DIpil Das

Our April 2019 survey of US online shoppers explored whether they had collected online purchases from a store, which category of product they had collected and from which retailers they had collected online purchases. In this report, we discuss key findings.

Almost Half of Online Shoppers Used BOPIS in the Past Year

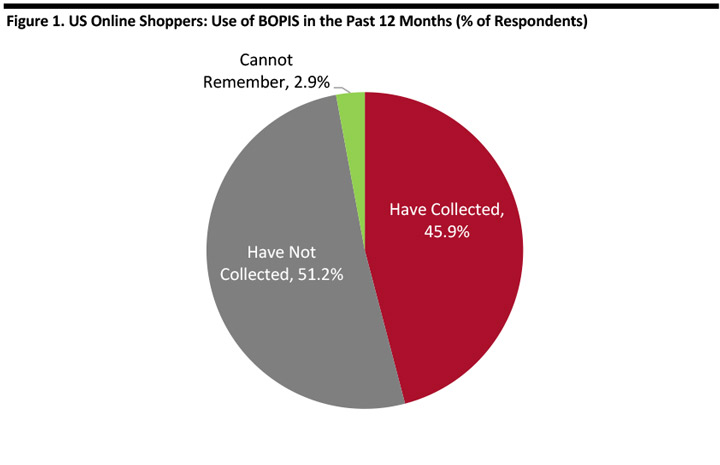

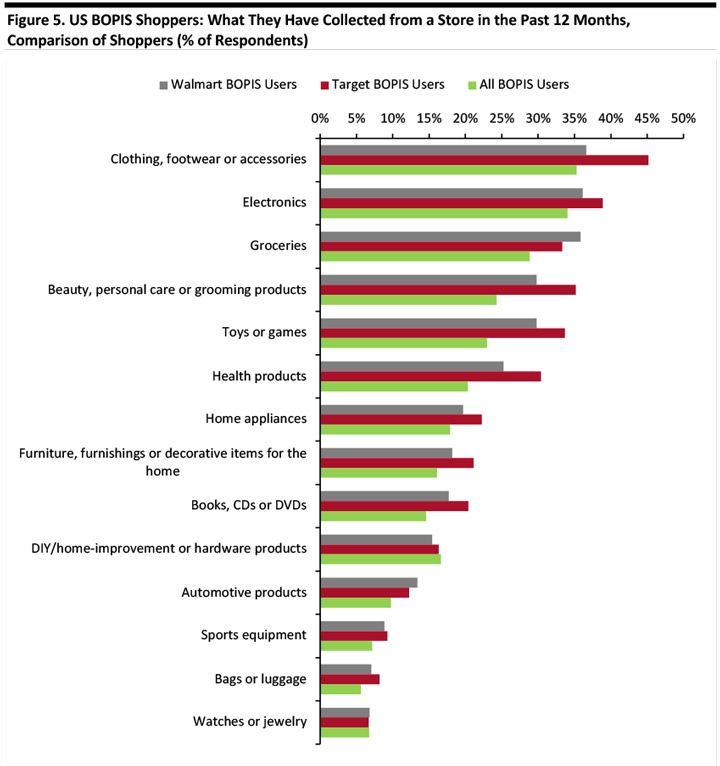

BOPIS is well established and highly popular: Some 46% of all online shoppers collected at least one order from a physical store in the past year.

[caption id="attachment_84781" align="aligncenter" width="720"] Base: 1,712 US Internet users ages 18+ who have made an online purchase in the past 12 months, surveyed in April 2019

Base: 1,712 US Internet users ages 18+ who have made an online purchase in the past 12 months, surveyed in April 2019

