albert Chan

Introduction

What’s the Story?

Coresight Research launched its proprietary BEST framework in 2019, helping retailers rethink their approach to retail via brand building, experiences, service and technology integration. Now, we are relaunching our BEST framework to provide all retail players with a consumer-centric approach to online and in-store retail, in line with Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity in 2022 and beyond (see the appendix of this report for more details).

Why It Matters

What was aspirational in 2019 is table stakes in 2022. Following the pandemic-led switch to e-commerce, consumers now demand convenience, ease and value—attributes finely honed in an online environment—and engaging and fun experiences when shopping in-store. In short: consumers want to do more than shop in physical locations—they want something new. Brands and retailers should take advantage of consumers’ pent-up desire for experiences, social interaction and discovery, driving store visits and making customers want to return.

Coresight Research’s BEST framework focuses on the key facets of this new, consumer-centric approach to online and in-person retail. BEST spans more than just in-person shopping. The framework spans online, in-store, in-app and the metaverse—everywhere the consumer engages with retailers and brands

BEST Framework: Coresight Research Analysis

In the following sections, we outline the four elements of the BEST framework through the lens of increased consumer centricity and explain how brands and retailers can best apply them.

Figure 1. The BEST Framework [caption id="attachment_153292" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Brand Building

Previously, many retailers utilized windows and outdoor displays to attract new customers. Now, however, retailers have a more comprehensive view of physical stores’ ability to build their brand, bring in new audiences and keep customers coming back. They are also brand building online, via apps, social media and branded websites, using every touchpoint to amplify their messaging and increase engagement. A consumer-centric retail strategy turns all online assets and physical locations—such as dressing rooms and check-out and pick-up areas—into expressions of the brand.

Internet-only retailers typically face higher marketing costs due to the absence of stores attracting passing traffic. Meanwhile, outside of marketing, customer acquisition costs are more or less fixed in a physical environment (rent and labor) versus the variable customer acquisition costs of digital retail, providing retailers with the opportunity to leverage rent and labor expenses for increased marketing potential.

Furthermore, according to a press release from the International Council of Shopping Centers, retailers have noted increased regional online traffic after opening a physical store in the same location. As such, a real-world store serves a continued marketing purpose—even when events are not being put on—delivering a return on investment. For instance, the photos on display in Paris-based department store Samaritaine showcase the extensive renovation the retailer has undergone, underlining the importance of the 150-year-old retailer to the city of Paris. Likewise, the display of iconic handbags at Coach's flagship store in New York City, Coach House, and the statue of Target's mascot, Bullseye, at its White Plains, New York, location anchor the stores in the brands’ cultures while also providing year-round photo opportunities for shoppers.

[caption id="attachment_153294" align="aligncenter" width="550"] Renovation photos on display in Samaritaine (top row); Coach House’s handbag display (bottom left); Bullseye statue at Target White Plains (bottom right)

Renovation photos on display in Samaritaine (top row); Coach House’s handbag display (bottom left); Bullseye statue at Target White Plains (bottom right)Source: Coresight Research[/caption]

Various premium and lifestyle brands, including Apple, Coach, NIKE and Ralph Lauren, have started offering experience-rich stores that do not just sell products but also serve as powerful marketing assets. For example, Coach now provides options to design bespoke Rogue bags or personalize leather goods at many of its in-person locations. Via their offerings, these brands differentiate themselves and build communities of like-minded shoppers who want both the individual products and the brand as a whole.

Multibrand retailers, such as department stores and mass merchants, should also look for ways to differentiate their retail brand, especially given the marketplace and retail-as-a-service revenue streams these companies can enjoy by attracting more consumers.

To maximize brand building, companies should reassess store sizes and layouts, as well as their overall fleet size. The BEST framework recommends higher-quality, well-invested stores that offer better experiences (E) and services (S) and are supported by technology (T). In fact, superior brand building is one of the by-products of—and often the intention of—brand experiences, retail services and in-store and online technologies.

2. Experiences

Due to the pandemic, experiential retail took a backseat over the past two years. Now, as the world emerges from Covid-19, we see pent-up demand for social activities, including visiting stores with experiences beyond simple commercial transactions. As such, retailers must bring brand-appropriate events, experiences and engagement opportunities to their e-commerce and in-person stores.

