albert Chan

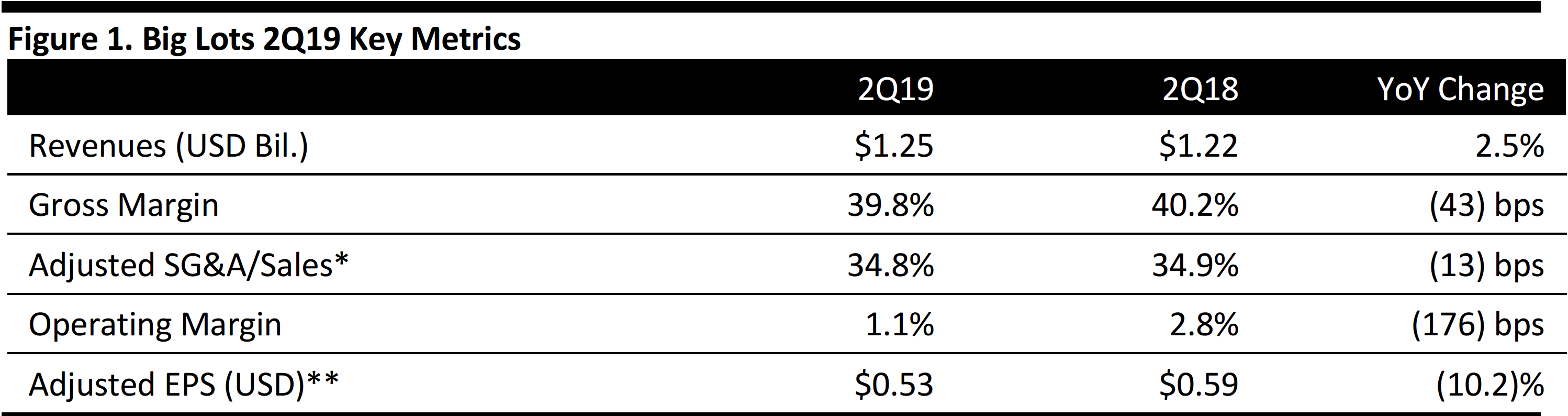

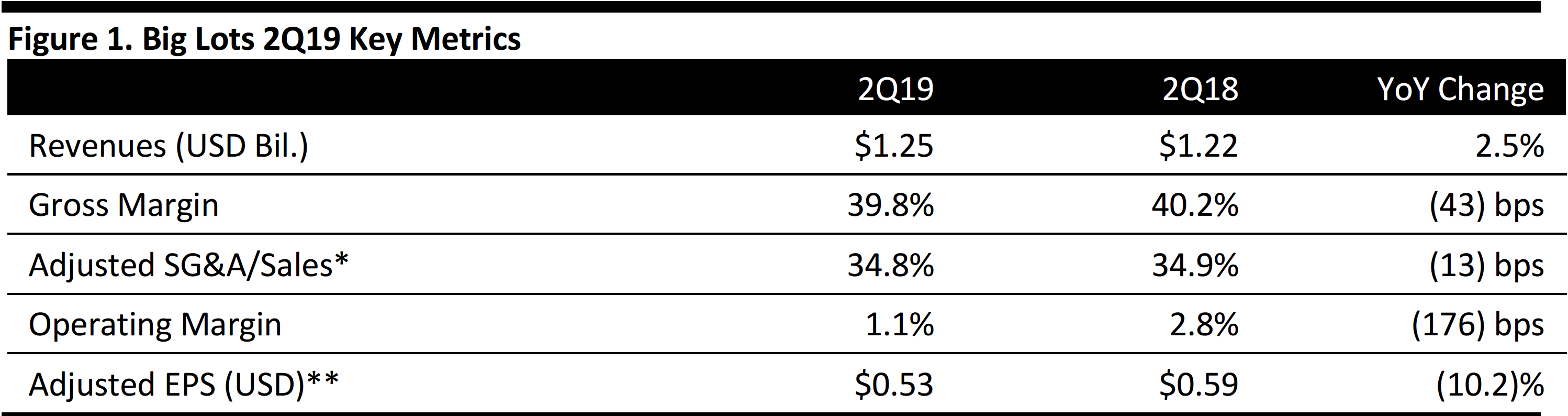

[caption id="attachment_95577" align="aligncenter" width="700"] *SG&A/Sales has been adjusted for the impact of transformational restructuring costs.

