albert Chan

Best Buy held its biannual investor update meeting on September 25, 2019, at the New York Stock Exchange.

Below, we include insights from the meeting.

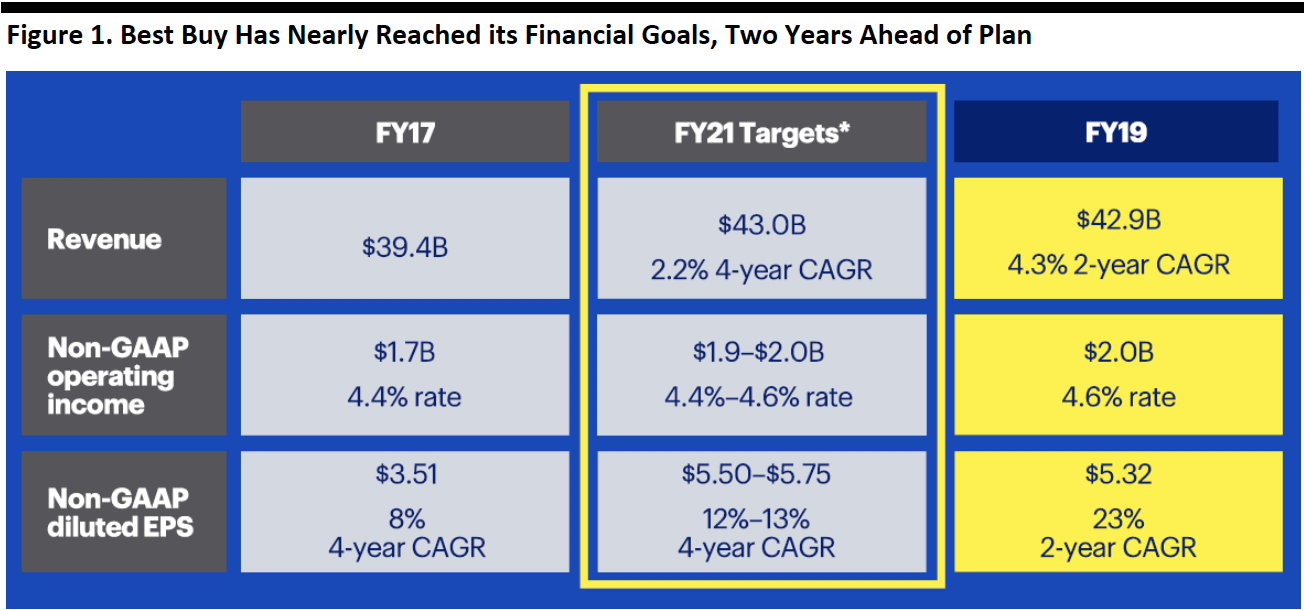

1) Best Buy has already accomplished its FY21 financial targets and has set aggressive but achievable targets for FY25.CEO Corie Barry delivered four main points:

- The company’s strategy is the right one, and it is working.

- Delivered well, its strategy will unlock profitable growth.

- Best Buy has tangible examples of how its strategy is coming to life for customers.

- The company has set aggressive but achievable targets.

Source: Company reports[/caption]

Source: Company reports[/caption]

