. In 2016, Home Depot rolled out pick up lockers in its stores. These automated lockers retrieve orders through QR codes and can hold over 60% of items available through BOPIS. As of February 2019, the company had installed lockers at about 1,000 locations and aims to have them in all stores by 2021.

As of 2018, about 48% of online orders at Home Depot used BOPIS, according to Adobe Analytics. Home Depot has successfully managed to leverage the upselling opportunity created by the BOPIS model. Adobe Analytics data suggests that while picking up online orders from Home Depot’s stores, about 20% of customers make an additional purchase.

In the next three fiscal years, Home Depot plans to invest about $11.1 billion to expand operations, which includes $5 billion for new stores and to revamp existing ones – which includes electronic shelf label technology.

Target

BOPIS launch: 2013.

Number of in-store locations: 1,850.

Number of curbside pick up locations: 1,400.

Category serviced: Home furnishings, toys, non-perishable food and gifts, among others.

Target started launched BOPIS in 2013, which quickly gained momentum and contributed about 15% of Target’s web revenues soon after launch. As of June 13, 2019, the company provides curbside pick up services at nearly 1,400 stores and in-store pick up in all its 1,850 stores. Target’s in-store and curbside pick up services covers everything from household essentials to TVs to apparel. The company’s BOPIS model has a smaller grocery selection, but offers various non-perishable foods, such as cookies, cereal and chips.

Target reported online sales of $5.35 billion in 2018, accounting for 7.1% of total revenues, up from 5.5% in 2017. The company made about two million parking lot deliveries for online orders in 2018. In the fourth quarter of 2018, nearly three of every four digital orders were fulfilled by stores, including in-store and curbside, and delivery via the company’s wholly owned subsidiary, Shipt. Target’s BOPIS offering witnessed a particular boost during the holiday period, with its combined in-store and curbside pick up services rising more than 60% in the November/December period, accounting for a quarter of the company’s digital sales. In the first quarter of fiscal 2019, Target said Shipt, curbside pick up and in-store pick up drove nearly 25% of its same-store growth and more than 50% of its e-commerce growth.

