albert Chan

Executive Summary

Western retail faces numerous challenges due to shifting consumer tastes and preferences being driven by the power and convenience of e-commerce. This has led to numerous store closures, bankruptcy filings, mergers, acquisitions and management changes.

However, Eastern retail—particularly in China—is flourishing. China’s retail market is growing—and surpassed the US market in size in 2019. Eastern consumers are enjoying the seamless fusion of online and offline in retail, centered around the use of smartphones for shopping, including discovering and browsing products, placing orders and making payments. In addition, Eastern commerce provides greater convenience, more compelling experiences and shopping festivals, which enhance the customer relationship and drive sales for brands and retailers.

How does Eastern retail provide this more elevated selection of convenience and experiences? It begins with an understanding and command of data.

Underlying retail operations is a solid foundation of data, powered by predictive analytics and artificial intelligence (AI). Eastern retailers have accessed a comprehensive selection of available retail data, which they use to power customer-facing, back-office and corporate-office activities. Retailers can offer customers personalized offers and experiences, entertainment and richer in-store experiences. Store associates are armed with hardware and software tools that enable them to access customer data and preferences to make data-assisted intelligent recommendations.

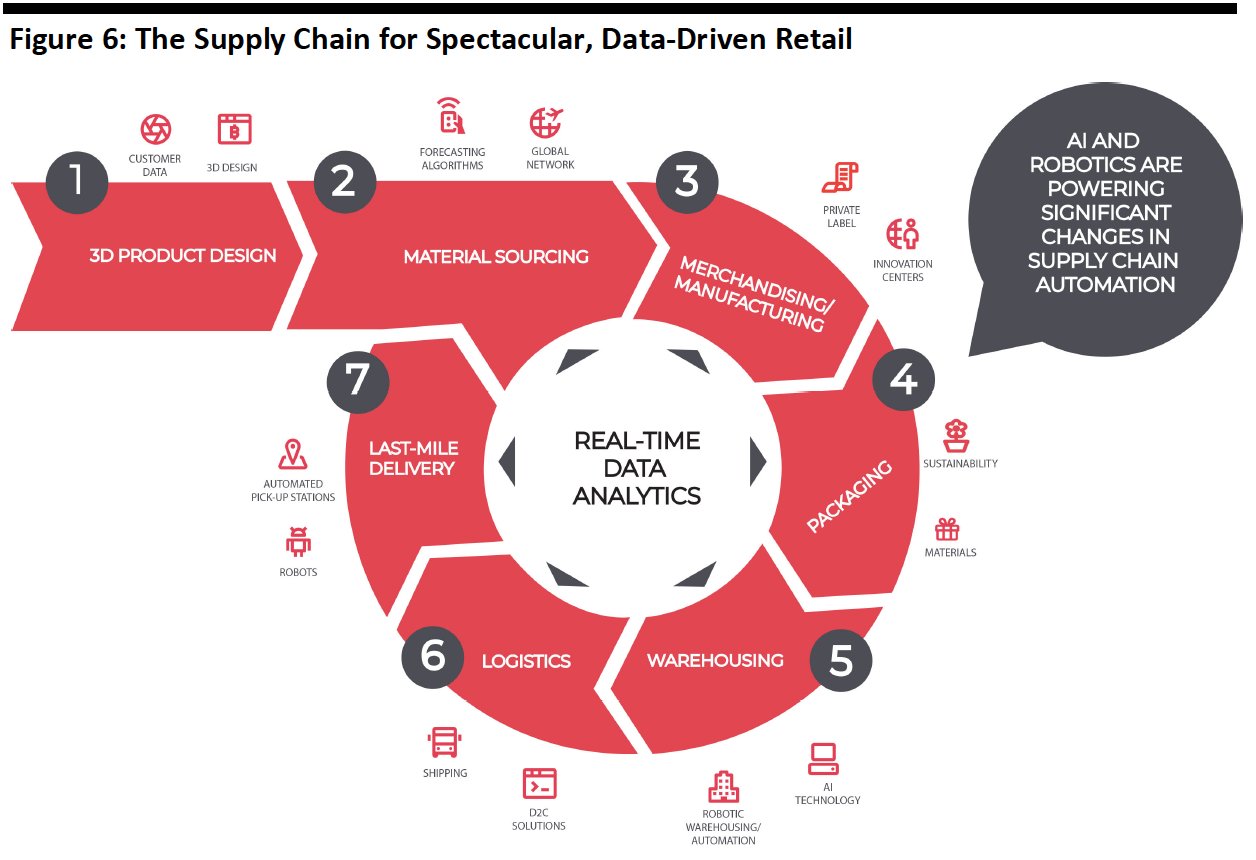

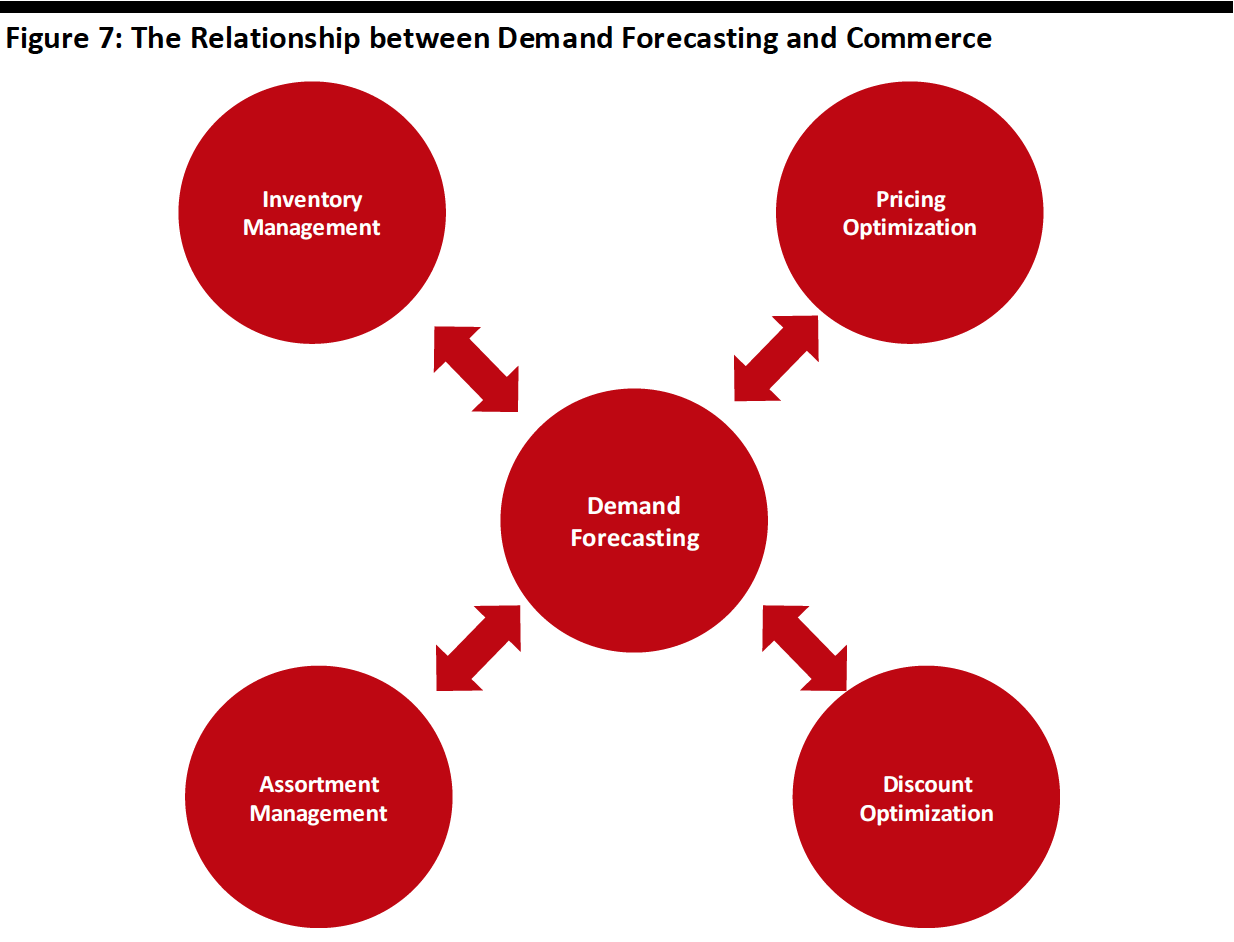

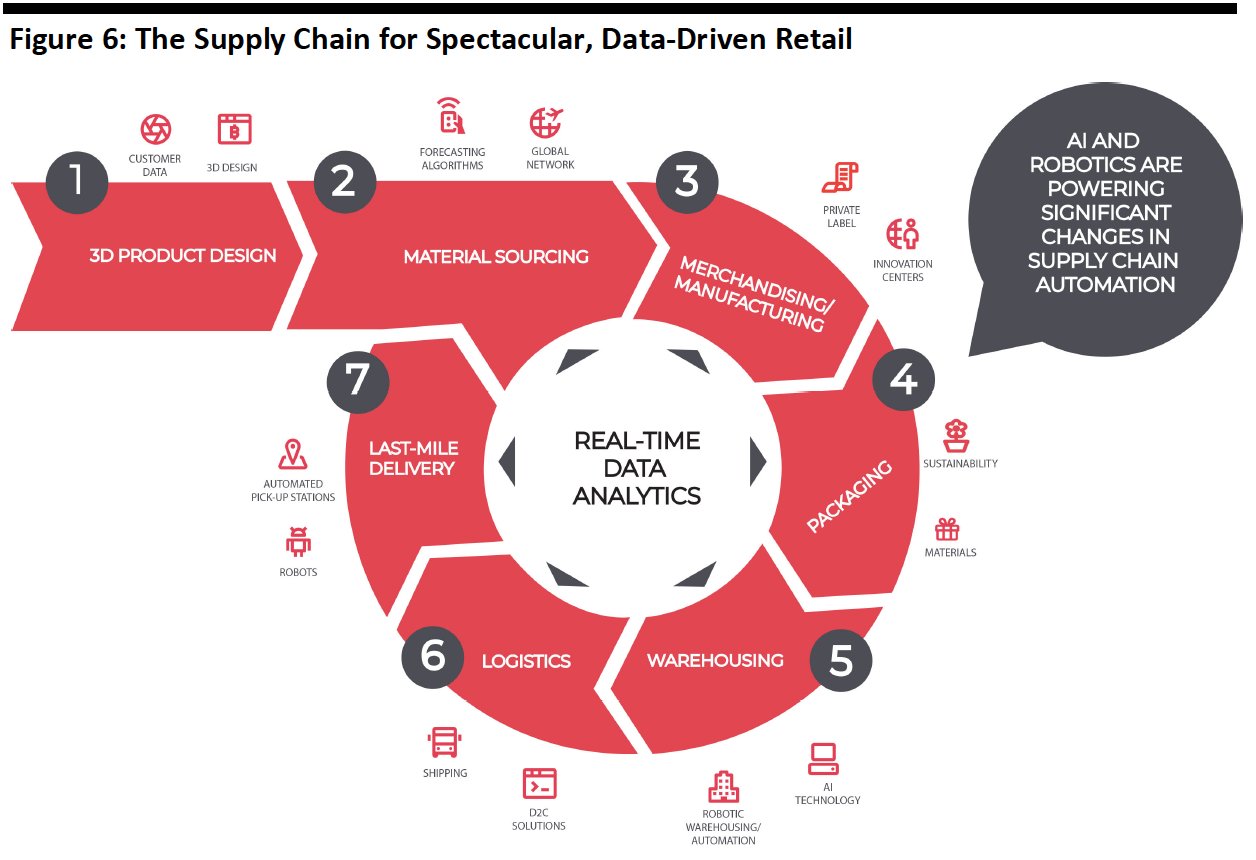

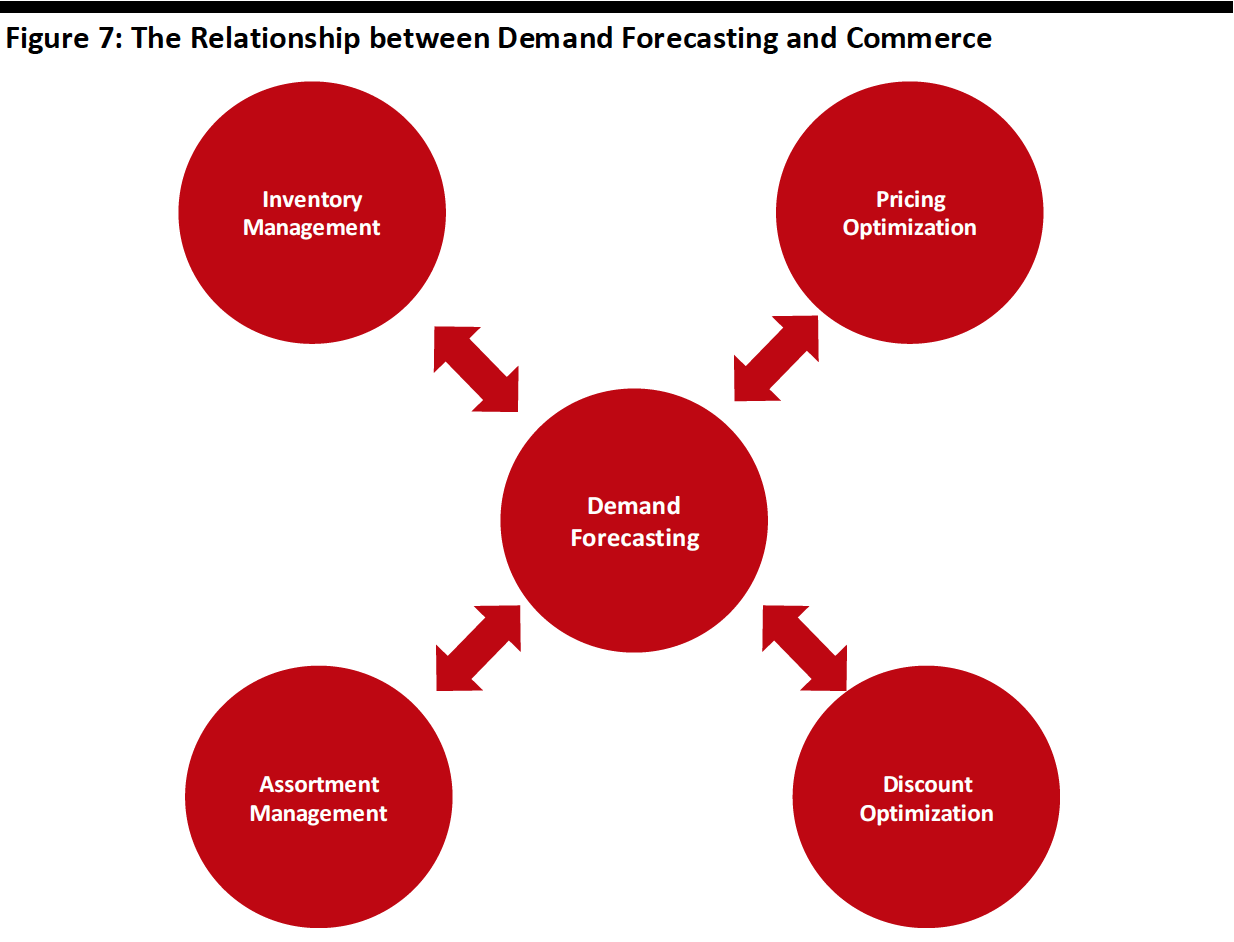

Behind the scenes, data and AI power a smart retail supply chain, from 3D product design to manufacturing, logistics and warehouse management to delivery. Businesses can also leverage data and predictive analytics to more accurately forecast demand, which has significant implications for pricing, discounting, inventory and assortment selection.

Furthermore, Eastern retailers are creating new physical store concepts that focus on experiential retail. Western retailers are also reimagining retail through the launch of flagship stores that reinforce the brand’s identity and provide experiences that make use of new technologies such as voice recognition.

There are many new concepts that the West can borrow and adapt from the East—which originally borrowed and adapted them from the West—to reimagine and reinvigorate retail.

Introduction: The Rise of Eastern Retail

Western retail faces numerous challenges, arising from shifting consumer tastes and preferences. This is resulting in a large number of store closures, bankruptcy filings, mergers and acquisitions. By contrast, retail in Asia—and in China in particular—is much healthier. China’s retail market is estimated to have surpassed the US in 2019 in terms of size. It grew 8.0% during the 12 months through November 2019, more than double the 3.1% growth rate of the US, according to data from the National Bureau of Statistics of China and the US Census Bureau, respectively.

