Source: Company reports/FGRT

3Q17 Results

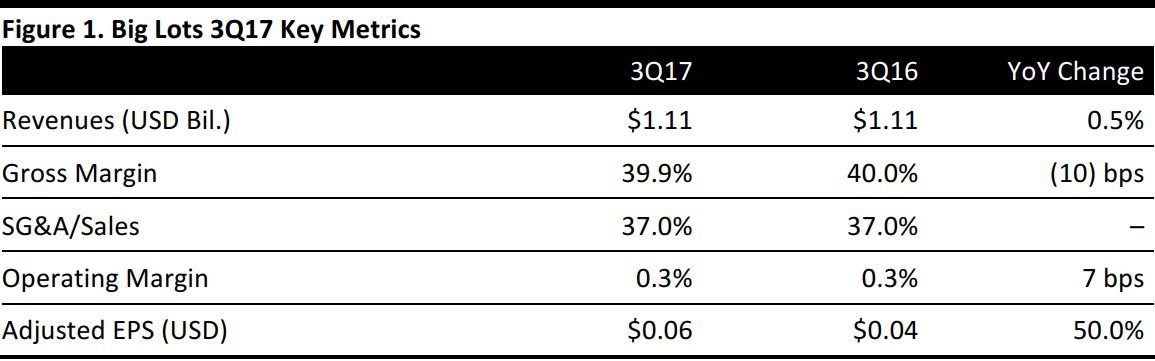

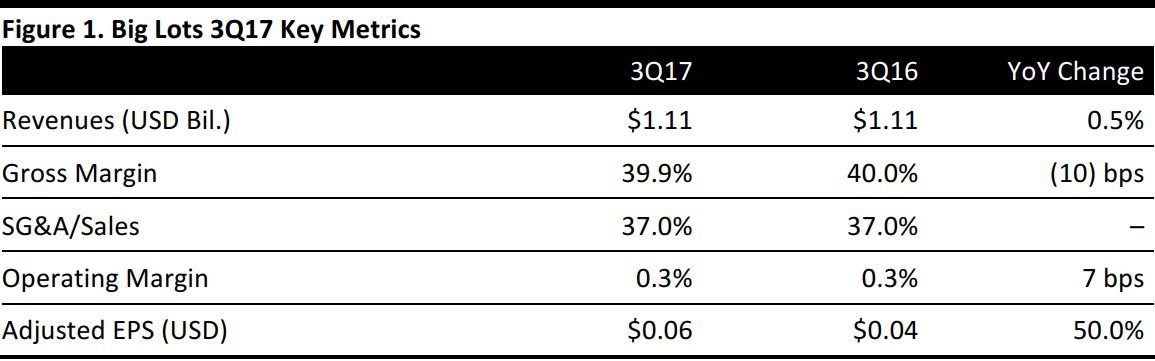

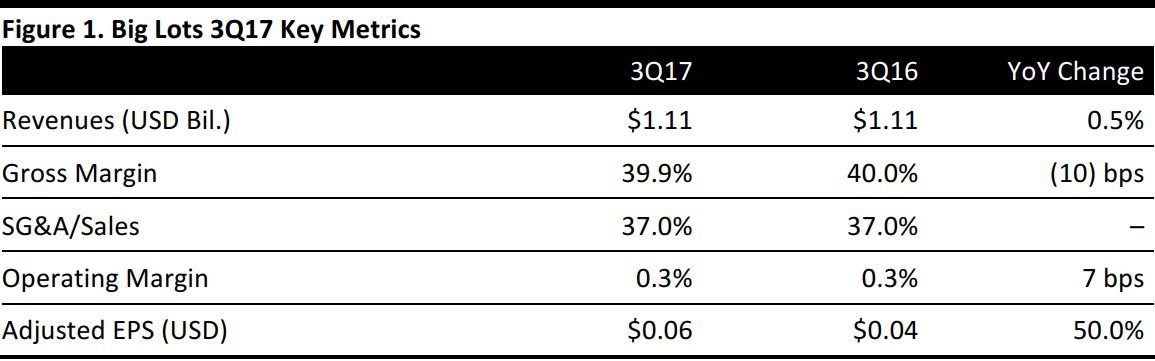

Big Lots reported 3Q17 adjusted EPS of $0.06, up from $0.04 in the year-ago quarter and above both the $0.04 consensus estimate and the company’s $0.01–$0.05 EPS guidance. Total revenues were $1.11 billion, up 0.5% year over year and slightly below the $1.12 billion consensus estimate.

Comparable store sales rose by 1.0% during the quarter, in line with company guidance but below the 1.6% consensus estimate. The soft home category was up by mid-single digits and the furniture and consumables categories were up by low single digits.

Inventory level per store increased by 1% from the year-ago quarter, to $1.04 million. The increase was partially offset by a lower store count year over year.

The company reiterated its strategy of focusing on “winnable merchandise categories.” Big Lots has been expanding its presentation of furniture and mattresses in recent quarters.

Outlook

The company raised its FY17 adjusted EPS guidance to $4.23–$4.28 from $4.15–$4.25 previously; consensus calls for full-year adjusted EPS of $4.24. Big Lots expects FY17 comp growth of 1% and a 2% increase in total sales, implying revenue of $5.30 billion.

The company raised its 4Q17 adjusted EPS guidance to $2.35–$2.40 from $2.30–$2.38 previously, versus the $2.38 consensus estimate. The company reaffirmed that it expects 4Q17 comps to be flat to up 2%, versus the 1.3% consensus estimate.

Management said it will continue to focus on improving merchandise presentations; winnable merchandise categories; offering more consistent, friendly customer service; and in-store execution.