DIpil Das

[caption id="attachment_89036" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

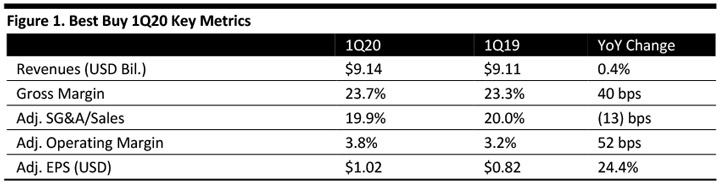

1Q20 Results

Best Buy reported fiscal 1Q20 Revenues of $9.14 billion, up 0.4% year over year and in line with the consensus estimate.

Enterprise comps increased 1.1%, beating the 1.0% consensus estimate. Domestic comps increased 1.3%, while international comps declined 1.2%.

Adjusted EPS was $1.02, up 24.4% year over year and beating the $0.87 consensus estimate. GAAP EPS was $0.98, compared with $0.72 in the year-ago quarter.

Segment Results

Domestic segment:

Source: Company reports/Coresight Research[/caption]

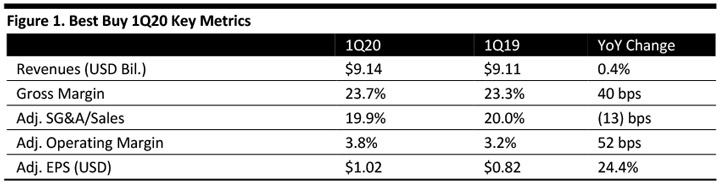

1Q20 Results

Best Buy reported fiscal 1Q20 Revenues of $9.14 billion, up 0.4% year over year and in line with the consensus estimate.

Enterprise comps increased 1.1%, beating the 1.0% consensus estimate. Domestic comps increased 1.3%, while international comps declined 1.2%.

Adjusted EPS was $1.02, up 24.4% year over year and beating the $0.87 consensus estimate. GAAP EPS was $0.98, compared with $0.72 in the year-ago quarter.

Segment Results

Domestic segment:

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Best Buy reported fiscal 1Q20 Revenues of $9.14 billion, up 0.4% year over year and in line with the consensus estimate.

Enterprise comps increased 1.1%, beating the 1.0% consensus estimate. Domestic comps increased 1.3%, while international comps declined 1.2%.

Adjusted EPS was $1.02, up 24.4% year over year and beating the $0.87 consensus estimate. GAAP EPS was $0.98, compared with $0.72 in the year-ago quarter.

Segment Results

Domestic segment:

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Best Buy reported fiscal 1Q20 Revenues of $9.14 billion, up 0.4% year over year and in line with the consensus estimate.

Enterprise comps increased 1.1%, beating the 1.0% consensus estimate. Domestic comps increased 1.3%, while international comps declined 1.2%.

Adjusted EPS was $1.02, up 24.4% year over year and beating the $0.87 consensus estimate. GAAP EPS was $0.98, compared with $0.72 in the year-ago quarter.

Segment Results

Domestic segment:

- Domestic revenues were $8.48 billion, an increase of 0.8% year over year, driven by the 1.3% increase in comps plus revenue from the acquisition of GreatCall in October 2018, partially offset by the revenue lost from the closure of 12 large-format stores and 165 Best Buy Mobile stores last year.

- The largest comp growth drivers were appliances, wearables and tablets, partially offset by declines in the entertainment category.

- Domestic online revenue was $1.31 billion, up 14.5% year over year, primarily due to higher average order values and increased traffic. Online revenue amounted to 15.4% of total domestic revenue versus 13.6% last year.

- International revenues were $661 million, a decrease of 5.2% year over year, owing to approximately 390 basis points of negative foreign currency exchange rates and a comp decline of 1.2%, driven by Canada.

- Tariff Situation: Pushback from companies that rely on imports from China such as Best Buy has limited the impact of tariffs thus far, and no decision has been made by the US administration on the implementation of tariffs on actual product categories. In addition, the company is pushing for more negotiations before the tariffs hit. The company estimates the tariffs will affect only 7% of cost of goods sold, and many of the products affected are accessories.

- Best Buy 2020 Strategy: The company continues to make progress in scaling the GreatCall consumer devices and advancing its commercial monitoring service to focus on seniors. Best Buy plans to open a third call center in San Antonio, Texas, with 2,400 agents providing 24/7 technical support and urgent response. In addition, the company acquired Critical Signal Technologies (CST) to help scale its commercial monitoring business. CST has approximately 100,000 senior subscribers as a supplemental benefit to Medicare advantage plans. This coverage enables GreatCall to engage with insurers to build insurance plans, as well as complement the company’s Geek Squad and In-Home Advisors businesses to access the commercial market.

- Lease-to-Own: Many customers are not able to qualify for the Best Buy credit card due to low credit scores or limited credit history, so the company launched a lease-to-own program that allows customers to pay over a six-month period. The program was launched in 36 states, or 70% of Best Buy stores, during the quarter and the company expects to roll it out to another nine states this year. Many customers are taking advantage of a May Day purchase option, which consists of a $79 initial payment in addition to the purchase price.

- Supply Chain: Best Buy wants most of its assortment to be available everywhere within one day at the latest. The company is working to improve delivery speed through initiatives, partnerships and metro e-commerce centers. Best Buy already offers same-day delivery on thousands of items in 40 metro areas, and free next-day delivery in 60 metro areas with a $35 minimum order, no membership fees required.

- Management Transition: On June 11, 2019, Chairman and CEO Hubert Joly will become Executive Chairman and CFO and Strategic Transformation Officer Corie Barry will become Best Buy’s 5th CEO in the company’s 53-year history.

- Total company revenues of $42.9-43.9 billion.

- Total company comp growth of 0.5-2.5%.

- Adjusted EPS of $5.45-5.65.

- Total company revenue of $9.5-9.6 billion (at or above the $9.5 billion consensus).

- Total company comp growth of 1.5-2.5% (compared to the 1.6% consensus).

- Adjusted EPS of $0.95-1.00 (compared to the consensus of $0.97).