Source: Company reports

4Q15 RESULTS

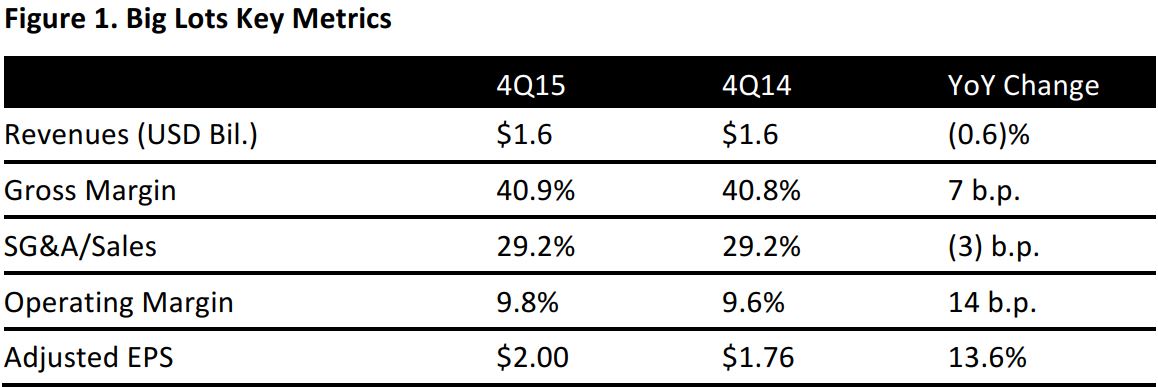

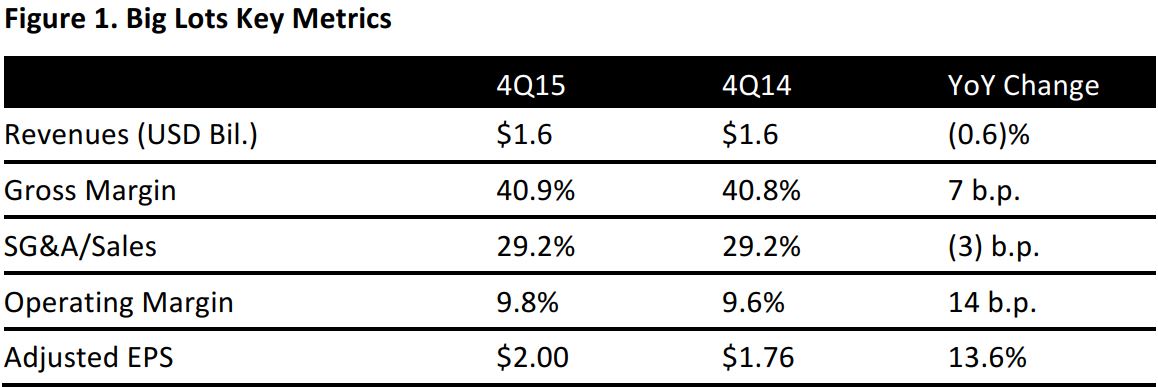

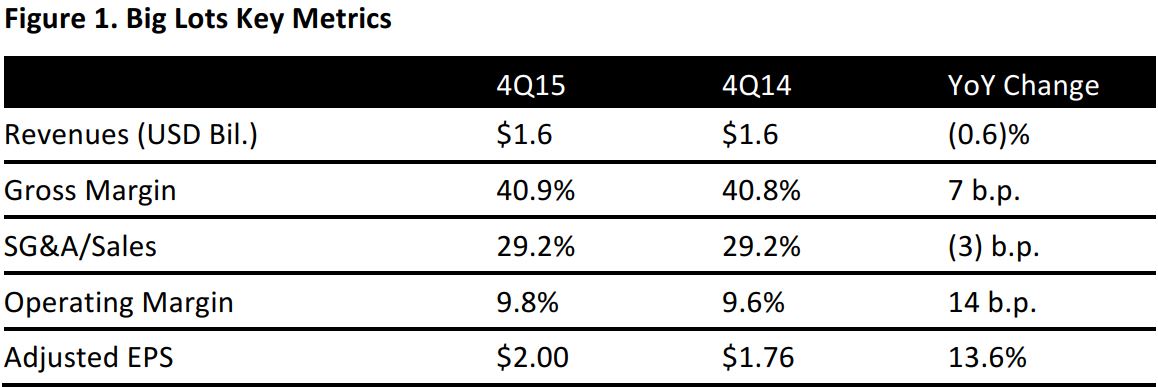

Big Lots’ fiscal 4Q15 revenues were $1.6 billion, down 0.6% from $1.6 billion a year ago. In the quarter, the company closed 14 stores and opened no new stores.

Comps increased by 0.7%, marking the eighth consecutive quarter of growth. The company noted that comps remained positive despite the impact of Winter Storm Jonas, which negatively affected approximately 400 stores during the company’s “Rewards” and “Friends and Family Weekend” promotions.

The “ownable and winnable” categories displayed the strongest performance, and furniture sales had the highest growth rate. The soft home goods category, including bath and fashion bedding, was up by mid-single digits and consumables grew by low single digits.

Adjusted EPS was $2.00, beating the consensus estimate of $1.98 and representing a 13.6% increase from to $1.76 in the year-ago quarter.

2015 Results

Revenues for 2015 were $5.2 billion, up 0.3% compared to $5.2 billion the prior year.

Comps increased by 1.8% in the year. In 2015, the company opened nine new stores and closed 20 stores, for a net decrease of 11 stores. This figure represented less than 1% of the company’s 1,449 total locations and was lower than the 2% of total stores that were estimated to be closed.

The company noted the success of its rewards and loyalty card sign-up program, thanks to new incentives and in-store signage. Sign-ups increased by over 20% in 2015. The company expects this program to also enhance its e-commerce operation, which it will launch in 2016.

Adjusted EPS from continuing operations was $2.97, up 20.7% from $2.46 in 2014.

Guidance

The company forecasted that comps will increase in the low single digits in 2016, including net sales of approximately $20–$22 million from its soon-to-be-launched e-commerce operation. Management guided for flat total sales, projecting that sales growth will be offset by a slightly lower overall store count.

2016 EPS guidance is for $3.20–$3.35, representing an 8%–13% increase, in line with the current consensus estimate of $3.30.

For the first quarter, the company expects EPS of $0.66–$0.72, in line with the consensus estimate of $0.71.