[caption id="attachment_79416" align="aligncenter" width="620"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

4Q18 Results

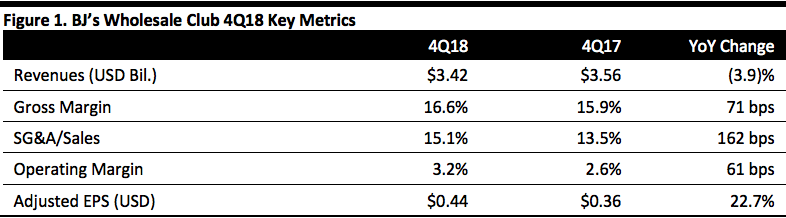

BJ’s Wholesale Club reported 4Q18 total revenues of $3.42 billion, down 3.9% and beating the $3.36 billion consensus estimate. Net sales declined 4.2% and membership fee income increased 4.2%.

The year-ago quarter included an additional week versus 4Q18 and contributed $240 million in sales and net income respectively. Excluding these figures, total revenues and net income would have increased 2.9% and 23.8%, respectively.

SG&A expense declined 2%, adjusted for stock-based compensation and costs related to the company’s initial public offering (IPO) and other charges.

Comps excluding gasoline increased 2.9% during the quarter, the sixth consecutive quarter of positive comps. Comparable club sales increased 2.8% year over year.

Adjusted EPS was $0.44, up 22.7% and beating the $0.36 consensus estimate. GAAP EPS was $0.46, compared to $0.71 in the year-ago quarter.

FY18 Results

FY18 total revenues were $13.01 billion, up 2.0%. Net sales increased 1.8% and membership fee income increased 9.4%.

Comps excluding gasoline increased 2.2% for the year.

Adjusted EPS was $1.33, up 51.2%. GAAP EPS was $1.05, compared to $0.54 the prior year.

Details from the Quarter and Year

Management said the quarter and year had exceeded its expectations for sales and earnings. The company ended the year with all-time high renewal rates and membership fee income and saw continued momentum through January.

- 4Q18 comps represent an acceleration of the two-year stack.

- Adjusted EBITDA was $165 million, up 16% year over year and enabling reduction of debt ahead of the previously announced schedule.

- 2018 marked the first year in which customers were able to take advantage of BJ’s omnichannel offering, including clicking coupons on a wrap, using buy online pickup in store as well as same-day delivery.

- Management characterized the company’s transformation as the company is investing in (1) acquiring and retaining members, (2) delivering value that encourages them to shop, (3) making it more convenient to shop at BJ’s and (4) expanding the company’s strategic footprint.

- BJ’s ended the quarter and year with record numbers of members, renewal rates and membership fee income. The company also achieved a record number of easy renewals (automatic renewals), of which 23% have purchased premium memberships. BJ’s continued to acquire new members through digital channels, and younger families just discovering clubs are a key demographic. The number of members acquired digitally doubled in 2018.

- In terms of delivering value to members, the company has launched a transformation of general merchandise, and comps increased 5% in the quarter, continuing the strong performance in Q3. For example, in TVs, BJ’s improved the quality of signals used to demonstrate the sets, and sales were above expectations in the quarter.

- Gas stations are an additional opportunity to deliver value to members. BJ’s opened two stations in 4Q18 and expects to have stations at two thirds of its clubs by the end of the year. Management characterized its real-estate pipeline as the strongest in years and plans to open 4-5 clubs and 8-10 gas stations in 2019.

- Looking at convenience, BJ’s made progress in improving its digital properties, including the launch and improvement of its app, as well as in buy online, pickup in club (BOPIC), digital coupons and same-day delivery. BJ’s had more than 100 million visits to its digital properties during the year, 1.5 million app downloads, and a 4.7-star rating in Apple’s App Store. In 4Q18, the company launched ship-from-club capabilities, rounding out its omnichannel offerings. BOPIC is still small but growing rapidly.

- In terms of the strategic footprint, the company plans to open a new club in Clearwater, Florida, in a few weeks and is pleased with membership acquisition thus far. Management characterized the club as an in-fill club, which plays an important role in attracting new and lapsed members.

Outlook

Management expects 2019 to be another strong year, in which the company plans to invest in analytics to improve member acquisition and launch point-of-sale technology that is expected to drive credit card sign-ups.

BJ’s is also planning to open two clubs in eastern Michigan later this year, targeting the smart-saving family. The company is looking for additional opportunities in the region.

The company provided the following guidance for 2019:

| Net sales |

$12.9-13.2 billion |

| Merchandise comps |

1.5-2.5% |

| Income from continuing operations |

$200-212 million |

| Adjusted EBITDA |

$590-600 million |

| EPS |

$1.42-1.50 |

| Capital expenditures |

About $200 million |

The current consensus estimates are for revenues of $13.37 billion and EPS of $1.47.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

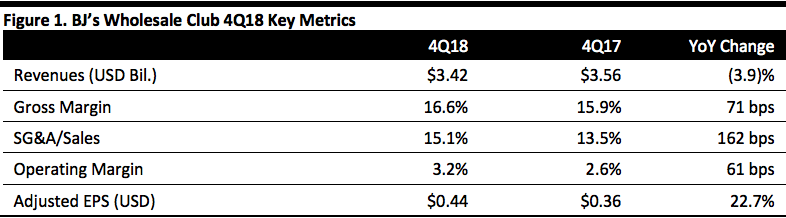

BJ’s Wholesale Club reported 4Q18 total revenues of $3.42 billion, down 3.9% and beating the $3.36 billion consensus estimate. Net sales declined 4.2% and membership fee income increased 4.2%.

