Blockchain Technology: The world’s Game changer?

EXECUTIVE SUMMARY

Millions of dollars are being poured into investigating whether blockchain technology can transform business, financial services, and information storage and usage. Bitcoin—virtual currency used to transfer value between two parties without the use of a centralized controlling source—uses blockchain to insure transactions. Some feel that bitcoin may not survive, but are convinced that blockchain will change the way businesses and organizations operate around the globe.

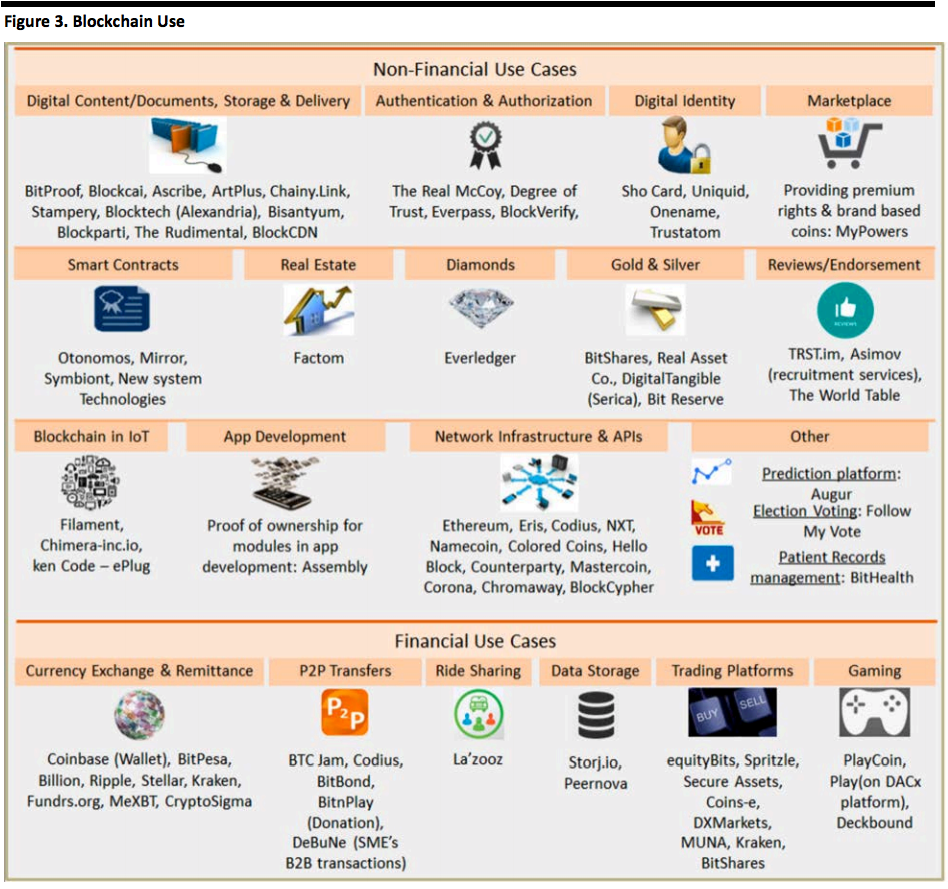

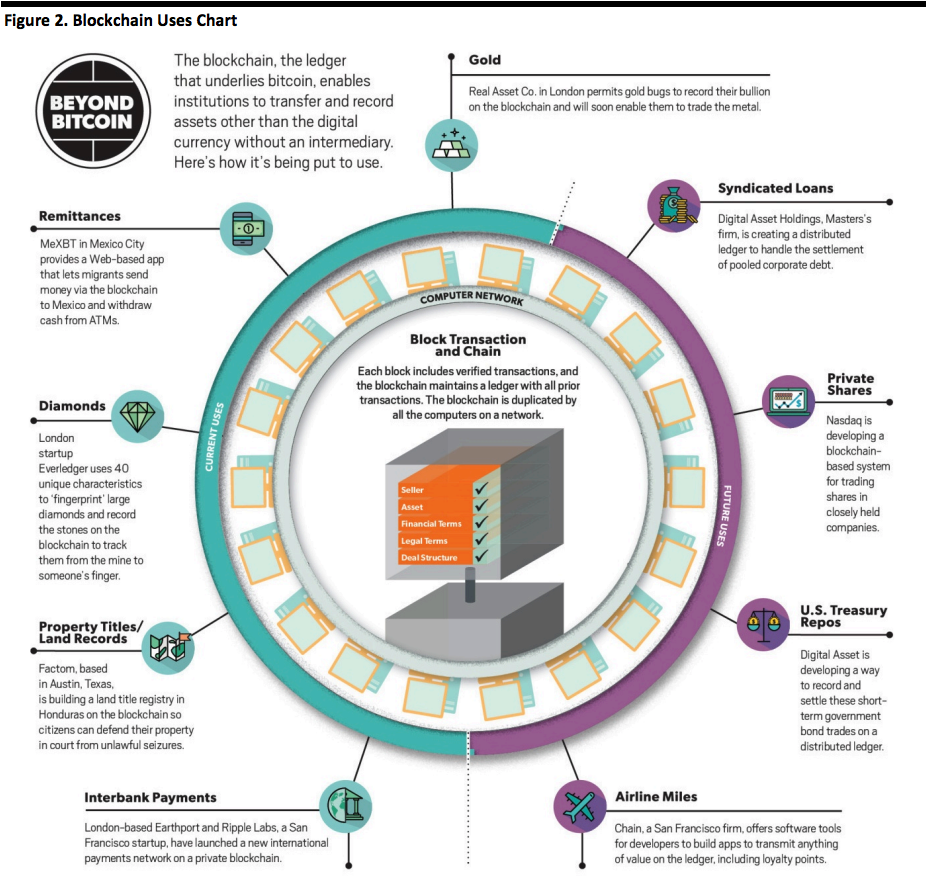

Blockchain could change how contracts work, how secure voting occurs, how the financial sector works, how financial and asset ownership information is stored, how email works, and how music is purchased. It could change the way healthcare records are stored, how ownership of diamonds and art is determined and traced, and even how collectible sneakers are proven to be real or knock-offs.

Blockchain’s combination of security and speed particularly intrigues the financial sector, which could use it to save tens of billions of dollars currently being spent with clearinghouses, banks and other centralized financial institutions. Because the technology is so new, and because only bitcoin and a few other applications have been run on it, there is much room for companies to experiment with it and develop ways to use it to further their own interests.

While all these uses for blockchain could be game-changing for businesses and industries, it is the financial services field where the technology could make the biggest impact—if developers can solve what many see as critical issues. Blockchain could revolutionize the way securities are traded, allowing trades to clear nearly instantaneously instead of over days. Entire industries—clearinghouses and exchanges, for example—could be wiped out, and billions of dollars in fees and escrow accounts could be freed up for both parties to a transaction. However, there are many issues that must be solved first.

Blockchain technology is in its infancy, and will have to go through the toddler stages before it grows into worldwide acceptance as a decentralized means of recording and verifying transactions. Many consider it a foundational technology, like the TCP/IP that enables the Internet: 25 years ago, no one imagined how thoroughly the Internet would change lives and lifestyles. But blockchain could have the same profound effect on the way business and financial transactions are conducted in the world. And every day, more potential uses for the technology are imagined and developed. Its use will be limited only by developers’ creativity and developmental dollars.

WILL BLOCKCHAIN TECHNOLOGY CHANGE THE WAY WE LIVE AND WORK?

Most people have already heard or read about bitcoin and its cousins—digital currencies used to complete transactions between two parties via computer without the need for a centralized source to confirm the transaction. Many believe that, in the long term, bitcoin will transform the way people and industry conduct business. But whether bitcoin and other digital currencies will be viable long term has yet to be determined. What will survive, and perhaps become the worldwide standard for transacting business and storing information, is the blockchain system that digital currencies run on.

Peer-to-peer exchanges of digital currency allow the transactors to move the currency from one account to another without passing it through a centralized banking authority. Instead, the money is transferred through an Internet-connected network via computers of mobile devices such as tablets and smartphones. Those involved in the system, rather than a governmental or centralized authority, maintain the network of computers through which the currency is created and moved and through which transactions are recorded.

Underpinning all digital currency transactions is the spine, a virtual ledger that records and stores every transaction. This is this underlying “blockchain” technology; it serves as the immutable record of the transaction. The parties involved in the transaction may not know each other, but they can exchange value with little fear thanks to the design of the blocks that record transactions and that make up the chain. The computers that form the network verify each transaction with sophisticated and complicated algorithms to confirm the transfer of value and create a historical ledger of all activity. The process is real-time and is much more secure than relying on a central authority to verify a transaction.

[caption id="attachment_86889" align="aligncenter" width="720"]

Source: Insurancetimes.co.uk

Source: Insurancetimes.co.uk[/caption]

Blockchain technology creates a public ledger (center) with each block sealed after a majority of the independent computers (nodes) in the network agree that a transaction has occurred. A block is sealed with a complicated algorithm called a “hash” that is unique to that block and all but unalterable unless the majority of the computers can be forced to change their minds and “rewrite history.”

