Nitheesh NH

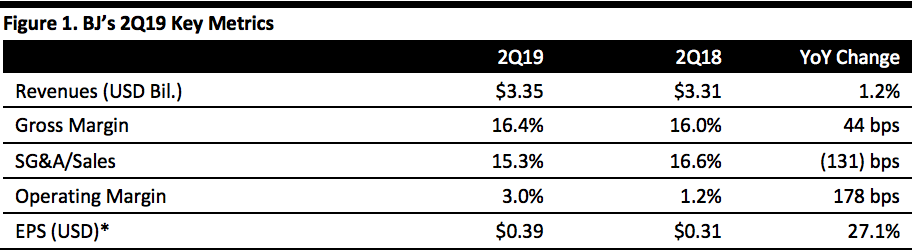

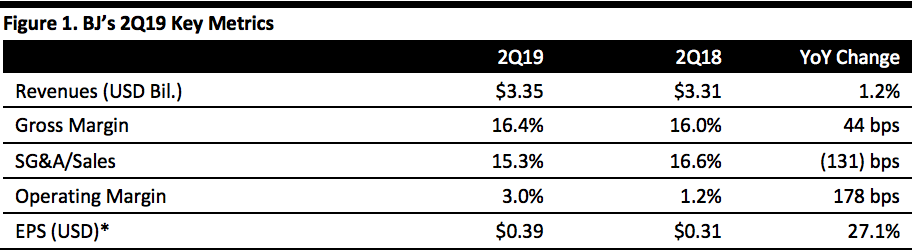

[caption id="attachment_95186" align="aligncenter" width="700"] *EPS is adjusted for offering costs pertaining to the company’s IPO.

*EPS is adjusted for offering costs pertaining to the company’s IPO.

Source: Company reports/Coresight Research[/caption] 2Q19 Results BJ’s Wholesale Club reported 2Q19 revenues of $3.35 billion, up 1.2% year over year but below the $3.39 billion consensus estimate. Net income was $54.5 million, or $0.39 per diluted share, and adjusted net income was $55.1 million, or $0.39 per diluted share, for the quarter. Comparable club sales for the quarter increased 0.6% against the year-ago quarter. Merchandise comparable sales excluding the impact of gasoline sales increased 1.6%. Gross margin grew 30 basis points (bps) over the year-ago quarter excluding gasoline and by 44 bps overall. The company attributed the improvement to benefits from procurement initiatives. Details from the Quarter Management said second quarter results for sales and earnings were consistent with expectations. It added sales were stronger in the second half of the quarter with better weather and expressed confidence about delivering on full-year expectations. Other details:

*EPS is adjusted for offering costs pertaining to the company’s IPO.

*EPS is adjusted for offering costs pertaining to the company’s IPO.Source: Company reports/Coresight Research[/caption] 2Q19 Results BJ’s Wholesale Club reported 2Q19 revenues of $3.35 billion, up 1.2% year over year but below the $3.39 billion consensus estimate. Net income was $54.5 million, or $0.39 per diluted share, and adjusted net income was $55.1 million, or $0.39 per diluted share, for the quarter. Comparable club sales for the quarter increased 0.6% against the year-ago quarter. Merchandise comparable sales excluding the impact of gasoline sales increased 1.6%. Gross margin grew 30 basis points (bps) over the year-ago quarter excluding gasoline and by 44 bps overall. The company attributed the improvement to benefits from procurement initiatives. Details from the Quarter Management said second quarter results for sales and earnings were consistent with expectations. It added sales were stronger in the second half of the quarter with better weather and expressed confidence about delivering on full-year expectations. Other details:

- SG&A expenses were $511 million in the second quarter, compared to $498 million in the year-ago quarter after excluding $51 million in non-recurring expenses in the prior year period. The increase in SG&A was due mainly to investments in capabilities, talent and member services such as its optical business.

- Adjusted EBITDA grew to $153 million, an increase of 7% over the year-ago quarter.

- Operating income grew to $98.7 million, or 3% of total revenues in the quarter, up from $38.7 million, or 1.2% of total revenues, in the year-ago quarter.

- Management said sales generated from BOPIC and same-day grocery delivery more than doubled over the year-ago quarter and also added that BOPIC sales growth in grocery and sundries has been encouraging.

- Net Interest expense decreased to $26.8 million in the quarter, compared to $59.6 million in the year-ago quarter.

- Income tax expenses were $17.7 million in the quarter, whereas the company recorded an income tax benefit of $15.4 million in the year-ago quarter.

- The company said the impact of the US and China tariffs is limited as the company has diversified its global supply chain and considerably reduced its reliance on China.

- The company said it continues to focus on transforming the edible and non-edible grocery divisions by simplifying assortment, adding new offerings and enhancing the value proposition.

- At the end of the second quarter, the company operated 217 clubs and 141 BJ’s Gas locations in 16 states.

- Net sales: $12.9-13.2 billion.

- Merchandise comparable store sales: up 1.5-2.5%.

- Income from continuing operations: $200-212 million.

- Adjusted EBITDA: $590-600 million.

- Interest expense: $105-110 million.

- Tax rate: Approximately 25%.

- Net income: $200-212 million.

- EPS: $1.42-1.50.

- Capital expenditures: approximately $200 million.