*SG&A/Sales has been adjusted for the impact of transformational restructuring costs.

**EPS has been adjusted for costs associated with the implementation of the company’s business transformation review.

Source: Company reports/Coresight Research[/caption] 2Q19 Results Big Lots reported 2Q19 revenues of $1.25 billion, up 2.5% year over year and broadly in line withthe consensus estimate. Growth was primarily driven by positive comps and sales growth in high-volume new stores, partially offset by the impact of a lower store count year over year. Comps increased 1.2%, in line with the company’s guidance of low-single-digit growth but short of the consensus estimate of 1.9%. The grossmargin decreased 43 basis points,due toa higher markdown rateand greater promotional selling primarily in seasonal products, partially offset by lower shrink costs and a favorable merchandise mix. Adjusted SG&A/sales improved slightly, driven by better store operations, and lower transportation and compensation costs. Adjusted EPS was $0.53, down 10.2% but beating the $0.40 consensus estimate. GAAP EPS was $0.16, down 72.9%. Details from the Quarter Management expressed encouragement from the progress of its transformation initiatives and strong near-term results, including continued strength in its “Store of the Future” format, improved omnichannel capabilities, growth in its rewards program and sales acceleration driven by two new initiatives—Life’s Occasions and Traffic Drivers.

*SG&A/Sales has been adjusted for the impact of transformational restructuring costs.

*SG&A/Sales has been adjusted for the impact of transformational restructuring costs.**EPS has been adjusted for costs associated with the implementation of the company’s business transformation review.

Source: Company reports/Coresight Research[/caption] 2Q19 Results Big Lots reported 2Q19 revenues of $1.25 billion, up 2.5% year over year and broadly in line withthe consensus estimate. Growth was primarily driven by positive comps and sales growth in high-volume new stores, partially offset by the impact of a lower store count year over year. Comps increased 1.2%, in line with the company’s guidance of low-single-digit growth but short of the consensus estimate of 1.9%. The grossmargin decreased 43 basis points,due toa higher markdown rateand greater promotional selling primarily in seasonal products, partially offset by lower shrink costs and a favorable merchandise mix. Adjusted SG&A/sales improved slightly, driven by better store operations, and lower transportation and compensation costs. Adjusted EPS was $0.53, down 10.2% but beating the $0.40 consensus estimate. GAAP EPS was $0.16, down 72.9%. Details from the Quarter Management expressed encouragement from the progress of its transformation initiatives and strong near-term results, including continued strength in its “Store of the Future” format, improved omnichannel capabilities, growth in its rewards program and sales acceleration driven by two new initiatives—Life’s Occasions and Traffic Drivers.

- Big Lots remodeled 123 stores into the new “Store of the Future” format through 2Q19 and is on pace to finish an additional 91 stores by the end of October. Remodeled stores contributed high-single-digit sales lifts in the first year, with increases in both traffic and ticket.

- E-commerce delivered improved results and the company launched a buy online pickup in store service in all stores, which helped drive incremental in-store sales.

- The Rewards loyalty program added 568,000 members in 2Q19, ending the quarter with 18.3 million active members.

- The new Life’s Occasions initiative—The Lot, a 500-square-feet area in front of stores featuring traffic-driving assortments and new categories, has been tested in six stores.

- The Traffic Drivers initiative has been rolled out to 24 locations. It added a significant number of SKUs in brand-name consumables based on customer research.

- Big Lots is on track for a soft launch of the Broyhill brand, which was acquired in March, in January 2020. The brand is expected to be a growth driver in the furniture, seasonal soft and hard home categories.

- The company improved its in-store labor model with new management structure to better serve the customers. Big Lots expects to reach cost savings of $100 million over the next three years.

- Tariffs are expected to be a growing headwind in the back half of 2019, but the company is confident of delivering a good result for the year.

- Furniture, soft home, seasonal and consumables were the four categories that drove sales growth in the quarter.