albert Chan

[caption id="attachment_78302" align="aligncenter" width="662"] Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

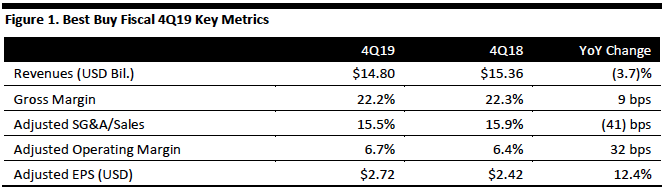

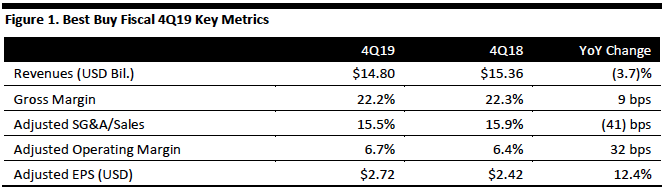

Best Buy reported fiscal 4Q19 revenues of $14.80 billion, down 3.7% year over year but beating the $14.68 billion consensus estimate.

Domestic comps increased 3.0%, beating the 1.8% consensus estimate, while international comps increased 2.5%. Domestic online comps increased 9.3%.

Adjusted EPS was $2.72, up 12.4% year over year and beating the $2.56 consensus estimate. GAAP EPS was $2.69, up from $1.23 in the year-ago period.

Segment Results

Domestic Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Best Buy reported fiscal 4Q19 revenues of $14.80 billion, down 3.7% year over year but beating the $14.68 billion consensus estimate.

Domestic comps increased 3.0%, beating the 1.8% consensus estimate, while international comps increased 2.5%. Domestic online comps increased 9.3%.

Adjusted EPS was $2.72, up 12.4% year over year and beating the $2.56 consensus estimate. GAAP EPS was $2.69, up from $1.23 in the year-ago period.

Segment Results

Domestic Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Best Buy reported fiscal 4Q19 revenues of $14.80 billion, down 3.7% year over year but beating the $14.68 billion consensus estimate.

Domestic comps increased 3.0%, beating the 1.8% consensus estimate, while international comps increased 2.5%. Domestic online comps increased 9.3%.

Adjusted EPS was $2.72, up 12.4% year over year and beating the $2.56 consensus estimate. GAAP EPS was $2.69, up from $1.23 in the year-ago period.

Segment Results

Domestic Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Best Buy reported fiscal 4Q19 revenues of $14.80 billion, down 3.7% year over year but beating the $14.68 billion consensus estimate.

Domestic comps increased 3.0%, beating the 1.8% consensus estimate, while international comps increased 2.5%. Domestic online comps increased 9.3%.

Adjusted EPS was $2.72, up 12.4% year over year and beating the $2.56 consensus estimate. GAAP EPS was $2.69, up from $1.23 in the year-ago period.

Segment Results

Domestic Segment

- Domestic revenues were $13.50 billion, a decrease of 3.5% year over year, owing to the extra week in the year-ago quarter, which generated $715 million in revenues.

- The closure of 257 Best Buy Mobile and 12 large-format stores contributed to the decline.

- The calendar shift added about 50 basis points to comps.

- International revenues were $1.30 billion, a decrease of 2.5% year over year, owing to the extra week in the year-ago quarter, which generated $45 million in revenues.

- Foreign currency movements hurt revenues by 470 basis points.

- Management commented that it has essentially already met the FY21 annual revenue and adjusted operating income targets provided at the company’s 2017 investor day, two years early.

- Best Buy’s Net Promoter Score rose more than 300 basis points during the year, as did its brand love metric within the customer segment. Customers interacted with the company across all channels, driving revenue growth in physical stores, online and in-home.

- The online channel represented 22% of domestic sales in the quarter.

- During the year, the company expanded the In-Home Advisor program from 300 to 530 advisors, who provided more than 175,000 free in-home consultations across the US. The revenue per order from these consultations exceeded that produced in-store or online, with a higher gross margin and higher attach rate of paid services. This business also features a high Net Promoter Score and low employee turnover.

- In October 2018, the company acquired GreatCall, a connected-health-service provider for aging consumers, as part of its strategy to help seniors live longer in their homes with the help of technology. Management characterized the integration as seamless and said envisioned value-creation opportunities are beginning to materialize.

- During the year, the company worked to elevate the customer experience around product fulfillments, enabled by a supply chain transformation. The company continues to improve its speed of delivery for small products through a combination of initiatives, including partnerships and automation, and it has expanded next-day and same-day delivery options. Best Buy now offers same-day delivery on thousands of items in 40 metro areas and next-day delivery in 60 metro areas. Customers also have the option to pick up their products in stores within one hour of placing an order. For larger products, such as appliances and TVs, the company has expanded its distribution-center capacity and brought fulfillment locations closer to customers.

- Management noted that opportunities from new technologies include the increasing penetration of larger screen sizes, 4K and OLED display technologies, and the introduction of new technologies such as 8K. In mobile, there are opportunities in wireless power, security and accessibility, as well as foldable phones and 5G. Interest in gaming continues to increase, and the performance gaming requires is driving innovation across both hardware and accessories. Management also sees significant opportunities in smart home technology and digital health, where technology can help customers across age groups with their health, fitness and sleep.

- Total company revenues of $42.9-43.9 billion (above consensus of $42.8 billion).

- Total company comp growth of 0.5-2.5% (in line with the 1.5% consensus).

- Adjusted EPS of $5.45-5.65 (the midpoint is above consensus of $5.49).

- Total company revenue of $9.05-9.15 billion (the midpoint is below the $9.15 billion consensus).

- Total company comp growth of 0.0-1.0% (below the 1.2% consensus).

- Adjusted EPS of $0.83-0.88 (above the consensus of $0.82).