Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

1H19 Update

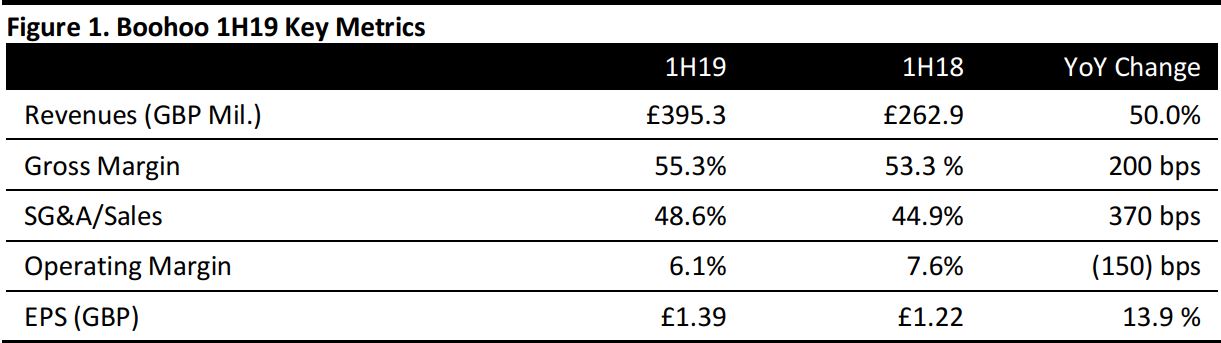

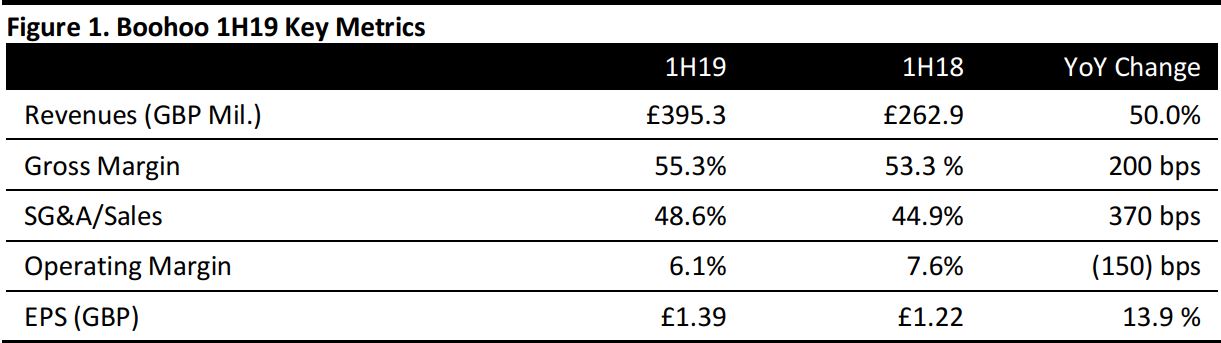

British online fashion pure-play Boohoo Group registered group revenues of £395.3 million in the first half ended August 31, up 49.0% year over year at constant currency (CCY) and up 50.0%, as reported. The retailer saw strong revenue growth across all brands and regions during the half.

Group gross margin expanded by 200 basis points to 55.3%, driven by the robust performance of PrettyLittleThing. SG&A costs as a percentage of sales expanded by 370 basis points and the operating margin contracted by 150 basis points due to investments in marketing activities and increased costs incurred while relocating PrettyLittleThing’s warehouse to Sheffield.

Boohoo Group delivered a strong balance sheet with net cash of £155.6 million (versus £119.2 million in 1H18) at the end of the period.

Revenue Breakdown by Brand

- Boohoo: Revenues were up 15.0% as reported (up 13.0% at CCY) to £209.0 million, against a strong comparative of 43.0% growth (40.0% at CCY) in the prior year. Gross margin improved by 110 bps to 53.4% on the back of improved stock control and customer proposition refinement, according to the company.

- PrettyLittleThing: Revenues soared by 132.0% (134.0% at CCY) year over year to £168.6 million. Gross margin improved to 57.3% as against 54.8% in 1H18 as a result of better sell-through and customer proposition refinement.

- Nasty Gal: Revenues grew by 111.0% (118.0% at CCY) to £17.7 million. Gross margin declined to 59% as against 63.8% in 1H18.

Revenue Breakdown by Region at CCY

- UK revenues were up 43.0%.

- Rest of Europe revenues were up 72.0%.

- US revenues were up 74.0%.

- Rest of World revenues were up 27.0%.

Boohoo Group highlighted that international markets now account for 41% of total revenues.

Outlook

Boohoo Group raised the guidance provided at the 1Q19 results update: for full-year revenue growth in the range of 38.0%–43.0% and maintained its guidance for an adjusted EBITDA margin of 9.0%–10.0%. Management reiterated its medium-term guidance to deliver sales growth of at least 25.0% per annum and 10.0% EBITDA margin.

Consensus estimates were compiled before Boohoo.com announced its latest results. In FY19, analysts expect Boohoo.com to report the following:

- Group revenue growth of 41.8%.

- PBT growth of 34.9%.

- Adjusted EPS growth of 23.8%.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research