Because the information regarding a transaction is approved by a majority of the computers in the system at the same time (and sometimes this involves thousands of computers located throughout the world), it is virtually impossible to go back and change it. After the majority of computers agree that the transaction has taken place, the block is sealed with a hash and part of

that hash comes from the previous block in the chain. This series of blocks becomes the virtual public ledger that traces the history of every transaction back to the beginning of the chain. Transactions take place in real time, 24/7/365, and can be completed in just minutes—and sometimes in just seconds. The beauty and strength of blockchain are its speed and security. Many compare the technology, still in its infancy, to the Internet in the 1990s, when no one truly knew what it would evolve into.

Blockchain could change how contracts work, how secure voting occurs, how the financial sector works, how financial and asset ownership information is stored, how email works and how music is purchased. It could change the way healthcare records are stored, how ownership of diamonds and art is determined and traced, and even how collectible sneakers are proven to be real or knock-offs.

Security is of utmost importance, and the many computers and computer-generated algorithm protocols associated with the hash that completes each transaction and prepares the next block are key. The technology is virtually impossible to unlock, and because each block is built on the previous one, any effort to change or manipulate the information within a block requires massive computer efforts to change block after block and history after history. It is this built-in security that attracts those who see the technology as a virtual storehouse that could replace much of the paper now used to document many records.

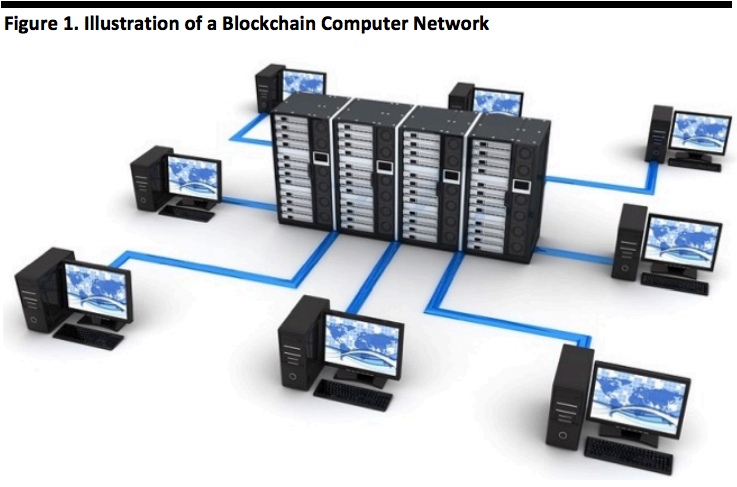

[caption id="attachment_86890" align="aligncenter" width="720"]

Source: Christophermarks.me

Source: Christophermarks.me[/caption]

Blockchain’s combination of security and speed particularly intrigues the financial sector, which could use it to save tens of billions of dollars currently being spent with clearinghouses, banks and other centralized financial institutions. Because the technology is so new and because only bitcoin and a few other applications have been run on it, there is much room for companies to experiment with it and develop ways to use it to further their own interests.

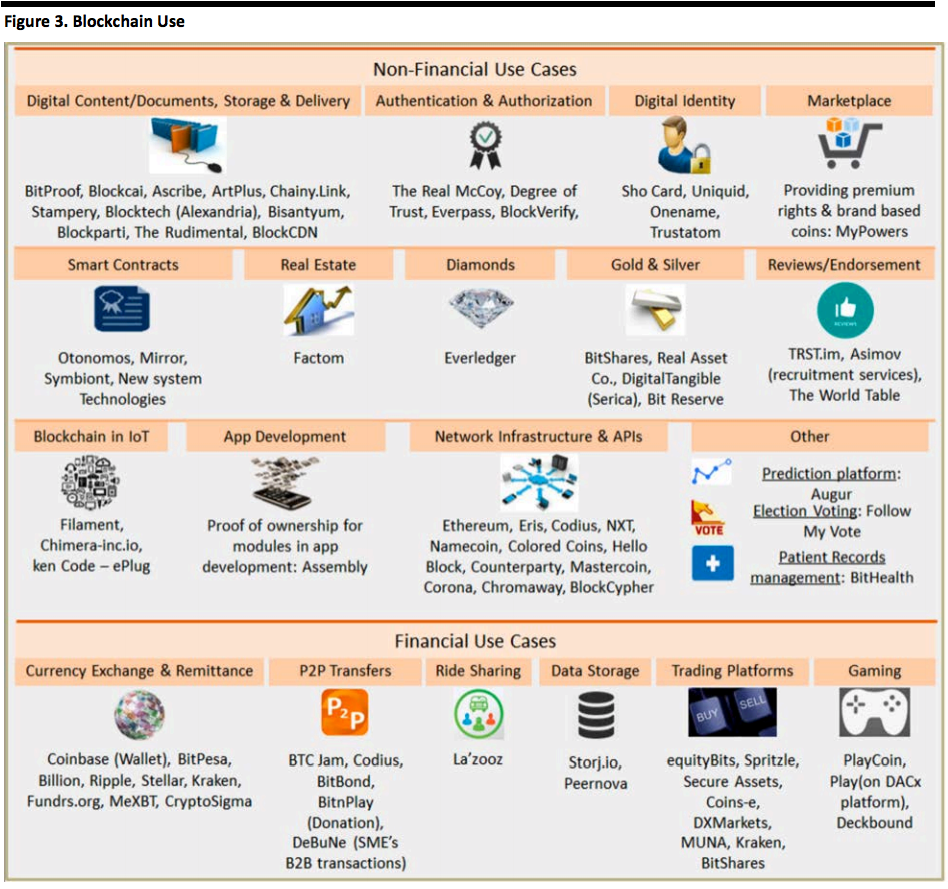

Companies and consortiums ranging from startups to many of the world’s largest financial corporations are developing blockchain applications. One area under development is using blockchain for “smart contracts,” agreements written in code that can “self-execute” when certain conditions are met. These could be used for online purchases of movies, music or goods. News websites could use smart contracts to unlock stories after a reader renders payment.

