Source: Company reports/Fung Global Retail & Technology

FY17 Results

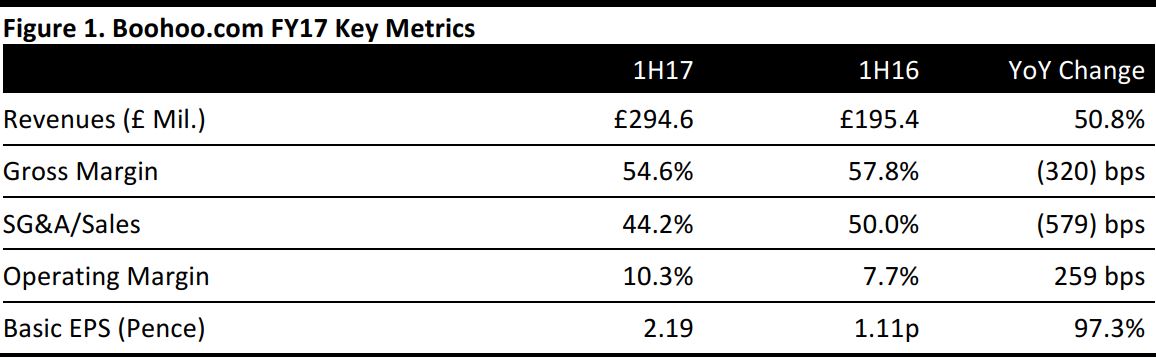

British online-only fashion retailer Boohoo.com reported group sales up 51% at current exchange rates, or 49% at constant currency (CCY), to £295 million in the year ended February 2017. This was slightly below the consensus estimate of £297 million.

The gross margin was negatively impacted by price investment, but the leveraging effects of booming sales growth pushed down the SG&A ratio. A 10% reduction in marketing spend also contributed, as the company focused more of its marketing on lower-cost channels such as social media and influence marketing, and as more customers became repeat shoppers. As a result, operating profit jumped 101% to £30.3 million. As with revenue, however, operating profit and EBITDA missed consensus, according to S&P Capital IQ.

Following recent acquisitions, Boohoo.com now consists of the Boohoo brand, PLT and Nasty Gal.

- Boohoo brand sales were up 45% as reported, or up 44% at CCY, to £283 million.

- PLT was acquired in December 2016, and for the two months to the end of the fiscal year, contributed £11.3 million of sales. PLT’s FY17 sales were £55.3 million.

- Sales at Nasty Gal, acquired in February 2017, were not consolidated in these results.

At constant exchange rates, the company reported the following regional performances:

- UK revenues were up 40% to £182 million.

- Rest of Europe revenues rose by 47% to £35 million.

- US revenues jumped by 124% to £40 million.

- Rest of the World revenues grew by 45% to £37 million.

