Introduction

China’s Belt and Road Initiative (BRI) involves multiple countries and encompasses massive infrastructure investment in Europe, Asia and Africa. The plan is to improve connectivity between China and these regions, but the huge amounts of money being invested could have a knock-on effect on the local economy and in the longer-term infrastructure improvements should support economic development, creating more opportunity to all companies.

In this report, we outline the details of the BRI, including how it’s being funded, how it will transform trade routes and foster economic integration and latest developments six years after launch. (The plan was originally called “One Belt, One Road” but Beijing renamed it in 2016). Then, we look at how multinational companies can capitalize on these emerging opportunities.

The Belt and Road Initiative as A Facilitator of Global Trade

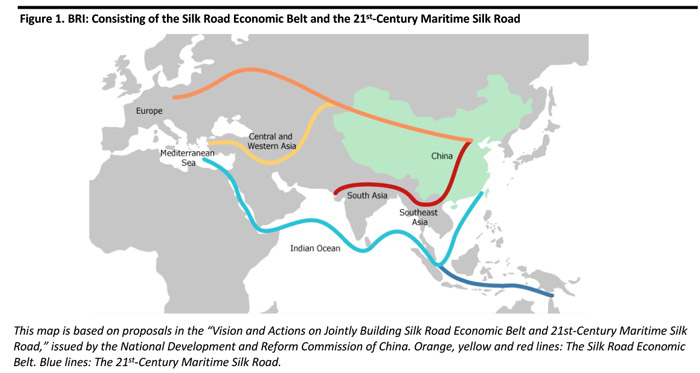

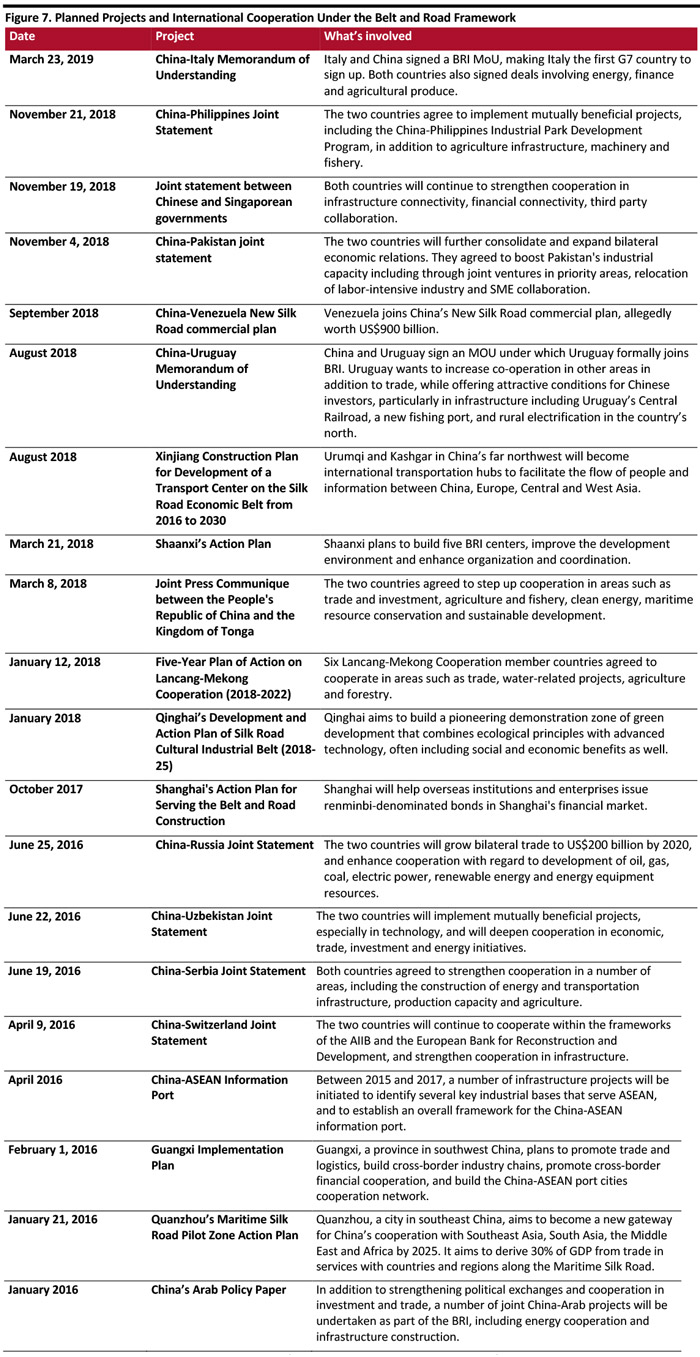

The BRI includes the Silk Road Economic Belt and the 21

st-Century Maritime Silk Road, which would connect China to more than 100 countries in Asia, Europe and Africa. One route is by land crossing Central Asia, the Middle East and into Europe, while the other is a sea route through the South China Sea, the Indian Ocean, eastern Africa and on to Europe through the Persian Gulf to the Mediterranean.

China’s strategy is to create a network of infrastructure such as roads, railroads, ports, electricity and energy, and trade and finance ties between China and the countries along the two routes. It also provides opportunities for China to export its supply of materials, easing overcapacity at home. The initiative focuses on numerous infrastructure investments in countries along the routes, and is expected to increase regional connectivity and facilitate trade. The projects will benefit not only China: in our view, multinational companies also stand to benefit from the numerous emerging opportunities.

[caption id="attachment_91015" align="aligncenter" width="700"]

Source: Hong Kong Trade Development Council

Source: Hong Kong Trade Development Council[/caption]

