Nitheesh NH

[caption id="attachment_95436" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q20 Results

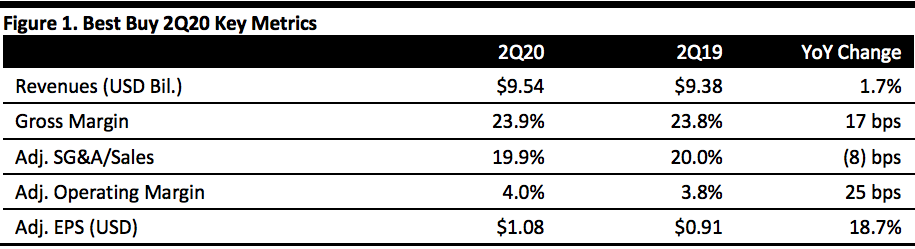

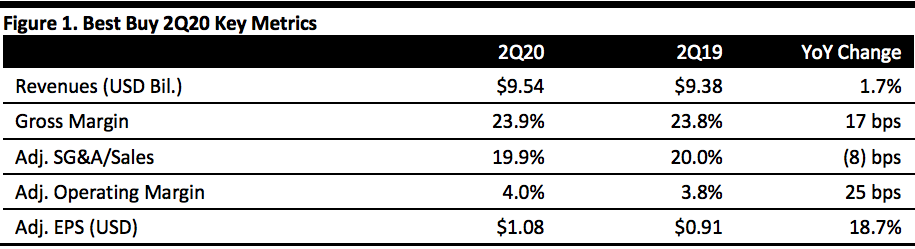

Best Buy reported fiscal 2Q20 Revenues of $9.54 billion, up 1.7% year over year and in line with the consensus estimate.

Enterprise comps increased 1.6% (following a 6.2% comp increase in the year-ago quarter), missing the 2.1% consensus estimate. Domestic comps increased 1.9%, while international comps declined 1.9%.

Adjusted EPS was $1.08, up 18.7% year over year and beating the $0.99 consensus estimate. GAAP EPS was $0.89, compared with $0.86 in the year-ago quarter.

Segment Results

Domestic

Source: Company reports/Coresight Research[/caption]

2Q20 Results

Best Buy reported fiscal 2Q20 Revenues of $9.54 billion, up 1.7% year over year and in line with the consensus estimate.

Enterprise comps increased 1.6% (following a 6.2% comp increase in the year-ago quarter), missing the 2.1% consensus estimate. Domestic comps increased 1.9%, while international comps declined 1.9%.

Adjusted EPS was $1.08, up 18.7% year over year and beating the $0.99 consensus estimate. GAAP EPS was $0.89, compared with $0.86 in the year-ago quarter.

Segment Results

Domestic

Source: Company reports/Coresight Research[/caption]

2Q20 Results

Best Buy reported fiscal 2Q20 Revenues of $9.54 billion, up 1.7% year over year and in line with the consensus estimate.

Enterprise comps increased 1.6% (following a 6.2% comp increase in the year-ago quarter), missing the 2.1% consensus estimate. Domestic comps increased 1.9%, while international comps declined 1.9%.

Adjusted EPS was $1.08, up 18.7% year over year and beating the $0.99 consensus estimate. GAAP EPS was $0.89, compared with $0.86 in the year-ago quarter.

Segment Results

Domestic

Source: Company reports/Coresight Research[/caption]

2Q20 Results

Best Buy reported fiscal 2Q20 Revenues of $9.54 billion, up 1.7% year over year and in line with the consensus estimate.

Enterprise comps increased 1.6% (following a 6.2% comp increase in the year-ago quarter), missing the 2.1% consensus estimate. Domestic comps increased 1.9%, while international comps declined 1.9%.

Adjusted EPS was $1.08, up 18.7% year over year and beating the $0.99 consensus estimate. GAAP EPS was $0.89, compared with $0.86 in the year-ago quarter.

Segment Results

Domestic

- Domestic revenues were $8.82 billion, an increase of 2.1% year over year, driven by the 1.9% increase in comps plus revenue from the acquisition of GreatCall in October 2018, partially offset by revenue lost from the closure of 13 large-format stores the past year.

- The largest comp growth drivers were appliances, wearables and tablets, partially offset by declines in the gaming and home theater category.

- Domestic online revenue was $1.42 billion, up 17.3% year over year, primarily due to higher average order values and increased traffic. Online revenue amounted to 16.1% of total domestic revenue versus 14.0% in the year-ago quarter.

- International revenues were $715 million, a decrease of 3.4% year over year, owing to a 1.9% decline in comps year over year, driven by Canada, plus approximately 120 basis points (bps) lost to foreign currency exchange rates.

- Management commented that Best Buy delivered improved profitability, driven by gross-margin expansion and continued disciplined expense management.

- The company reported continued progress on its “Building the New Blue” strategy and expanded its presence in the health and wellness category through an expanded assortment and two acquisitions.

- During Q2, the company launched a new collection of connected fitness products from several exercise companies, including Hydrow, ProForm, Hyperice and NordicTrack, as well as connected bikes and rowing machines and a popular recovery system. The collection is now available on the company’s website and coming to more than 100 stores by the end of the year. Employees and in-home advisors will offer training to help customers discover, understand and purchase the equipment, while Best Buy and Geek Squad manage delivery and installation.

- Membership in the company’s Total Tech Support program grew in the quarter, and the company added in-home advisors and continued to transform its supply chain to improve speed of delivery.

- Best Buy plans to hold an investor day on September 25.

- A revised estimate on the impact of tariffs on goods from China, including the increase to 30% for goods on List 3 and 15% for goods on List 4.

- Better-than-expected earnings in Q2.

- Uncertainty regarding consumer purchases in the second half of the year.

- Total company revenues of $43.1-43.6 billion (up 1-2%) versus $42.9-43.9 billion previously.

- Total company comp growth of 0.5-2.5% versus 0.7-1.7% previously.

- Adjusted EPS of $5.45-5.65 (up 5-8%) versus $5.45-5.65 previously.

- Total company revenues of $9.65-9.75 billion (up 1-2%).

- Total company comp growth of 0.5-1.5%.

- Adjusted EPS of $1.00-1.05 (up 8-13%).