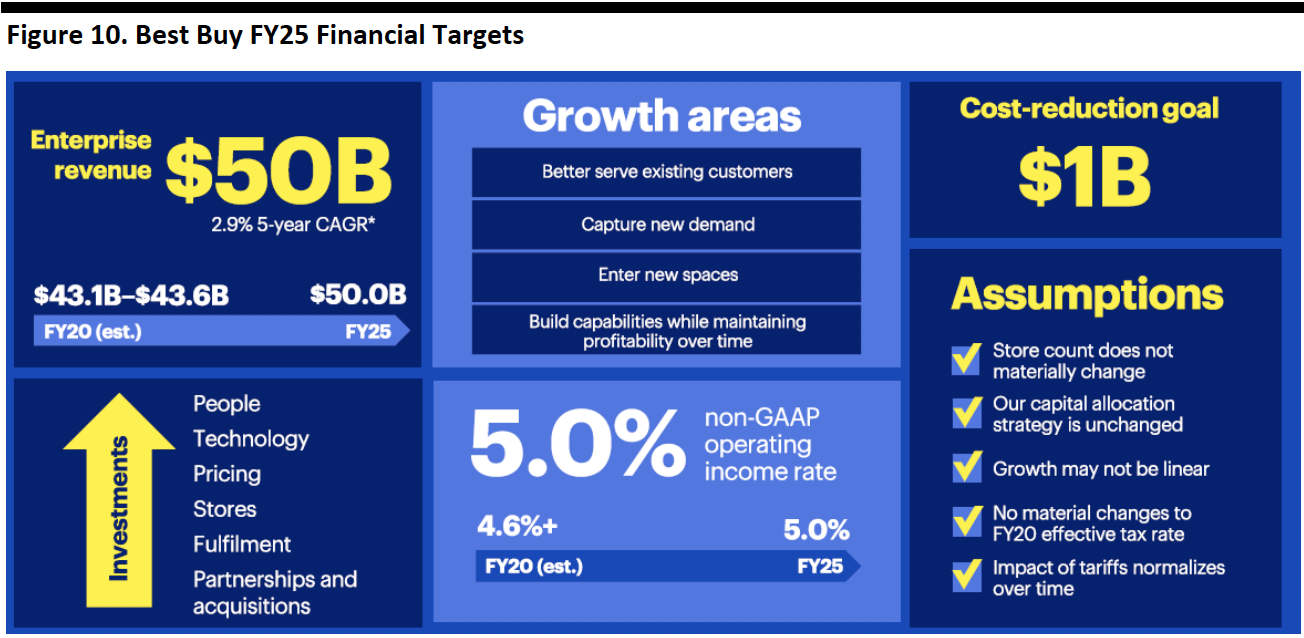

The company’s financial goals are as follows:

- Enterprise revenue of $50 billion, compared to current fiscal 2020 revenue guidance of $43.1-43.6 billion.

- Adjusted operating margin of 5.0%, compared to current fiscal 2020 guidance of flat to slightly up from FY19’s 4.6% adjusted operating margin.

- $1 billion of additional cost reductions and efficiencies.

Barry mentioned additional goals of being one of the best companies to work for in the US, doubling significant customer relationship events to $50 million and delivering consistent top- and bottom-line growth over time.

She calls the updated strategy “Building the New Blue: Chapter Two.”

