Source: Company reports/Coresight Research

FY18 Results

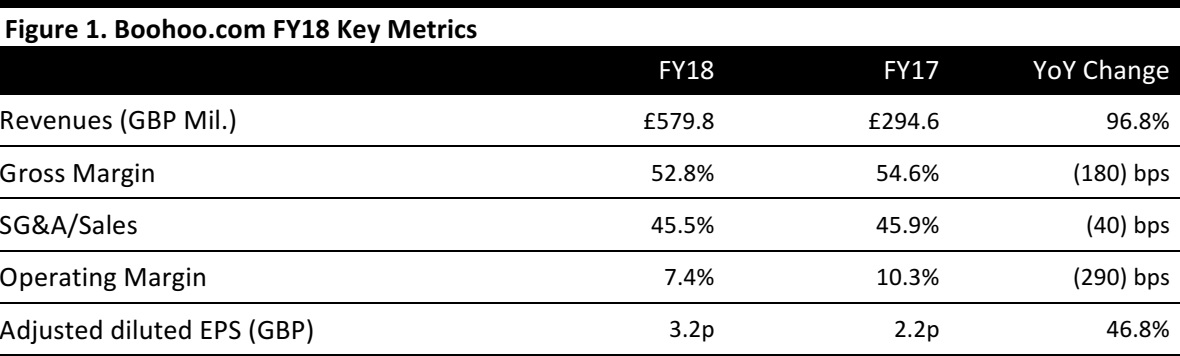

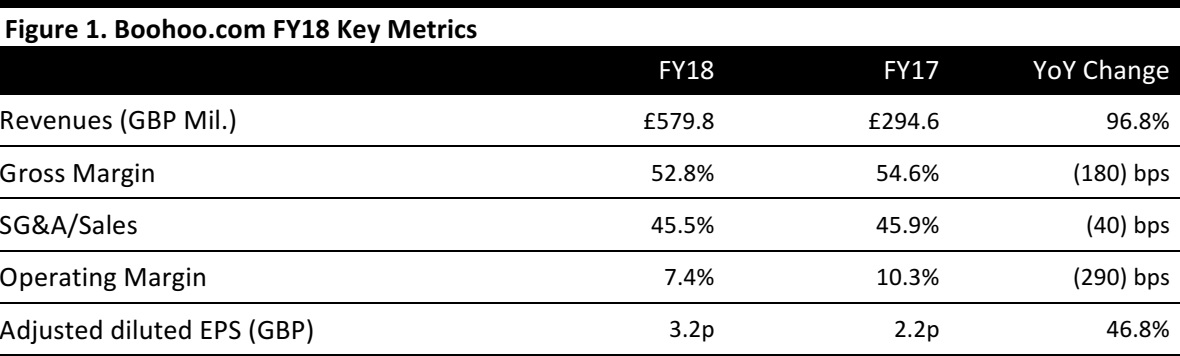

British online fashion pure-play Boohoo.com had a strong year in FY18, reporting a 96.8% jump in group revenues to £579.8 million. Revenues were slightly above the consensus estimate of £574.9 million, as recorded by S&P Capital IQ, and also above the guidance of 90% revenue growth provided at the 3Q18 trading update.

At constant exchange rates, group revenues grew by 92%.

Performances at PLT and Nasty Gal, which were acquired in December 2016 and February 2017, respectively, provided a significant boost to group performance in FY18.

Boohoo.com provided the following additional details about performance in the year ended February 28:

- Gross margin fell by 180 basis points, due to increased promotional activity and partly due to an increase in the proportion of wholesale revenue. The gross margin was in line with consensus.

- Adjusted EBITDA grew by 60% and the adjusted EBITDA margin fell from 12.1% to 9.8%, in line with guidance. Management said that this was “due to a combination of investment in the customer proposition in the Boohoo brand driving revenue growth and the immaturity of the newly acquired and rapidly growing businesses, PLT and Nasty Gal.”

- Adjusted PBT was up by 60% and adjusted PAT was up by 68%.

- Reported PBT was up by 40% and reported PAT was up by 46%.

- Adjusted diluted EPS was 3.2 pence, indicating growth of 46.8%, and in line with analysts’ expectations of 3.0 pence. Reported EPS was up by 25%.

- The group despatched 22 million orders to 9.8 million active customers across all its brands, during the year.

The Coresight Research team attended the presentation to analysts. Management underlined the company’s strategy of operating multiple brands that take share in multiple geographies. The company made investments in the customer proposition such as delivery thresholds and returns services in FY18 and management remarked that the company had invested in price globally. However, management pointed to the continued leveraging of central costs in the past year, which pushed down the SG&A ratio, and also noted that it expects this leveraging to continue. PLT distribution will move to a new, 600,000-square-foot warehouse operated by Clipper Logistics.

Revenue Breakdown by Brand

- Boohoo: Revenues were up by 32% as reported and by 29% at constant currency to £374.1 million.

- PLT: Revenues shot up by 228% on a 12-month comparative period to £181.3 million.

- Nasty Gal: Revenues were £24.4 million, with strong revenue and customer growth since Boohoo.com acquired it in March 2017.

Revenue Breakdown by Region (at Constant Currency)

- UK revenues were up by 95%.

- Rest of Europe revenues were up by 73%.

- US revenues were up by 121%.

- Rest of World revenues were up by 64%.

Outlook

Management remarked that Boohoo.com has made a strong start to FY19 and guided for:

- Group revenue growth in the range of 35%–40%.

- Adjusted EBITDA margin in the range of 9%–10%.

- Capex of £50–£60 million.

Consensus estimates were compiled before Boohoo.com announced the latest results. In FY19, analysts expect Boohoo.com’s:

- Group revenues to rise by 0.1%.

- Gross margin to contract by 70 basis points.

- PBT to grow by 18.0%.

- Adjusted EPS to fall by 7.0%.