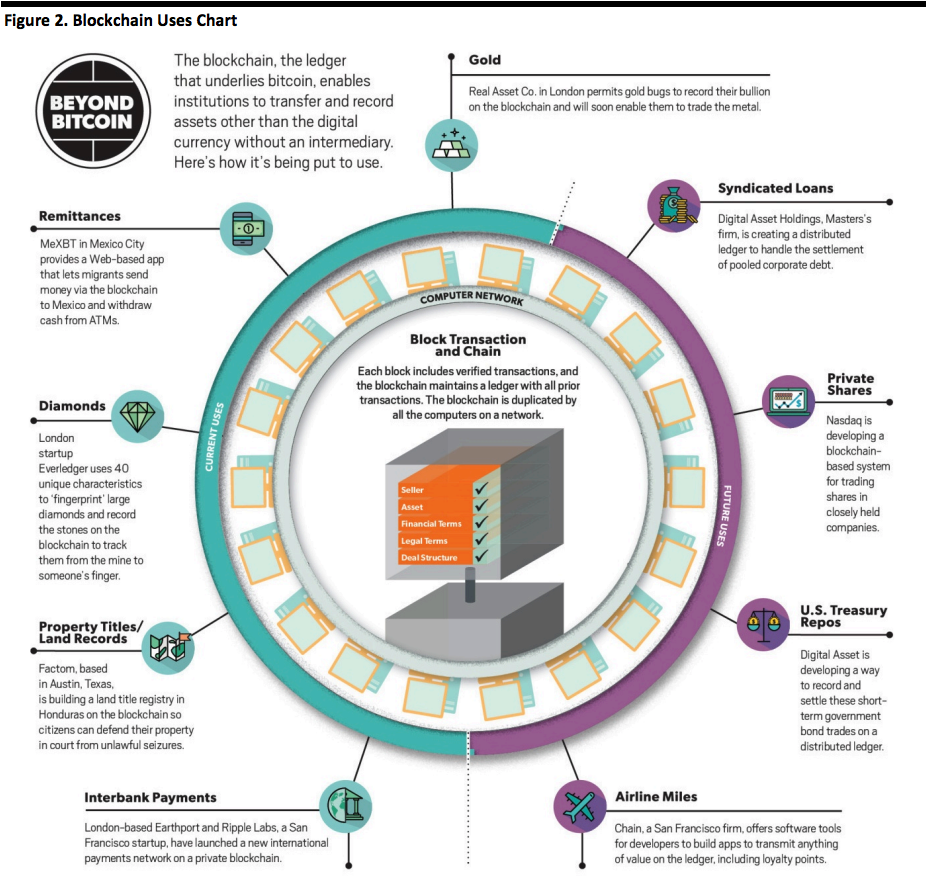

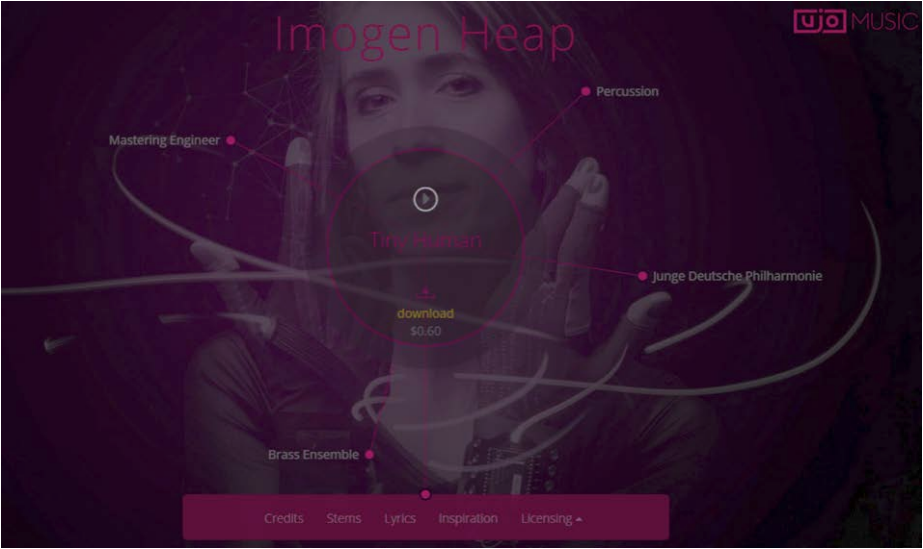

Singer/songwriter Imogen Heap released a new single on Ujo, a peer-to-peer music blockchain built on software from open-source Ethereum. Ujo presently has limited reach because it is not supported by Apple Music, Spotify or other services, but the release portends great potential for blockchain use in music. For example, it could be used to assist artists in obtaining royalty payments that may presently go unpaid. A new recording file type could be developed that carries blockchain technology about intellectual property rights and payment requirements. Payment would be made to the artist at the time of purchase, allowing the artist to pay agreed-upon fees to writers and band members at the time of purchase instead of them having to wait months or years to receive their share of royalties. A smart contract could ensure that the song would not play unless payment had been transferred and, because blockchain operates in real time, both buyer and artist would benefit immediately. Such technology could easily be applied to movies and other digital content.

[caption id="attachment_86892" align="aligncenter" width="720"]

Source: Letstalkpayments.com

Source: Letstalkpayments.com[/caption]

Smart contracts could also be used to secure and verify transactions of high-value articles such as art, antiques and diamonds, allowing parties to quickly trace ownership and certify provenance. These contracts could help remove illegal goods from the system and cut into fraud. In the diamond market, for example, fraud often occurs in documentation. To address the problem, Allianz Digital Accelerator, an emerging-technologies group at insurer Allianz Group, is working with startup Everledger to develop a blockchain to track diamonds from mine to retail sale. For each diamond, Everledger measures 40 attributes and then generates a serial number that is microscopically inscribed into the diamond and added to Everledger’s blockchain.

Everledger CEO Leanne Kemp notes that ownership histories are obtainable from the blockchain’s virtual ledger for each stone, providing a way for police and insurance investigators to track stolen gems. As of February 2016, more than 858,000 diamonds had been registered by Everledger, and more than 900,000 were in the queue to be registered. Kemp plans to expand her firm’s activities into other high-value markets such as fine art and, perhaps, titanium aerospace parts.

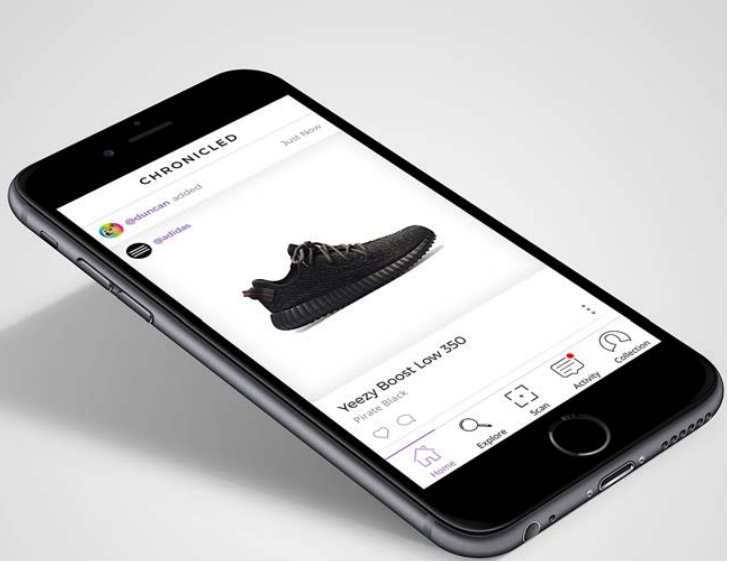

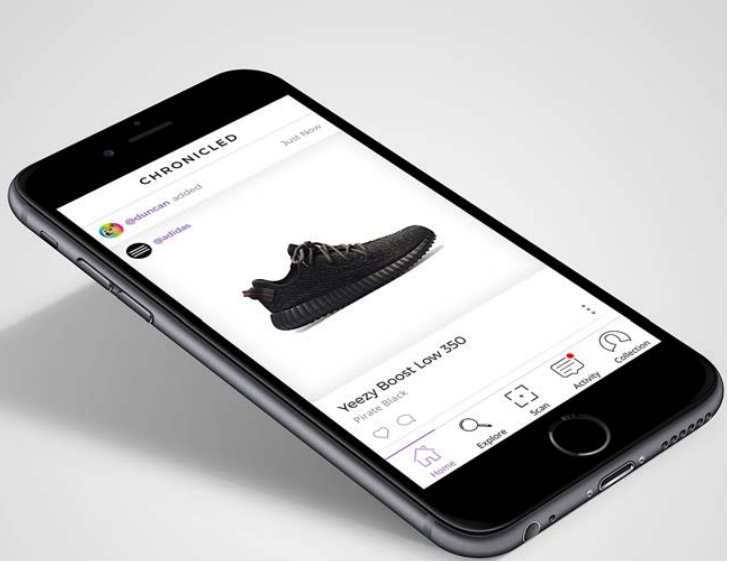

Even sneaker collectors could benefit from blockchain. These collectors have created a multimillion-dollar industry, with some people willing to spend many multiples of retail prices for rare shoes. But fake limited-edition shoes have seriously damaged the market, and Chronicled, a Silicon Valley company, has received $3.42 million in seed funding to continue development of its blockchain technology that will verify the authenticity of sneakers. Chronicled will use “smart tags” to identify authentic sneakers and blockchain to create an anonymous and encrypted registry of them. Collectors can scan the tags with a smartphone to verify shoes’ authenticity and use the Chronicled app to track and display their collections.

“Collectible and vintage sneakers are just the beginning,” said Dan Morehead, a partner at Pantera Capital, which participated in the recent funding round. “Authenticity verification and provenance of luxury goods and other physical items is a huge untapped market and, due to privacy concerns, consumers will want to own the data history associated with their physical property, which is a benefit of the blockchain-based back-end.” The secondary market for collectible sneakers is estimated to be worth more than $1 billion and limited-edition sneaker launches draw huge crowds outside stores. Some customers wait in line for weeks just to get their hands on the shoes, and then instantly put them on sale on eBay for four or five times the retail price. According to Chronicled, up to 75% of the sneakers sold on eBay are counterfeit.

Tierion is a pioneer of verifiable data records that use the bitcoin blockchain, and the firm’s platform has been used to build practical use cases that include a verifiable audit trail of insurance claims and an audit trail for healthcare processes and patient data. Through Salesforce.com, Tierion can track the purchasing approvals of goods and services. Tierion can also archive every Slack communication at a company, creating a verifiable record of the company’s online conversations, which is of particular use in regulated industries such as finance and healthcare.

Researchers at MIT are developing a blockchain that lets individuals store personal data securely and then selectively issue permission for its use. The Enigma project shifts power to privacy-seeking consumers, according to Alex Pentland, a computer science professor and the project’s advisor. In one Enigma application, individuals could select portions of personal data to release to their doctors or for drug researchers to study. “You get to issue permissions that this person can use this data for this purpose, with an end date,” Dr. Pentland said. “We are going to start trading data more like money. You own it, you control it, you give it to people for a certain purpose and that’s it.”

MIT hopes to establish Enigma, due to enter beta tests this year, as a standard blockchain infrastructure platform on which companies can build applications. Market researchers could, for example, use it to study anonymized personal data, Dr. Pentland said. He added that financial services companies could also use it to issue loans, having applicants submit encrypted personal data, and then using it to execute smart contracts. Other companies are looking into ways to use the technology to provide secure voting in elections and to create peer-to-peer email that encrypts the message and masks both the sender and the receiver.

While all these uses for blockchain could be game-changing for businesses and industries, it is the financial services field where the technology could make the biggest impact—if developers can solve what many see as critical issues.

Transparency, security, trust and speed are the four hallmarks of blockchain technology—and each is of vital importance to the trading, clearing and profit making of the financial markets. Block by block, the chain can be examined, and every transaction can be traced back to the very beginning of the chain. This transparency engenders trust; parties know that they can trust that what the blocks

say has happened has indeed happened.