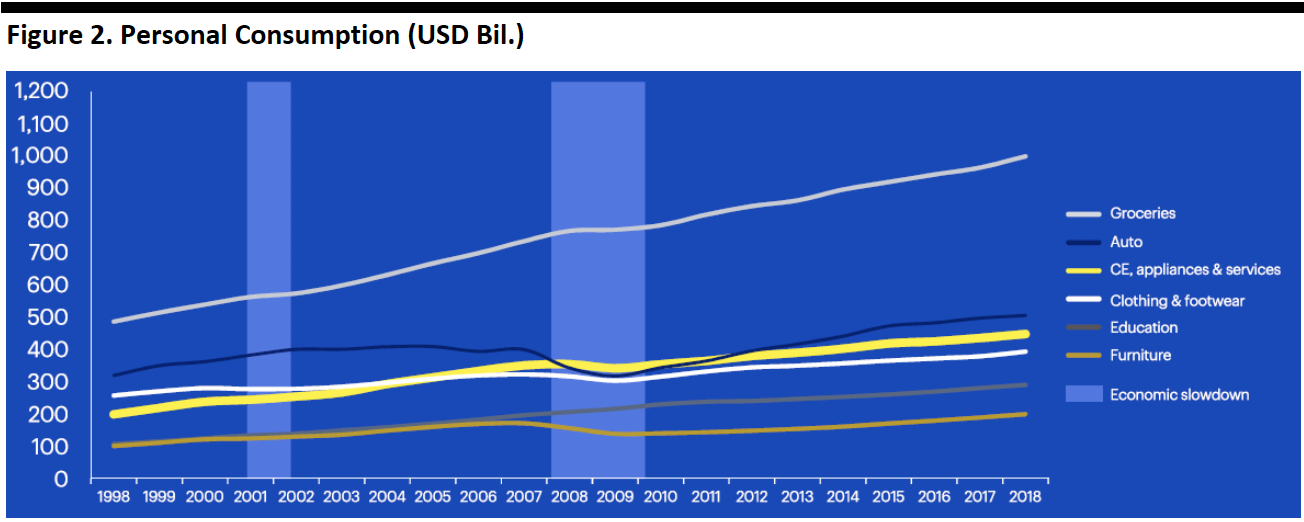

2) The consumer electronics industry continues to grow and is more stable than commonly perceived and is the third largest US retail sector after groceries and autos.

[caption id="attachment_97245" align="aligncenter" width="700"] Source: US Bureau of Economic Analysis/company reports[/caption]

Source: US Bureau of Economic Analysis/company reports[/caption]

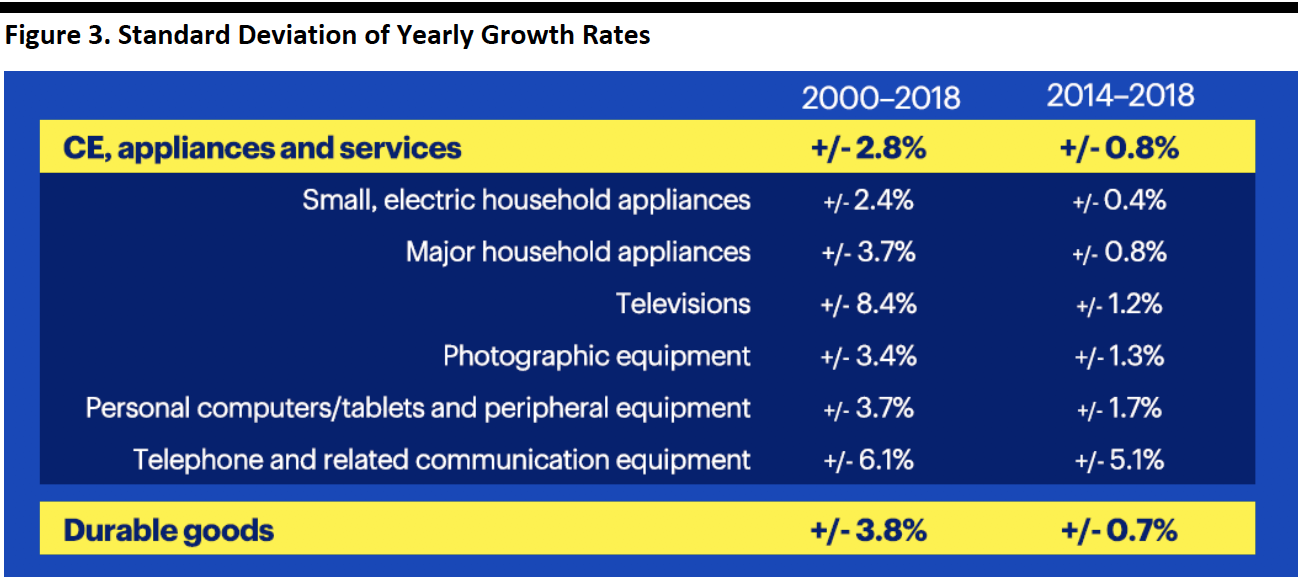

On a category level, volatility in consumer electronics spending has declined to that of household appliances.

[caption id="attachment_97246" align="aligncenter" width="700"] Source: US Bureau of Economic Analysis/company reports[/caption]

Source: US Bureau of Economic Analysis/company reports[/caption]

In addition, innovation in consumer electronics is prolific, particularly in gaming, 8K televisions, 5G wireless, dual-screen computing, foldable smartphones and digital health. Best Buy is the market leader in a highly fragmented market.

