DIpil Das

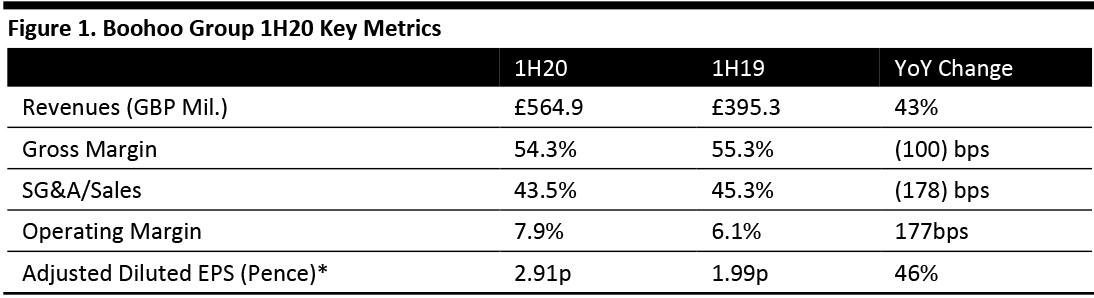

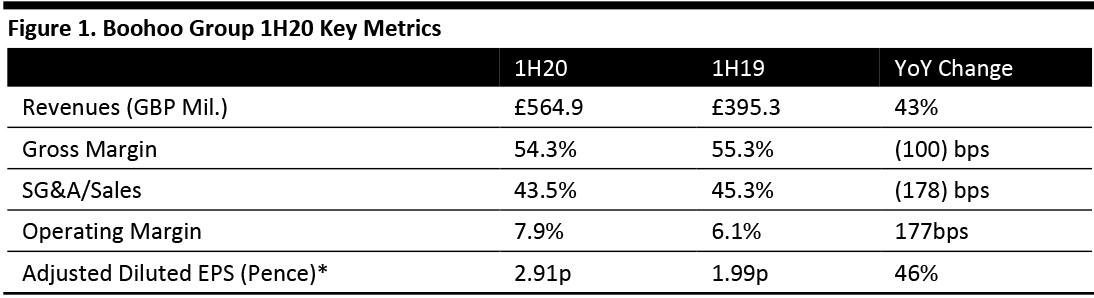

[caption id="attachment_97089" align="aligncenter" width="700"] *Adjusted for amortisation of acquired intangible assets, share‐based payment charges and exceptional items

*Adjusted for amortisation of acquired intangible assets, share‐based payment charges and exceptional items

Source: Company reports [/caption] 1H20 Results The 1H20 results of British pure-play online fashion retailer Boohoo Group exceeded expectations, with both the top line and EPS ahead of consensus.

*Adjusted for amortisation of acquired intangible assets, share‐based payment charges and exceptional items

*Adjusted for amortisation of acquired intangible assets, share‐based payment charges and exceptional items Source: Company reports [/caption] 1H20 Results The 1H20 results of British pure-play online fashion retailer Boohoo Group exceeded expectations, with both the top line and EPS ahead of consensus.

- The group reported revenues of £564.9 million, up 43% year over year and above the consensus estimate of £553.0 million recorded by StreetAccount. Growth was driven by strong performance of all brand segments and key focus territories.

- The group’s adjusted EBITDA was £60.7 million, up 53% year over year and higher than the consensus estimate of £56.7 million recorded by StreetAccount.

- The group’s adjusted EBITDA margin expanded 80 bps to 10.8%, due to efficiency improvements, increased leverage of fixed overheads and effective marketing across the group.

- The group reported adjusted diluted EPS of 2.91p, up 46% year over year, and beating the consensus estimate of 2.7p recorded by StreetAccount. Adjusted diluted EPS excludes amortisation of acquired intangible assets, share-based payment charges and exceptional items.

- The group reported that automation at the Burnley distribution center went live in April 2019. The automation of the warehouse helped drive efficiency and increased throughput at the facility.

- The company developed new apps for Boohoo, BoohooMAN and Nasty Girl in house and introduced these in 1H20. Management said that the apps saw a high rate of adoption.

- To provide customers more choice and flexibility, the company introduced new payment methods in several markets. This move contributed to improvements in the size of orders and the frequency with which they are placed.

- Revenues were up 34.0% year over year at £281.0 million, mainly due to strong growth in all key geographies including Northern Europe, the UK and the US.

- Gross margin improved by 20bps at 53.6%. Growth was driven by an improved offering in core product lines and refinement of the customer proposition.

- Active customers over the last 12 months stood at 8.4 million, up 20% year over year.

- Revenues surged 41% year over year to £237.6 million. Growth was driven by the exceptional performance of the brand in the French and US markets.

- Gross margin contracted 200bps to 55.3%, as the company continues to make efforts to optimize growth and refine the customer proposition.

- Active customers in the year totaled 5.7 million, up 43% year over year.

- Revenues grew 148% year over year to £43.9 million. Growth was driven by exceptional performance by the brand in the UK, the US and International territories, coupled with increasing consumer awareness.

- Gross margin contracted 480bps to 54.2%, which is reflective of the re-alignment of the customer proposition.

- Nasty Gal had 1.5 million active customers, up 112% year over year.

- UK revenues in 1H20 were up 35% to £315 million.

- Rest of Europe revenues were up 69% at constant currency to £87.5 million (up 71% as reported).

- US revenues were up 65% at constant currency to £110.7 million (up 62% as reported).

- Rest of World revenues were up 25% at constant currency to £51.7 million (up 24% as reported).

It has been a fantastic first half of the year for the group. We have delivered significant market share gains across all of our key markets, and for the first time in our history, revenue has exceeded £1 billion in the last 12 months. We have delivered strong growth and operating leverage in our more established brands and will continue to invest in both our more established and newly acquired brands. We enter the second half of the year well placed and confident that our platform—which combines the latest fashion, great prices and excellent customer service, all underpinned by a well-invested infrastructure—will deliver further market share gains.

Outlook For FY20, the company expects to report:- Revenue growth in the range of 33% to 38%.

- An adjusted EBITDA margin of around 10%.