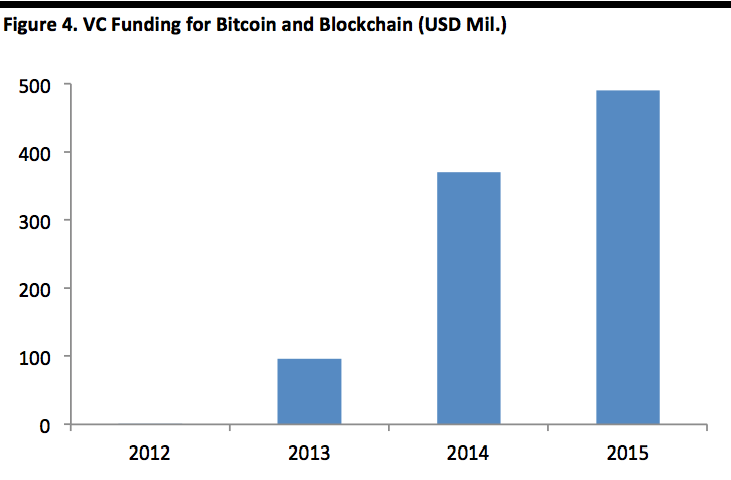

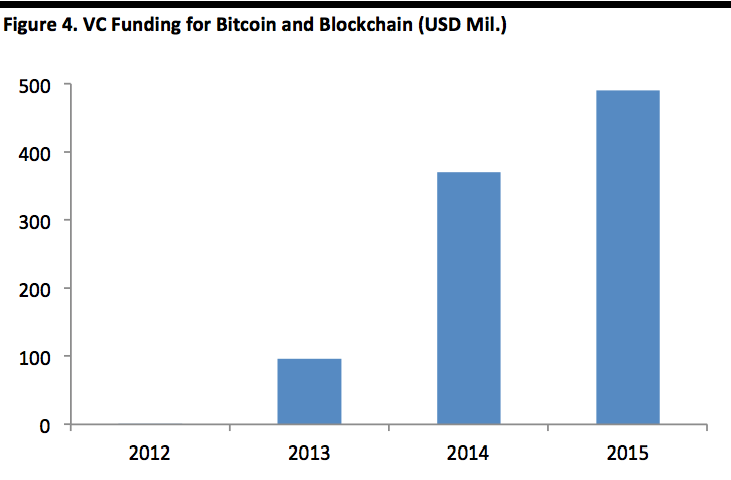

The fact that transactions are examined and approved by many computers located around the world at the same time—and are then sealed with an encrypted algorithm that is impossible to change without a majority of those computers agreeing to it at the same time—provides an unprecedented level of security for transactions. And the fact that transactions are made, examined, agreed upon and then sealed and completed nearly in real time provides speed and savings. Accordingly, some of the world’s largest financial houses are investing millions to determine the feasibility and workability of blockchain technology in their future. In two years, venture capital funding for bitcoin and blockchain technology has nearly quintupled, to almost $500 million.

[caption id="attachment_86895" align="aligncenter" width="720"]

Source: CoinDesk/Goldman Sachs Global Investment Research

Source: CoinDesk/Goldman Sachs Global Investment Research[/caption]

Blockchain could revolutionize the way securities are traded, allowing trades to clear nearly instantaneously instead over days. Entire industries—clearinghouses and exchanges, for example—could be wiped out, and billions of dollars in fees and escrow accounts could be freed up for both parties to a transaction. However, there are many issues that must be solved first. Presently, central clearinghouses are the managers and guarantors of settling each trade, and there is normally a three-day window over which buyers and sellers are matched, securities obtained, ownership transferred and financial matters settled. Eliminating the three-day window is appealing to many involved because it would speed up trading and settlement. But changing the current system would take years and many millions of dollars. Issues include information leakage about who owns what and when, confidentiality regarding investment decisions, manner of trading—because each security would need to be in the name of the person or company buying or selling it in order to trace provenance—and overcoming the time differences in international transactions. Also, incredible amounts of new paperwork could result from the restructuring that would be necessary to recognize and identify owners of individual shares and securities.

[caption id="attachment_86896" align="aligncenter" width="720"]

Source: Cbinsights.com

Source: Cbinsights.com[/caption]

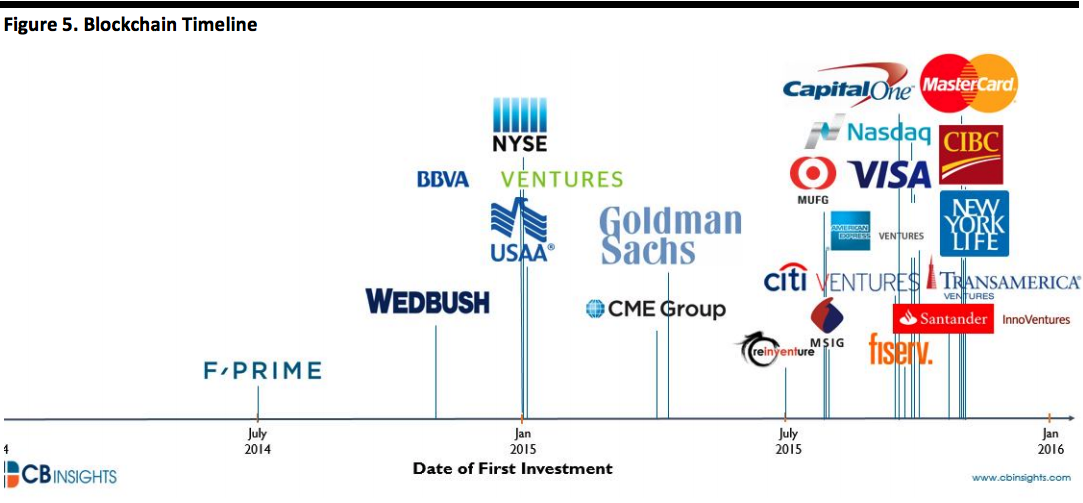

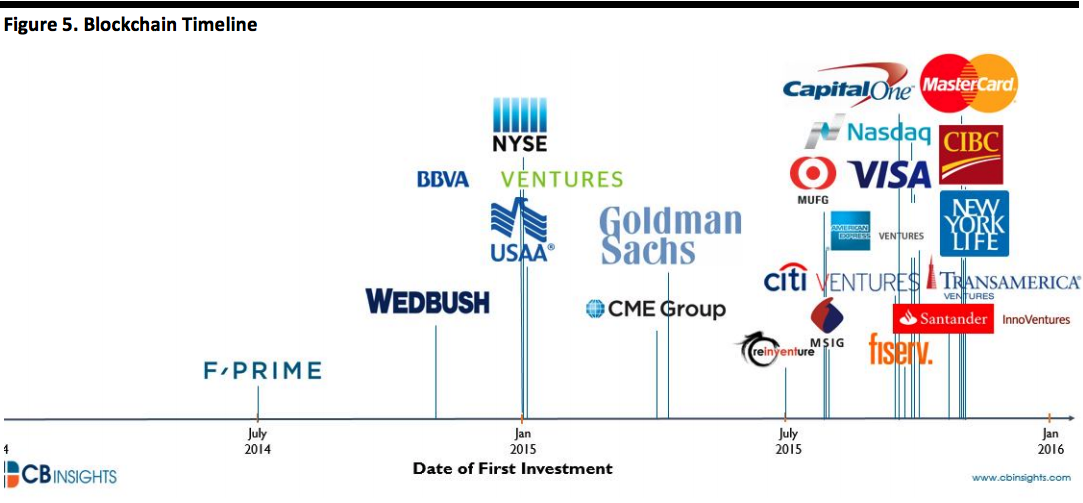

Despite these issues, many firms have become intellectually and financially attracted to the technology. Interest and investment in blockchain development by some of the world’s largest financial houses ballooned during 2015, and the surge is expected to continue in 2016. Financial institutions such as Citigroup, Deutsche Börse, Goldman Sachs and BNP Paribas have invested in it, and in September 2015, Barclays, UBS, J.P. Morgan and others partnered with financial technology company R3 to establish standards for a public ledger using blockchain. In February 2016, IBM announced a set of tools designed to let financial, logistics and other companies use blockchain.

In January 2016, a five-day pilot program saw 11 banks try Ethereum’s distributed ledger on Microsoft Azure. The following month, the R3 CEV blockchain consortium undertook an expanded test. Forty banks tested five different blockchain vendors and three cloud providers to see how different combinations handled simulated transactions in commercial paper. Technology groups at Bank of America, Morgan Stanley, Deutsche Bank, RBS and 36 other banks helped build the ledgers using base technology from rivals Chain, Eris Industries, Ethereum, Intel and IBM. Cloud infrastructure came from Amazon, IBM and Microsoft. The test was intended to show a blockchain’s capabilities in executing smart contracts and help CIOs determine what criteria to use to evaluate blockchain technologies from competing vendors.