Eastern consumers benefit from a wealth of superior conveniences and experiences, including mobile payments, the seamless merging of online and offline, numerous partnerships between brands and shopping festivals that offer fun in addition to bargains.

Underlying the dynamic and advanced state of Eastern retail is a strong foundation in data and AI, which add intelligence to marketing, customer service, the shopping experience and entertainment on the customer-facing side. In the back and corporate office, data enhances consumer insights, demand forecasting and the improvement of store operations and logistics.

What the West Can Learn from the East

The flourishing Eastern retail market features many concepts that enhance the shopping experience for consumers. Below, we discuss in more detail several of these that the West could borrow and adapt: walletless payments, social commerce, shopping festivals, new store formats and brand collaborations.

Walletless Payments

As one of the largest mobile markets, China had a smartphone adoption rate of 69% in 2018, which is expected to grow to 88% in 2025, according to the Global System for Mobile Association. China also leads the way in mobile payments, dominated by big players Alipay and WeChat Pay, which collectively hold over 90% of the third-party mobile payments market. These apps are easy to use and ensure seamless payment—by scanning a QR code with the phone, consumers can self-order and checkout instantly. In addition to being adopted by numerous restaurant and retail chains, mobile payments have even seen increasing acceptance in China’s mom-and-pop stores and at street stands.

Facial recognition technology is now being applied to payment systems, fueled by Chinese AI startups such as Megvii Technology, SenseTime and Yitu. These systems are linked to Alipay and WeChat Pay, and users simply need to register images of their faces with a bank account to make purchases by posing in front of the point-of-sale (POS) machine’s camera. Facial payment is even easier and smoother than mobile payment, since the process does not require smartphone operation. This technology is being increasingly adopted in transportation, retail and banking. Alipay plans to spend ¥3 billion ($448 million) over the next three years to implement its “DragonFly” POS device. The convenience and ease of use of walletless payments have boosted consumer spending in China.

Social Commerce

Social commerce has become a driving force of China’s e-commerce sector as consumers increasingly engage with social media. The country’s social commerce market is expected to reach ¥1.2.1 trillion ($300 billion) in 2020 and grow 39% to ¥2.9 trillion ($410 billion) in 2021, according to digital media China Internet Watch.

[caption id="attachment_104438" align="aligncenter" width="500"] Source: China Internet Watch[/caption]