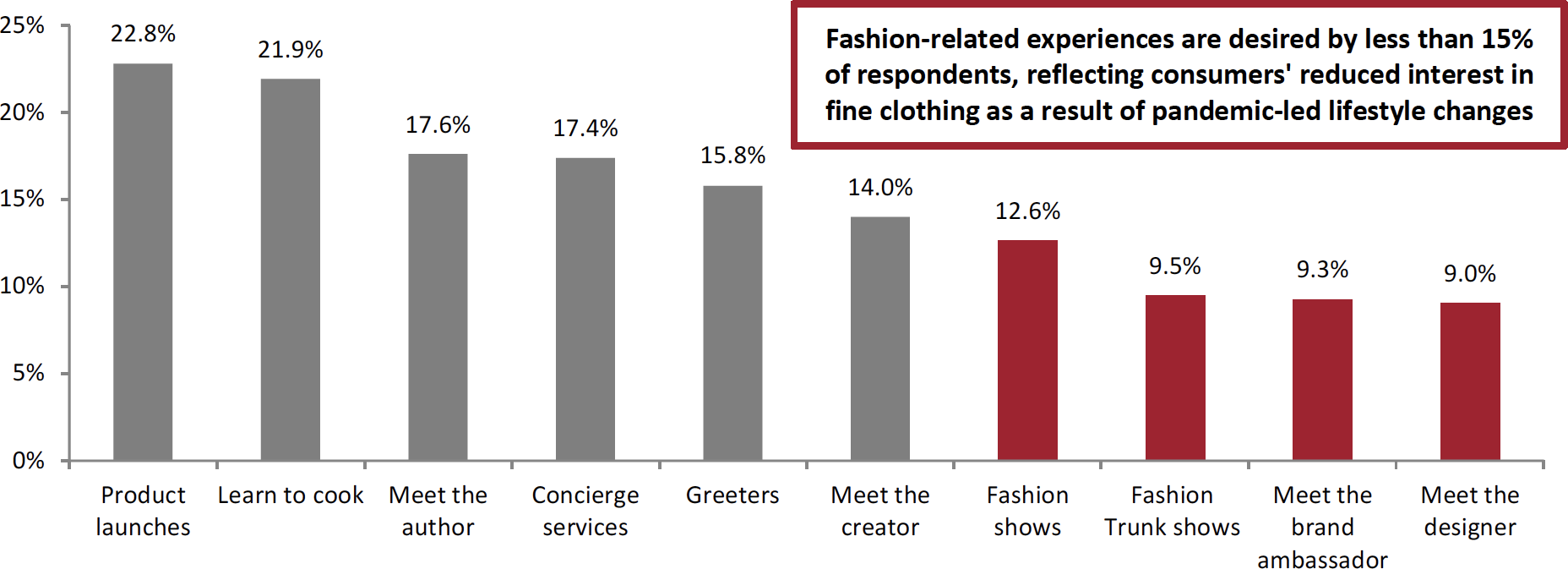

In February 2022, Coresight Research asked US adult shoppers which of 10 selected in-store experiences they would most like to see (see Figure 2). The responses revealed that more than one-fifth of consumers favored product launches and cooking lessons, suggesting that access to something new—whether purchasing a new product or learning something new—is a priority for consumers.

Figure 2. In-Store Experiences US Consumers Would Most Like To See (% of Respondents) [caption id="attachment_153295" align="aligncenter" width="700"]

Respondents could select up to five options

Respondents could select up to five optionsBase: 443 US respondents aged 18+, surveyed in February 2022

Source: Coresight Research[/caption] Recently, Nordstrom has created various month-long pop-ups as an opportunity to foster brand discovery, release exclusive products and create one-of-a-kind experiences. The company’s 2022 pop-ups have included the launch of Etam (a French intimates brand) in the US, as well as experiences dedicated to fragrance and candle brand Diptyque and ASOS, a UK-based cosmetics and fashion retailer. [caption id="attachment_153296" align="aligncenter" width="350"]

