Source: Company reports/Fung Global Retail & Technology

1H17 RESULTS

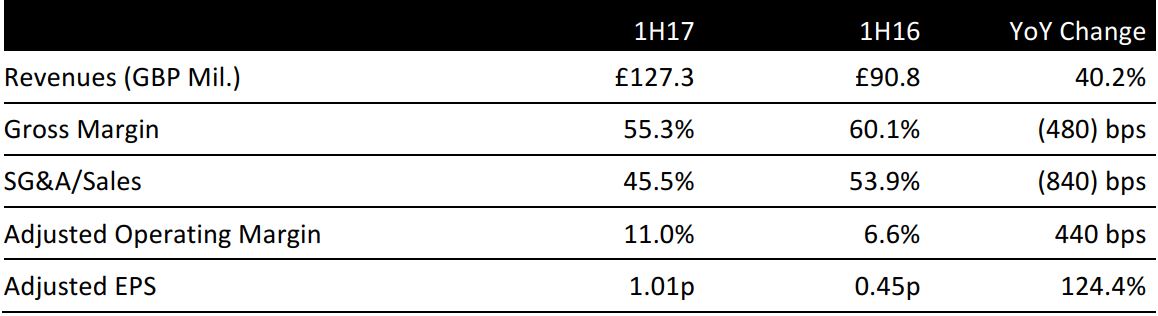

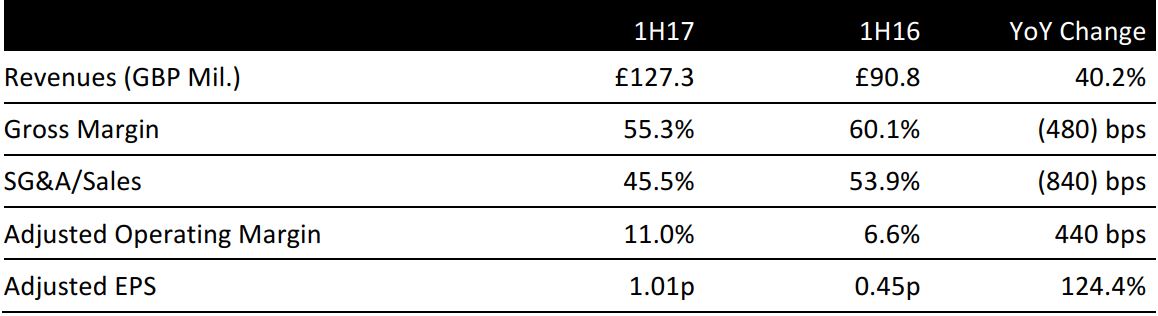

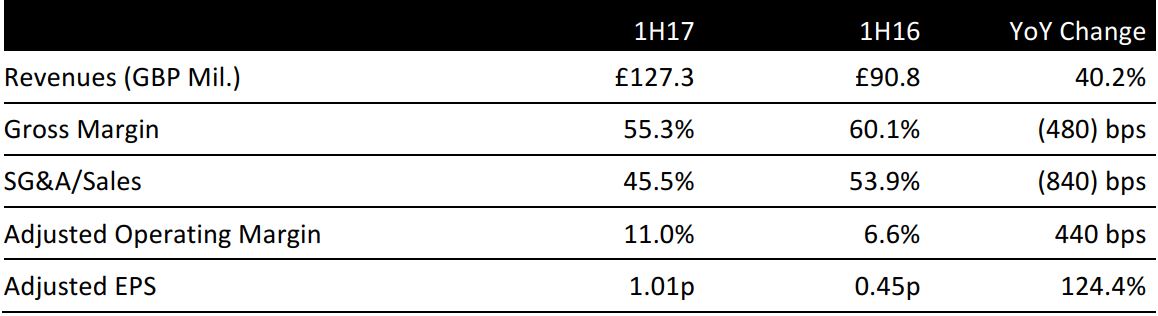

British online fashion retailer boohoo.com reported £127.3 million in revenues, in the 6 months ending August 31, 2016, beating the consensus estimate of £126.6 million and up 40.2% from £90.8 million in the 6 months to August 31, 2015. 1H17 constant-currency revenues increased 41% year over year.

The gross margin contracted by 480 bps in 1H17 to 55.3%. However, this was offset by an SG&A margin decline of 840 basis points, from 53.9% in 1H16 to 45.5% in 1H17, helped by a decrease in marketing expenditure. The adjusted operating margin expanded by 440 basis points from 6.6% in 1H16 to 11.0% in 1H17. Diluted EPS was 1.01 pence for 1H17, up 124.4% from 0.45 pence in 1H16 and in line with the consensus estimate.

GEOGRAPHIC SALES BREAKDOWN

In 1H17, UK sales grew 38% year over year to £81.7 million. Rest of Europe sales increased by 41% year over year at constant currencies to £14.7 million, US sales increased by 81% at constant currency to £15.2 million and Rest of World revenues expanded 27% year over year at constant currencies to £15.7 million.

boohoo.com active customers increased 28% year over year to 4.5 million and the number of orders increased 32% year over year in 1H17. Average order value increased 9.6% to £37.16 and the number of items per basket increased 4.4% to 2.86 in 1H17.

GUIDANCE

Following the strong performance in 1H17, boohoo.com has raised its revenue guidance outlook for the third time this year. The company now expects FY17 revenue growth to fall in the range of +30-35%. The company also stated that it forecasts an FY17 EBITDA margin of 11%, up 140 bps from 9.6% in FY16. However, this marks a sequential deceleration from the 1H17 EBITDA margin of 13%, as the company will make significant investments in IT systems and e-commerce platforms in 2H17.

FY17 revenue consensus estimates stand at £260.0 million, implying annual year-over-year growth of 33.0%. Consensus expects operating profit at £24.3 million, implying a year-over-year increase of 61.5%. The FY17 consensus EPS estimate is 2.0 pence, implying a year-over-year increase of 100%.