Source: Company reports/Fung Global Retail & Technology

1H17 RESULTS

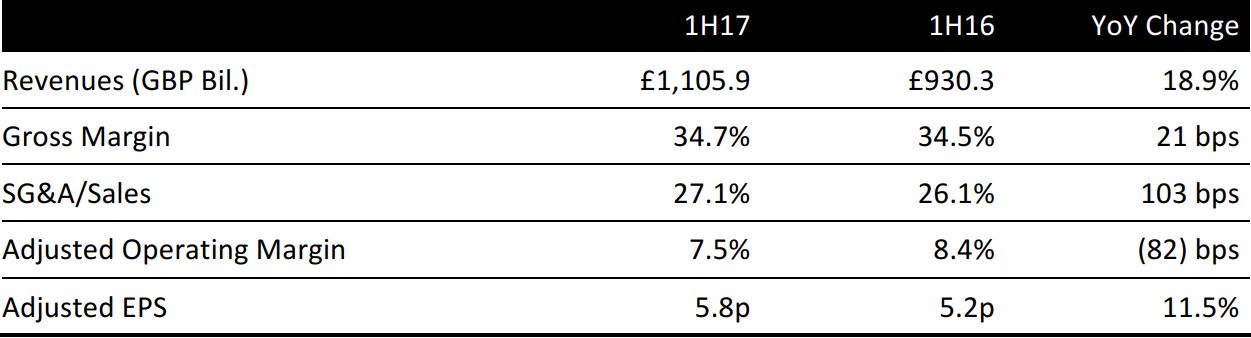

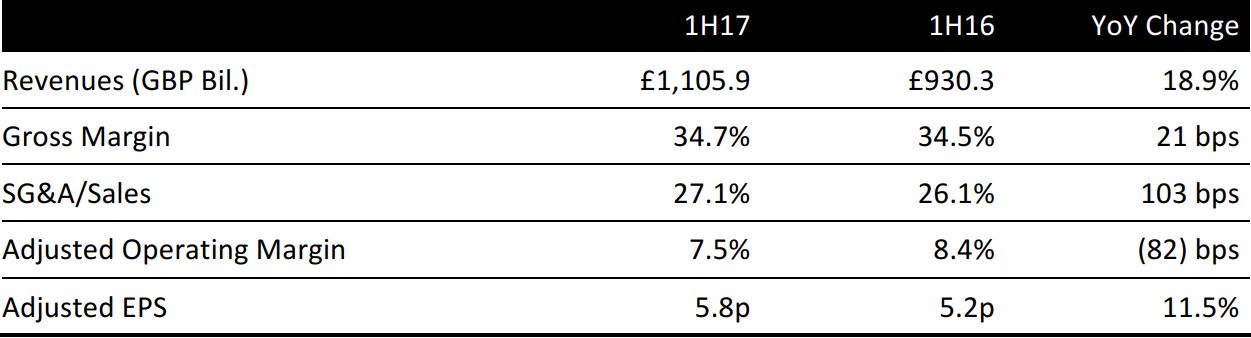

Discount retailer B&M European Value Retail reported an 18.9% year-over-year increase in revenues in the 26 weeks ended September 24. At constant currency, revenues grew 17.7%.

The top line was bolstered by 20 net UK store openings in the UK and 10 net new stores in Germany. UK comps rose just 0.2%. However, according to the company, if it excluded the cannibalization effect of new stores, underlying UK comps were up 1.9%.

The gross margin increased despite adverse effects from a strong US dollar. The company said a stronger sales mix from its new, larger stores, together with a good sell-through of seasonal ranges, offset the currency impact.

However, the SG&A ratio climbed, in part due to an increase in the UK minimum wage, but also due to operating deleverage as underlying UK sales flatlined. In Germany, the SG&A ratio was impacted by a substantial increase in warehouse capacity and investment in the central buying and property teams in anticipation of further expansion.

EBIT came in marginally below expectations, while pretax profit was ahead of consensus, and EPS of 5.8 pence was above analysts’ expectations of 5.6 pence.

Regional Breakdown

B&M operates in the UK under an eponymous banner and in Germany under the Jawoll name.

The UK

- In the UK, total sales rose 18.0% in 1H17, and, as noted above, comps increased 0.2%. The company grew its UK store estate by 10.0% to 519 stores. The UK contributed 92% of total revenues.

- The UK business is on track to open at least 50 stores this fiscal year.

Germany

- Revenues in Germany jumped 29.6% in GBP terms, helped by a 26.9% increase in store numbers to 66. Comparable sales growth was not stated.

- The company said Jawoll is moving into a phase of more rapid store openings. Its plan to open 19 new stores this year is “well on track,” with 10 stores secured through organic expansion and a further nine through the acquisition of a small family chain. B&M believes that Jawoll has the potential to become a “second growth engine” for the group.

OUTLOOK

The company commented that its 3Q has “started solidly.” It expects the cannibalization effect of new stores to decline, from an impact of 46 stores at the start of 3Q16 to 32 stores at the end of the quarter, as store openings annualize.

B&M noted exchange-rate volatility and stated that this will not impact its purchasing until spring 2017, due to hedging. The company said that around 30% of its product purchases are sourced directly from China. While B&M expects an impact on the cost of goods next year, this impact is “not yet measurable with precision.”

As a non-fixed-price retailer, B&M has slightly greater scope to pass on cost increases, versus fixed-price rivals such as Poundland. However, it aims to “minimise the effects” of cost increases on prices.

For FY17, analysts expect revenues to climb by 16.9%, EBIT to rise by 12.6% and GAAP EPS to increase by 15.5% to 14 pence.