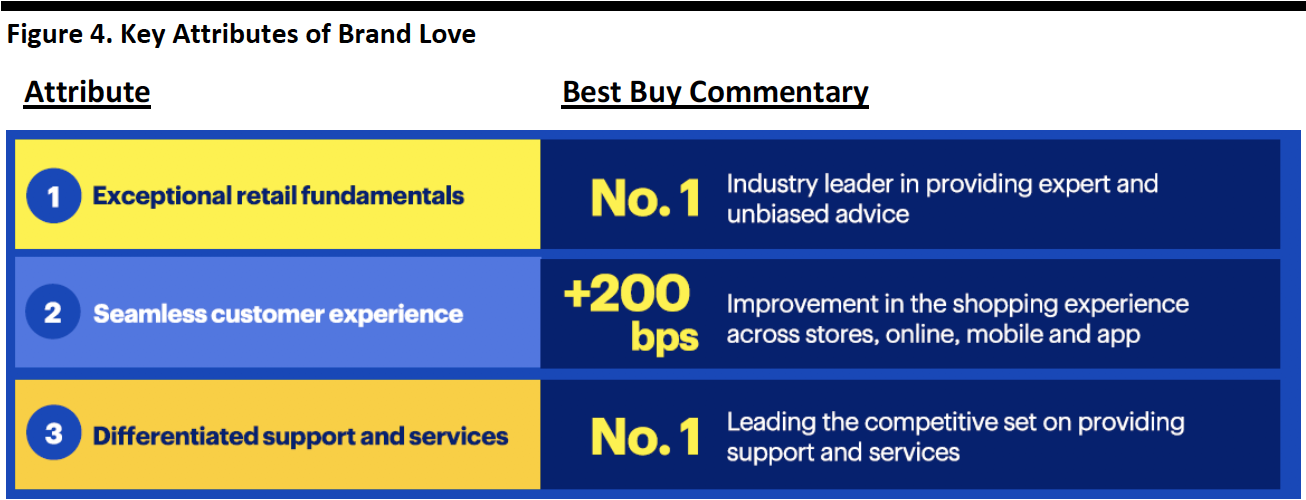

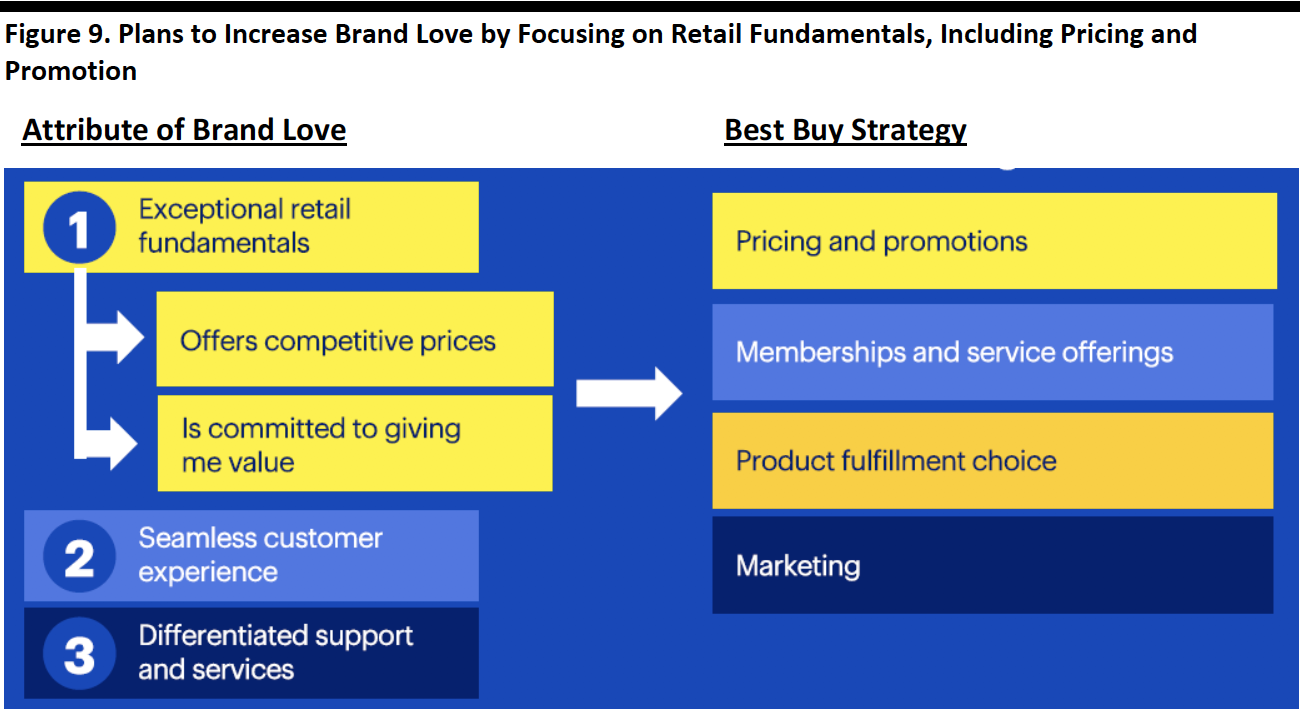

3) Best Buy is focused on increasing “brand love” by focusing on retail fundamentals, including pricing and promotions.

Management cited a statistic that 50% of consumers are overwhelmed by technology (according to a 2018 Kantar US Monitor Survey) and commented that customers love it when they get help with technology issues.

Barry continued with the key attributes of brand love:

[caption id="attachment_97247" align="aligncenter" width="700"] Source: Best Buy and Marketing Evolution Brand Health Study, 2018-2019[/caption]

Source: Best Buy and Marketing Evolution Brand Health Study, 2018-2019[/caption]

Barry reiterated the company’s unchanged corporate purpose: to enrich lives through technology.

4) Best Buy is intensely focused on the customer and is targeting adjacent opportunities where it has lower market share.