ASOS pop-up at Nordstrom NYC flagship, 57th Street

ASOS pop-up at Nordstrom NYC flagship, 57th StreetSource: Coresight Research[/caption] Nordstrom is pairing these real-world pop-ups with next-level online experiences. Many fashion items on Nordstrom.com include an online video where a Nordstrom associate explains the product—including how the fabric feels and flows—and makes suggestions for a more complete outfit, as shown in the image below. [caption id="attachment_153297" align="aligncenter" width="350"]

Nordstrom.com representative discusses The Zinna Slub Piqué Polo

Nordstrom.com representative discusses The Zinna Slub Piqué PoloSource: Company website[/caption]

Experiences can also serve several other purposes:

- Compete for experience dollars—Events give retailers the opportunity to vie for consumer spending, pulling them away from online retail and leisure activities and bringing them into stores. With inflation raising prices across the board, we expect consumers to become squeezed in 2022—thus, superior in-store and online experiences and events will help move product.

- Drive traffic—In-store experiences can excite shoppers and create a sense of urgency and a fear of missing out, supporting shopper traffic and encouraging a greater return frequency.

- Deepen engagement with shoppers—Even digitally native brands armed with mass amounts of shopper data realize the importance of engaging with consumers in physical environments. Brands that are expanding their physical retail footprint have discovered the value of in-store experiences. For example, NIKE’s Soho flagship, which opened in 2016, includes trial zones for several sports, such as basketball, soccer and running.

3. Services

The services a retailer offers is another way to differentiate itself—but the offerings provided will be specific to the retailer and its target shopper. A consumer-centric company will offer services across in-store and online platforms to make shopping easy and frictionless. Services developed by online retailers should be subsumed into physical retail service offerings, while traditional service offerings can be used to differentiate in-store experiences.