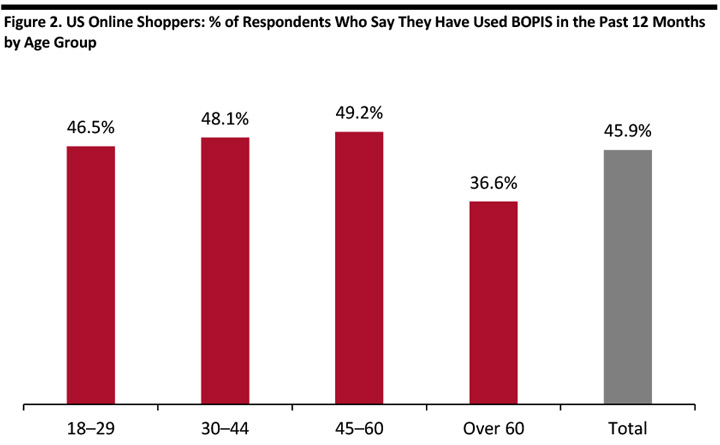

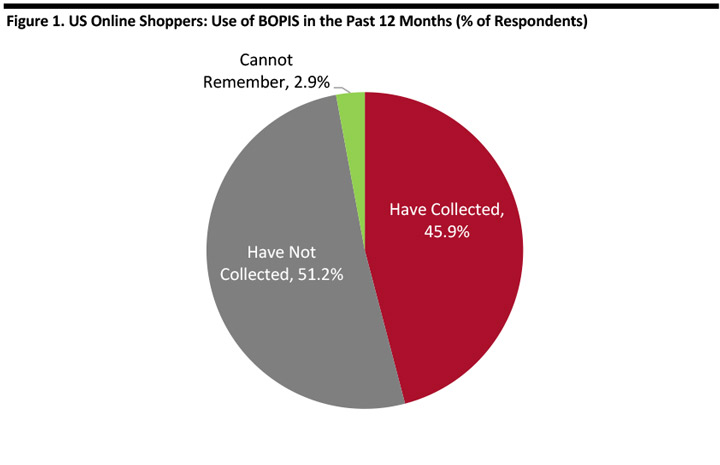

Source: Coresight Research [/caption] The average usage rate for BOPIS is dragged down by older online shoppers, who are much less likely than the average to pick up online orders from a store: Only 37% of online shoppers aged over 60 had collected an order from a store in the past year, versus 47-49% among younger age groups. Our survey suggests the average BOPIS consumer is around two years younger than the average online shopper who has not collected an order in the past year. The average BOPIS user is also slightly more affluent than online shoppers who have not collected an order from a store — implying these are valuable shoppers. [caption id="attachment_84782" align="aligncenter" width="720"] Base: 1,712 US Internet users ages 18+ who have made an online purchase in the past 12 months, surveyed in April 2019

Base: 1,712 US Internet users ages 18+ who have made an online purchase in the past 12 months, surveyed in April 2019