The banks simulated three kinds of transactions: issuing, trading and redeeming commercial paper. Identical smart contracts were written for the transactions and run on different combinations of ledgers and cloud programs. IBM, for example, ran its ledger on its own cloud, while Chain ran its ledger on Amazon Web Services’ cloud. Since testing is only in the pilot stages, much is still to be learned. R3 CEV plans to conduct similar tests with the participation of government regulators as well as tests for integrating blockchains with banks’ legacy transaction systems.

[caption id="attachment_86897" align="aligncenter" width="720"]

Source: Aite Group

Source: Aite Group[/caption]

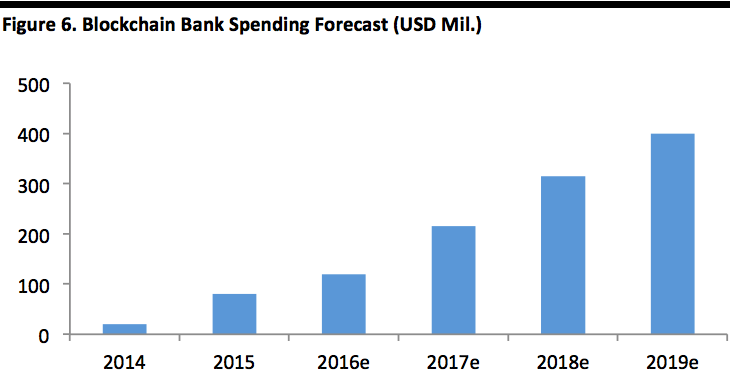

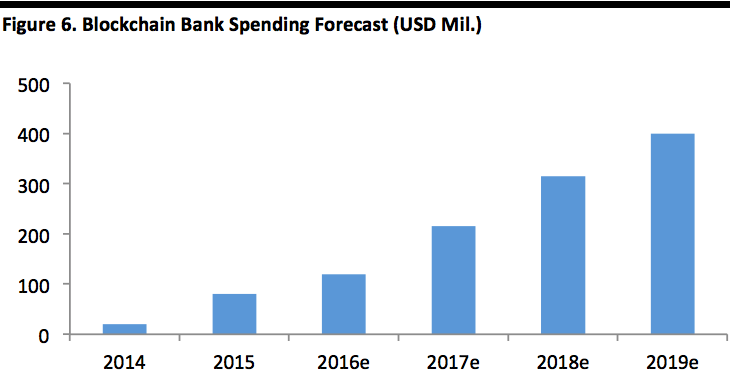

The Aite Group estimates that investment spending by banks on emerging blockchain technology will reach $400 million by 2019, a huge increase from the approximately $75 million spent on it in 2015.

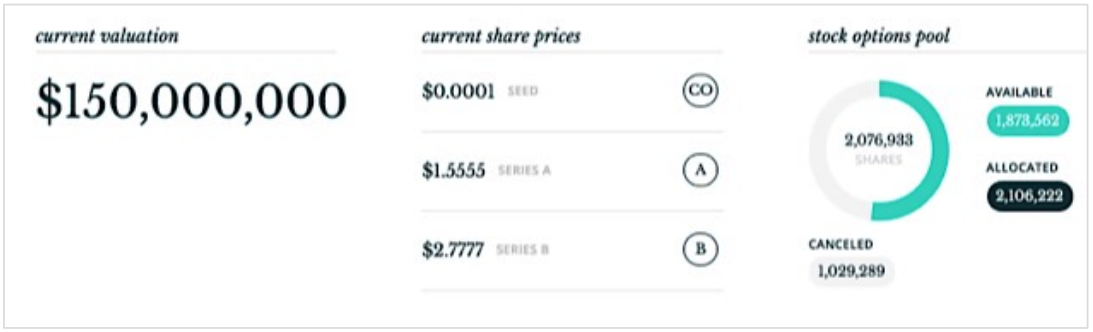

While R3 CEV and the banking industry are working on their transactional activities, Nasdaq has unveiled Linq, a solution that enables private companies to digitally represent share ownership using blockchain-based technology. According to Fredrik Voss, Vice President of Blockchain Innovation at Nasdaq, the company has been quite deliberate with regard to introducing Linq. “[Linq] is a useful solution, and we’re putting it out there with a group of pilot customers. Most of these companies are actually involved with blockchain technology, so our interests are aligned,” Voss said. The first participants to use Linq will include Chain, ChangeTip, PeerNova, Synack, Tango and Vera.

Voss knows the transition of Linq to a complete solution will be gradual. “With technology, that journey takes a little bit of time, and we want to start by affecting people’s attitudes toward that technology,” he said. “Your competitor may use it, or another part of your company might use it, or someone you think makes good decisions—and that’s how we start the process of changing attitudes. Over time, we hope that it leads to a desire and acceptance of the technology.”

[caption id="attachment_86899" align="aligncenter" width="720"]

Source: Letstalkpayments.com

Source: Letstalkpayments.com[/caption]

CONCLUSION

Blockchain technology is in its infancy, and will have to go through the toddler stages before it grows into worldwide acceptance as a decentralized means of recording and verifying transactions. Many consider it a foundational technology, like the TCP/IP that enables the Internet: 25 years ago, no one imagined how thoroughly the Internet would change lives and lifestyles. But blockchain could have the same profound effect on the way business and financial transactions are conducted in the world. And every day, more potential uses for blockchain are imagined and developed. Its use will be limited only by developers’ creativity and developmental dollars.

Blockchain could change how contracts work, how secure voting occurs, how the financial sector works, how financial and asset ownership information is stored, how email works, and how music is purchased. It could change the way healthcare records are stored, how ownership of diamonds and art is determined and traced, and even how collectible sneakers are proven to be real or knock-offs.

Blockchain’s combination of security and speed particularly intrigues the financial sector, which could use it to save tens of billions of dollars currently being spent with clearinghouses, banks and other centralized financial institutions. Because the technology is so new, and because only bitcoin and a few other applications have been run on it, there is much room for companies to experiment with it and develop ways to use it to further their own interests.

While all these uses for blockchain could be game-changing for businesses and industries, it is the financial services field where the technology could make the biggest impact—if developers can solve what many see as critical issues. Blockchain could revolutionize the way securities are traded, allowing trades to clear nearly instantaneously instead of over days. Entire industries—clearinghouses and exchanges, for example—could be wiped out, and billions of dollars in fees and escrow accounts could be freed up for both parties to a transaction. However, there are many issues that must be solved first.

Blockchain technology is in its infancy, and will have to go through the toddler stages before it grows into worldwide acceptance as a decentralized means of recording and verifying transactions. Many consider it a foundational technology, like the TCP/IP that enables the Internet: 25 years ago, no one imagined how thoroughly the Internet would change lives and lifestyles. But blockchain could have the same profound effect on the way business and financial transactions are conducted in the world. And every day, more potential uses for the technology are imagined and developed. Its use will be limited only by developers’ creativity and developmental dollars.

WILL BLOCKCHAIN TECHNOLOGY CHANGE THE WAY WE LIVE AND WORK?

Most people have already heard or read about bitcoin and its cousins—digital currencies used to complete transactions between two parties via computer without the need for a centralized source to confirm the transaction. Many believe that, in the long term, bitcoin will transform the way people and industry conduct business. But whether bitcoin and other digital currencies will be viable long term has yet to be determined. What will survive, and perhaps become the worldwide standard for transacting business and storing information, is the blockchain system that digital currencies run on.

Peer-to-peer exchanges of digital currency allow the transactors to move the currency from one account to another without passing it through a centralized banking authority. Instead, the money is transferred through an Internet-connected network via computers of mobile devices such as tablets and smartphones. Those involved in the system, rather than a governmental or centralized authority, maintain the network of computers through which the currency is created and moved and through which transactions are recorded.

Blockchain could change how contracts work, how secure voting occurs, how the financial sector works, how financial and asset ownership information is stored, how email works, and how music is purchased. It could change the way healthcare records are stored, how ownership of diamonds and art is determined and traced, and even how collectible sneakers are proven to be real or knock-offs.

Blockchain’s combination of security and speed particularly intrigues the financial sector, which could use it to save tens of billions of dollars currently being spent with clearinghouses, banks and other centralized financial institutions. Because the technology is so new, and because only bitcoin and a few other applications have been run on it, there is much room for companies to experiment with it and develop ways to use it to further their own interests.

While all these uses for blockchain could be game-changing for businesses and industries, it is the financial services field where the technology could make the biggest impact—if developers can solve what many see as critical issues. Blockchain could revolutionize the way securities are traded, allowing trades to clear nearly instantaneously instead of over days. Entire industries—clearinghouses and exchanges, for example—could be wiped out, and billions of dollars in fees and escrow accounts could be freed up for both parties to a transaction. However, there are many issues that must be solved first.