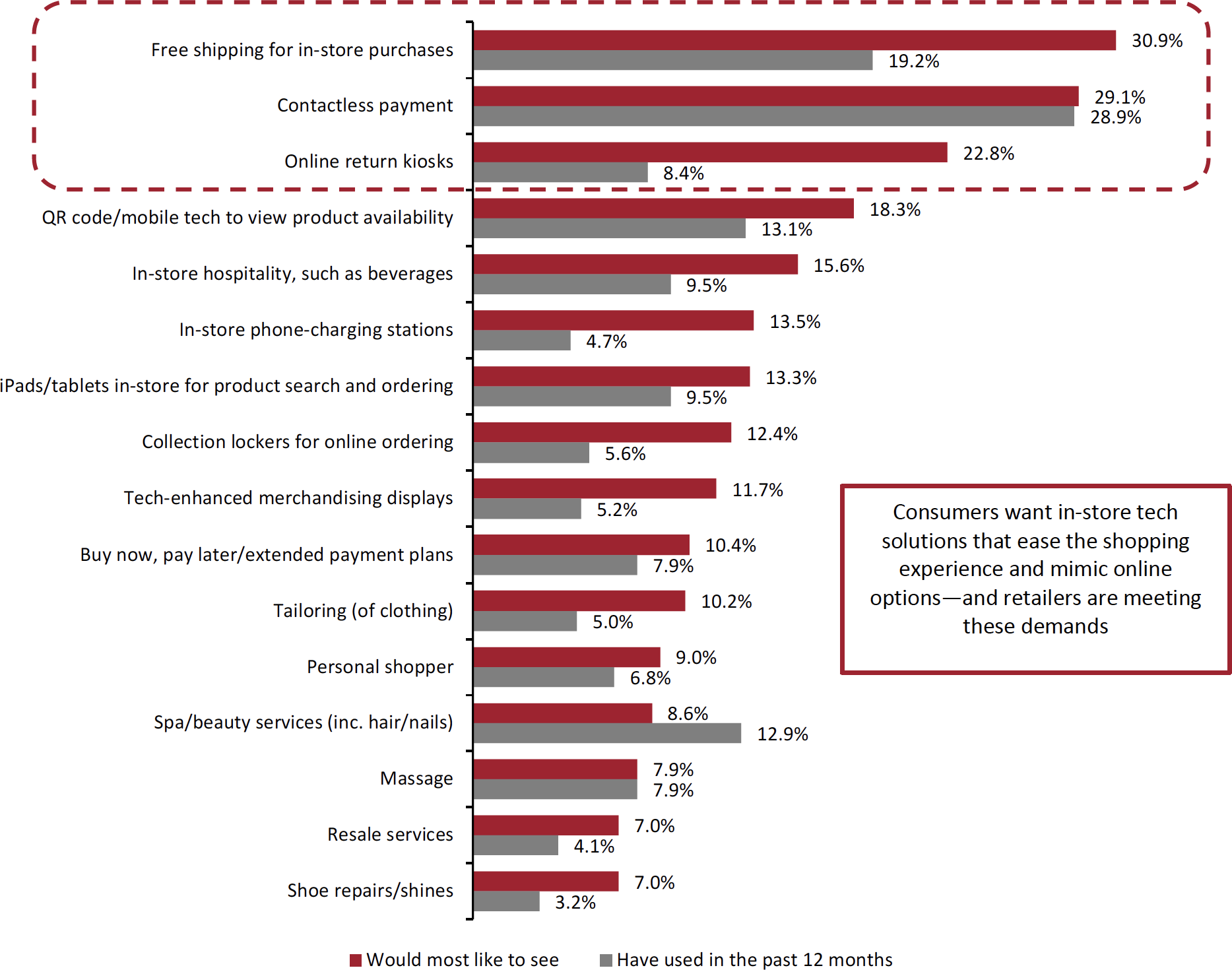

Our February 2022 survey found that, among 16 in-store services and technologies that US consumers would most like to see offered, free shipping for in-store purchases is the most desired (cited by three in 10 respondents), demonstrating the importance of eliminating last-mile barriers.

Contactless payment and online return kiosks also ranked highly in our survey, given consumers’ increased focus on health and cleanliness due to the pandemic. The desire for online return kiosks also speaks to the demand for easier and more efficient return options. On the other hand, the more traditional services of tailoring, personal shoppers and shoe repair are not highly sought after, suggesting an evolving shopper with more tech-influenced demands.

Resale is a relatively new service offering aimed at sustainably minded consumers—a growing cohort—as well as those seeking vintage and value products. We expect the share of shoppers that desire this service will grow as sustainability and circularity become increasingly important to many.

Unsurprisingly, consumers shop at the retailers that provide them with the options they desire. Contactless payment and free shipping for in-store purchases also ranked as the top two services and technologies that respondents used in the 12 months prior to the survey (Figure 3).

Figure 3. Services and Technologies US Consumers Would Most Like To See In-Store (% of Respondents) and Those Which They Have Used in the Past 12 Months (% of Respondents) [caption id="attachment_153298" align="aligncenter" width="700"]

Respondents could select up to five options for both survey questions

Respondents could select up to five options for both survey questionsBase: 443 US respondents aged 18+, surveyed in February 2022

Source: Coresight Research[/caption]