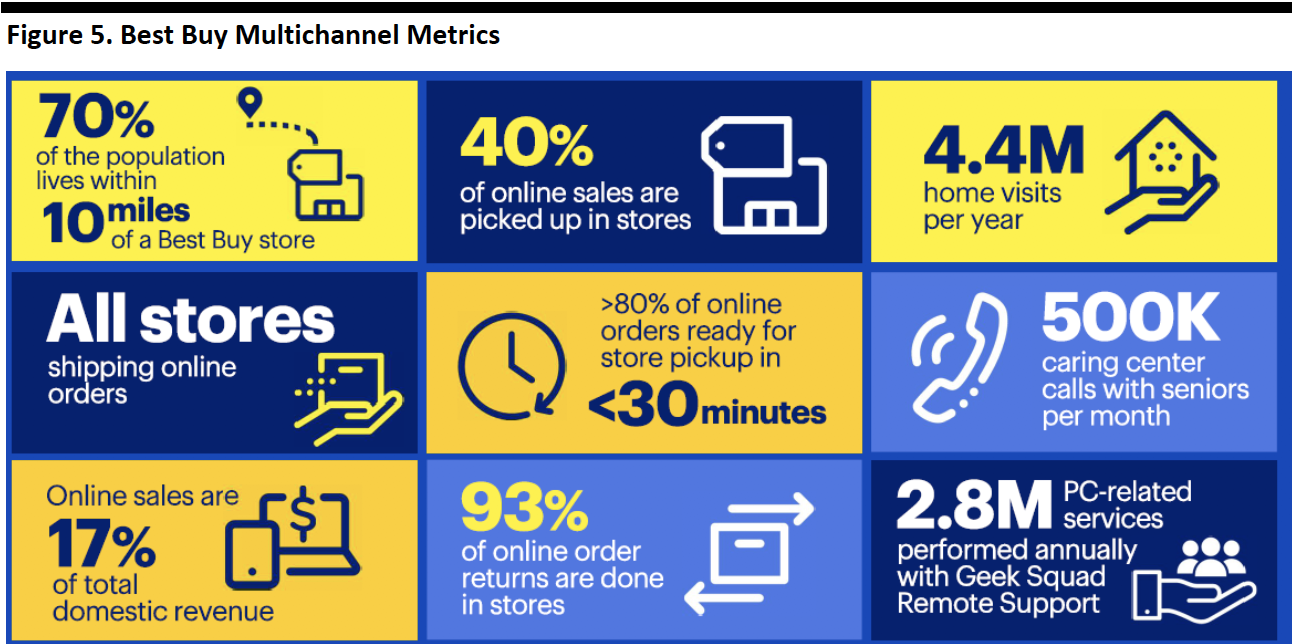

President and COO Mike Mohan began his remarks with a summary of Best Buy’s industry-leading multichannel metrics.

[caption id="attachment_97248" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

The company is leveraging its service offerings (such as Geek Squad, GreatCall and Total Tech Support) to expand beyond its current opportunities (“Market A”) into an adjacent market with solid growth prospects but in which the company has a much smaller presence (“Market B”).

[caption id="attachment_97249" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

An additional way for Best Buy to attract customers is through its lease-to-own program, which has generated positive early feedback. The customer base is nearly 50% millennials.