BRI at a Glance

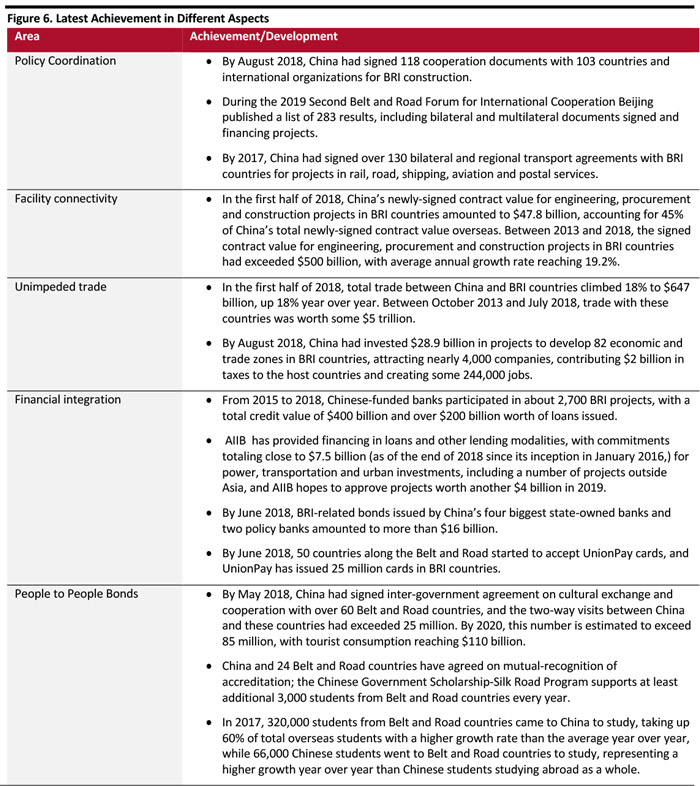

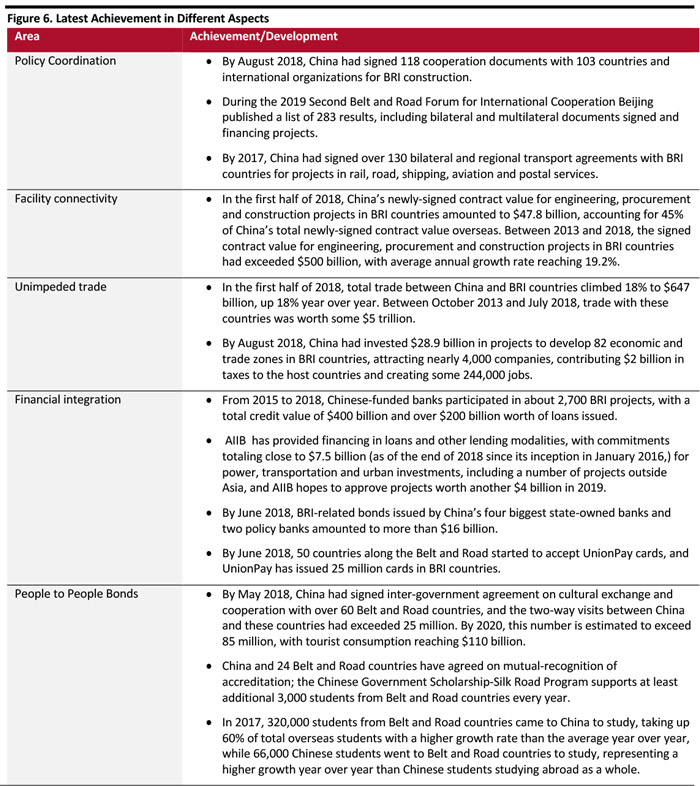

China’s BRI contains some ambitious goals in five categories: policy coordination, facilities connectivity, unimpeded trade, financial integration and people-to-people bonds.

- By policy coordination, Beijing means countries involved in the initiative will jointly devise development plans for infrastructure projects, and trade and economic development and measures to facilitate cooperation, such as inter-governmental communication on macroeconomic policies to better align their national priorities with regional planning needs.

- Facilities connectivity involves building an infrastructure network to better connect China to other parts of Asia, Europe and Africa.

- Unimpeded trade involves seeking to increase the value of imports and exports and bringing in more countries.

- Financial integration means financial cooperation, including ensuring currency stability, and building a framework for investment, financing and credit services.

- People-to-people bonds include exchanges between different cultures, and interactions between people of different countries.

Further details on what BRI has achieved are given below. More details can be found in the appendix section.

[caption id="attachment_91016" align="aligncenter" width="700"]

Source: China Banking and Insurance Regulatory Commission/ AIIB/National Development and Reform Commission/Export Import Bank of China/ China UnionPay/ Xinhua News Agency/ People’s Daily/General Administration of Customs of China/ State Council Information Office of China/Ministry of Transport of China/Ministry of Commerce/Ministry of Education/Coresight Research

Source: China Banking and Insurance Regulatory Commission/ AIIB/National Development and Reform Commission/Export Import Bank of China/ China UnionPay/ Xinhua News Agency/ People’s Daily/General Administration of Customs of China/ State Council Information Office of China/Ministry of Transport of China/Ministry of Commerce/Ministry of Education/Coresight Research[/caption]

