Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

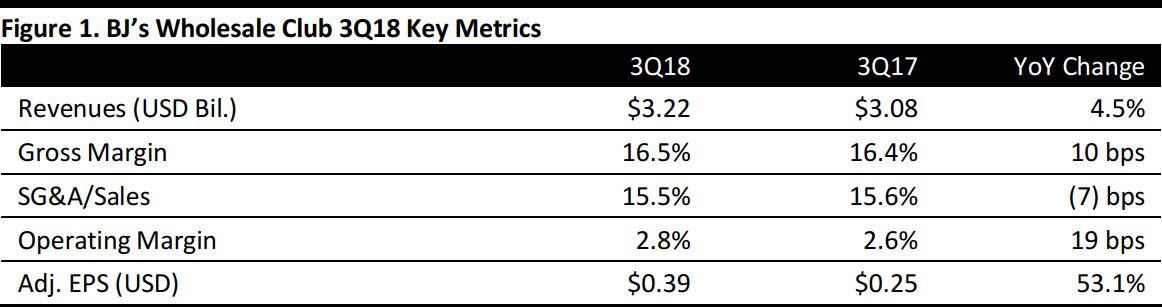

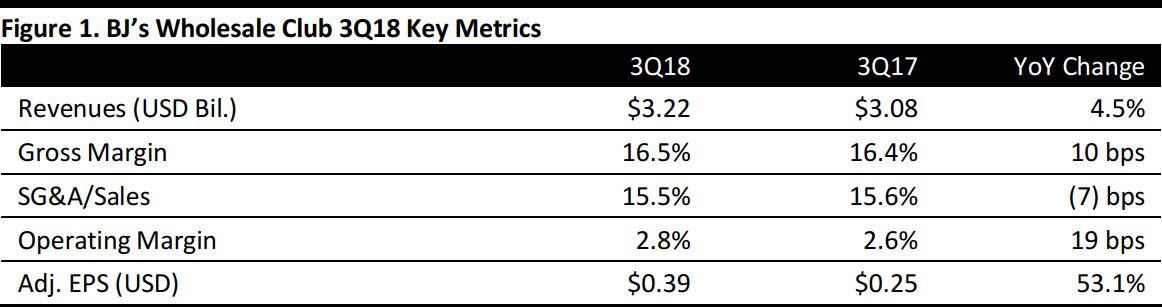

3Q18 Results

BJ’s Wholesale Club reported 3Q18 revenues of $3.22 billion, up 4.5% year over year and beating the $3.17 billion consensus. Membership fee income was $71.4 million, up 10.1% year over year.

Comps excluding gasoline increased 1.9%.

Adjusted EPS was $0.39, up 53.1% year over year and beating the $0.34 consensus estimate.

Details from the Quarter

Management commented that sales and earnings exceeded expectations and that the company has delivered 11 consecutive quarters of improved profitability and five quarters of positive comps. Still, the company remains in the early stages of a transformation with significant opportunities ahead, according to management.

Other points:

- Comps increased 3.6% year over year, 1.9% excluding gasoline.

- On October 1, 2018, BJs completed the sale of 32.2 million shares of common stock at a public offering price of $26.00 per share. The company did not receive any proceeds from this offering and incurred the costs associated with the sale, other than underwriting discounts and commissions.

- Adjusted EBITDA was $149 million, up 5.3% year over year and an all-time high for the company in the third quarter.

- Performance was particularly strong in the company’s core Northeastern markets.

- Management provided an update on strategic priorities, starting with its membership base:

- Membership and renewal rate trends in the quarter continued to exceed expectations despite the fee increase instituted earlier in the year. Management expects year-end membership and renewal rates will hit historic highs and was pleased with its success in re-engaging lapsed members by showing the company’s transformation.

- The company continues to focus on acquiring new members through digital channels, which are key to attracting younger members. Through the end of the quarter, BJ’s more than doubled the number of members acquired digitally versus the same period a year ago. In addition, the company has been successful in moving members to higher membership levels with nearly one-quarter of its members now in premium tiers.

- During the quarter, the company held an open house to showcase how it has captured more members prior to the holiday season, an extension of its members position program to talk to prospects and most importantly, to recaptured lapsed users. The company showcased merchandise and services, previewed holiday and Black Friday deals and highlighted new features, such as the app, buy-online-pickup-in-club, digital coupons and same-day delivery.

- BJ’s second priority is to deliver value to get members shopping: The company has set a target of ensuring members a 10xreturn on membership fees.

- BJ’s has more than 1 million members who shop on average more than 50 times a year. Management considers the fresh-food business key in delivering value and driving frequency, and the company says it will seek to remain competitive pricing in this area. While 3Q18was a deflationary environment in many perishable categories, unit sales were up as the company continues to focus on value and improve execution by its field operations team. In the quarter, own-brand penetration was 20%.

- In the quarter, apparel grew by double digits as the company delivered value with brands such as Levi's, Champion, and Jones New York.

Outlook

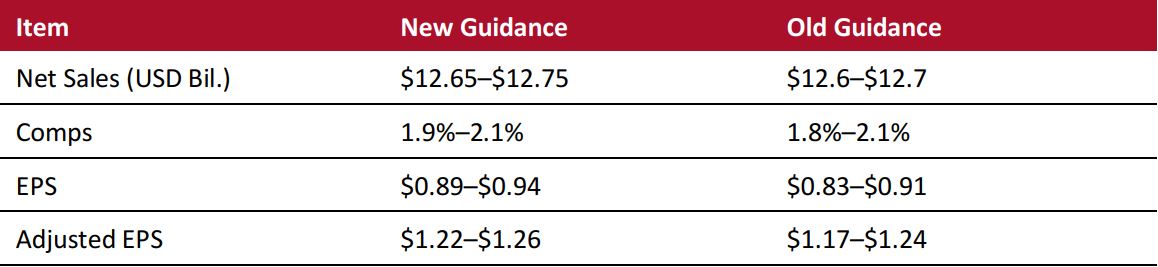

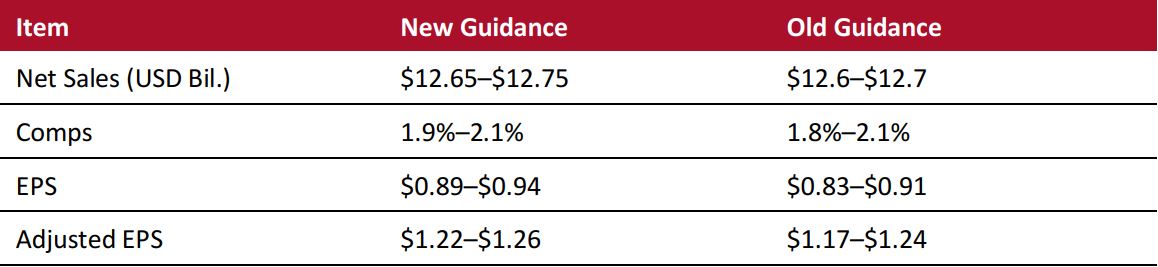

The company raised full-year guidance as follows:

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research