Blockchain technology is in its infancy, and will have to go through the toddler stages before it grows into worldwide acceptance as a decentralized means of recording and verifying transactions. Many consider it a foundational technology, like the TCP/IP that enables the Internet: 25 years ago, no one imagined how thoroughly the Internet would change lives and lifestyles. But blockchain could have the same profound effect on the way business and financial transactions are conducted in the world. And every day, more potential uses for the technology are imagined and developed. Its use will be limited only by developers’ creativity and developmental dollars.

WILL BLOCKCHAIN TECHNOLOGY CHANGE THE WAY WE LIVE AND WORK?

Most people have already heard or read about bitcoin and its cousins—digital currencies used to complete transactions between two parties via computer without the need for a centralized source to confirm the transaction. Many believe that, in the long term, bitcoin will transform the way people and industry conduct business. But whether bitcoin and other digital currencies will be viable long term has yet to be determined. What will survive, and perhaps become the worldwide standard for transacting business and storing information, is the blockchain system that digital currencies run on.

Peer-to-peer exchanges of digital currency allow the transactors to move the currency from one account to another without passing it through a centralized banking authority. Instead, the money is transferred through an Internet-connected network via computers of mobile devices such as tablets and smartphones. Those involved in the system, rather than a governmental or centralized authority, maintain the network of computers through which the currency is created and moved and through which transactions are recorded.

Underpinning all digital currency transactions is the spine, a virtual ledger that records and stores every transaction. This is this underlying “blockchain” technology; it serves as the immutable record of the transaction. The parties involved in the transaction may not know each other, but they can exchange value with little fear thanks to the design of the blocks that record transactions and that make up the chain. The computers that form the network verify each transaction with sophisticated and complicated algorithms to confirm the transfer of value and create a historical ledger of all activity. The process is real-time and is much more secure than relying on a central authority to verify a transaction.

[caption id="attachment_86889" align="aligncenter" width="720"]

Underpinning all digital currency transactions is the spine, a virtual ledger that records and stores every transaction. This is this underlying “blockchain” technology; it serves as the immutable record of the transaction. The parties involved in the transaction may not know each other, but they can exchange value with little fear thanks to the design of the blocks that record transactions and that make up the chain. The computers that form the network verify each transaction with sophisticated and complicated algorithms to confirm the transfer of value and create a historical ledger of all activity. The process is real-time and is much more secure than relying on a central authority to verify a transaction.

[caption id="attachment_86889" align="aligncenter" width="720"] Source: Insurancetimes.co.uk[/caption]

Blockchain technology creates a public ledger (center) with each block sealed after a majority of the independent computers (nodes) in the network agree that a transaction has occurred. A block is sealed with a complicated algorithm called a “hash” that is unique to that block and all but unalterable unless the majority of the computers can be forced to change their minds and “rewrite history.”

Because the information regarding a transaction is approved by a majority of the computers in the system at the same time (and sometimes this involves thousands of computers located throughout the world), it is virtually impossible to go back and change it. After the majority of computers agree that the transaction has taken place, the block is sealed with a hash and part of that hash comes from the previous block in the chain. This series of blocks becomes the virtual public ledger that traces the history of every transaction back to the beginning of the chain. Transactions take place in real time, 24/7/365, and can be completed in just minutes—and sometimes in just seconds. The beauty and strength of blockchain are its speed and security. Many compare the technology, still in its infancy, to the Internet in the 1990s, when no one truly knew what it would evolve into.

Blockchain could change how contracts work, how secure voting occurs, how the financial sector works, how financial and asset ownership information is stored, how email works and how music is purchased. It could change the way healthcare records are stored, how ownership of diamonds and art is determined and traced, and even how collectible sneakers are proven to be real or knock-offs.

Security is of utmost importance, and the many computers and computer-generated algorithm protocols associated with the hash that completes each transaction and prepares the next block are key. The technology is virtually impossible to unlock, and because each block is built on the previous one, any effort to change or manipulate the information within a block requires massive computer efforts to change block after block and history after history. It is this built-in security that attracts those who see the technology as a virtual storehouse that could replace much of the paper now used to document many records.

[caption id="attachment_86890" align="aligncenter" width="720"]

Source: Insurancetimes.co.uk[/caption]

Blockchain technology creates a public ledger (center) with each block sealed after a majority of the independent computers (nodes) in the network agree that a transaction has occurred. A block is sealed with a complicated algorithm called a “hash” that is unique to that block and all but unalterable unless the majority of the computers can be forced to change their minds and “rewrite history.”

Because the information regarding a transaction is approved by a majority of the computers in the system at the same time (and sometimes this involves thousands of computers located throughout the world), it is virtually impossible to go back and change it. After the majority of computers agree that the transaction has taken place, the block is sealed with a hash and part of that hash comes from the previous block in the chain. This series of blocks becomes the virtual public ledger that traces the history of every transaction back to the beginning of the chain. Transactions take place in real time, 24/7/365, and can be completed in just minutes—and sometimes in just seconds. The beauty and strength of blockchain are its speed and security. Many compare the technology, still in its infancy, to the Internet in the 1990s, when no one truly knew what it would evolve into.

Blockchain could change how contracts work, how secure voting occurs, how the financial sector works, how financial and asset ownership information is stored, how email works and how music is purchased. It could change the way healthcare records are stored, how ownership of diamonds and art is determined and traced, and even how collectible sneakers are proven to be real or knock-offs.

Security is of utmost importance, and the many computers and computer-generated algorithm protocols associated with the hash that completes each transaction and prepares the next block are key. The technology is virtually impossible to unlock, and because each block is built on the previous one, any effort to change or manipulate the information within a block requires massive computer efforts to change block after block and history after history. It is this built-in security that attracts those who see the technology as a virtual storehouse that could replace much of the paper now used to document many records.

[caption id="attachment_86890" align="aligncenter" width="720"] Source: Christophermarks.me[/caption]

Blockchain’s combination of security and speed particularly intrigues the financial sector, which could use it to save tens of billions of dollars currently being spent with clearinghouses, banks and other centralized financial institutions. Because the technology is so new and because only bitcoin and a few other applications have been run on it, there is much room for companies to experiment with it and develop ways to use it to further their own interests.

Companies and consortiums ranging from startups to many of the world’s largest financial corporations are developing blockchain applications. One area under development is using blockchain for “smart contracts,” agreements written in code that can “self-execute” when certain conditions are met. These could be used for online purchases of movies, music or goods. News websites could use smart contracts to unlock stories after a reader renders payment.

Singer/songwriter Imogen Heap released a new single on Ujo, a peer-to-peer music blockchain built on software from open-source Ethereum. Ujo presently has limited reach because it is not supported by Apple Music, Spotify or other services, but the release portends great potential for blockchain use in music. For example, it could be used to assist artists in obtaining royalty payments that may presently go unpaid. A new recording file type could be developed that carries blockchain technology about intellectual property rights and payment requirements. Payment would be made to the artist at the time of purchase, allowing the artist to pay agreed-upon fees to writers and band members at the time of purchase instead of them having to wait months or years to receive their share of royalties. A smart contract could ensure that the song would not play unless payment had been transferred and, because blockchain operates in real time, both buyer and artist would benefit immediately. Such technology could easily be applied to movies and other digital content.

Source: Christophermarks.me[/caption]

Blockchain’s combination of security and speed particularly intrigues the financial sector, which could use it to save tens of billions of dollars currently being spent with clearinghouses, banks and other centralized financial institutions. Because the technology is so new and because only bitcoin and a few other applications have been run on it, there is much room for companies to experiment with it and develop ways to use it to further their own interests.

Companies and consortiums ranging from startups to many of the world’s largest financial corporations are developing blockchain applications. One area under development is using blockchain for “smart contracts,” agreements written in code that can “self-execute” when certain conditions are met. These could be used for online purchases of movies, music or goods. News websites could use smart contracts to unlock stories after a reader renders payment.

Singer/songwriter Imogen Heap released a new single on Ujo, a peer-to-peer music blockchain built on software from open-source Ethereum. Ujo presently has limited reach because it is not supported by Apple Music, Spotify or other services, but the release portends great potential for blockchain use in music. For example, it could be used to assist artists in obtaining royalty payments that may presently go unpaid. A new recording file type could be developed that carries blockchain technology about intellectual property rights and payment requirements. Payment would be made to the artist at the time of purchase, allowing the artist to pay agreed-upon fees to writers and band members at the time of purchase instead of them having to wait months or years to receive their share of royalties. A smart contract could ensure that the song would not play unless payment had been transferred and, because blockchain operates in real time, both buyer and artist would benefit immediately. Such technology could easily be applied to movies and other digital content.

[caption id="attachment_86892" align="aligncenter" width="720"]

[caption id="attachment_86892" align="aligncenter" width="720"] Source: Letstalkpayments.com[/caption]

Smart contracts could also be used to secure and verify transactions of high-value articles such as art, antiques and diamonds, allowing parties to quickly trace ownership and certify provenance. These contracts could help remove illegal goods from the system and cut into fraud. In the diamond market, for example, fraud often occurs in documentation. To address the problem, Allianz Digital Accelerator, an emerging-technologies group at insurer Allianz Group, is working with startup Everledger to develop a blockchain to track diamonds from mine to retail sale. For each diamond, Everledger measures 40 attributes and then generates a serial number that is microscopically inscribed into the diamond and added to Everledger’s blockchain.