The year-ago quarter included an additional week versus 4Q18 and contributed $240 million in sales and net income respectively. Excluding these figures, total revenues and net income would have increased 2.9% and 23.8%, respectively.

SG&A expense declined 2%, adjusted for stock-based compensation and costs related to the company’s initial public offering (IPO) and other charges.

Comps excluding gasoline increased 2.9% during the quarter, the sixth consecutive quarter of positive comps. Comparable club sales increased 2.8% year over year.

Adjusted EPS was $0.44, up 22.7% and beating the $0.36 consensus estimate. GAAP EPS was $0.46, compared to $0.71 in the year-ago quarter.

FY18 Results

FY18 total revenues were $13.01 billion, up 2.0%. Net sales increased 1.8% and membership fee income increased 9.4%.

Comps excluding gasoline increased 2.2% for the year.

Adjusted EPS was $1.33, up 51.2%. GAAP EPS was $1.05, compared to $0.54 the prior year.

Details from the Quarter and Year

Management said the quarter and year had exceeded its expectations for sales and earnings. The company ended the year with all-time high renewal rates and membership fee income and saw continued momentum through January.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

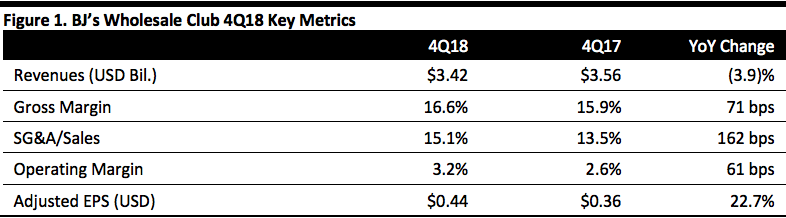

BJ’s Wholesale Club reported 4Q18 total revenues of $3.42 billion, down 3.9% and beating the $3.36 billion consensus estimate. Net sales declined 4.2% and membership fee income increased 4.2%.

The year-ago quarter included an additional week versus 4Q18 and contributed $240 million in sales and net income respectively. Excluding these figures, total revenues and net income would have increased 2.9% and 23.8%, respectively.

SG&A expense declined 2%, adjusted for stock-based compensation and costs related to the company’s initial public offering (IPO) and other charges.

Comps excluding gasoline increased 2.9% during the quarter, the sixth consecutive quarter of positive comps. Comparable club sales increased 2.8% year over year.

Adjusted EPS was $0.44, up 22.7% and beating the $0.36 consensus estimate. GAAP EPS was $0.46, compared to $0.71 in the year-ago quarter.

FY18 Results

FY18 total revenues were $13.01 billion, up 2.0%. Net sales increased 1.8% and membership fee income increased 9.4%.

Comps excluding gasoline increased 2.2% for the year.

Adjusted EPS was $1.33, up 51.2%. GAAP EPS was $1.05, compared to $0.54 the prior year.

Details from the Quarter and Year

Management said the quarter and year had exceeded its expectations for sales and earnings. The company ended the year with all-time high renewal rates and membership fee income and saw continued momentum through January.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

BJ’s Wholesale Club reported 4Q18 total revenues of $3.42 billion, down 3.9% and beating the $3.36 billion consensus estimate. Net sales declined 4.2% and membership fee income increased 4.2%.

The year-ago quarter included an additional week versus 4Q18 and contributed $240 million in sales and net income respectively. Excluding these figures, total revenues and net income would have increased 2.9% and 23.8%, respectively.

SG&A expense declined 2%, adjusted for stock-based compensation and costs related to the company’s initial public offering (IPO) and other charges.

Comps excluding gasoline increased 2.9% during the quarter, the sixth consecutive quarter of positive comps. Comparable club sales increased 2.8% year over year.

Adjusted EPS was $0.44, up 22.7% and beating the $0.36 consensus estimate. GAAP EPS was $0.46, compared to $0.71 in the year-ago quarter.

FY18 Results

FY18 total revenues were $13.01 billion, up 2.0%. Net sales increased 1.8% and membership fee income increased 9.4%.

Comps excluding gasoline increased 2.2% for the year.

Adjusted EPS was $1.33, up 51.2%. GAAP EPS was $1.05, compared to $0.54 the prior year.

Details from the Quarter and Year

Management said the quarter and year had exceeded its expectations for sales and earnings. The company ended the year with all-time high renewal rates and membership fee income and saw continued momentum through January.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

BJ’s Wholesale Club reported 4Q18 total revenues of $3.42 billion, down 3.9% and beating the $3.36 billion consensus estimate. Net sales declined 4.2% and membership fee income increased 4.2%.

The year-ago quarter included an additional week versus 4Q18 and contributed $240 million in sales and net income respectively. Excluding these figures, total revenues and net income would have increased 2.9% and 23.8%, respectively.

SG&A expense declined 2%, adjusted for stock-based compensation and costs related to the company’s initial public offering (IPO) and other charges.

Comps excluding gasoline increased 2.9% during the quarter, the sixth consecutive quarter of positive comps. Comparable club sales increased 2.8% year over year.

Adjusted EPS was $0.44, up 22.7% and beating the $0.36 consensus estimate. GAAP EPS was $0.46, compared to $0.71 in the year-ago quarter.

FY18 Results

FY18 total revenues were $13.01 billion, up 2.0%. Net sales increased 1.8% and membership fee income increased 9.4%.

Comps excluding gasoline increased 2.2% for the year.

Adjusted EPS was $1.33, up 51.2%. GAAP EPS was $1.05, compared to $0.54 the prior year.

Details from the Quarter and Year

Management said the quarter and year had exceeded its expectations for sales and earnings. The company ended the year with all-time high renewal rates and membership fee income and saw continued momentum through January.