Source: Company reports/Coresight Research

2Q18 Results

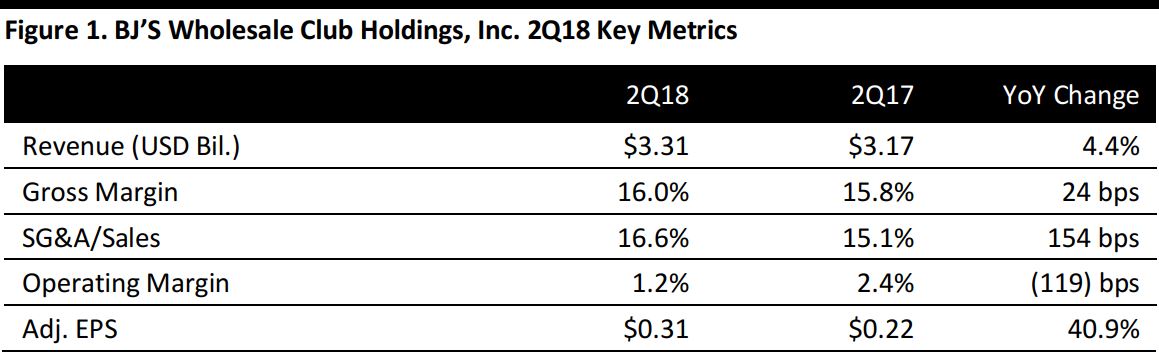

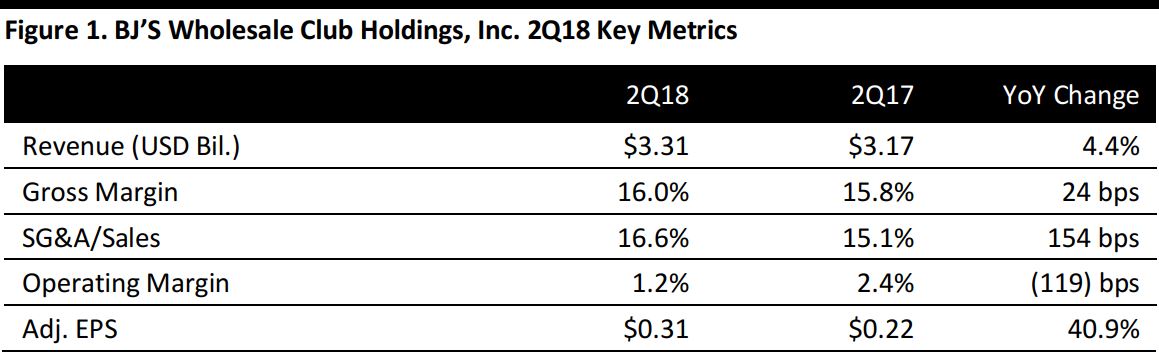

BJ'S Wholesale Club Holdings Inc.reported 2Q18 total revenues of $3.31 billion, up 4.4% year over year and above the consensus estimate of $3.27 billion. Adjusted EPS was $0.31,beating the consensus estimate of $0.27. Net sales reported were $3.2 billion, a 4.3% increase from $3.1 billion from 2Q17.

General merchandise business led merchandise comp sales gains of4%. Comp sales of the edible and non-edible grocery businesses increased by 2% and 1%, respectively. Excluding gasoline sales, merchandise comparable sales grew 2% compared to 2Q17, making this the fourth consecutive quarter of positive merchandise comparable sales.

Membership fee income grew from $64.2 million in 2Q17 to $70.4 million, up 9.7% year over year, driven by the increase in membership fees.

Gross margin increased to 16.0% compared to 15.8% in 2Q17. The category profitability improvement program was reported as the primary reason for the approximately 80-basis-points increase in gross margin, excluding the influence of gasoline sales.

Although SG&A expenses increased from $477.3 million in 2Q17 to $549.2 million, excluding $51 million charges related to IPO process and management compensation, SG&A was $498.2 million compared to $473.2 million in 2Q17.

Adjusted EPS was $0.31, a 40.9% increase from $0.22 in 2Q17. The company reported a GAAP net loss of $0.05 per diluted share;adjusted net income excludes a $48.9 million charge for stock-based compensation, IPO-related costs and other items.

Management detailed its plan for growth:

Acquire and retain members

- The average BJ’s member can save about 10 times their investment in membership fees each year.

Deliver value to customers

- Increase offerings in dairy, seafood, floral and frozen products.

- Change apparel inventory three times more often than two years ago.

- Invest in merchandising and assortments, new brands and improve in merchandise display.

Upgrade technology infrastructure, payment options and the online experience

- Rolled out buy online, pick up in club (BOPIC) to all 215 clubs.

- Improve omnichannel capabilities.

- Added same-day delivery across the chain for this quarter.

Expand strategic footprint

- Reinvented the opening model using data-driven approach.

Recent Developments

- The company sold 43.1 million shares of its common stock at $17.00 per share to the public during its recent IPO, and the total net proceeds from the transaction were $691 million.

Outlook

BJ'S Wholesale provided initial full-year guidance for fiscal 2018:

- Revenues in the range of $12.6–$12.7 billion.

- Net income of $101–$111 million.

- Adjusted net income in the $163–$173 million range.

- Adjusted EPS of $1.17–$1.24.

- Plan to open 15–20 new clubs over the next five years.