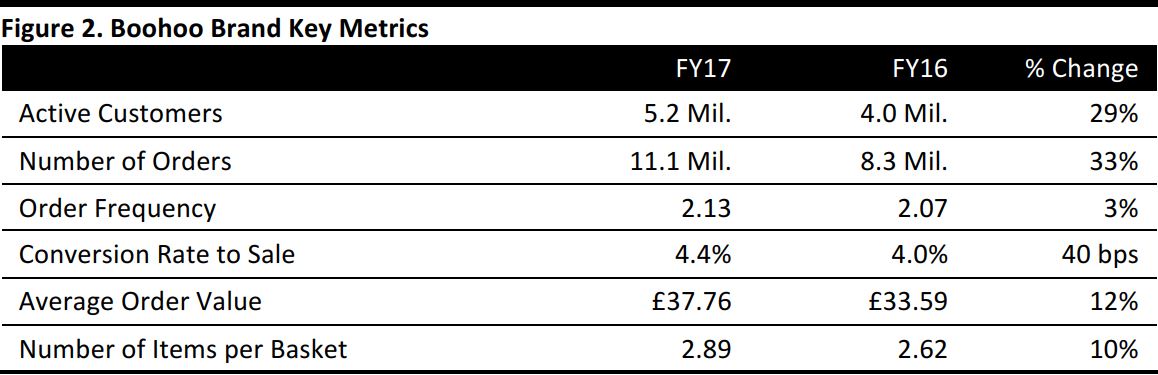

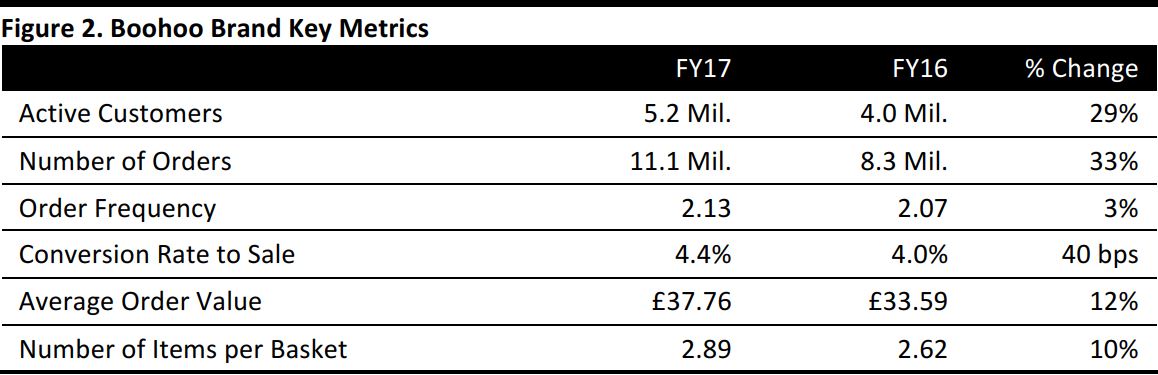

Nonfinancial metrics noted included the following for the Boohoo brand:

Source: Company reports

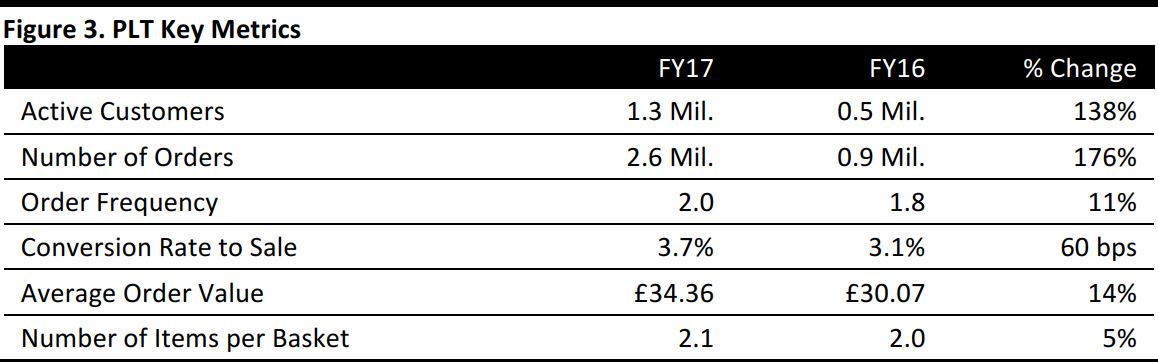

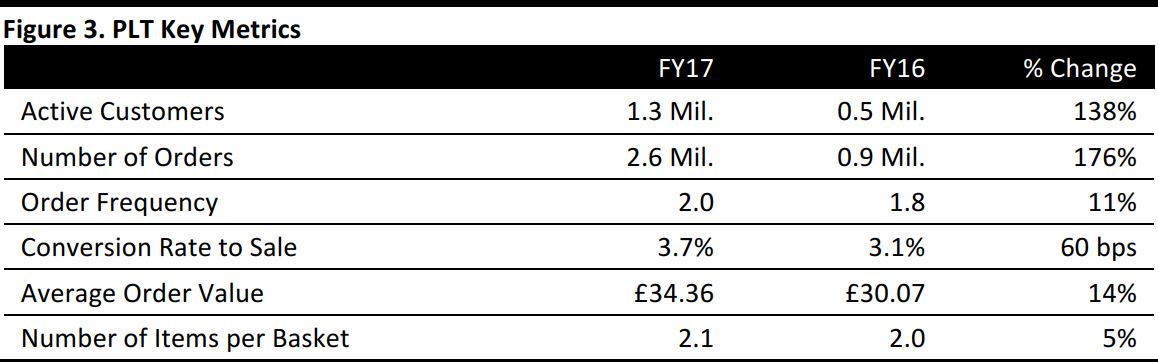

PLT is seeing faster growth across most metrics, from a smaller base. Management noted that PLT has a slightly higher average selling price than Boohoo brand.

Source: Company reports

At the management meeting, the company noted the following:

- Its now-multiple brands are complementary. For instance, PLT customers are “addicted to fashion” and heavily influenced by social media, while Nasty Gal shoppers are “confident, capable and stylish” and are, on average, slightly older than customers of Boohoo and PLT.

- International orders will continue to be despatched from the company’s Burnley, UK, base. Management noted that its US deliveries are quick, even in comparison to local competitors in that market. The company will open a second Burnley distribution center in FY18.

- The company tends to see slightly higher basket sizes internationally than in the UK.

- Nasty Gal has soft launched in the UK, having previously been US only.

Outlook

The company expects to grow group revenues 50% in FY18. By brand, it expects 25% revenue growth at Boohoo (which looks somewhat conservative in view of the last 12 months), 35% growth at PLT and “the balance of growth” at Nasty Gal. It expects capex of £34 million, including £27 million associated with its new distribution center in Burnley.

In FY18 and over the medium term, the company expects to report an EBITDA margin of around 10%. This compares to an adjusted FY17 EBITDA margin of 12.1%. The newer brands, PLT and Nasty Gal, will have a depressing effect on EBITDA margins.

For FY18, analysts expect the company to grow revenues by 51%, EBITDA by 33% and EBIT by 23%. These estimates were collated before yesterday’s results.