Nitheesh NH

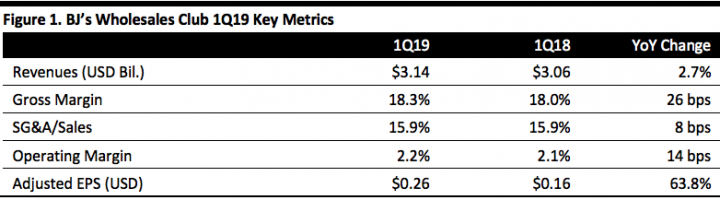

[caption id="attachment_89114" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

BJ’s Wholesale Club reported 1Q19 revenues of $3.14 billion, up 2.7% year over year and above the $3.05 billion consensus estimate.

Net income was $35.8 million, or $0.25 per diluted share, and adjusted net income was $36.7 million, or $0.26 per diluted share, for the quarter.

First quarter adjusted EBITDA of $124.1 million represented an increase of 2.1% over the first quarter of fiscal 2018.

Comparable club sales for the first quarter of fiscal 2019 increased 2.0% compared to the first quarter of fiscal 2018. Excluding the impact of gasoline sales, merchandise comparable sales increased 1.9%.

Operating income increased to $70.7 million, or 2.2% of total revenues, in the first quarter of fiscal 2019 compared to $64.6 million, or 2.1% of total revenues, in the first quarter of fiscal 2018.

Details from the Quarter

Management was pleased by the company performance.

This is what Christopher J. Baldwin, Chairman and Chief Executive Officer, BJ’s Wholesale Club said:

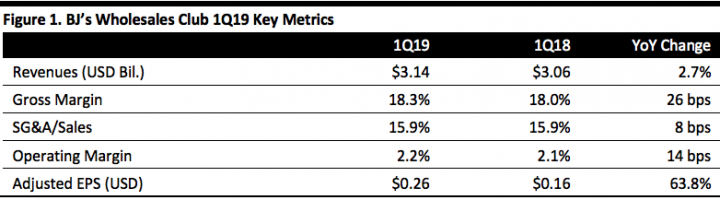

Source: Company reports/Coresight Research[/caption]

1Q19 Results

BJ’s Wholesale Club reported 1Q19 revenues of $3.14 billion, up 2.7% year over year and above the $3.05 billion consensus estimate.

Net income was $35.8 million, or $0.25 per diluted share, and adjusted net income was $36.7 million, or $0.26 per diluted share, for the quarter.

First quarter adjusted EBITDA of $124.1 million represented an increase of 2.1% over the first quarter of fiscal 2018.

Comparable club sales for the first quarter of fiscal 2019 increased 2.0% compared to the first quarter of fiscal 2018. Excluding the impact of gasoline sales, merchandise comparable sales increased 1.9%.

Operating income increased to $70.7 million, or 2.2% of total revenues, in the first quarter of fiscal 2019 compared to $64.6 million, or 2.1% of total revenues, in the first quarter of fiscal 2018.

Details from the Quarter

Management was pleased by the company performance.

This is what Christopher J. Baldwin, Chairman and Chief Executive Officer, BJ’s Wholesale Club said:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

BJ’s Wholesale Club reported 1Q19 revenues of $3.14 billion, up 2.7% year over year and above the $3.05 billion consensus estimate.

Net income was $35.8 million, or $0.25 per diluted share, and adjusted net income was $36.7 million, or $0.26 per diluted share, for the quarter.

First quarter adjusted EBITDA of $124.1 million represented an increase of 2.1% over the first quarter of fiscal 2018.

Comparable club sales for the first quarter of fiscal 2019 increased 2.0% compared to the first quarter of fiscal 2018. Excluding the impact of gasoline sales, merchandise comparable sales increased 1.9%.

Operating income increased to $70.7 million, or 2.2% of total revenues, in the first quarter of fiscal 2019 compared to $64.6 million, or 2.1% of total revenues, in the first quarter of fiscal 2018.

Details from the Quarter

Management was pleased by the company performance.

This is what Christopher J. Baldwin, Chairman and Chief Executive Officer, BJ’s Wholesale Club said:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

BJ’s Wholesale Club reported 1Q19 revenues of $3.14 billion, up 2.7% year over year and above the $3.05 billion consensus estimate.

Net income was $35.8 million, or $0.25 per diluted share, and adjusted net income was $36.7 million, or $0.26 per diluted share, for the quarter.

First quarter adjusted EBITDA of $124.1 million represented an increase of 2.1% over the first quarter of fiscal 2018.

Comparable club sales for the first quarter of fiscal 2019 increased 2.0% compared to the first quarter of fiscal 2018. Excluding the impact of gasoline sales, merchandise comparable sales increased 1.9%.

Operating income increased to $70.7 million, or 2.2% of total revenues, in the first quarter of fiscal 2019 compared to $64.6 million, or 2.1% of total revenues, in the first quarter of fiscal 2018.

Details from the Quarter

Management was pleased by the company performance.

This is what Christopher J. Baldwin, Chairman and Chief Executive Officer, BJ’s Wholesale Club said:

We delivered merchandise comparable sales of 1.9%, improved margins and continued to grow earnings by executing against our strategic priorities. Looking forward, we continue to see momentum across our business and are encouraged by the opportunities ahead of us, as we continue to transform BJ's Wholesale Club.

Other details:- The company’s SG&A expenses were $500 million in the first quarter compared to $481 million in the prior year after excluding $5 million in non-recurring expenses in the prior year period. This year-over-year increase in SG&A was primarily driven by the company’s investments in the optical business.

- The company’s gross profit increased to $574.2 million, compared to $551.4 million in the year-ago quarter.

- Interest expense, net, decreased to $27.8 million in the first quarter of fiscal 2019, compared to $45.2 million in the first quarter of fiscal 2018.

- BJ’s Wholesale Club is working on the following strategic initiatives:

- Investments in new technologies and partnerships such as with Starbucks.

- Focus on expansion and adding new locations in the US.

- Adding more members and providing better membership services.

- Income tax expenses were $6.8 million higher than $5.1 million in the year-ago quarter.

- The company’s credit card enrollment saw a 20% increase compared to last year, and the company expects strong growth in 2019.

- The company said the impact of the US and China tariffs is limited as the company directly or indirectly sources only about 5% of its products from China.

- BJ’s Warehouse Club streamlined the buy online, pick up in-club feature by enabling members to check in for pick up using the company app, eliminating the need to wait in line.

- The company is transforming the edible and non-edible grocery divisions by simplifying assortment, adding new offerings, and enhancing the value proposition.

- At the end of the first quarter, the company operated 217 clubs and 138 BJ's Gas locations in 16 states.

- Net sales: $12.9-13.2 billion.

- Merchandise comparable store sales: Up 1.5-2.5%.

- Income from Continuing Operations: $200-212 million.

- Adjusted EBITDA: $590-600 million.

- Interest expense: $105-110 million.

- Tax Rate: Approximately 25%.

- Net income: $200-212 million.

- EPS: $1.42-1.50.

- Capital expenditures: Approximately $200 million.