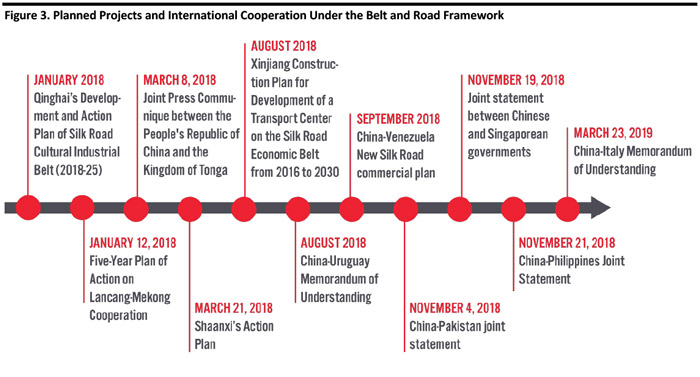

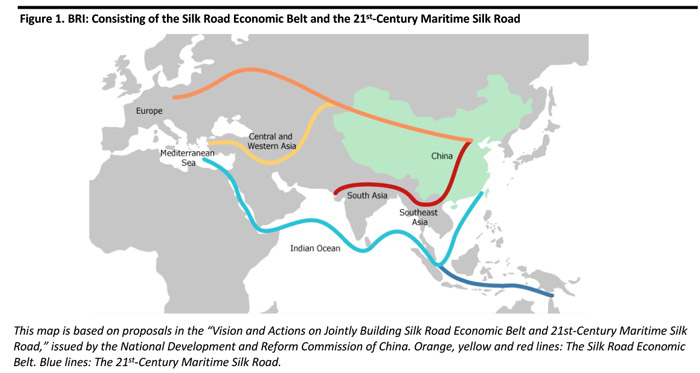

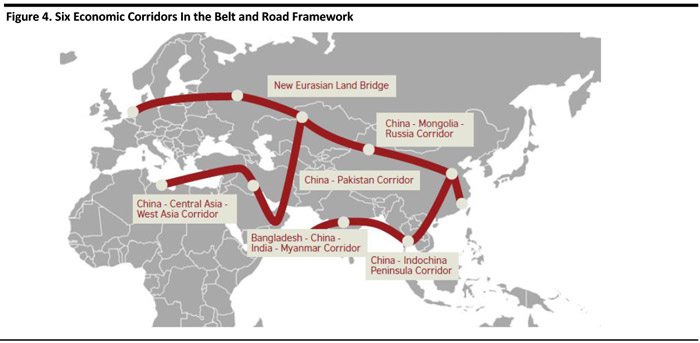

Are Other Countries Working with China?

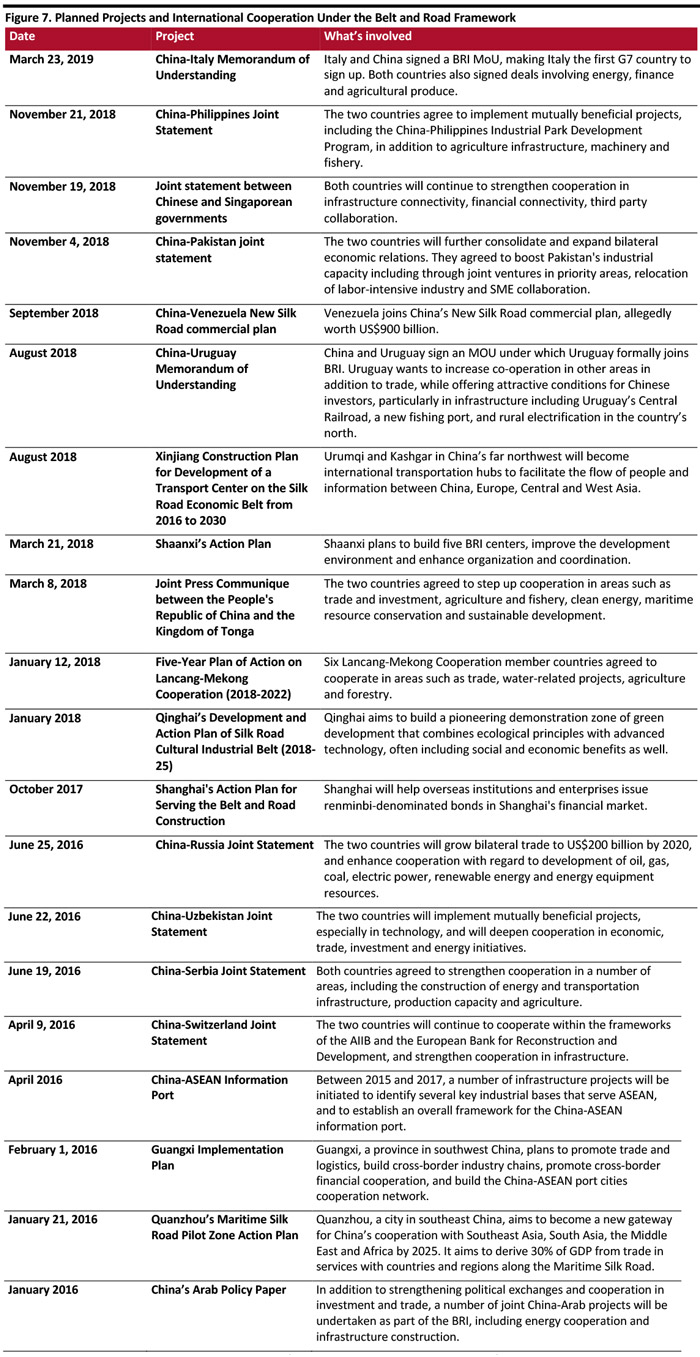

The road to collaboration has been bumpy so far, as China’s plans have met with mixed responses from various countries. Some have embraced the initiative and the promise of enhanced trade, infrastructure and jobs, but others have been more cautious – and some have sought to cancel or scale back BRI projects.