Everledger CEO Leanne Kemp notes that ownership histories are obtainable from the blockchain’s virtual ledger for each stone, providing a way for police and insurance investigators to track stolen gems. As of February 2016, more than 858,000 diamonds had been registered by Everledger, and more than 900,000 were in the queue to be registered. Kemp plans to expand her firm’s activities into other high-value markets such as fine art and, perhaps, titanium aerospace parts.

Even sneaker collectors could benefit from blockchain. These collectors have created a multimillion-dollar industry, with some people willing to spend many multiples of retail prices for rare shoes. But fake limited-edition shoes have seriously damaged the market, and Chronicled, a Silicon Valley company, has received $3.42 million in seed funding to continue development of its blockchain technology that will verify the authenticity of sneakers. Chronicled will use “smart tags” to identify authentic sneakers and blockchain to create an anonymous and encrypted registry of them. Collectors can scan the tags with a smartphone to verify shoes’ authenticity and use the Chronicled app to track and display their collections.

Source: Letstalkpayments.com[/caption]

Smart contracts could also be used to secure and verify transactions of high-value articles such as art, antiques and diamonds, allowing parties to quickly trace ownership and certify provenance. These contracts could help remove illegal goods from the system and cut into fraud. In the diamond market, for example, fraud often occurs in documentation. To address the problem, Allianz Digital Accelerator, an emerging-technologies group at insurer Allianz Group, is working with startup Everledger to develop a blockchain to track diamonds from mine to retail sale. For each diamond, Everledger measures 40 attributes and then generates a serial number that is microscopically inscribed into the diamond and added to Everledger’s blockchain.

Everledger CEO Leanne Kemp notes that ownership histories are obtainable from the blockchain’s virtual ledger for each stone, providing a way for police and insurance investigators to track stolen gems. As of February 2016, more than 858,000 diamonds had been registered by Everledger, and more than 900,000 were in the queue to be registered. Kemp plans to expand her firm’s activities into other high-value markets such as fine art and, perhaps, titanium aerospace parts.

Even sneaker collectors could benefit from blockchain. These collectors have created a multimillion-dollar industry, with some people willing to spend many multiples of retail prices for rare shoes. But fake limited-edition shoes have seriously damaged the market, and Chronicled, a Silicon Valley company, has received $3.42 million in seed funding to continue development of its blockchain technology that will verify the authenticity of sneakers. Chronicled will use “smart tags” to identify authentic sneakers and blockchain to create an anonymous and encrypted registry of them. Collectors can scan the tags with a smartphone to verify shoes’ authenticity and use the Chronicled app to track and display their collections.

“Collectible and vintage sneakers are just the beginning,” said Dan Morehead, a partner at Pantera Capital, which participated in the recent funding round. “Authenticity verification and provenance of luxury goods and other physical items is a huge untapped market and, due to privacy concerns, consumers will want to own the data history associated with their physical property, which is a benefit of the blockchain-based back-end.” The secondary market for collectible sneakers is estimated to be worth more than $1 billion and limited-edition sneaker launches draw huge crowds outside stores. Some customers wait in line for weeks just to get their hands on the shoes, and then instantly put them on sale on eBay for four or five times the retail price. According to Chronicled, up to 75% of the sneakers sold on eBay are counterfeit.

Tierion is a pioneer of verifiable data records that use the bitcoin blockchain, and the firm’s platform has been used to build practical use cases that include a verifiable audit trail of insurance claims and an audit trail for healthcare processes and patient data. Through Salesforce.com, Tierion can track the purchasing approvals of goods and services. Tierion can also archive every Slack communication at a company, creating a verifiable record of the company’s online conversations, which is of particular use in regulated industries such as finance and healthcare.

Researchers at MIT are developing a blockchain that lets individuals store personal data securely and then selectively issue permission for its use. The Enigma project shifts power to privacy-seeking consumers, according to Alex Pentland, a computer science professor and the project’s advisor. In one Enigma application, individuals could select portions of personal data to release to their doctors or for drug researchers to study. “You get to issue permissions that this person can use this data for this purpose, with an end date,” Dr. Pentland said. “We are going to start trading data more like money. You own it, you control it, you give it to people for a certain purpose and that’s it.”

MIT hopes to establish Enigma, due to enter beta tests this year, as a standard blockchain infrastructure platform on which companies can build applications. Market researchers could, for example, use it to study anonymized personal data, Dr. Pentland said. He added that financial services companies could also use it to issue loans, having applicants submit encrypted personal data, and then using it to execute smart contracts. Other companies are looking into ways to use the technology to provide secure voting in elections and to create peer-to-peer email that encrypts the message and masks both the sender and the receiver.

“Collectible and vintage sneakers are just the beginning,” said Dan Morehead, a partner at Pantera Capital, which participated in the recent funding round. “Authenticity verification and provenance of luxury goods and other physical items is a huge untapped market and, due to privacy concerns, consumers will want to own the data history associated with their physical property, which is a benefit of the blockchain-based back-end.” The secondary market for collectible sneakers is estimated to be worth more than $1 billion and limited-edition sneaker launches draw huge crowds outside stores. Some customers wait in line for weeks just to get their hands on the shoes, and then instantly put them on sale on eBay for four or five times the retail price. According to Chronicled, up to 75% of the sneakers sold on eBay are counterfeit.

Tierion is a pioneer of verifiable data records that use the bitcoin blockchain, and the firm’s platform has been used to build practical use cases that include a verifiable audit trail of insurance claims and an audit trail for healthcare processes and patient data. Through Salesforce.com, Tierion can track the purchasing approvals of goods and services. Tierion can also archive every Slack communication at a company, creating a verifiable record of the company’s online conversations, which is of particular use in regulated industries such as finance and healthcare.

Researchers at MIT are developing a blockchain that lets individuals store personal data securely and then selectively issue permission for its use. The Enigma project shifts power to privacy-seeking consumers, according to Alex Pentland, a computer science professor and the project’s advisor. In one Enigma application, individuals could select portions of personal data to release to their doctors or for drug researchers to study. “You get to issue permissions that this person can use this data for this purpose, with an end date,” Dr. Pentland said. “We are going to start trading data more like money. You own it, you control it, you give it to people for a certain purpose and that’s it.”

MIT hopes to establish Enigma, due to enter beta tests this year, as a standard blockchain infrastructure platform on which companies can build applications. Market researchers could, for example, use it to study anonymized personal data, Dr. Pentland said. He added that financial services companies could also use it to issue loans, having applicants submit encrypted personal data, and then using it to execute smart contracts. Other companies are looking into ways to use the technology to provide secure voting in elections and to create peer-to-peer email that encrypts the message and masks both the sender and the receiver.

While all these uses for blockchain could be game-changing for businesses and industries, it is the financial services field where the technology could make the biggest impact—if developers can solve what many see as critical issues.

Transparency, security, trust and speed are the four hallmarks of blockchain technology—and each is of vital importance to the trading, clearing and profit making of the financial markets. Block by block, the chain can be examined, and every transaction can be traced back to the very beginning of the chain. This transparency engenders trust; parties know that they can trust that what the blocks say has happened has indeed happened.

The fact that transactions are examined and approved by many computers located around the world at the same time—and are then sealed with an encrypted algorithm that is impossible to change without a majority of those computers agreeing to it at the same time—provides an unprecedented level of security for transactions. And the fact that transactions are made, examined, agreed upon and then sealed and completed nearly in real time provides speed and savings. Accordingly, some of the world’s largest financial houses are investing millions to determine the feasibility and workability of blockchain technology in their future. In two years, venture capital funding for bitcoin and blockchain technology has nearly quintupled, to almost $500 million.

[caption id="attachment_86895" align="aligncenter" width="720"]

While all these uses for blockchain could be game-changing for businesses and industries, it is the financial services field where the technology could make the biggest impact—if developers can solve what many see as critical issues.

Transparency, security, trust and speed are the four hallmarks of blockchain technology—and each is of vital importance to the trading, clearing and profit making of the financial markets. Block by block, the chain can be examined, and every transaction can be traced back to the very beginning of the chain. This transparency engenders trust; parties know that they can trust that what the blocks say has happened has indeed happened.

The fact that transactions are examined and approved by many computers located around the world at the same time—and are then sealed with an encrypted algorithm that is impossible to change without a majority of those computers agreeing to it at the same time—provides an unprecedented level of security for transactions. And the fact that transactions are made, examined, agreed upon and then sealed and completed nearly in real time provides speed and savings. Accordingly, some of the world’s largest financial houses are investing millions to determine the feasibility and workability of blockchain technology in their future. In two years, venture capital funding for bitcoin and blockchain technology has nearly quintupled, to almost $500 million.

