DIpil Das

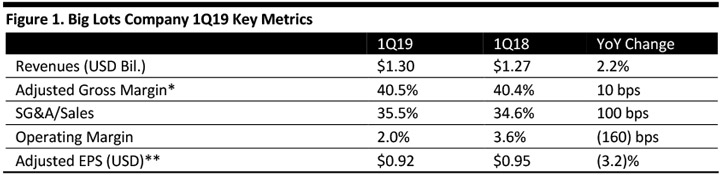

[caption id="attachment_89786" align="aligncenter" width="720"] *Gross margin has been adjusted to account for the impact of inventory impairment charges from a merchandise department exit.

*Gross margin has been adjusted to account for the impact of inventory impairment charges from a merchandise department exit.

**EPS has been adjusted for costs related to the company’s business transformation review and the impact of legal settlement loss contingencies

Source: Company reports/Coresight Research [/caption] 1Q19 Results Big Lots reported 1Q19 revenues of $1.30 billion, up 2.2% year over year and marginally above the consensus estimate as recorded by S&P Capital IQ. Positive comps and sales growth in high volume new stores primarily drove revenue growth. The impact of a lower store count year-over-year partially offset this growth. Comps increased 1.5%, in line with the company’s guidance of low single digit growth but short of the consensus estimate of 2.2% Adjusted EPS was $0.92, down 3.2% but beating the $0.70 consensus estimate. GAAP EPS was $0.39, down 47.2%. Adjusted gross margin improved 10 basis points and was in line with guidance, driven by better initial markups, lower shrink costs and a favorable merchandise mix, partially offset by higher markdown rates primarily in seasonal products. GAAP gross margin was 40.1%, down 32 basis points. Details from the Quarter Management expressed satisfaction with progress in the long-term strategic aspects of the business and its impact on near-term results, including a strong showing in its “store of the future” format, sales acceleration in new stores, steady growth in its loyalty program and in e-commerce. Other details:

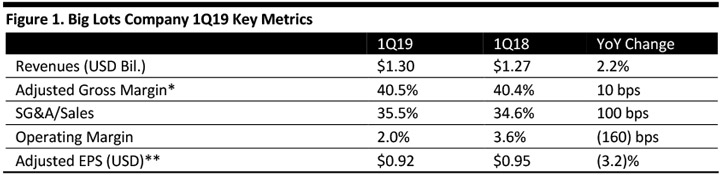

*Gross margin has been adjusted to account for the impact of inventory impairment charges from a merchandise department exit.

*Gross margin has been adjusted to account for the impact of inventory impairment charges from a merchandise department exit. **EPS has been adjusted for costs related to the company’s business transformation review and the impact of legal settlement loss contingencies

Source: Company reports/Coresight Research [/caption] 1Q19 Results Big Lots reported 1Q19 revenues of $1.30 billion, up 2.2% year over year and marginally above the consensus estimate as recorded by S&P Capital IQ. Positive comps and sales growth in high volume new stores primarily drove revenue growth. The impact of a lower store count year-over-year partially offset this growth. Comps increased 1.5%, in line with the company’s guidance of low single digit growth but short of the consensus estimate of 2.2% Adjusted EPS was $0.92, down 3.2% but beating the $0.70 consensus estimate. GAAP EPS was $0.39, down 47.2%. Adjusted gross margin improved 10 basis points and was in line with guidance, driven by better initial markups, lower shrink costs and a favorable merchandise mix, partially offset by higher markdown rates primarily in seasonal products. GAAP gross margin was 40.1%, down 32 basis points. Details from the Quarter Management expressed satisfaction with progress in the long-term strategic aspects of the business and its impact on near-term results, including a strong showing in its “store of the future” format, sales acceleration in new stores, steady growth in its loyalty program and in e-commerce. Other details:

- Big Lots continued to expand its loyalty program, increasing membership 16% year over year with 500,000 new members, ending the quarter with 17.7 million active members.

- Sales results represent the fourth consecutive quarter of positive comps, which management viewed as encouraging amidst the context of delayed income tax refunds and weather challenges in many of its markets.

- The company opened nine stores and closed six during the quarter, ending the period with 1,404 stores.

- The company plans to remodel over 200 stores and open around 50 stores in its “Store of the Future” format in fiscal year 2019.

- The company registered its best quarterly performance in its e-commerce business since its launch in 2016, and the lowest operating loss within the segment since the last three years.

- Capital expenditure in the quarter totaled $77 million, up significantly from $31 million in the year-ago quarter. The company attributed the increase to strategic investment in the “store of the future,” its new distribution center in California and a higher number of new store openings.

- A low single-digit increase in comps.

- Cash flow from operations less capex of approximately $100 million.

- Adjusted EPS of $3.70-3.85, up from previous guidance of $3.55-3.75, and above the $3.64 consensus estimate.

- A low single-digit increase in comps.

- Adjusted EPS of $0.35-0.45, in line with the $0.43 consensus estimate.