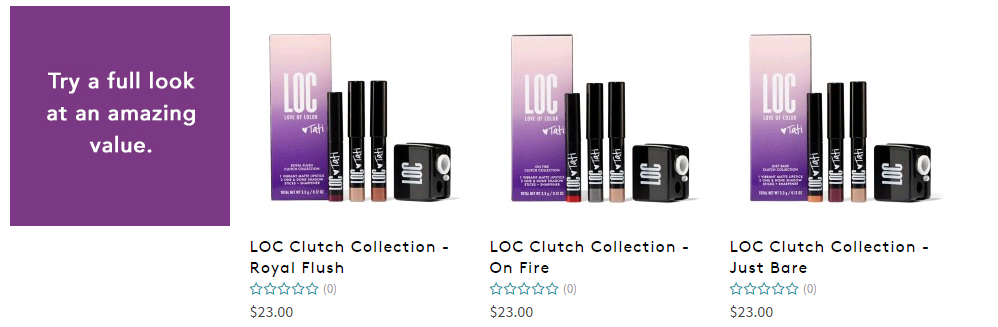

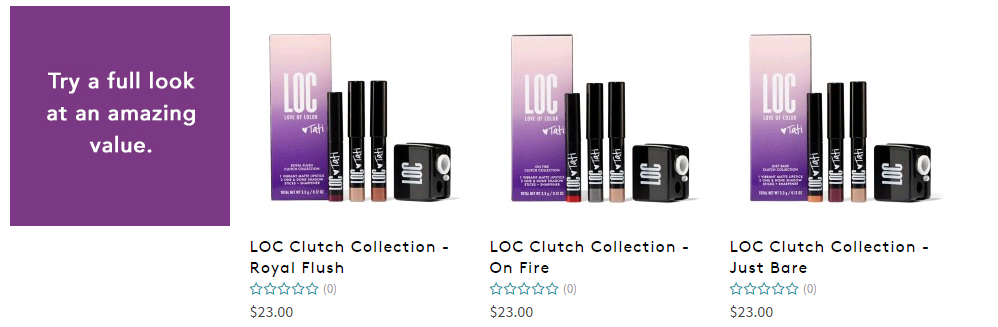

Birchbox’s new LOC brand will focus on trend-right and in-season colors, rather than offering a comprehensive range of products. It was developed with YouTube star Tati Westbrook, who is acting as brand ambassador.

Birchbox built its name on giving subscribers the chance to try sample sizes of new beauty products from third-party brands. But it has diversified beyond its core beauty box service with a transactional site that sells big-name branded products individually, an apparel offering and a New York store that has taken its presence beyond e-commerce.

The launch of a private label is another logical step in the company’s move toward becoming a “standard” beauty retailer.

Katia Beauchamp, cofounder and CEO of Birchbox, told the Fast Company website, “We’ve had a product development team for years now. We’ve had a hand—sometimes a significant hand and sometimes a lighter hand—in shaping products that were coming from our brand partners….This is just taking that process to the next level.” Beauchamp also said that the company plans to roll out new products and brands on an ongoing basis—LOC will not be the company’s only private label, and a second brand is set to be released early next year.

ADVANTAGES AND DISADVANTAGES

We see more pluses than minuses for Birchbox in its new product offering. Private labels yield a number of benefits for retailers:

- Private-label products tend to generate higher margins than third-party brands for retailers.

- Brand exclusivity: the LOC line will offer products consumers cannot get elsewhere.

- Private labels give firms the opportunity to generate media coverage as the labels become brands in their own right. Selling other companies’ products does not provide this benefit.

Potential downsides for Birchbox include:

- Customer disappointment if they expect big-name brands in their beauty box deliveries.

- Inventory risk if the product does not sell through. This risk is increased by LOC’s focus on seasonal trends, which will become dated quickly.

GROWING BIRCHBOX’S SCOPE

Birchbox has grown to a substantial scale since being founded in 2010. In April 2014,

Fortune estimated that privately owned Birchbox had annual revenues of $96 million—based on stated numbers of 800,000 subscribers paying $10 a month. By August 2015, subscriber numbers had exceeded 1 million, again according to Fortune, suggesting a run rate for subscription revenues in excess of $120 million per year.

But extrapolating revenues from subscriptions does not tell the full story: the company has indicated that some 30% of its revenues come from regular retail sales of full-size products. This suggests a revenue run rate in August 2015 of approximately $170 million.

The brand launch comes after the departure of co-CEO Hayley Barna in summer 2015, leaving Beauchamp in sole charge. Barna’s departure preceded a reported new round of funding; a $60 million series B round of funding in April 2014 reportedly valued the company at between $400 and $500 million.

Incremental moves into men’s beauty boxes, apparel and single-product purchases have helped underpin growth in sales—and the new private labels will likely make a further contribution.

BIRCHBOX IS BECOMING A REGULAR RETAILER

In the US, beauty specialist retailers posted a CAGR in sector sales of 5.6% in the five years through 2014, according to Euromonitor International. And Internet retailing of beauty and personal care goods grew at a CAGR of 10.3% in the same five years, Euromonitor says.

So, by evolving from a beauty subscription service to a more conventional retailer, both online and offline, Birchbox is able to tap two relatively high-growth sectors. The company has already moved well beyond its beauty subscription origins, and a private label is a natural and progressive step in its migration to becoming a more mainstream proposition beauty retailer.

Birchbox’s new LOC brand will focus on trend-right and in-season colors, rather than offering a comprehensive range of products. It was developed with YouTube star Tati Westbrook, who is acting as brand ambassador.

Birchbox built its name on giving subscribers the chance to try sample sizes of new beauty products from third-party brands. But it has diversified beyond its core beauty box service with a transactional site that sells big-name branded products individually, an apparel offering and a New York store that has taken its presence beyond e-commerce.

The launch of a private label is another logical step in the company’s move toward becoming a “standard” beauty retailer.

Katia Beauchamp, cofounder and CEO of Birchbox, told the Fast Company website, “We’ve had a product development team for years now. We’ve had a hand—sometimes a significant hand and sometimes a lighter hand—in shaping products that were coming from our brand partners….This is just taking that process to the next level.” Beauchamp also said that the company plans to roll out new products and brands on an ongoing basis—LOC will not be the company’s only private label, and a second brand is set to be released early next year.

Birchbox’s new LOC brand will focus on trend-right and in-season colors, rather than offering a comprehensive range of products. It was developed with YouTube star Tati Westbrook, who is acting as brand ambassador.

Birchbox built its name on giving subscribers the chance to try sample sizes of new beauty products from third-party brands. But it has diversified beyond its core beauty box service with a transactional site that sells big-name branded products individually, an apparel offering and a New York store that has taken its presence beyond e-commerce.

The launch of a private label is another logical step in the company’s move toward becoming a “standard” beauty retailer.

Katia Beauchamp, cofounder and CEO of Birchbox, told the Fast Company website, “We’ve had a product development team for years now. We’ve had a hand—sometimes a significant hand and sometimes a lighter hand—in shaping products that were coming from our brand partners….This is just taking that process to the next level.” Beauchamp also said that the company plans to roll out new products and brands on an ongoing basis—LOC will not be the company’s only private label, and a second brand is set to be released early next year.