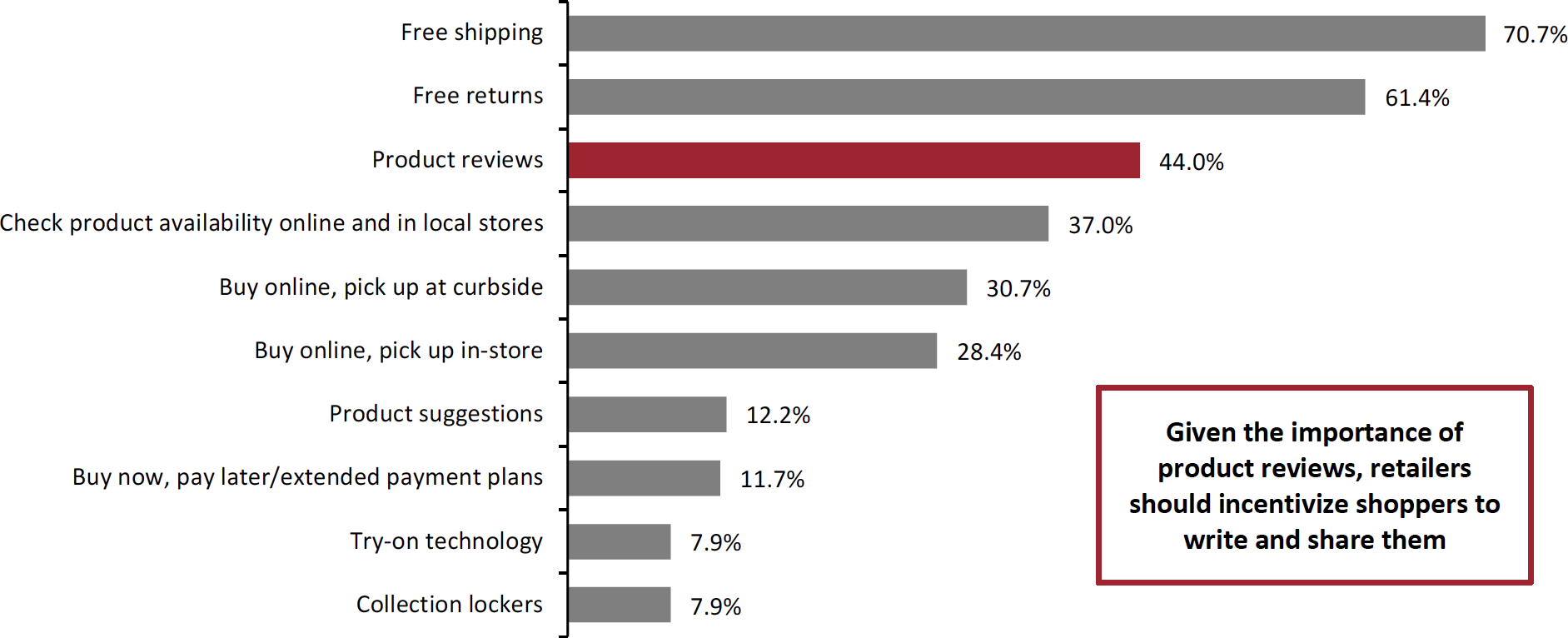

Meanwhile, when it comes to e-commerce, the last mile has become the cost of doing business for many brands and retailers, as US shoppers increasingly demand low-cost (and free) last-mile services: 60% of our survey respondents feel that free returns are important when shopping online—topping the list of important online services and technologies (see Figure 4).

Some brands and retailers have always charged for some or all returns, including luxury consignor The RealReal and luxury department store Saks Fifth Avenue, which has a $9.95 return charge if the return is not initiated within 14 days of the shipment date. However, companies should carefully consider the implications of changing their return policies.

With the escalating price of gas and transportation, eliminating free shipping and returns options would be appealing to retailers to save costs, but we doubt that consumers will be willing to take back the cost of the last mile. Instead, to minimize the cost of free returns, retailers with physical locations should persuade customers to use in-store returns services. Bringing these customers to stores also provides further brand engagement and add-on sales opportunities.

Additionally, improved online visualization and sizing tools could go far in reducing the need for returns. The online videos provided by companies like Nordstrom and Zappos provide useful information for shoppers when making purchases, facilitating fewer returns. Product reviews, which ranked third most important in our survey, can have a similar effect, providing shoppers with the information they need to make correct purchases, all while creating a community of those who review.

It is interesting to note that collection lockers are a desired service by 12.4% of in-store shoppers (for their online orders), but only 7.9% of online shoppers, suggesting the expectation of free delivery services is much more ingrained in the minds of online shoppers.

Figure 4. Services That Consumers Believe Are Most Important When Online Shopping (% of Respondents) [caption id="attachment_153299" align="aligncenter" width="700"]

Respondents could select up to five options

Respondents could select up to five optionsBase: 443 US respondents aged 18+, surveyed in February 2022

Source: Coresight Research[/caption]

Retailers should develop multipronged service offerings that strengthen their brand identity and consumer engagement. We see multiple pockets of opportunity:

- Take service capabilities to the next level—Retailers should aim to build out a suite of service offerings that, where relevant, spans pre-purchase advice, product personalization, after-sales enhancements and return and repair services. Companies such as Bloomingdales and Nordstrom have already started providing next-level service amenities at their New York stores. At Nordstrom Women’s New York City flagship, the company opened a two-floor beauty department offering spa services, including waxing, facials, clinical procedures and traditional hair and nail services. It also includes Nordstrom’s Beauty Haven on the second floor, an immersive and interactive area where top-trending brands and services pamper shoppers with the latest wellness, haircare and beauty tools.