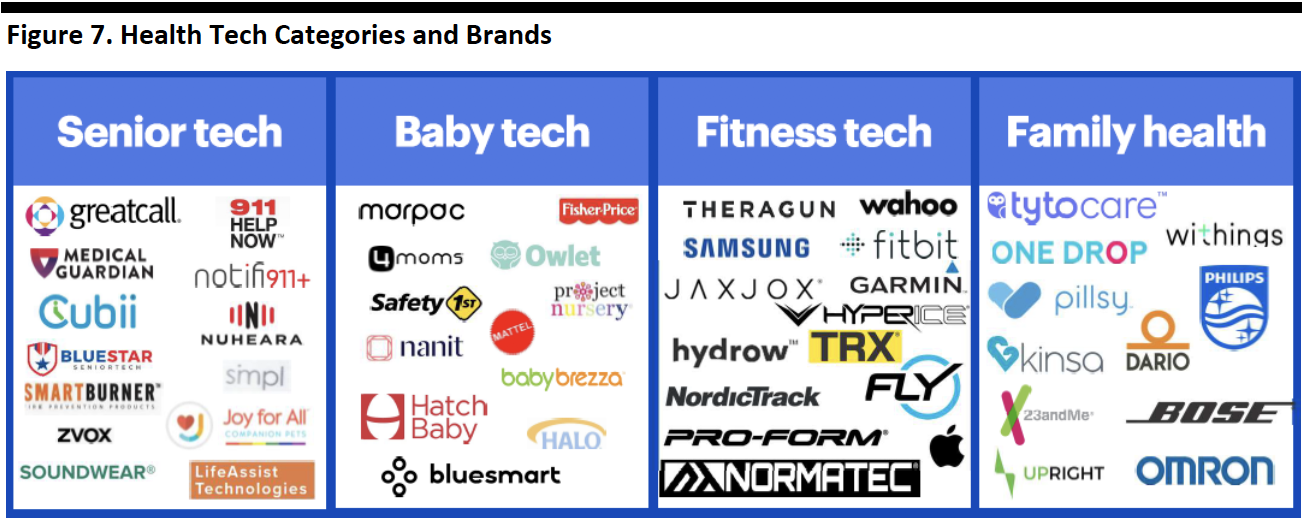

5) The health tech category is a $50 billion addressable market, which is undergoing a structural transformation that is unlocking new possibilities.

Best Buy views health tech as a $50 billion addressable market.

[caption id="attachment_97250" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

The industry is also undergoing a structural transformation:

- A sharply aging population: Some 10,000 people turn 65 every day and two out of three seniors live with chronic conditions.

- A changing business model, from payments being tied to “value delivered.”

- A steadily changing mindset, in which consumers are demanding greater control over health-related matters and care, which is supported by regulators offering new reimbursement models.

