Nitheesh NH

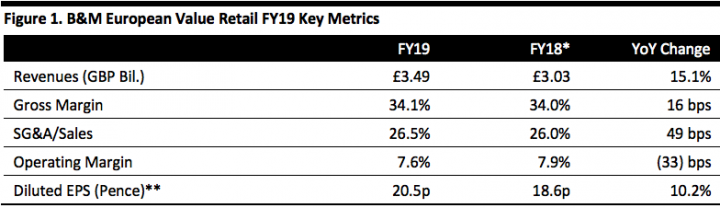

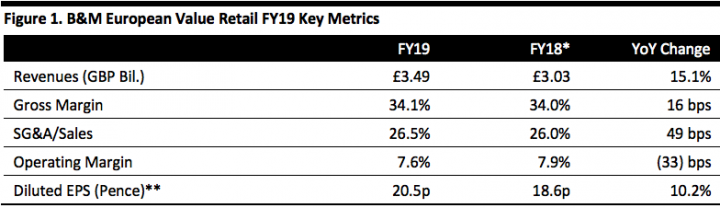

[caption id="attachment_89104" align="aligncenter" width="720"] *FY18 was 53 weeks

*FY18 was 53 weeks

**Attributable to ordinary equity holders

Source: Company reports/Coresight Research[/caption] FY19 Results B&M reported FY19 results with sales ahead of consensus and in-line EPS. The highlights are as follows:

*FY18 was 53 weeks

*FY18 was 53 weeks**Attributable to ordinary equity holders

Source: Company reports/Coresight Research[/caption] FY19 Results B&M reported FY19 results with sales ahead of consensus and in-line EPS. The highlights are as follows:

- B&M posted group revenue of £3.49 billion, up 15.1% year over year. FY18 was 53 weeks and, after adjusting for the additional week, revenue increased 17% on a constant-currency basis (up 17.1% as reported). Revenue came in ahead of the consensus estimate of £3.44 billion recorded by StreetAccount.

- Adjusted EBITDA was up 10.3% year over year to £312.3 million, below the consensus of £315.8 million.

- Operating margin contracted 33 bps year over year to 7.6%, due to higher administrative expenses. Operating costs excluding depreciation and amortisation grew 20.0% to £877.1 million, including new store pre-opening costs. Depreciation and amortisation expenses grew 37.4% to £49.7 million, due to investments in new stores and the additional depreciation related to Heron Foods and Babou.

- The company reported pretax profit of £249.4 million, up 8.7% year over year. On a 52-week basis, pretax profits were up 10.3%..

- The company reported diluted EPS of 20.5 pence, up 10.2% year over year, roughly in line with the consensus. On a 52-week basis, EPS was up 12.0%.

- The company opened 54 B&M banner stores in the period (44 net stores).

- It completed the acquisition of Babou in October 2018.

- The company grew its UK B&M revenues 6.5% year over year to £2.79 billion, ahead of consensus of £2.75 billion. Revenues were up 8.7% year over year on a 52-week basis. UK B&M comparable sales grew 0.7%, beating the consensus of 0.3%. EBITDA margin expanded 46 bps to 10.6%. Segment profits grew 10.9% year over year to £215.4 million, higher than top-line growth, due to lower operating costs.

- UK Heron revenues grew 68.6% year over year to £354.1 million, beating the consensus of £343.5 million. EBITDA margin slightly expanded 3 bps to 5.6%. Segment profits grew 74.9% year over year to £7.5 million, led by top-line growth, cost control efforts and operating leverage benefits.

- Jawoll revenues grew 6.7% year over year to £213.7 million, below the consensus of £214.2 million. EBITDA margin contracted 759 bps to (4.8)%. The segment posted a loss of £(10.64) million, compared to £600,000 profit in the previous year.

- Babou sales were £129.1 million.

We have made important progress in establishing platforms for further long term expansion in both Germany and France although there is much work to be done to implement the disruptive, value-led B&M model in these large new markets. We enter the new financial year with renewed trading momentum particularly in the UK, a high-quality new store expansion program in place, and investing in our new infrastructure to support future growth.

Management announced key four strategies to drive growth: Delivering great value to customers:- By keeping running costs low, buying large volumes per product line from factories and stocking only a limited assortment of the bestselling items in any one category.

- The company’s toy category revenues have grown faster than the business as more key suppliers, such as Lego, Disney and MGA, are partnering with the company and enabling it build better ranges for customers.

- Homewares ranges underperformed in the second and third quarters of the year but after a category review, reset and remerchandising of stores, homewares posted positive comps.

- Performance in the seasonal category was strong as the company witnessed strong demand during the summer months for garden and outdoor leisure products.

- The company has a target of 950 stores in the UK, excluding Heron Foods and B&M Express.

- It opened 54 main B&M banner stores in the year and closed 10 stores due to the expiry of leases. B&M plans to open 50 new B&M banner stores in fiscal 2020, compared to its earlier plan of 45 stores.

- Heron Foods opened 20 new stores in the year and closed or replaced four.

- In Germany, Jawoll opened 10 new stores in the year and plans five new stores in the next fiscal year.

- B&M looks to get rid of poor-selling legacy ranges in German business Jawoll.

- The company hopes to expand in France after acquiring Babou and leverage its experience from operating in Germany.

- A distribution center with an area of one million square feet is under construction in Bedford to support UK store expansion, scheduled to start its operations on January 2020. B&M expects the new distribution centre to provide sufficient capacity for expansion plans into the foreseeable future, which include the 950-store target.

- B&M plans to invest in strengthening its senior management.