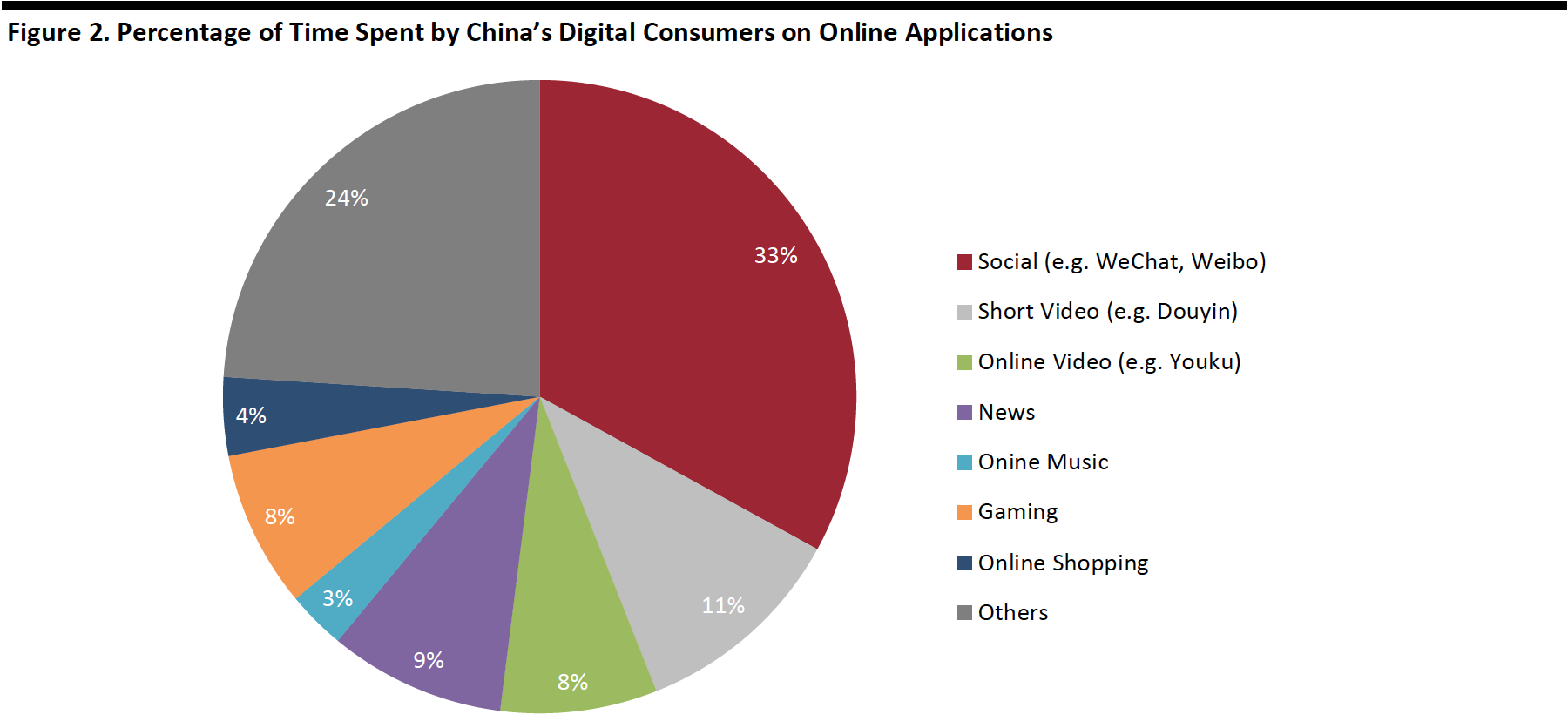

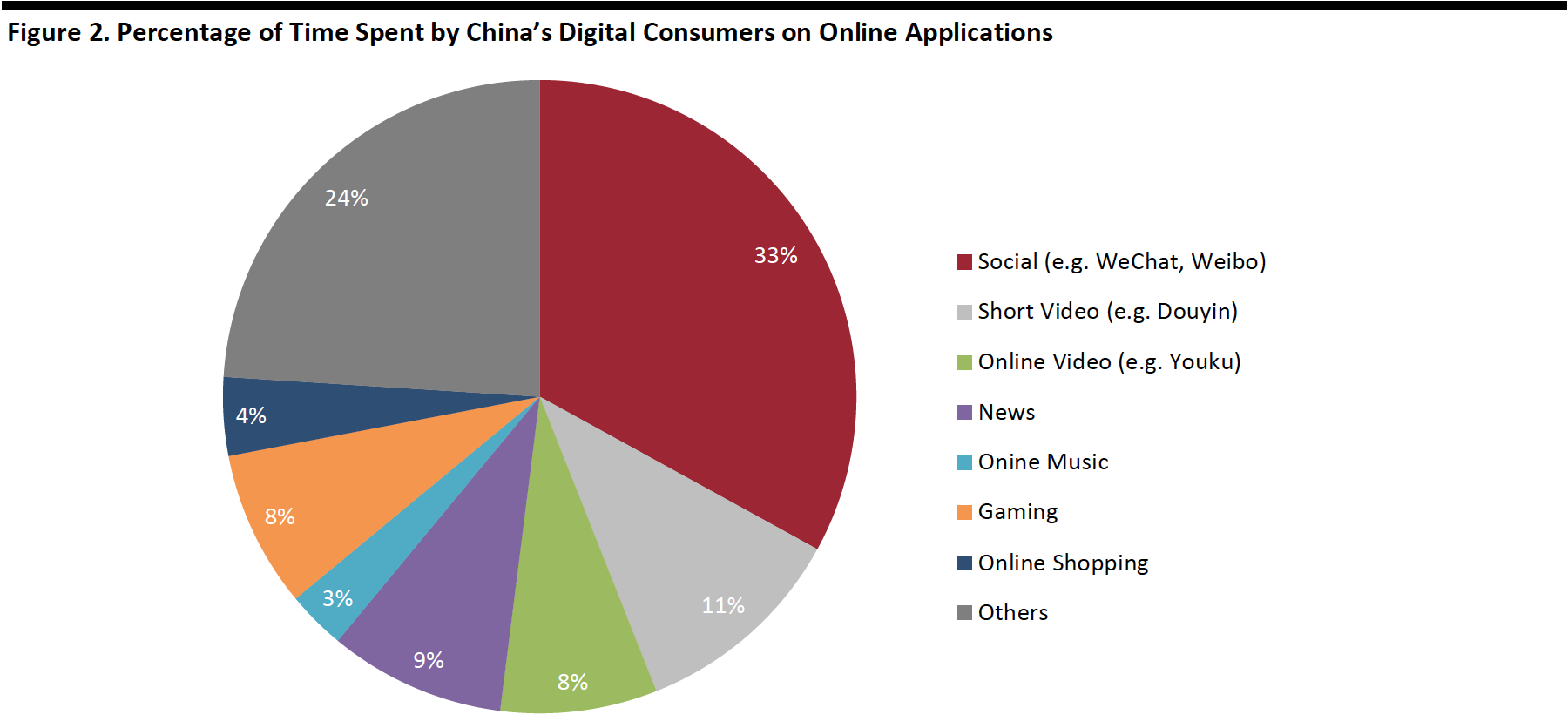

The social media ecosystem in China is different from that in the West. Not only is it a platform for product discovery and content sharing, it is also a marketplace for consumers to make direct online purchases through media such as livestreaming and referral selling. Digital consumers spend 33% of their time on social media apps, according to the China Digital Consumer Trends 2019 survey by global research firm McKinsey.

[caption id="attachment_104439" align="aligncenter" width="750"]

Source: China Internet Watch[/caption]

The social media ecosystem in China is different from that in the West. Not only is it a platform for product discovery and content sharing, it is also a marketplace for consumers to make direct online purchases through media such as livestreaming and referral selling. Digital consumers spend 33% of their time on social media apps, according to the China Digital Consumer Trends 2019 survey by global research firm McKinsey.

[caption id="attachment_104439" align="aligncenter" width="750"] Base: More than 4,300 digital consumers across four city tiers and rural areas in China

Base: More than 4,300 digital consumers across four city tiers and rural areas in China

Source: McKinsey China Digital Consumer Trends 2019 Survey[/caption] Retailers can leverage social media platforms to promote brand awareness—by engaging with consumers and partnering with key opinion leaders, for example. Livestreaming is becoming the go-to option for Chinese consumers to discover products, driving impulse shopping. Alibaba’s Taobao Live accounted for 7.5% of the company’s Singles’ Day total sales of $38.4 billion in 2019. The platform has started to implement 5G technology to improve the user experience. Social app Red, e-commerce platform Pinduoduo and even WeChat have started testing live broadcast functions to tap into the growing livestreaming opportunity. Shopping Festivals Shopping festivals are huge in China: The total GMV generated during Alibaba’s 2019 Singles’ Day was more than five times that of Black Friday in the US. Retailers are using shopping festivals to promote products and launch new items. For consumers, festivals are more than just sale events to purchase products at discounted prices: they are opportunities to try new products and discover brands. Over 200,000 brands participated in Singles’ Day in 2019, and around one million new products were introduced on Tmall and Taobao. Tmall has also launched its Flagship Store 2.0, which helps brands create a personalized storefront. Shopping festival promotions also allow consumers to engage with brands through interactive games such as lotteries. [caption id="attachment_104440" align="aligncenter" width="300"] Singles’ Day Game on Tmall

Singles’ Day Game on Tmall

Source: Tmall[/caption] New Store Formats New Retail refers to the integration of online and offline commerce and the transformation of the supply chain through digitalization, data and technology. Alibaba is the pioneer of the concept, which it employs through its Freshippo supermarket chain (called Hema in Chinese). The company has adopted a multi-format approach for the stores and expanded to 170 locations in China (as of September 30, 2019). The company also added the Freshippo Mall in Shenzhen to its portfolio, the supermarket chain’s seventh format. Freshippo stores enable the consumer to order from the store, purchase groceries in the store, select food to be cooked and eaten in the store, all of which can be picked up in the store or delivered. The outwardly seamless function of the store runs on a tight data-based platform that stores and acts on digital data, which extends from the supply chain to the consumer. [caption id="attachment_104441" align="aligncenter" width="500"] The Freshippo Mall in Shenzhen

The Freshippo Mall in Shenzhen

Source: Coresight Research[/caption] Alibaba rival JD.com has also embraced the New Retail concept—it opened the JD E-Space electronics experiential store in November 2019 and lifestyle social space Seven Fun in December 2019. JD-Espace lets consumers try and test electronics and appliances, and has dedicated stores such as a Microsoft smart-home experience. Seven Fun offers 1,000 square meters of retail space, plus three in-store bars and 12 restaurants, merging shopping and socializing. These new store formats are driven by data and powered by smartphones. All products are available to order through the store apps, and the company offers delivery up to three kilometers. Physical stores continue to play an indispensable role in the consumer shopping journey. E-commerce giants are opening new store formats to fulfill various consumer needs, with the aim of attracting new customers and taking advantage of the halo effect to boosting online business. Brand Collaborations Brand mashups are a phenomenon in China: Collaboration between brands (especially highly dissimilar ones) can turn conventional products into unique offerings that drive consumer purchases. For example, American fashion designer Alexander Wang partnered with McDonald’s in December 2019 to release two accessories inspired by fast-food takeaway culture. The limited collection sold out on the first day of launch. [caption id="attachment_104442" align="aligncenter" width="500"] Source: McDonald’s Weibo[/caption]

During the 2019 Singles’ Day pre-sales period, 13,000 crossover gift sets by beauty brand Shu Uemura and Pokémon were sold in the first 10 minutes on Tmall.

To appeal to Chinese consumers, brands are designing exclusive products. Luxury and beauty brands have introduced a wide range of products inspired by the Chinese Zodiac—2020 being the Year of the Rat. For instance, watch brand Chopard released a L.U.C XP Urushi Year of the Rat timepiece, crafted using the Japanese urushi lacquer technique. Korean beauty brand Etude House launched a Tom & Jerry-themed makeup collection. (The Chinese character for “mouse” and “rat” is the same).

[caption id="attachment_104443" align="aligncenter" width="400"]

Source: McDonald’s Weibo[/caption]

During the 2019 Singles’ Day pre-sales period, 13,000 crossover gift sets by beauty brand Shu Uemura and Pokémon were sold in the first 10 minutes on Tmall.

To appeal to Chinese consumers, brands are designing exclusive products. Luxury and beauty brands have introduced a wide range of products inspired by the Chinese Zodiac—2020 being the Year of the Rat. For instance, watch brand Chopard released a L.U.C XP Urushi Year of the Rat timepiece, crafted using the Japanese urushi lacquer technique. Korean beauty brand Etude House launched a Tom & Jerry-themed makeup collection. (The Chinese character for “mouse” and “rat” is the same).

[caption id="attachment_104443" align="aligncenter" width="400"] Source: Chopard/Etude House Weibo[/caption]