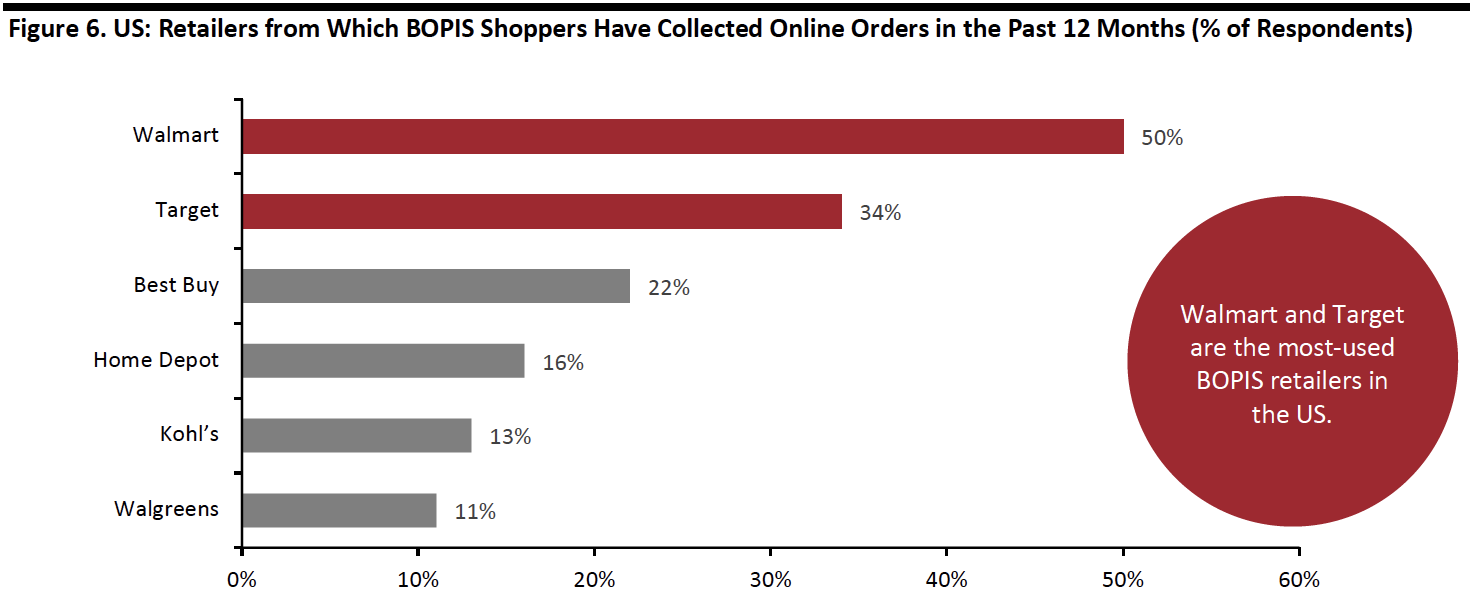

Walmart and Target Are the Most Popular BOPIS Retailers in the US

According to an April 2019 survey by Coresight Research, Walmart and Target are the most popular BOPIS retailers in the US. The study found that about 50% of US BOPIS shoppers have collected online orders from Walmart in the past 12 months, while some 34% of shoppers picked up online orders from Target. These mass merchandisers became the most-used retailers for BOPIS in the US owing to their breadth of assortment, extensive store networks and substantial shopper base.

Following Walmart and Target, Best Buy and Home Depot are the next-most-used retailers for collection in store. Kohl’s is the only department store that made it into the top five.

[caption id="attachment_92179" align="aligncenter" width="700"] Only retailers registering >10% are shown

Only retailers registering >10% are shownBase: 786 US Internet users aged 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019

Source: Coresight Research[/caption]

Our View on How Retailers Can Get Omnichannel Right With BOPIS

We believe retailers can take the following measures to make the most of BOPIS initiatives:

1. Get the basics right to make it easy. As customers continue to demand more fulfillment options, retailers need to make it simple for customers to get what they want, when they want it and in the way they want it. The basics of this is getting communication right. Firstly, retailers should tell customers BOPIS is available – clearly and obviously on the site. Secondly, retailers must ensure they give customers accurate information and directions on how to pick up online orders. 2. Adopt demand-based forecasting methods. Effective demand forecasting is essential to manage inventory and create upselling opportunities. Retailers need to forecast online and in-store demand accurately.With accurate demand forecasting, more BOPIS orders can be fulfilled with in-store inventory, saving costs and time for customers and retailers.

Predictive analytics programs can leverage data, modeling and artificial intelligence to analyze trends and make predictions. Predictive analytics can help retailers combine BOPIS and online or in-store only demand into a single forecast and determine how the two affect one other – and identify risks.

3. Integrate inventory and order management systems. Retailers can use tagging technology such as RFID and install mobile POS terminals to ensure seamless communication between various types of data, such as item, inventory, order, customer, shipping and tracking. With integrated inventory and order management systems, customers have almost real-time visibility into inventory to ensure the product they want is in stock. 4. Optimize the in-store experience for incremental sales. BOPIS provides a second opportunity for retailers to sell to an already-engaged customer. Retailers can gain repeat customers by creating a specialized experience. For example, retailers can locate popular items next to BOPIS pick up counters or offer a discount for additional in-store purchases on the day of collection. 5. Train and incentivize store staff. Store staff must be trained and incentivized to perform their new role as fulfillment experts and handling the BOPIS customers at the store. Information and training can reduce delays and confusion at the point of collection. 6. Automate order pick up. Automating order pick up with smart lockers or kiosks not only solves labor challenges but also streamlines the time to complete the pick up process. With front-of-store automation, the back-end can focus on managing the critical devices used to track inventory and point of sale transactions. According to a recent collaborative research report from OrderDynamics, Bell and Howell and IHL Group, retailers using automated pick up witnessed a 28% improvement in pick up time – with Walmart seeing a 60% improvement.The Way Ahead

The low BOPIS penetration in the US suggests significant opportunities for omnichannel retailers to grow in-store collection — and offer a competitive advantage over online-only rivals. Technology, staffing, training, and automation can help retailers take advantage of growing consumer demand for collection services.