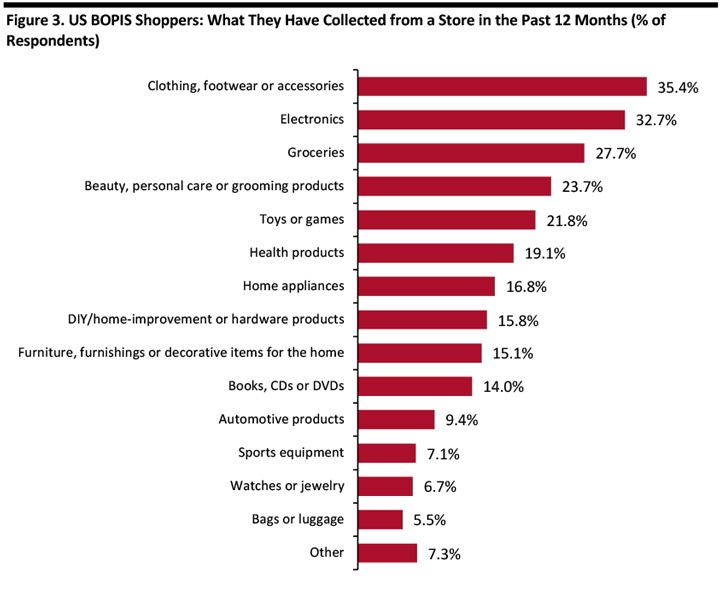

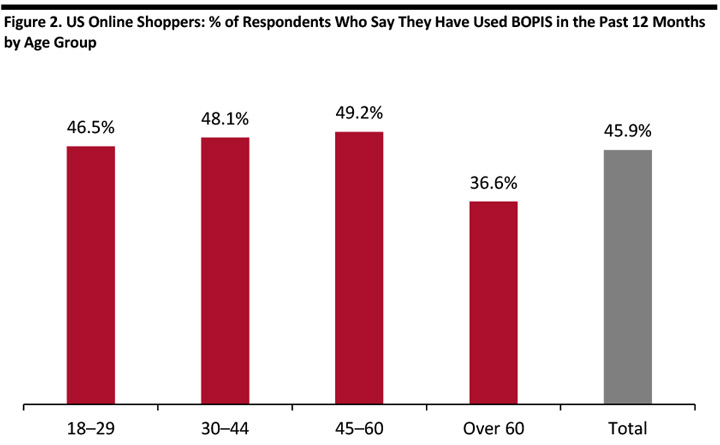

Source: Coresight Research [/caption] Apparel and Electronics are the Most-Collected Categories Apparel is the most-collected category and, despite being an occasional purchase category, electronics ranks second. The fact that electronics are bought with BOPIS more often than groceries, which are bought much more frequently, reflects the relatively low online penetration rate in grocery. [caption id="attachment_84783" align="aligncenter" width="720"] Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019

Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019

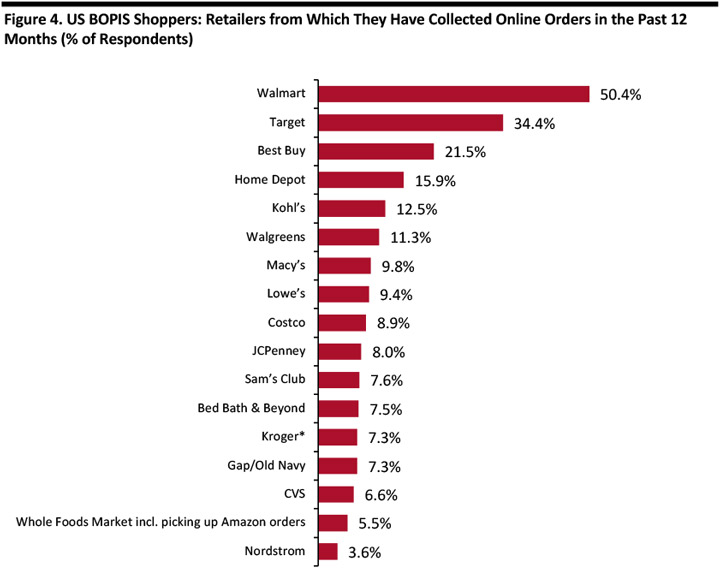

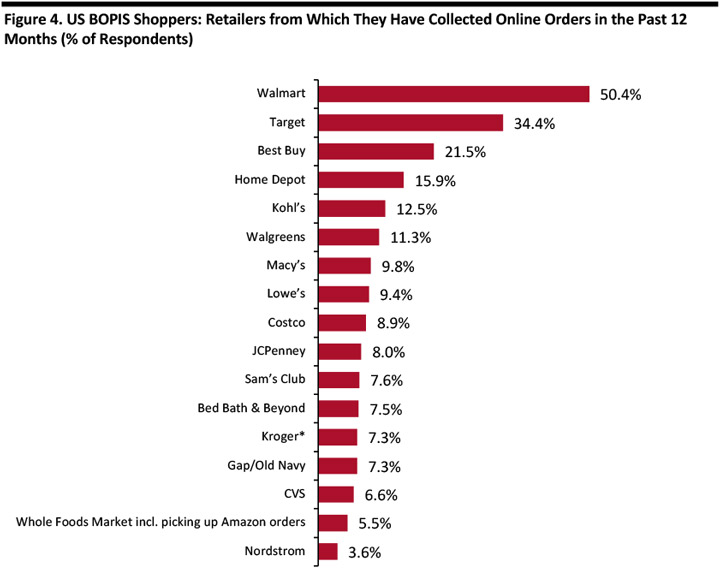

Source: Coresight Research [/caption] Mass Merchandisers, Best Buy and Home Depot are the Most-Used Retailers for BOPIS Given their breadth of assortment, extensive store networks and substantial shopper bases, it is unsurprising that Walmart and Target are the most popular BOPIS retailers in the US. Reflecting the strength of demand to pick up electronics (shown above), Best Buy is the third-most-used retailer for collection. Given department stores sell a very wide range of merchandise that includes more frequently bought categories than electronics or home-improvement products, and given the scale of major department stores’ online revenues, major department-store rankings are a little disappointing: Only Kohl’s makes the top five. There is BOPIS demand for drugstore products: Walgreens ranks relatively high while CVS comes in ahead of some major retailers. [caption id="attachment_84784" align="aligncenter" width="720"] Only retailers registering >3% are shown.

Only retailers registering >3% are shown.

*Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug

Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019

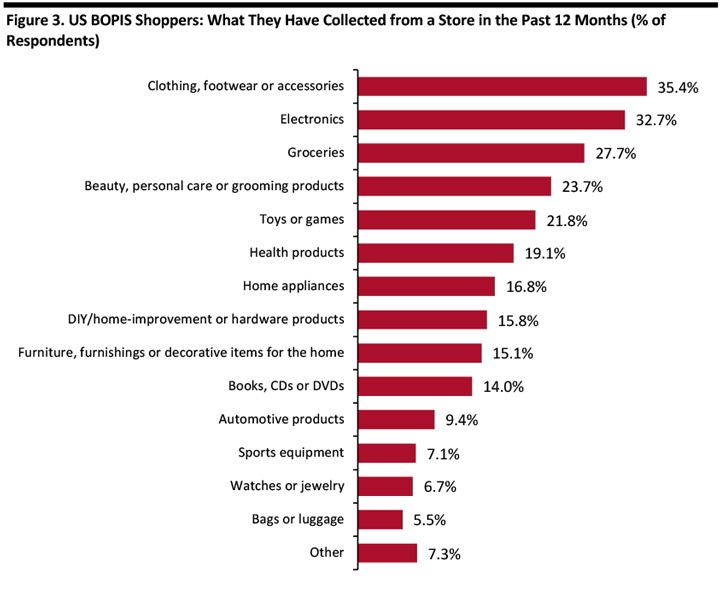

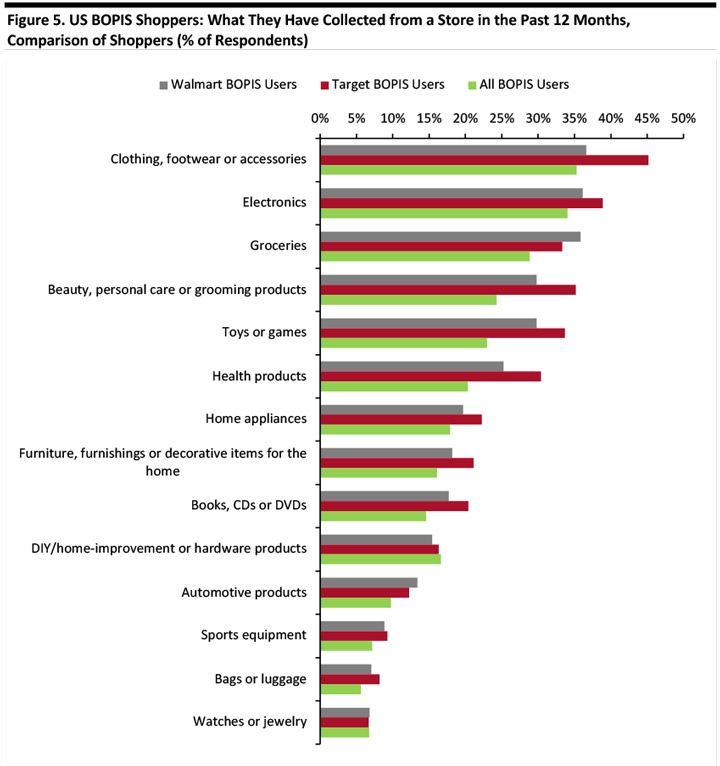

Source: Coresight Research [/caption] What are Mass Merchandiser Customers Picking Up In Store? The chart below compares two of the data sets shown above: Which categories have been picked up from a store in the past 12 months by those who have used BOPIS services at Walmart and Target. While the survey did not specifically ask Walmart and Target BOPIS users where they collected these items, the results give a strong indication of what shoppers are picking up from these mass merchandisers. Focusing on statistically significant differences from the average: Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019

Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019

Source: Coresight Research [/caption]

Base: 1,712 US Internet users ages 18+ who have made an online purchase in the past 12 months, surveyed in April 2019

Base: 1,712 US Internet users ages 18+ who have made an online purchase in the past 12 months, surveyed in April 2019 Source: Coresight Research [/caption] The average usage rate for BOPIS is dragged down by older online shoppers, who are much less likely than the average to pick up online orders from a store: Only 37% of online shoppers aged over 60 had collected an order from a store in the past year, versus 47-49% among younger age groups. Our survey suggests the average BOPIS consumer is around two years younger than the average online shopper who has not collected an order in the past year. The average BOPIS user is also slightly more affluent than online shoppers who have not collected an order from a store — implying these are valuable shoppers. [caption id="attachment_84782" align="aligncenter" width="720"]

Base: 1,712 US Internet users ages 18+ who have made an online purchase in the past 12 months, surveyed in April 2019

Base: 1,712 US Internet users ages 18+ who have made an online purchase in the past 12 months, surveyed in April 2019 Source: Coresight Research [/caption] Apparel and Electronics are the Most-Collected Categories Apparel is the most-collected category and, despite being an occasional purchase category, electronics ranks second. The fact that electronics are bought with BOPIS more often than groceries, which are bought much more frequently, reflects the relatively low online penetration rate in grocery. [caption id="attachment_84783" align="aligncenter" width="720"]

Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019

Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019 Source: Coresight Research [/caption] Mass Merchandisers, Best Buy and Home Depot are the Most-Used Retailers for BOPIS Given their breadth of assortment, extensive store networks and substantial shopper bases, it is unsurprising that Walmart and Target are the most popular BOPIS retailers in the US. Reflecting the strength of demand to pick up electronics (shown above), Best Buy is the third-most-used retailer for collection. Given department stores sell a very wide range of merchandise that includes more frequently bought categories than electronics or home-improvement products, and given the scale of major department stores’ online revenues, major department-store rankings are a little disappointing: Only Kohl’s makes the top five. There is BOPIS demand for drugstore products: Walgreens ranks relatively high while CVS comes in ahead of some major retailers. [caption id="attachment_84784" align="aligncenter" width="720"]

Only retailers registering >3% are shown.

Only retailers registering >3% are shown. *Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug

Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019

Source: Coresight Research [/caption] What are Mass Merchandiser Customers Picking Up In Store? The chart below compares two of the data sets shown above: Which categories have been picked up from a store in the past 12 months by those who have used BOPIS services at Walmart and Target. While the survey did not specifically ask Walmart and Target BOPIS users where they collected these items, the results give a strong indication of what shoppers are picking up from these mass merchandisers. Focusing on statistically significant differences from the average:

- Walmart BOPIS shoppers are more likely than the average BOPIS user to have collected groceries — as well as beauty and personal care products, toys and games, and healthcare products.

- Target BOPIS shoppers meaningfully overindex for collecting apparel — and, like Walmart shoppers, beauty and personal care products, toys and games, and healthcare products. Target shoppers are also more likely than the average to have collected furniture or furnishings, and books, CDs or DVDs.

Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019

Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the past 12 months, surveyed in April 2019 Source: Coresight Research [/caption]