The BEST Framework for Brick-and-Mortar Stores

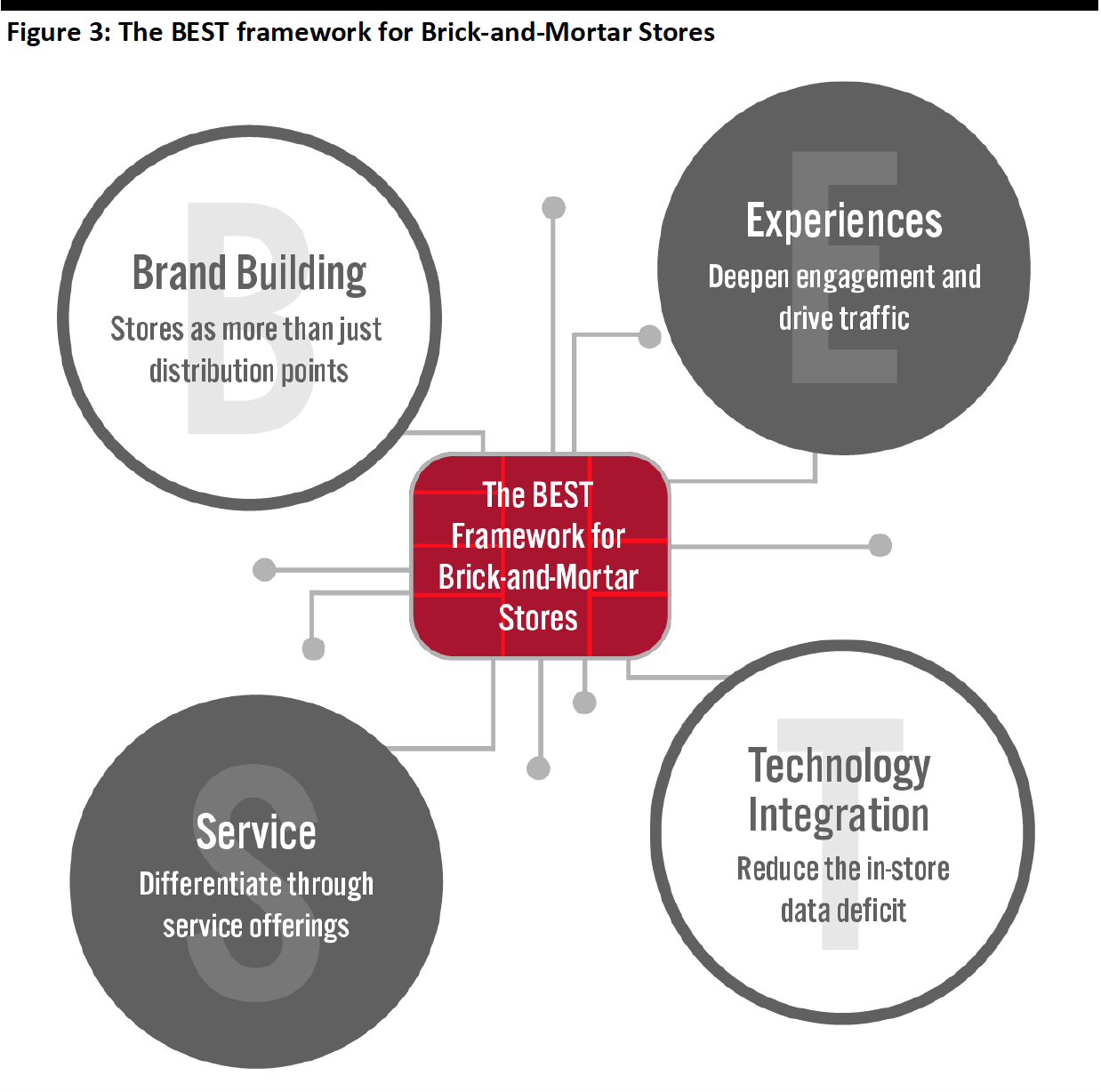

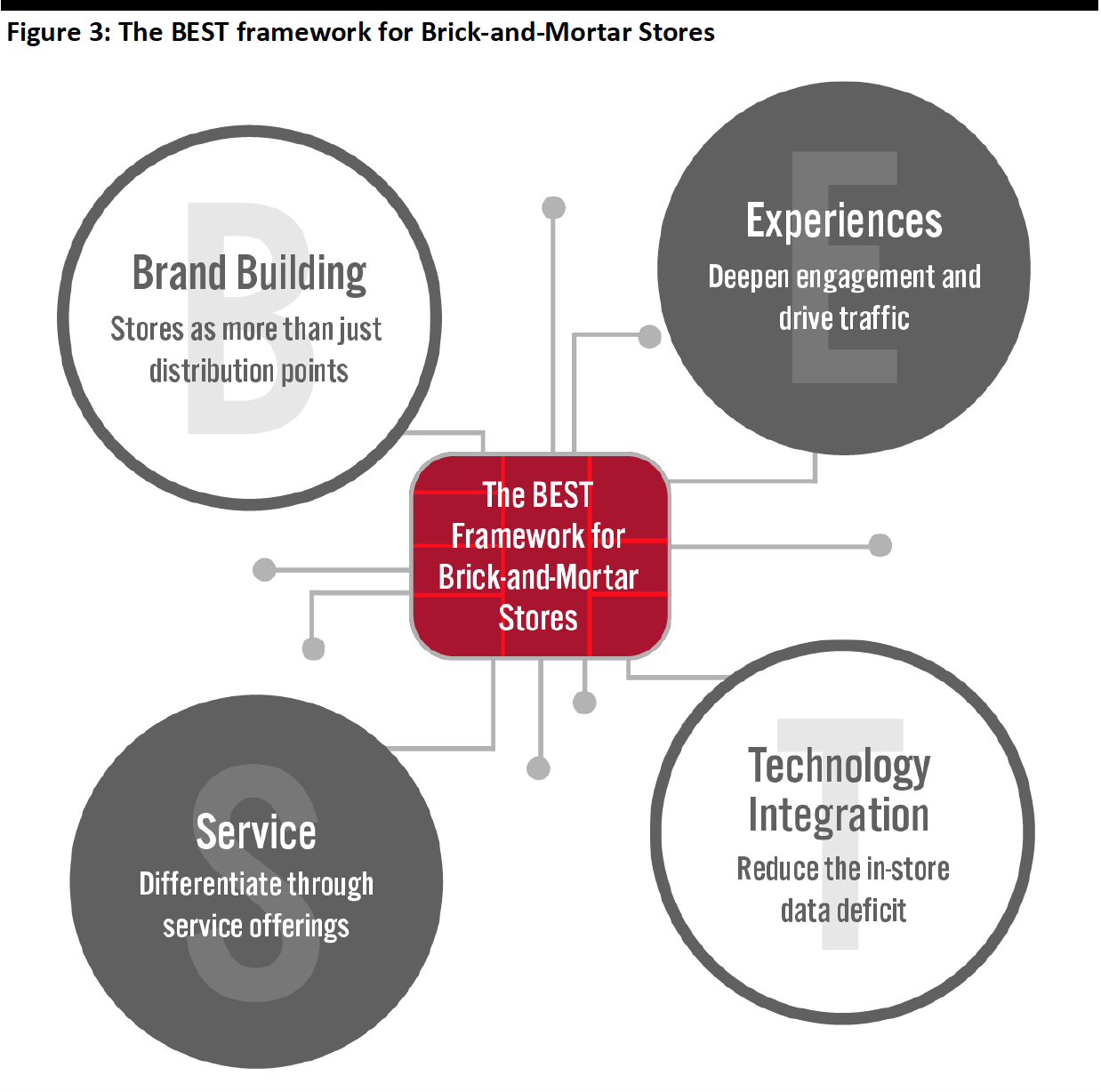

Coresight Research created the BEST framework to help retailers better meet consumer expectations by strategizing physical retail around four themes (see Figure 3): Brand Building, Experiences, Service and Technology Integration.

In practice, the four elements are often tightly interlinked to create a shopping experience that drives conversion, return visits, superior consumer engagement and loyalty.

[caption id="attachment_104444" align="aligncenter" width="500"]

Source: Chopard/Etude House Weibo[/caption]

The BEST Framework for Brick-and-Mortar Stores

Coresight Research created the BEST framework to help retailers better meet consumer expectations by strategizing physical retail around four themes (see Figure 3): Brand Building, Experiences, Service and Technology Integration.

In practice, the four elements are often tightly interlinked to create a shopping experience that drives conversion, return visits, superior consumer engagement and loyalty.

[caption id="attachment_104444" align="aligncenter" width="500"] Source: Coresight Research[/caption]

Brand Building

Retailers must utilize physical stores as a marketing channel, not simply as a sales channel. We think that more retailers must maximize the value of their store assets to build and reinforce their identity, as well as to create and deepen emotional connections with potential customers. Physical locations should provide the most extensive brand experience, so retailers should look beyond “four-wall” profitability—i.e., the profitability of a store based on the sales made on those premises—and consider the wider value of their stores.

This value can include financial benefits that are not immediately obvious. For example, many retailers have seen a halo effect, whereby online sales in a specific area increase when a physical store is opened in that area. At the same time, Internet-only retailers typically face higher marketing costs due to the absence of stores which would otherwise attract passing traffic. Physical stores serve a marketing purpose that delivers a return on investment beyond what happens within the four walls.

Luxury, premium and lifestyle brands such as Adidas, Apple and Lululemon lead the way in offering high-quality, experience-rich stores that not only sell product but serve as powerful marketing assets for the brand.

We see similar opportunities for monobrand retailers such as some apparel stores, where there is no distinction between the retailer and the brand. Brand building is less directly relevant to multibrand retailers focused on selling other companies’ brands (think traditional department stores), but differentiating the retail brand is nevertheless important in driving loyalty and gaining an edge over online-only multibrand retailers.

Target is a good example of a multi-line retailer that has created a destination based on in-store experiences along with private-label offerings. The Conservatory, a specialty boutique, curates premium brands at its Hudson Yards, New York, location, which enhances The Conservatory’s branded assortment while also building its own brand.

A focus on brand building implies changes in the type of stores that retailers need. In short, it suggests that retailers should look to maximize quality over quantity (of space). It demands higher-quality, well-invested stores that typically offer better service and better experiences. This theme also suggests that there are opportunities for smaller stores, which could function with more limited inventories.

Experiences

Experiential retail is already a much-discussed element of renewal plans for a number of companies. So far, however, we have seen limited convincing evidence of investment into physical retail experiences. We think more legacy, store-based retailers must bring events, experiences and opportunities for engagement into their stores. Those already doing so should do more than pay lip service to the concept and should innovate to maximize cut-through.

Through experiences, retailers can achieve several objectives:

Source: Coresight Research[/caption]

Brand Building

Retailers must utilize physical stores as a marketing channel, not simply as a sales channel. We think that more retailers must maximize the value of their store assets to build and reinforce their identity, as well as to create and deepen emotional connections with potential customers. Physical locations should provide the most extensive brand experience, so retailers should look beyond “four-wall” profitability—i.e., the profitability of a store based on the sales made on those premises—and consider the wider value of their stores.

This value can include financial benefits that are not immediately obvious. For example, many retailers have seen a halo effect, whereby online sales in a specific area increase when a physical store is opened in that area. At the same time, Internet-only retailers typically face higher marketing costs due to the absence of stores which would otherwise attract passing traffic. Physical stores serve a marketing purpose that delivers a return on investment beyond what happens within the four walls.

Luxury, premium and lifestyle brands such as Adidas, Apple and Lululemon lead the way in offering high-quality, experience-rich stores that not only sell product but serve as powerful marketing assets for the brand.

We see similar opportunities for monobrand retailers such as some apparel stores, where there is no distinction between the retailer and the brand. Brand building is less directly relevant to multibrand retailers focused on selling other companies’ brands (think traditional department stores), but differentiating the retail brand is nevertheless important in driving loyalty and gaining an edge over online-only multibrand retailers.

Target is a good example of a multi-line retailer that has created a destination based on in-store experiences along with private-label offerings. The Conservatory, a specialty boutique, curates premium brands at its Hudson Yards, New York, location, which enhances The Conservatory’s branded assortment while also building its own brand.

A focus on brand building implies changes in the type of stores that retailers need. In short, it suggests that retailers should look to maximize quality over quantity (of space). It demands higher-quality, well-invested stores that typically offer better service and better experiences. This theme also suggests that there are opportunities for smaller stores, which could function with more limited inventories.

Experiences

Experiential retail is already a much-discussed element of renewal plans for a number of companies. So far, however, we have seen limited convincing evidence of investment into physical retail experiences. We think more legacy, store-based retailers must bring events, experiences and opportunities for engagement into their stores. Those already doing so should do more than pay lip service to the concept and should innovate to maximize cut-through.

Through experiences, retailers can achieve several objectives:

Source: Coresight Research[/caption]