[caption id="attachment_86895" align="aligncenter" width="720"] Source: CoinDesk/Goldman Sachs Global Investment Research[/caption]

Blockchain could revolutionize the way securities are traded, allowing trades to clear nearly instantaneously instead over days. Entire industries—clearinghouses and exchanges, for example—could be wiped out, and billions of dollars in fees and escrow accounts could be freed up for both parties to a transaction. However, there are many issues that must be solved first. Presently, central clearinghouses are the managers and guarantors of settling each trade, and there is normally a three-day window over which buyers and sellers are matched, securities obtained, ownership transferred and financial matters settled. Eliminating the three-day window is appealing to many involved because it would speed up trading and settlement. But changing the current system would take years and many millions of dollars. Issues include information leakage about who owns what and when, confidentiality regarding investment decisions, manner of trading—because each security would need to be in the name of the person or company buying or selling it in order to trace provenance—and overcoming the time differences in international transactions. Also, incredible amounts of new paperwork could result from the restructuring that would be necessary to recognize and identify owners of individual shares and securities.

[caption id="attachment_86896" align="aligncenter" width="720"]

Source: CoinDesk/Goldman Sachs Global Investment Research[/caption]

Blockchain could revolutionize the way securities are traded, allowing trades to clear nearly instantaneously instead over days. Entire industries—clearinghouses and exchanges, for example—could be wiped out, and billions of dollars in fees and escrow accounts could be freed up for both parties to a transaction. However, there are many issues that must be solved first. Presently, central clearinghouses are the managers and guarantors of settling each trade, and there is normally a three-day window over which buyers and sellers are matched, securities obtained, ownership transferred and financial matters settled. Eliminating the three-day window is appealing to many involved because it would speed up trading and settlement. But changing the current system would take years and many millions of dollars. Issues include information leakage about who owns what and when, confidentiality regarding investment decisions, manner of trading—because each security would need to be in the name of the person or company buying or selling it in order to trace provenance—and overcoming the time differences in international transactions. Also, incredible amounts of new paperwork could result from the restructuring that would be necessary to recognize and identify owners of individual shares and securities.

[caption id="attachment_86896" align="aligncenter" width="720"] Source: Cbinsights.com[/caption]

Despite these issues, many firms have become intellectually and financially attracted to the technology. Interest and investment in blockchain development by some of the world’s largest financial houses ballooned during 2015, and the surge is expected to continue in 2016. Financial institutions such as Citigroup, Deutsche Börse, Goldman Sachs and BNP Paribas have invested in it, and in September 2015, Barclays, UBS, J.P. Morgan and others partnered with financial technology company R3 to establish standards for a public ledger using blockchain. In February 2016, IBM announced a set of tools designed to let financial, logistics and other companies use blockchain.

In January 2016, a five-day pilot program saw 11 banks try Ethereum’s distributed ledger on Microsoft Azure. The following month, the R3 CEV blockchain consortium undertook an expanded test. Forty banks tested five different blockchain vendors and three cloud providers to see how different combinations handled simulated transactions in commercial paper. Technology groups at Bank of America, Morgan Stanley, Deutsche Bank, RBS and 36 other banks helped build the ledgers using base technology from rivals Chain, Eris Industries, Ethereum, Intel and IBM. Cloud infrastructure came from Amazon, IBM and Microsoft. The test was intended to show a blockchain’s capabilities in executing smart contracts and help CIOs determine what criteria to use to evaluate blockchain technologies from competing vendors.

The banks simulated three kinds of transactions: issuing, trading and redeeming commercial paper. Identical smart contracts were written for the transactions and run on different combinations of ledgers and cloud programs. IBM, for example, ran its ledger on its own cloud, while Chain ran its ledger on Amazon Web Services’ cloud. Since testing is only in the pilot stages, much is still to be learned. R3 CEV plans to conduct similar tests with the participation of government regulators as well as tests for integrating blockchains with banks’ legacy transaction systems.

[caption id="attachment_86897" align="aligncenter" width="720"]

Source: Cbinsights.com[/caption]

Despite these issues, many firms have become intellectually and financially attracted to the technology. Interest and investment in blockchain development by some of the world’s largest financial houses ballooned during 2015, and the surge is expected to continue in 2016. Financial institutions such as Citigroup, Deutsche Börse, Goldman Sachs and BNP Paribas have invested in it, and in September 2015, Barclays, UBS, J.P. Morgan and others partnered with financial technology company R3 to establish standards for a public ledger using blockchain. In February 2016, IBM announced a set of tools designed to let financial, logistics and other companies use blockchain.

In January 2016, a five-day pilot program saw 11 banks try Ethereum’s distributed ledger on Microsoft Azure. The following month, the R3 CEV blockchain consortium undertook an expanded test. Forty banks tested five different blockchain vendors and three cloud providers to see how different combinations handled simulated transactions in commercial paper. Technology groups at Bank of America, Morgan Stanley, Deutsche Bank, RBS and 36 other banks helped build the ledgers using base technology from rivals Chain, Eris Industries, Ethereum, Intel and IBM. Cloud infrastructure came from Amazon, IBM and Microsoft. The test was intended to show a blockchain’s capabilities in executing smart contracts and help CIOs determine what criteria to use to evaluate blockchain technologies from competing vendors.

The banks simulated three kinds of transactions: issuing, trading and redeeming commercial paper. Identical smart contracts were written for the transactions and run on different combinations of ledgers and cloud programs. IBM, for example, ran its ledger on its own cloud, while Chain ran its ledger on Amazon Web Services’ cloud. Since testing is only in the pilot stages, much is still to be learned. R3 CEV plans to conduct similar tests with the participation of government regulators as well as tests for integrating blockchains with banks’ legacy transaction systems.

[caption id="attachment_86897" align="aligncenter" width="720"] Source: Aite Group[/caption]

The Aite Group estimates that investment spending by banks on emerging blockchain technology will reach $400 million by 2019, a huge increase from the approximately $75 million spent on it in 2015.

While R3 CEV and the banking industry are working on their transactional activities, Nasdaq has unveiled Linq, a solution that enables private companies to digitally represent share ownership using blockchain-based technology. According to Fredrik Voss, Vice President of Blockchain Innovation at Nasdaq, the company has been quite deliberate with regard to introducing Linq. “[Linq] is a useful solution, and we’re putting it out there with a group of pilot customers. Most of these companies are actually involved with blockchain technology, so our interests are aligned,” Voss said. The first participants to use Linq will include Chain, ChangeTip, PeerNova, Synack, Tango and Vera.

Source: Aite Group[/caption]

The Aite Group estimates that investment spending by banks on emerging blockchain technology will reach $400 million by 2019, a huge increase from the approximately $75 million spent on it in 2015.

While R3 CEV and the banking industry are working on their transactional activities, Nasdaq has unveiled Linq, a solution that enables private companies to digitally represent share ownership using blockchain-based technology. According to Fredrik Voss, Vice President of Blockchain Innovation at Nasdaq, the company has been quite deliberate with regard to introducing Linq. “[Linq] is a useful solution, and we’re putting it out there with a group of pilot customers. Most of these companies are actually involved with blockchain technology, so our interests are aligned,” Voss said. The first participants to use Linq will include Chain, ChangeTip, PeerNova, Synack, Tango and Vera.

Voss knows the transition of Linq to a complete solution will be gradual. “With technology, that journey takes a little bit of time, and we want to start by affecting people’s attitudes toward that technology,” he said. “Your competitor may use it, or another part of your company might use it, or someone you think makes good decisions—and that’s how we start the process of changing attitudes. Over time, we hope that it leads to a desire and acceptance of the technology.”

[caption id="attachment_86899" align="aligncenter" width="720"]

Voss knows the transition of Linq to a complete solution will be gradual. “With technology, that journey takes a little bit of time, and we want to start by affecting people’s attitudes toward that technology,” he said. “Your competitor may use it, or another part of your company might use it, or someone you think makes good decisions—and that’s how we start the process of changing attitudes. Over time, we hope that it leads to a desire and acceptance of the technology.”

[caption id="attachment_86899" align="aligncenter" width="720"] Source: Letstalkpayments.com[/caption]

CONCLUSION

Blockchain technology is in its infancy, and will have to go through the toddler stages before it grows into worldwide acceptance as a decentralized means of recording and verifying transactions. Many consider it a foundational technology, like the TCP/IP that enables the Internet: 25 years ago, no one imagined how thoroughly the Internet would change lives and lifestyles. But blockchain could have the same profound effect on the way business and financial transactions are conducted in the world. And every day, more potential uses for blockchain are imagined and developed. Its use will be limited only by developers’ creativity and developmental dollars.

Source: Letstalkpayments.com[/caption]

CONCLUSION

Blockchain technology is in its infancy, and will have to go through the toddler stages before it grows into worldwide acceptance as a decentralized means of recording and verifying transactions. Many consider it a foundational technology, like the TCP/IP that enables the Internet: 25 years ago, no one imagined how thoroughly the Internet would change lives and lifestyles. But blockchain could have the same profound effect on the way business and financial transactions are conducted in the world. And every day, more potential uses for blockchain are imagined and developed. Its use will be limited only by developers’ creativity and developmental dollars.