- Surprise shoppers with unexpected service offerings—Small unexpected extras, such as thoughtful features, free treats or one-day discounts, enhance loyalty and improve customers’ lifetime value. For instance, Nordstrom has Certified Prosthesis Fitters to assist women dealing with breast cancer or recent surgery issues.

- Equip staff to better inform customers—Better equipping retail staff can include deploying handheld devices, installing more staffed, in-store ordering points and integrating online and offline customer relationship databases. As customers expect sales staff to have more access, information and product knowledge than they do, knowledgeable and engaging staff will facilitate repeat visits.

In the long term, paid memberships can retain customers by offering various benefits, including access to member-only events, providing exclusive services. VIP treatment, dedicated customer support, early access to new products and brand rewards. These elements translate into deeper customer relationships, resulting in higher customer engagement and satisfaction. Executives from Yotpo, an e-commerce marketing platform, told Coresight Research that experiential programs, when done right, can drive repeat business through the roof, even during tough economic times.

- For more on the benefits of loyalty programs, read Coresight Research’s report Think Tank: US Retail Loyalty Programs—Redefining Customer Engagement.

4. Technology Integration

Retail technology can—and should—support the elements noted above: it can strengthen brand building, create more immersive online and in-store experiences and enhance and quicken services offered. Associate-centric technology also enables store workers to assist shoppers by offering intelligent, personalized experiences that enhance the experience of visiting physical stores and maximize upselling opportunities.

- We have identified associate-centric technology as a key trend in retail. Read more in our 2022 Global Retail Trends report.

In-person customer service is one of the major advantages that physical retailers have over e-commerce. Moreover, as many brands and retailers have mentioned in recent earnings call, including Ulta Beauty CEO Dave Kimball, consumers have repeatedly stated that they enjoy visiting physical stores. Retailers need to empower existing associates with the consumer and product data they have, allowing them to make thoughtful recommendations to consumers. Artificial intelligence and machine learning can further find relationships between past purchases and current inventories, providing insight into each customer’s purchases and suggesting relevant products and services.

Covid-19 forced shoppers who were reluctant to shop online orders prior to the pandemic to adopt online shopping methods. Now a certain amount of digitalization is expected in stores; for instance, electronic shelf-edge labels can help to reduce the information gap by displaying product information, changing prices rapidly and cost-effectively, and personalizing promotions.

Technology can also help retailers gain more data than ever before. For example, using Wi-Fi and Bluetooth allows retailers to track shopper movements in stores, similar to monitoring browsing and buying behavior online.

What We Think

The consumer has become the point of sale, and retailers and brands need to address this moving target in a comprehensive, brand-appropriate manner. Every facet of Coresight Research’s BEST framework works together to provide a superior retail experience. Armed with their mobile phones, shoppers have access to limitless options and diversions. As such, when they are in-store, engaging experiences, services and team members are necessary to keep shoppers’ attention, upsell and create lasting relationships. Meanwhile, well-designed and personalized e-commerce options and experiences will keep customers engaged when they are not physically shopping. The right technology solutions can help facilitate these experiences and services, which are crucial to building a brand’s retail identity.

Implications for Brands/Retailers

- Brands and retailers must know their core customer, designing in-store experiences with them in mind and offering the services and technology their key demographic demands.

- Brands need to view retail as more than simply a distribution channel. Instead, every in-store customer touchpoint should be used as an opportunity to build the brand and customer relationships.

- Companies should aim to surprise and delight in-store shoppers, creating engaging experiences, such as in-store and membership-only events, and offering unique services that result in more time spent in-store and more frequent returns.

- Real estate firms should help design and build common areas for in-store events, experiences, art shows and kiosks, helping retailers drive traffic.

- Firms that can provide locations with established technology that supports the wireless needs of retailers and shoppers will be in the best position to work with brands and retailers that want to open new stores.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Appendix Figure 1. RESET Framework

[caption id="attachment_143517" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]