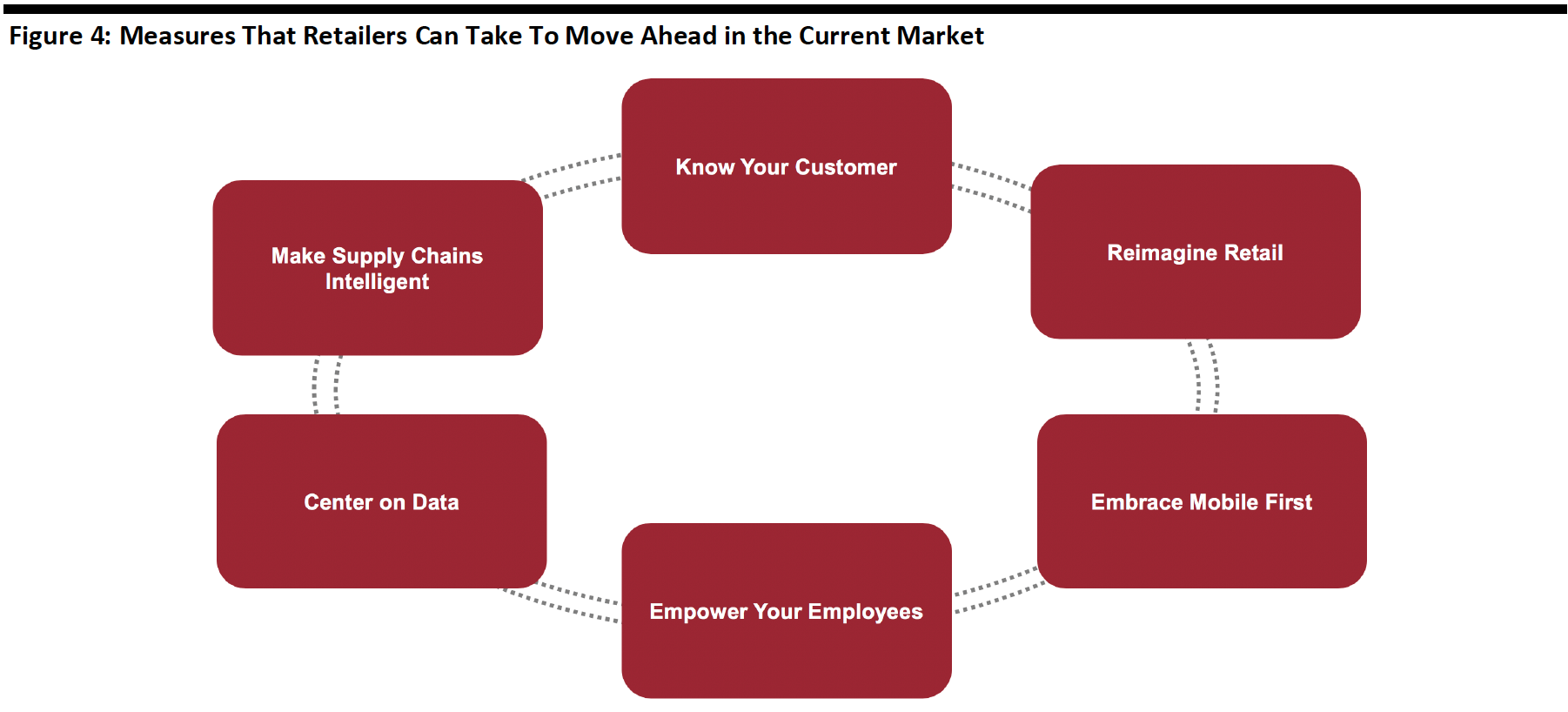

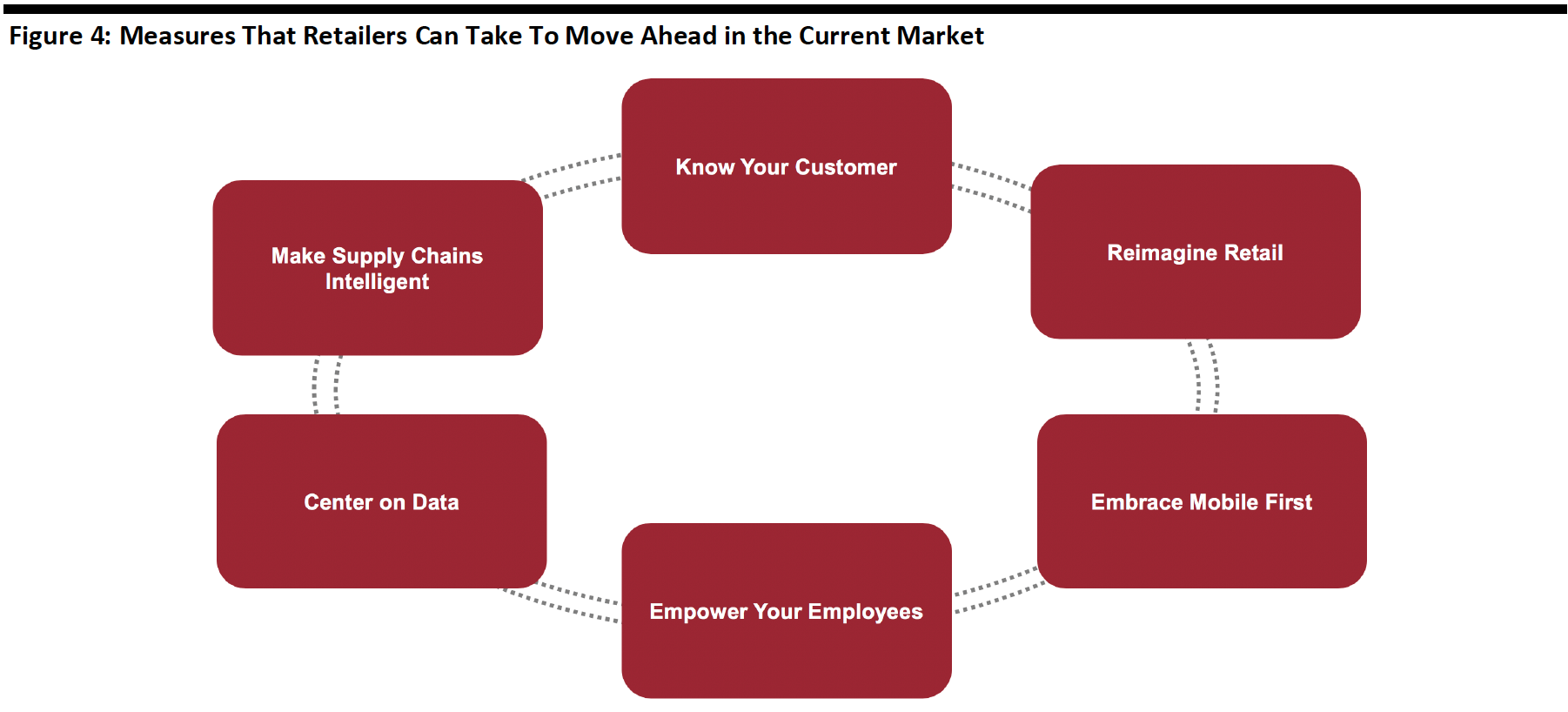

Know Your Customer

Many consumers feel like they are just another number when they make a purchase online or shop in a store. In addition, consumers can receive a barrage of e-mail offers completely unaligned with their wants and desires. However, retailers also possess a treasure trove of data, which can be analyzed to develop a more accurate understanding of the customer.

Consumers react positively to personalized products and services: One in five consumers said they would pay up to 20% more for them, according to a 2019 Deloitte survey.

Product recommendations need to take advantage of human intelligence as well: Many are merely extrapolations of data on recent purchases, whereas intelligent product recommendations consider applications or experiences based on the purchase data.

Data-Driven Insights

Personalized consumer communication and insights run on data. Two key examples are as follows:

Source: Coresight Research[/caption]

Know Your Customer

Many consumers feel like they are just another number when they make a purchase online or shop in a store. In addition, consumers can receive a barrage of e-mail offers completely unaligned with their wants and desires. However, retailers also possess a treasure trove of data, which can be analyzed to develop a more accurate understanding of the customer.

Consumers react positively to personalized products and services: One in five consumers said they would pay up to 20% more for them, according to a 2019 Deloitte survey.

Product recommendations need to take advantage of human intelligence as well: Many are merely extrapolations of data on recent purchases, whereas intelligent product recommendations consider applications or experiences based on the purchase data.

Data-Driven Insights

Personalized consumer communication and insights run on data. Two key examples are as follows:

Macy’s STORY retail concept

Macy’s STORY retail concept

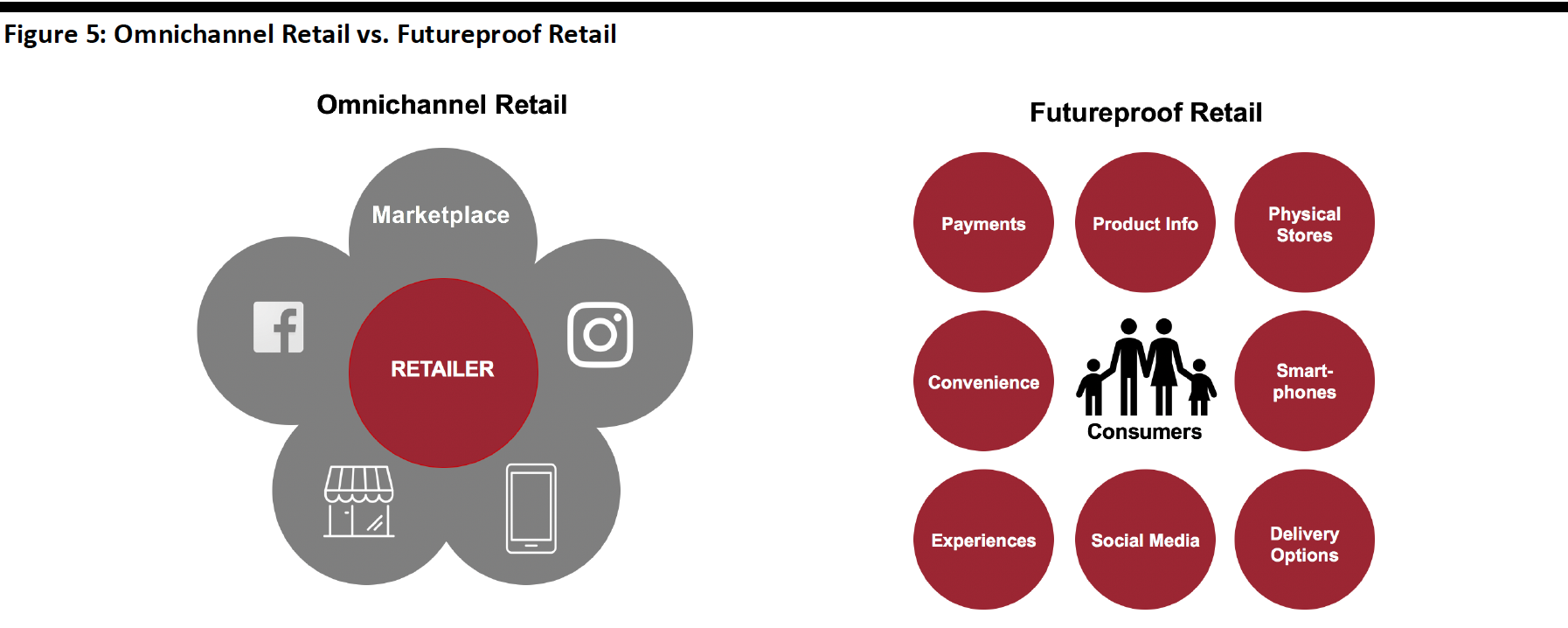

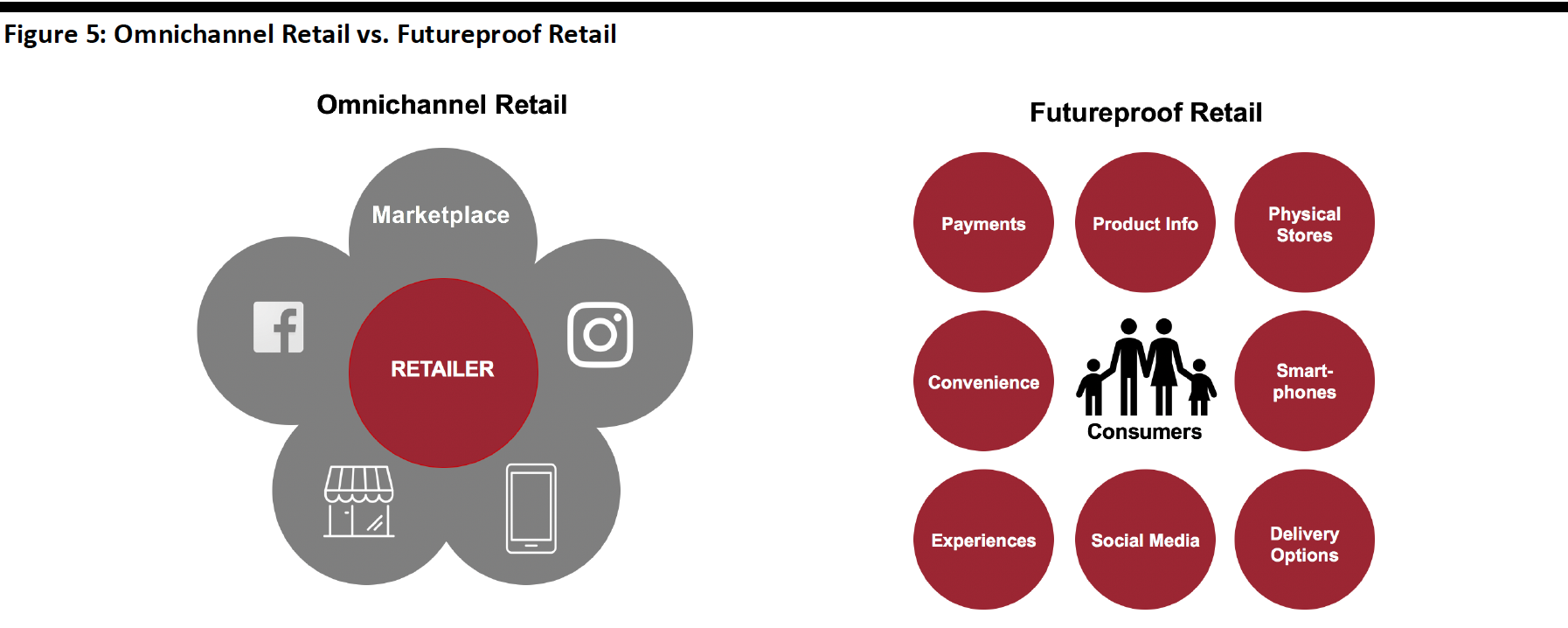

Source: Macy’s[/caption] Customer-Centric Retail The retail industry traditionally comprised department stores, boutiques and markets, which operated on a retailer-centric model. The advent of the Internet—and e-commerce, social media and smartphones—unlocked convenient, diverse and economical new distribution channels, but even with an omnichannel approach, retailers were still the central focus of operations. Omnichannel retail positioned the retailer in the middle, separated from the consumer by marketplaces, physical stores and online, leaving the consumer left out of the equation. The modern version of futureproof retail puts the consumer back in the middle, with access to a variety of information, media, and experiences, as depicted on the right-hand side of the figure. [caption id="attachment_104447" align="aligncenter" width="750"] Source: Coresight Research[/caption]

Embrace Mobile First

Smartphones are here to stay and taking on an ever-greater importance in consumer’s lives. In addition to being able to make phone calls, smartphone apps are replacing many functions previously performed on a web browser, and consumers are using smartphones for mobile payments, to link to retailer loyalty programs and to access public transportation.

US smartphone penetration is expected to hit 72.7% in 2020, up from 20.2% in 2010, according to Statista, illustrating the rapid rise in adoption.

Smartphones accounted for 39% of US e-commerce sales during the 2019 holiday shopping season, up 21% year over year, and mobile shopping accounted for an additional $14 billion in holiday sales, according to Adobe.

More telling is that 50% of consumers will willingly shop on their phones, also according to Adobe.

With such a high percentage of consumers having smartphones in their pockets and an increasing willingness to shop using the devices, retailers need to embrace mobile first and take the time to fine-tune a mobile-optimized experience.

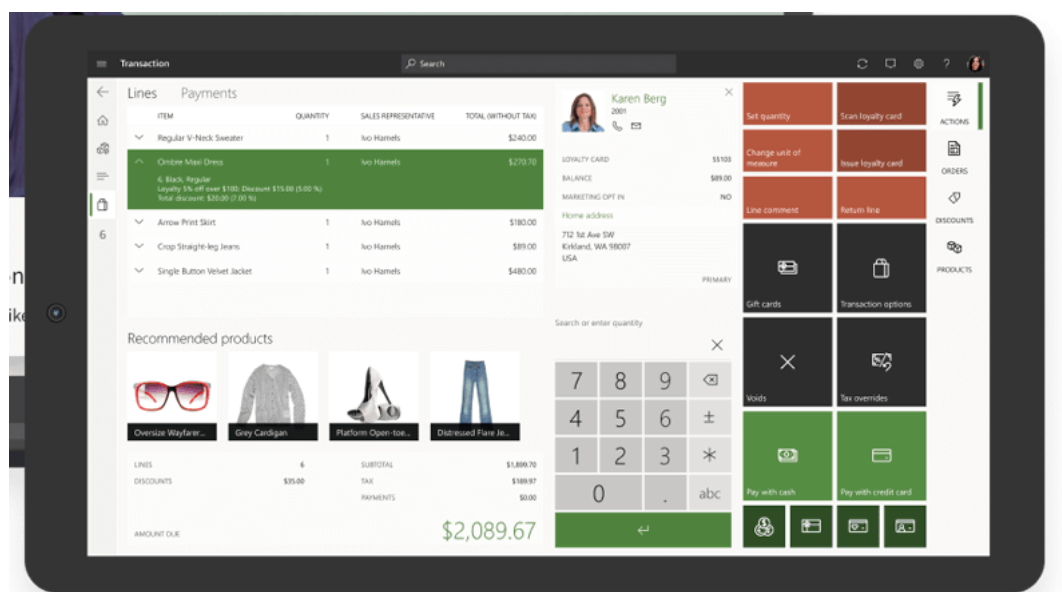

Empower Your Employees

One key distinction between online and physical retail is the ability of stores to offer knowledgeable associates that give product advice. Retailers are strengthening their technology in the backroom and in the front of the store to enable employees to spend more time delivering customer service. Many retailers have separate platforms for e-commerce, warehouse management and fulfillment, which create complex and time-consuming processes for employees to complete a simple online order for pickup. Companies need to consolidate these disparate systems to simplify the process.

Hardware Tools

Often, consumers enter a store having already researched products on the company’s website and on social media, so store associates need to be armed with at least this level of information to help and impress shoppers.

There are many ways in which retailers can use technology to empower employees:

Source: Coresight Research[/caption]

Embrace Mobile First

Smartphones are here to stay and taking on an ever-greater importance in consumer’s lives. In addition to being able to make phone calls, smartphone apps are replacing many functions previously performed on a web browser, and consumers are using smartphones for mobile payments, to link to retailer loyalty programs and to access public transportation.

US smartphone penetration is expected to hit 72.7% in 2020, up from 20.2% in 2010, according to Statista, illustrating the rapid rise in adoption.

Smartphones accounted for 39% of US e-commerce sales during the 2019 holiday shopping season, up 21% year over year, and mobile shopping accounted for an additional $14 billion in holiday sales, according to Adobe.

More telling is that 50% of consumers will willingly shop on their phones, also according to Adobe.

With such a high percentage of consumers having smartphones in their pockets and an increasing willingness to shop using the devices, retailers need to embrace mobile first and take the time to fine-tune a mobile-optimized experience.

Empower Your Employees

One key distinction between online and physical retail is the ability of stores to offer knowledgeable associates that give product advice. Retailers are strengthening their technology in the backroom and in the front of the store to enable employees to spend more time delivering customer service. Many retailers have separate platforms for e-commerce, warehouse management and fulfillment, which create complex and time-consuming processes for employees to complete a simple online order for pickup. Companies need to consolidate these disparate systems to simplify the process.

Hardware Tools

Often, consumers enter a store having already researched products on the company’s website and on social media, so store associates need to be armed with at least this level of information to help and impress shoppers.

There are many ways in which retailers can use technology to empower employees:

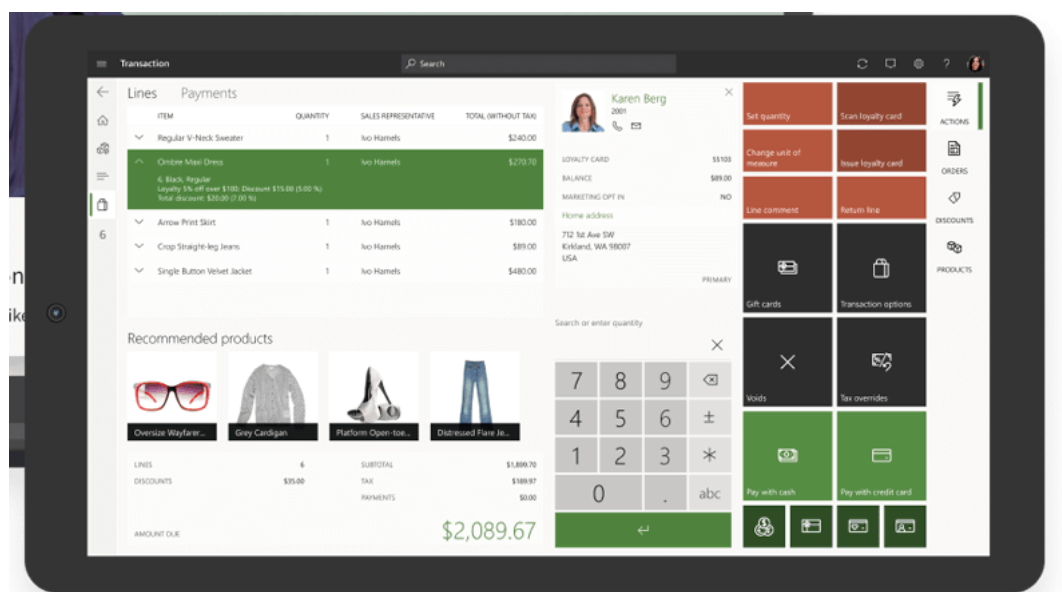

Microsoft’s store-associate tablet

Microsoft’s store-associate tablet

Source: Microsoft[/caption] Software Tools There are many software platforms that enable employees to do their best work, in the back office as well as on the shop floor. In the back office or corporate office, retailers can benefit from data analysis and visualization tools, many of which are simple to use through drag-and-drop user interfaces. In addition, tools such as predictive analytics and machine learning can offer insights for offering enhanced, personalized offers online and offline. Make Supply Chains Intelligent Intelligent retail depends upon a smart supply chain that uses real-time data analytics in all stages, from 3D product design to sourcing materials, packaging, warehousing and logistics to last-mile delivery, as shown in Figure 6. [caption id="attachment_104449" align="aligncenter" width="500"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

This means the outputs from demand forecasting have implications for the makeup of inventory, its location, product assortment, pricing and discounting. These, in turn, impact demand forecasting—for example, if goods are not priced optimally, this could lead to excess inventory, resulting in distortions in pricing and requiring steep discounts.

Conclusion: The Virtuous Circle of Data

Western retailers continue to face challenges due to changes in consumer tastes and preferences, as consumers increasingly take advantage of the convenience and efficiency offered by e-commerce. Retailers can elevate their service and experience offerings by borrowing ideas from the east, which uses a foundation of data to offer convenience and experiences.

Leveraging a data foundation enables retailers to operate more intelligently, and a data-powered supply chain is the key to offering seamless services and experiences. Retailers can also reimagine stores, creating dramatic spaces that transport the consumer away from the transaction and arming store associates with data-driven hardware and software tools to better know customers and offer more intimate, personalized service.

Source: Coresight Research[/caption]

This means the outputs from demand forecasting have implications for the makeup of inventory, its location, product assortment, pricing and discounting. These, in turn, impact demand forecasting—for example, if goods are not priced optimally, this could lead to excess inventory, resulting in distortions in pricing and requiring steep discounts.

Conclusion: The Virtuous Circle of Data

Western retailers continue to face challenges due to changes in consumer tastes and preferences, as consumers increasingly take advantage of the convenience and efficiency offered by e-commerce. Retailers can elevate their service and experience offerings by borrowing ideas from the east, which uses a foundation of data to offer convenience and experiences.

Leveraging a data foundation enables retailers to operate more intelligently, and a data-powered supply chain is the key to offering seamless services and experiences. Retailers can also reimagine stores, creating dramatic spaces that transport the consumer away from the transaction and arming store associates with data-driven hardware and software tools to better know customers and offer more intimate, personalized service.

Source: China Internet Watch[/caption]

The social media ecosystem in China is different from that in the West. Not only is it a platform for product discovery and content sharing, it is also a marketplace for consumers to make direct online purchases through media such as livestreaming and referral selling. Digital consumers spend 33% of their time on social media apps, according to the China Digital Consumer Trends 2019 survey by global research firm McKinsey.