In March 2019, Italy became the first G7 economy to join BRI, with both parties signing a memorandum of understanding (MoU). Both countries also signed deals including port management, e-commerce, and finance.

By November 2018, China had joint statements with Pakistan, Singapore and Philippines to strengthen cooperation and expand economic relations. Further details on what countries are cooperating with China are given below. Details of the planned projects can be found in the appendix section.

[caption id="attachment_91017" align="aligncenter" width="700"]

Source: National Development and Reform Commission/Hong Kong Trade Development Council/Coresight Research

Source: National Development and Reform Commission/Hong Kong Trade Development Council/Coresight Research[/caption]

However, some countries are seeking to either cancel or scale back BRI projects.

Sierra Leone decided to cancel a $400 million Chinese-funded project to build a new airport outside the capital Freetown in October 2018. Sierra Leone’s decision is just the latest setback, as politicians and economists in an increasing number of countries that once courted Chinese investments have now publicly expressed fears that some of the projects are too costly and would saddle them with too much debt.

Troubling for many was the high-profile handover of Sri Lanka’s newly built Hambantota Port to China after the local government was unable to keep up with payments.

Myanmar has decided to scale back plans for a Chinese-backed deepwater port in Kyauk Pyu on the western tip of Myanmar’s Rakhine state in August 2018, sharply reducing the cost of the project after concerns it could leave the Southeast Asian nation heavily indebted, according statements from a top government official to Reuters. The revised cost would be “down from $7.3 billion to around $1.3 billion, something that’s much more plausible for Myanmar’s use,” said Sean Turnell, economic advisor to Myanmar’s civilian leader, Aung San Suu Kyi.

It should be noted, however, that despite the attention-grabbing Sri Lanka example, in most cases China has either forgiven debts or renegotiated terms to enable projects to continue as originally planned.

BRI Implications

Market Opportunities

Despite the challenges, the improved policy coordination, facility connectivity, trade and financial integration will bring new business opportunities. The investments in infrastructure improve the connectivity and therefore help foreign companies operate more efficiently in the regions. BRI also means new opportunities in the ASEAN, Central Asian and African countries along the route. In particular, ASEAN countries’ economies are worth $2.6 trillion, if it were one market it would be the world’s sixth-largest economy and Asia’s third-largest, just behind China and Japan. And, these economies are likely to continue growing thanks to large, young workforces

and the infrastructure improvements from BRI.

Cost Reduction by Moving Manufacturing Facilities to Developing Countries in the Region Thanks to Increased Connectivity

Improved infrastructure conditions along BRI countries will likely benefit all players: Increased connectivity with improved infrastructure should

lower transit costs and enable companies to

tap into the lower wages in countries they may not otherwise look to as sourcing sites. In turn, economic development in these countries can also create new markets.

Drive Demand for Consumer Goods Along the Countries

Multinational companies and brands will gain from

enlarged market for their products due to improvements in infrastructure and the removal of non-tariff barriers—such as product quotas and licensing, customs clearances, certification standards, entry taxes as well as language and culture. The improvement of these will make it easier for multinational companies to do business.

Consumer goods brands could also benefit from growing consumer demand, as BRI could boost local incomes along the route.

Logistics Industry: Multinational Company Cooperating With Local Players

The upgrade of transportation networks and improvements in connectivity could help reduce delivery costs and potentially drive e-commerce and delivery services for logistics companies.

DHL Express is one company that stands to benefit. DHL Express has 27% of its global work force in the Asia Pacific region. To benefit from the improving connectivity, DHL Express is working with local logistic players to reach remote areas where the company does not have a presence.