- The emergence of the home as a care site due to advances in technology.

6) Best Buy has made substantial improvements to its supply chain, in automation, evolving strategies in partnership and fulfillment, expanding its supply chain and customer experience.

Chief Supply Chain Officer Rob Bass cited four reasons to improve the supply chain:

- Customer expectations for convenience and speed.

- A quickly evolving competitive environment.

- Opportunities to increase efficiency.

- Product innovation and an evolving product mix.

Bass further cited positive accomplishments against the goals announced at the investor meeting in 2017:

- Expanding automation.

- Adding market e-commerce centers.

- Continuing to evolve partner strategies and store fulfillment.

- Expanding the supply-chain footprint.

- Improving the customer experience.

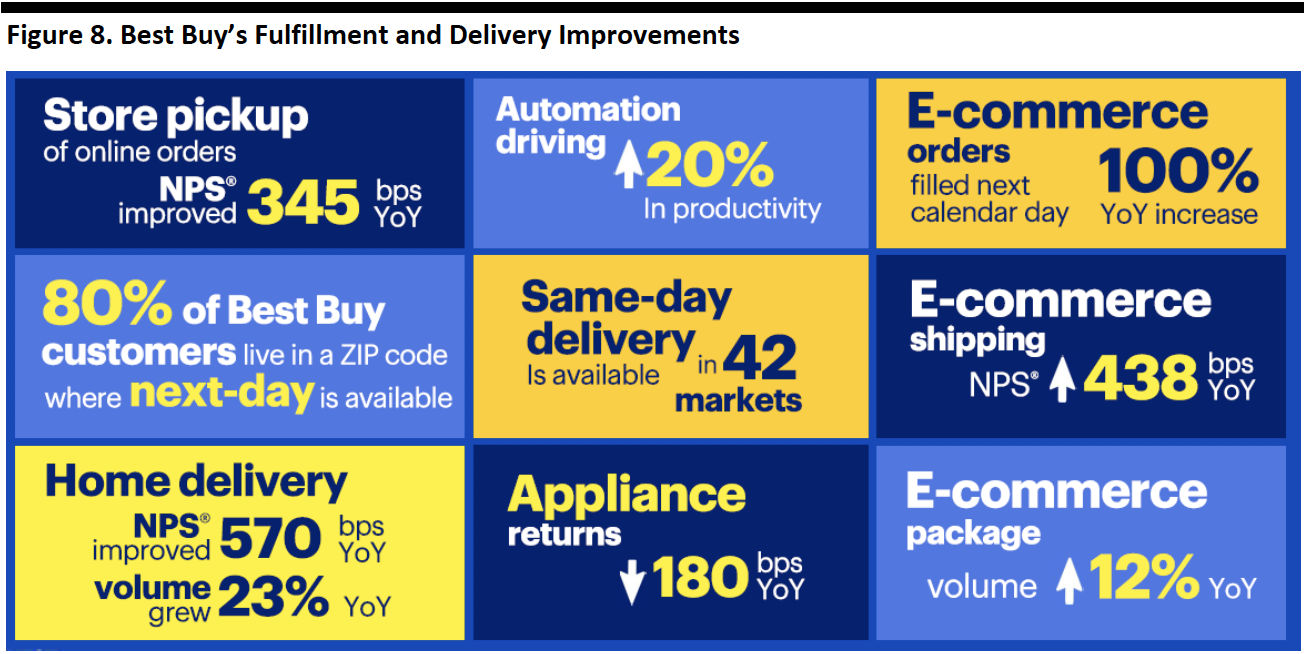

He also displayed a matrix of improvements in fulfillment and delivery:

[caption id="attachment_97251" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

7) Best Buy also aims to increase brand love by improving the retail experience and has set aggressive but achievable targets for FY25.

CRO Matt Bilunas explained how Best Buy plans to achieve its financial goals, in particular by increasing brand love.

[caption id="attachment_97252" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Bilunas also offered financial targets for FY25:

[caption id="attachment_97253" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]