[caption id="attachment_104439" align="aligncenter" width="750"]

Source: China Internet Watch[/caption]

The social media ecosystem in China is different from that in the West. Not only is it a platform for product discovery and content sharing, it is also a marketplace for consumers to make direct online purchases through media such as livestreaming and referral selling. Digital consumers spend 33% of their time on social media apps, according to the China Digital Consumer Trends 2019 survey by global research firm McKinsey.

[caption id="attachment_104439" align="aligncenter" width="750"] Base: More than 4,300 digital consumers across four city tiers and rural areas in China

Base: More than 4,300 digital consumers across four city tiers and rural areas in ChinaSource: McKinsey China Digital Consumer Trends 2019 Survey[/caption] Retailers can leverage social media platforms to promote brand awareness—by engaging with consumers and partnering with key opinion leaders, for example. Livestreaming is becoming the go-to option for Chinese consumers to discover products, driving impulse shopping. Alibaba’s Taobao Live accounted for 7.5% of the company’s Singles’ Day total sales of $38.4 billion in 2019. The platform has started to implement 5G technology to improve the user experience. Social app Red, e-commerce platform Pinduoduo and even WeChat have started testing live broadcast functions to tap into the growing livestreaming opportunity. Shopping Festivals Shopping festivals are huge in China: The total GMV generated during Alibaba’s 2019 Singles’ Day was more than five times that of Black Friday in the US. Retailers are using shopping festivals to promote products and launch new items. For consumers, festivals are more than just sale events to purchase products at discounted prices: they are opportunities to try new products and discover brands. Over 200,000 brands participated in Singles’ Day in 2019, and around one million new products were introduced on Tmall and Taobao. Tmall has also launched its Flagship Store 2.0, which helps brands create a personalized storefront. Shopping festival promotions also allow consumers to engage with brands through interactive games such as lotteries. [caption id="attachment_104440" align="aligncenter" width="300"]

Singles’ Day Game on Tmall

Singles’ Day Game on TmallSource: Tmall[/caption] New Store Formats New Retail refers to the integration of online and offline commerce and the transformation of the supply chain through digitalization, data and technology. Alibaba is the pioneer of the concept, which it employs through its Freshippo supermarket chain (called Hema in Chinese). The company has adopted a multi-format approach for the stores and expanded to 170 locations in China (as of September 30, 2019). The company also added the Freshippo Mall in Shenzhen to its portfolio, the supermarket chain’s seventh format. Freshippo stores enable the consumer to order from the store, purchase groceries in the store, select food to be cooked and eaten in the store, all of which can be picked up in the store or delivered. The outwardly seamless function of the store runs on a tight data-based platform that stores and acts on digital data, which extends from the supply chain to the consumer. [caption id="attachment_104441" align="aligncenter" width="500"]

The Freshippo Mall in Shenzhen

The Freshippo Mall in ShenzhenSource: Coresight Research[/caption] Alibaba rival JD.com has also embraced the New Retail concept—it opened the JD E-Space electronics experiential store in November 2019 and lifestyle social space Seven Fun in December 2019. JD-Espace lets consumers try and test electronics and appliances, and has dedicated stores such as a Microsoft smart-home experience. Seven Fun offers 1,000 square meters of retail space, plus three in-store bars and 12 restaurants, merging shopping and socializing. These new store formats are driven by data and powered by smartphones. All products are available to order through the store apps, and the company offers delivery up to three kilometers. Physical stores continue to play an indispensable role in the consumer shopping journey. E-commerce giants are opening new store formats to fulfill various consumer needs, with the aim of attracting new customers and taking advantage of the halo effect to boosting online business. Brand Collaborations Brand mashups are a phenomenon in China: Collaboration between brands (especially highly dissimilar ones) can turn conventional products into unique offerings that drive consumer purchases. For example, American fashion designer Alexander Wang partnered with McDonald’s in December 2019 to release two accessories inspired by fast-food takeaway culture. The limited collection sold out on the first day of launch. [caption id="attachment_104442" align="aligncenter" width="500"]

Source: McDonald’s Weibo[/caption]

During the 2019 Singles’ Day pre-sales period, 13,000 crossover gift sets by beauty brand Shu Uemura and Pokémon were sold in the first 10 minutes on Tmall.

To appeal to Chinese consumers, brands are designing exclusive products. Luxury and beauty brands have introduced a wide range of products inspired by the Chinese Zodiac—2020 being the Year of the Rat. For instance, watch brand Chopard released a L.U.C XP Urushi Year of the Rat timepiece, crafted using the Japanese urushi lacquer technique. Korean beauty brand Etude House launched a Tom & Jerry-themed makeup collection. (The Chinese character for “mouse” and “rat” is the same).

[caption id="attachment_104443" align="aligncenter" width="400"]

Source: McDonald’s Weibo[/caption]

During the 2019 Singles’ Day pre-sales period, 13,000 crossover gift sets by beauty brand Shu Uemura and Pokémon were sold in the first 10 minutes on Tmall.

To appeal to Chinese consumers, brands are designing exclusive products. Luxury and beauty brands have introduced a wide range of products inspired by the Chinese Zodiac—2020 being the Year of the Rat. For instance, watch brand Chopard released a L.U.C XP Urushi Year of the Rat timepiece, crafted using the Japanese urushi lacquer technique. Korean beauty brand Etude House launched a Tom & Jerry-themed makeup collection. (The Chinese character for “mouse” and “rat” is the same).

[caption id="attachment_104443" align="aligncenter" width="400"] Source: Chopard/Etude House Weibo[/caption]

The BEST Framework for Brick-and-Mortar Stores

Coresight Research created the BEST framework to help retailers better meet consumer expectations by strategizing physical retail around four themes (see Figure 3): Brand Building, Experiences, Service and Technology Integration.

In practice, the four elements are often tightly interlinked to create a shopping experience that drives conversion, return visits, superior consumer engagement and loyalty.

[caption id="attachment_104444" align="aligncenter" width="500"]

Source: Chopard/Etude House Weibo[/caption]

The BEST Framework for Brick-and-Mortar Stores

Coresight Research created the BEST framework to help retailers better meet consumer expectations by strategizing physical retail around four themes (see Figure 3): Brand Building, Experiences, Service and Technology Integration.

In practice, the four elements are often tightly interlinked to create a shopping experience that drives conversion, return visits, superior consumer engagement and loyalty.

[caption id="attachment_104444" align="aligncenter" width="500"] Source: Coresight Research[/caption]

Brand Building

Retailers must utilize physical stores as a marketing channel, not simply as a sales channel. We think that more retailers must maximize the value of their store assets to build and reinforce their identity, as well as to create and deepen emotional connections with potential customers. Physical locations should provide the most extensive brand experience, so retailers should look beyond “four-wall” profitability—i.e., the profitability of a store based on the sales made on those premises—and consider the wider value of their stores.

This value can include financial benefits that are not immediately obvious. For example, many retailers have seen a halo effect, whereby online sales in a specific area increase when a physical store is opened in that area. At the same time, Internet-only retailers typically face higher marketing costs due to the absence of stores which would otherwise attract passing traffic. Physical stores serve a marketing purpose that delivers a return on investment beyond what happens within the four walls.

Luxury, premium and lifestyle brands such as Adidas, Apple and Lululemon lead the way in offering high-quality, experience-rich stores that not only sell product but serve as powerful marketing assets for the brand.

We see similar opportunities for monobrand retailers such as some apparel stores, where there is no distinction between the retailer and the brand. Brand building is less directly relevant to multibrand retailers focused on selling other companies’ brands (think traditional department stores), but differentiating the retail brand is nevertheless important in driving loyalty and gaining an edge over online-only multibrand retailers.

Target is a good example of a multi-line retailer that has created a destination based on in-store experiences along with private-label offerings. The Conservatory, a specialty boutique, curates premium brands at its Hudson Yards, New York, location, which enhances The Conservatory’s branded assortment while also building its own brand.

A focus on brand building implies changes in the type of stores that retailers need. In short, it suggests that retailers should look to maximize quality over quantity (of space). It demands higher-quality, well-invested stores that typically offer better service and better experiences. This theme also suggests that there are opportunities for smaller stores, which could function with more limited inventories.

Experiences

Experiential retail is already a much-discussed element of renewal plans for a number of companies. So far, however, we have seen limited convincing evidence of investment into physical retail experiences. We think more legacy, store-based retailers must bring events, experiences and opportunities for engagement into their stores. Those already doing so should do more than pay lip service to the concept and should innovate to maximize cut-through.

Through experiences, retailers can achieve several objectives:

Source: Coresight Research[/caption]

Brand Building

Retailers must utilize physical stores as a marketing channel, not simply as a sales channel. We think that more retailers must maximize the value of their store assets to build and reinforce their identity, as well as to create and deepen emotional connections with potential customers. Physical locations should provide the most extensive brand experience, so retailers should look beyond “four-wall” profitability—i.e., the profitability of a store based on the sales made on those premises—and consider the wider value of their stores.

This value can include financial benefits that are not immediately obvious. For example, many retailers have seen a halo effect, whereby online sales in a specific area increase when a physical store is opened in that area. At the same time, Internet-only retailers typically face higher marketing costs due to the absence of stores which would otherwise attract passing traffic. Physical stores serve a marketing purpose that delivers a return on investment beyond what happens within the four walls.

Luxury, premium and lifestyle brands such as Adidas, Apple and Lululemon lead the way in offering high-quality, experience-rich stores that not only sell product but serve as powerful marketing assets for the brand.

We see similar opportunities for monobrand retailers such as some apparel stores, where there is no distinction between the retailer and the brand. Brand building is less directly relevant to multibrand retailers focused on selling other companies’ brands (think traditional department stores), but differentiating the retail brand is nevertheless important in driving loyalty and gaining an edge over online-only multibrand retailers.

Target is a good example of a multi-line retailer that has created a destination based on in-store experiences along with private-label offerings. The Conservatory, a specialty boutique, curates premium brands at its Hudson Yards, New York, location, which enhances The Conservatory’s branded assortment while also building its own brand.

A focus on brand building implies changes in the type of stores that retailers need. In short, it suggests that retailers should look to maximize quality over quantity (of space). It demands higher-quality, well-invested stores that typically offer better service and better experiences. This theme also suggests that there are opportunities for smaller stores, which could function with more limited inventories.

Experiences

Experiential retail is already a much-discussed element of renewal plans for a number of companies. So far, however, we have seen limited convincing evidence of investment into physical retail experiences. We think more legacy, store-based retailers must bring events, experiences and opportunities for engagement into their stores. Those already doing so should do more than pay lip service to the concept and should innovate to maximize cut-through.

Through experiences, retailers can achieve several objectives:

- Compete for experience dollars: Events give retailers the opportunity to fight for consumer spending otherwise directed to leisure. This is particularly true among younger shoppers, who tend to prioritize spending on experience over transactional purchases.

- Drive traffic: In-store experiences can excite shoppers with newness and create a sense of urgency through a fear of missing out; both support shopper traffic by encouraging greater frequency of store visits.

- Deepen engagement with shoppers: Brands that are moving further into physical retail have discovered the value of in-store experiences to strengthen their connections with shoppers—for example, Nike’s SoHo flagship, which opened in 2016, includes trial zones for several sports, such as basketball, soccer and running.

- Create memories: Brand-appropriate experiences—i.e., cooking classes at Williams-Sonoma or book signings at Barnes & Noble—create the backdrop for social interactions and building a community with the retailer at the center. Shoppers are also more likely to post experiences on social media, promoting the brand further.

