DIpil Das

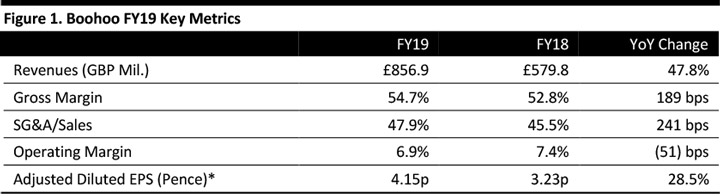

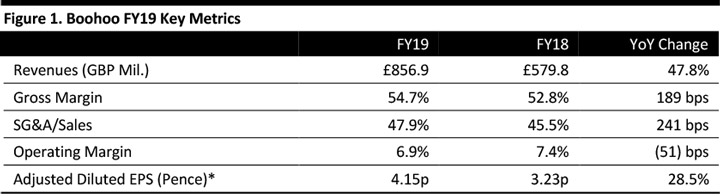

[caption id="attachment_85168" align="aligncenter" width="720"] *Adjusted for amortisation of acquired PrettyLittleThing and Nasty Gal intangible assets, share‐based payment charges and exceptional items

*Adjusted for amortisation of acquired PrettyLittleThing and Nasty Gal intangible assets, share‐based payment charges and exceptional items

Source: Company reports/Coresight Research [/caption] FY19 Results British online fashion pure play Boohoo Group reported full year fiscal 2019 results ended February 28, 2019, with both the top line and EPS ahead of consensus. Key operating metrics are as follows:

*Adjusted for amortisation of acquired PrettyLittleThing and Nasty Gal intangible assets, share‐based payment charges and exceptional items

*Adjusted for amortisation of acquired PrettyLittleThing and Nasty Gal intangible assets, share‐based payment charges and exceptional items Source: Company reports/Coresight Research [/caption] FY19 Results British online fashion pure play Boohoo Group reported full year fiscal 2019 results ended February 28, 2019, with both the top line and EPS ahead of consensus. Key operating metrics are as follows:

- The group reported revenues of £856.9 million, up 47.0% at constant currency and 48.0% as reported, beating the consensus estimate of £843.9 million recorded by StreetAccount. Growth was driven by strong performance at PrettyLittleThing.

- Group gross margin expanded 189 basis points to 54.7%, ahead of the consensus estimate of 54.4% recorded by StreetAccount, due to improvements in the customer proposition, tighter stock control and reduced clearance.

- SG&A costs as a percentage of sales expanded 241 basis points to 47.9%.

- The operating margin contracted 51 basis points due to higher selling and distribution expenses, and higher exceptional costs related to share‐based payments and warehouse relocation.

- Boohoo Group’s adjusted EBITDA margin expanded 5 bps to 9.9%, ahead of the consensus estimate of 9.6% recorded by StreetAccount. Adjusted EBITDA margin excludes share‐based payment charges and exceptional items.

- The group reported adjusted diluted EPS of 4.15 pence, up 28.5% year over year, beating the consensus estimate of 4.0 pence recorded by StreetAccount. Adjusted diluted EPS is calculated as diluted earnings per share, adding back amortisation of acquired PrettyLittleThing and Nasty Gal intangible assets, share‐based payment charges and exceptional items.

- The average order value increased 5% year over year to £41.4, while the average number of items per basket fell 1% to 3.04.

- Revenues were up 15.0% at constant currency to £434.6 million and up 16% as reported, ahead of the consensus estimate of £427.5 million recorded by StreetAccount.

- Gross margin improved by 170 bps to 52.9% on the back of improved stock control and customer proposition refinement, according to the company.

- Active customers in the year stood at 7 million, up 9% year over year.

- International sales accounted for 44% of revenues.

- Revenues surged 107% both at constant currency and as reported to £374.4 million, ahead of the consensus estimate of £369.9 million recorded by StreetAccount.

- Gross margin expanded 140 bps to 56.6% as a result of better sell-through and customer proposition refinement.

- Active customers in the year were 5 million, up 70% year over year.

- Revenues grew 100% at constant currency to £47.9 million (up 96% as reported), above the consensus estimate of £46.7 million recorded by StreetAccount.

- Gross margin contracted 290 bps to 56.7%.

- Nasty Gal had 900,000 active customers, up 122% year over year.

- UK revenues were up 37% to £488.2 million.

- Rest of Europe revenues were up 67% % at constant currency to £115.1 million (up 74% as reported).

- US revenues were up 81% at constant currency to £166.3 million (up 79% as reported).

- Rest of World revenues were up 30% at constant currency to £87.3 million (up 34% as reported).

I am very excited to have joined the boohoo Group at this key stage of its growth, with the group's disruptive and proven business model having delivered yet another excellent set of financial and operational results. In my short time within the business, I am delighted to have been able to meet a number of hugely talented people and have already been able to see many parts of the business. This has confirmed my belief and optimism that the group's investments into its brands and infrastructure have allowed it to develop a scalable multi‐brand platform that is well‐positioned to disrupt, gain market share and capitalise on what is a truly global opportunity.

Outlook For FY20, the company expects to report:- Revenue growth in the range of 25% to 30%.

- An adjusted EBITDA margin of around 10%.

- Capital expenditure in the range of £50 to £60 million.