- Take service capabilities to the next level: Retailers should aim to build out a suite of service offerings that, where relevant, span general and expert pre-purchase advice, personalization of products, after-sales enhancements such as free delivery and recycling, a choice of product returns options and product repair services.

- Delight shoppers with service offerings they may not expect: These could include product rental services, try-before-you-buy options or free replacements while a product is being repaired. Retailers should look to exceed in-store expectations with small unexpected extras, from free treats to one-day discounts when collecting orders.

- Self-service or high-touch service: Nike offers both of these at its Fifth Avenue Nike NYC location, where shoppers can opt for personalized expert shopping sessions (30/60 minutes) or can avoid all interaction by buying online (on the company’s website or in the app) and using store lockers for pickup.

- Retail as a Service (RaaS): Increasingly, digitally native brands are testing physical retail. RaaS allows the creation of turnkey pop-up locations for such brands in the nascent stages of physical retail.

- Equip staff to better inform customers: This can include deploying handheld devices, installing ordering points and integrating online and offline customer relationship databases.

- Provide in-store product information: Online, shoppers are free to research, compare and check specifications. In store, shoppers are dependent on the information presented, low-tech style, on shelf-edge labels or on packaging—unless they get out their smartphone and start searching.

- Offer relevant personalized product: Homepages and e-mails can be personalized online, yet using data to personalize the in-store experience remains extremely rare.

- Create dynamic pricing: Online, retailers can change prices whenever they want in response to competitors or demand. In store, it takes costly labor hours to change prices. Meanwhile, consumers expect prices to be the same in-store and online.

Source: Coresight Research[/caption]

Know Your Customer

Many consumers feel like they are just another number when they make a purchase online or shop in a store. In addition, consumers can receive a barrage of e-mail offers completely unaligned with their wants and desires. However, retailers also possess a treasure trove of data, which can be analyzed to develop a more accurate understanding of the customer.

Consumers react positively to personalized products and services: One in five consumers said they would pay up to 20% more for them, according to a 2019 Deloitte survey.

Product recommendations need to take advantage of human intelligence as well: Many are merely extrapolations of data on recent purchases, whereas intelligent product recommendations consider applications or experiences based on the purchase data.

Data-Driven Insights

Personalized consumer communication and insights run on data. Two key examples are as follows:

Source: Coresight Research[/caption]

Know Your Customer

Many consumers feel like they are just another number when they make a purchase online or shop in a store. In addition, consumers can receive a barrage of e-mail offers completely unaligned with their wants and desires. However, retailers also possess a treasure trove of data, which can be analyzed to develop a more accurate understanding of the customer.

Consumers react positively to personalized products and services: One in five consumers said they would pay up to 20% more for them, according to a 2019 Deloitte survey.

Product recommendations need to take advantage of human intelligence as well: Many are merely extrapolations of data on recent purchases, whereas intelligent product recommendations consider applications or experiences based on the purchase data.

Data-Driven Insights

Personalized consumer communication and insights run on data. Two key examples are as follows:

- Adaptive targeting, which includes geotargeted promotions and contextual product discovery.

- Chatbot assistants, which use natural language processing to convert a consumer’s purchase history and other factors such as time of day and emotions to offer intimate, immediate conversation.

- Fusion: Leveraging the synergies between disparate product categories, blurring the borders between food/beverages and apparel sales—for example in RH’s rooftop restaurant in New York City

- Collaborations: Celebrities and brands or brands in different segments working together—for example, Louis Vuitton and Supreme, or Mickey Mouse with Coach.

- Localized products: Reflecting the tastes or preferences of a specific region, such as Guess’ Farmer’s Market and Adidas’ LDN store (in London), which offer locally inspired exclusive products.

- Macy’s invested in, and subsequently acquired, luxury beauty retailer Bluemercury. It operates both freestanding stores and shops within Macy’s locations.

- Luckin Coffee, which launched a single trial store in Beijing, expanded into a network of 2,370 stores in 28 cities within 18 months.

- STORY, which Macy’s acquired in 2018, offers an innovative, narrative-driven retail concept that curates product arrays according to a theme that changes every couple of months.

- American Eagle, founded in 1977, has seen its Aerie brand become highly successful, recording rapid growth and on the way to becoming a $1 billion brand.

Macy’s STORY retail concept

Macy’s STORY retail conceptSource: Macy’s[/caption] Customer-Centric Retail The retail industry traditionally comprised department stores, boutiques and markets, which operated on a retailer-centric model. The advent of the Internet—and e-commerce, social media and smartphones—unlocked convenient, diverse and economical new distribution channels, but even with an omnichannel approach, retailers were still the central focus of operations. Omnichannel retail positioned the retailer in the middle, separated from the consumer by marketplaces, physical stores and online, leaving the consumer left out of the equation. The modern version of futureproof retail puts the consumer back in the middle, with access to a variety of information, media, and experiences, as depicted on the right-hand side of the figure. [caption id="attachment_104447" align="aligncenter" width="750"]

Source: Coresight Research[/caption]

Embrace Mobile First

Smartphones are here to stay and taking on an ever-greater importance in consumer’s lives. In addition to being able to make phone calls, smartphone apps are replacing many functions previously performed on a web browser, and consumers are using smartphones for mobile payments, to link to retailer loyalty programs and to access public transportation.

US smartphone penetration is expected to hit 72.7% in 2020, up from 20.2% in 2010, according to Statista, illustrating the rapid rise in adoption.

Smartphones accounted for 39% of US e-commerce sales during the 2019 holiday shopping season, up 21% year over year, and mobile shopping accounted for an additional $14 billion in holiday sales, according to Adobe.

More telling is that 50% of consumers will willingly shop on their phones, also according to Adobe.

With such a high percentage of consumers having smartphones in their pockets and an increasing willingness to shop using the devices, retailers need to embrace mobile first and take the time to fine-tune a mobile-optimized experience.

Empower Your Employees

One key distinction between online and physical retail is the ability of stores to offer knowledgeable associates that give product advice. Retailers are strengthening their technology in the backroom and in the front of the store to enable employees to spend more time delivering customer service. Many retailers have separate platforms for e-commerce, warehouse management and fulfillment, which create complex and time-consuming processes for employees to complete a simple online order for pickup. Companies need to consolidate these disparate systems to simplify the process.

Hardware Tools

Often, consumers enter a store having already researched products on the company’s website and on social media, so store associates need to be armed with at least this level of information to help and impress shoppers.

There are many ways in which retailers can use technology to empower employees:

Source: Coresight Research[/caption]

Embrace Mobile First

Smartphones are here to stay and taking on an ever-greater importance in consumer’s lives. In addition to being able to make phone calls, smartphone apps are replacing many functions previously performed on a web browser, and consumers are using smartphones for mobile payments, to link to retailer loyalty programs and to access public transportation.

US smartphone penetration is expected to hit 72.7% in 2020, up from 20.2% in 2010, according to Statista, illustrating the rapid rise in adoption.

Smartphones accounted for 39% of US e-commerce sales during the 2019 holiday shopping season, up 21% year over year, and mobile shopping accounted for an additional $14 billion in holiday sales, according to Adobe.

More telling is that 50% of consumers will willingly shop on their phones, also according to Adobe.

With such a high percentage of consumers having smartphones in their pockets and an increasing willingness to shop using the devices, retailers need to embrace mobile first and take the time to fine-tune a mobile-optimized experience.

Empower Your Employees

One key distinction between online and physical retail is the ability of stores to offer knowledgeable associates that give product advice. Retailers are strengthening their technology in the backroom and in the front of the store to enable employees to spend more time delivering customer service. Many retailers have separate platforms for e-commerce, warehouse management and fulfillment, which create complex and time-consuming processes for employees to complete a simple online order for pickup. Companies need to consolidate these disparate systems to simplify the process.

Hardware Tools

Often, consumers enter a store having already researched products on the company’s website and on social media, so store associates need to be armed with at least this level of information to help and impress shoppers.

There are many ways in which retailers can use technology to empower employees:

- Mobile checkout options, freeing customers from having to stand in line to complete the transaction.

- Robots to track inventory on store shelves, unload trucks and sweep floors.

- Tablets for store associates that enable them to access product information.

Microsoft’s store-associate tablet

Microsoft’s store-associate tabletSource: Microsoft[/caption] Software Tools There are many software platforms that enable employees to do their best work, in the back office as well as on the shop floor. In the back office or corporate office, retailers can benefit from data analysis and visualization tools, many of which are simple to use through drag-and-drop user interfaces. In addition, tools such as predictive analytics and machine learning can offer insights for offering enhanced, personalized offers online and offline. Make Supply Chains Intelligent Intelligent retail depends upon a smart supply chain that uses real-time data analytics in all stages, from 3D product design to sourcing materials, packaging, warehousing and logistics to last-mile delivery, as shown in Figure 6. [caption id="attachment_104449" align="aligncenter" width="500"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

- 3D product design: The current cycle time for design through delivery of apparel can take as long as 40 weeks. The combination of 3D digital visual design and employing dashboards, business intelligence, simulation, predictive analytics and data visualization can shrink the cycle to 21 weeks, a 48% reduction, according to global supply chain leader Li & Fung.

- Sourcing materials: Materials for manufacturing can arrive from all around the world, and their delivery is subject to manmade and natural disasters, which can delay or impede timing or availability. An intelligent sourcing dashboard can anticipate and track the progress of materials, provide alerts from disruptions and even suggest alternate suppliers or workarounds.

- Packaging: Weight and size of packaging affects shipping costs and other requirements, a challenge compounded by rising consumer demand for sustainability.

- Warehousing: Algorithms can determine the optimal location and placement of goods within warehouses to ensure efficient loading and shipping.

- Logistics: Mobility data can enable smart route planning, finding the optimal route and avoiding traffic in real time, reducing delivery time and fuel costs.

- Last-mile delivery: The last segment of the delivery route requires an advanced, intelligent delivery network that incorporates real-time delivery updates, AI-based route optimization and a precise understanding of factors influencing delays and waiting times.

Source: Coresight Research[/caption]

This means the outputs from demand forecasting have implications for the makeup of inventory, its location, product assortment, pricing and discounting. These, in turn, impact demand forecasting—for example, if goods are not priced optimally, this could lead to excess inventory, resulting in distortions in pricing and requiring steep discounts.

Conclusion: The Virtuous Circle of Data

Western retailers continue to face challenges due to changes in consumer tastes and preferences, as consumers increasingly take advantage of the convenience and efficiency offered by e-commerce. Retailers can elevate their service and experience offerings by borrowing ideas from the east, which uses a foundation of data to offer convenience and experiences.

Leveraging a data foundation enables retailers to operate more intelligently, and a data-powered supply chain is the key to offering seamless services and experiences. Retailers can also reimagine stores, creating dramatic spaces that transport the consumer away from the transaction and arming store associates with data-driven hardware and software tools to better know customers and offer more intimate, personalized service.

Source: Coresight Research[/caption]

This means the outputs from demand forecasting have implications for the makeup of inventory, its location, product assortment, pricing and discounting. These, in turn, impact demand forecasting—for example, if goods are not priced optimally, this could lead to excess inventory, resulting in distortions in pricing and requiring steep discounts.

Conclusion: The Virtuous Circle of Data

Western retailers continue to face challenges due to changes in consumer tastes and preferences, as consumers increasingly take advantage of the convenience and efficiency offered by e-commerce. Retailers can elevate their service and experience offerings by borrowing ideas from the east, which uses a foundation of data to offer convenience and experiences.

Leveraging a data foundation enables retailers to operate more intelligently, and a data-powered supply chain is the key to offering seamless services and experiences. Retailers can also reimagine stores, creating dramatic spaces that transport the consumer away from the transaction and arming store associates with data-driven hardware and software tools to better know customers and offer more intimate, personalized service.