E-commerce development in ASEAN countries has been hindered by poor transport infrastructure and inefficiency in last mile delivery, according to CIMB ASEAN Research Institute. The upgrade of transportation networks and improvements in connectivity could drive e-commerce, benefiting retailers, logistic and delivery companies.

Tourism Industry: More Opportunities for Airline Companies to Cover Cities Along the Belt and Road Region

The BRI presents opportunities to promote integrated tourism development between China and the countries along the BRI route and hence drive Chinese outbound tourism. According to the Ministry of Culture and Tourism, the number of Chinese outbound tourists reached 150 million in 2018 and they spent $120 billion overseas – making China the largest source of outbound tourists in the world.

The BRI has also brought opportunities for Chinese airlines to open new routes to cities along the route. For example, Air China plans new routes connecting cities in western China with Central Asia and Africa, which will open new destinations for Chinese outbound travelers. As of May 2018, Air China had 29 routes linking China and Europe, providing 296 flights a week, in addition to 30 routes connecting China to other parts of Asia with 352 flights a week.

Challenges Facing BRI

The BRI faces a number of challenges — some practical, some political. As a result, we are seeing some countries scale back projects.

One of the major concerns is China’s influence. Chinese firms are some of the greatest participants in BRI projects. This, coupled with Chinese firms gaining majority stakes in key infrastructure abroad, has made some politicians wary and even resulted in local protests. Some politicians are concerned the plan is a way for China to extend its influence, that infrastructure projects could be debt traps and general wariness from some of China’s neighbors – especially those with whom China has territorial disputes.

Some countries have provided direct guarantees or real collateral for BRI projects, which could raise lending recovery rates in the event of repayment difficulty. A report from Fitch Ratings notes that Laos, for example, has provided assets in the form of potash mines as collateral for a loan that will push up its public debt to GDP ratio by around 60 percentage points. While lenders have concern over the funds being repaid, borrowing countries also fear, for instance, what has happened to Sri Lanka —the country handed over its strategic port to China after it could not pay off its debt.

BRI also poses financial risks for China, according to Fitch Ratings. Poor commercial lending prospects in key countries along the trade routes could pose a serious threat to creditors. Fitch also believes China may fund projects based on political motivations rather than economic motivations – which means non-viable projects could still be funded. Chinese banks have been the largest lenders so far, with China Development Bank lending an estimated US$100 billion while Bank of China has already committed to US$20 billion in loans.

Conclusion

In summary, the BRI is an ambitious initiative to transform the trade landscape from China to Europe via Asia and Africa. We see progress in terms of policy coordination, facility connectivity, trade and financial integration. However, there are also political and financial concerns.

Notwithstanding, all companies stand to benefit from the growing opportunities in the markets along the BRI as improved infrastructure bolsters trade and local economies, creating new or expanding existing consumer markets.

All parties in the countries along or near BRI projects should benefit from lower transit costs. Additionally,

multinational companies will benefit from lower manufacturing costs.

Western brands will likely benefit from an enlarged market for products as BRI boosts economies in Southeast Asia, Central Asia and Africa. The opening of markets would likely lead to lower non-trade tariffs, such as reduced complexity and regulatory costs and would potentially open the market to competition with domestic players. Moreover, improvements in the business climate and in disposable income along the Belt and Road regions will also likely support demand for consumer goods.

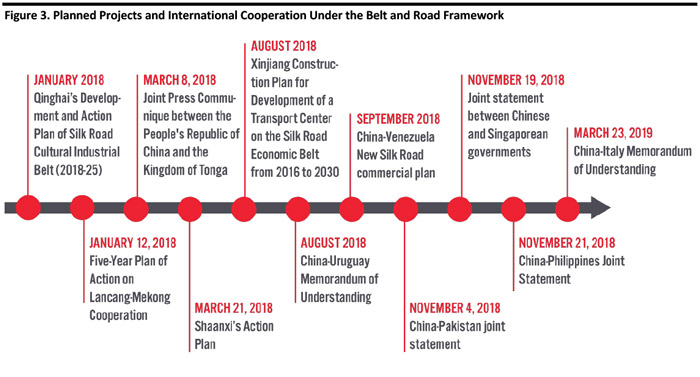

Appendix

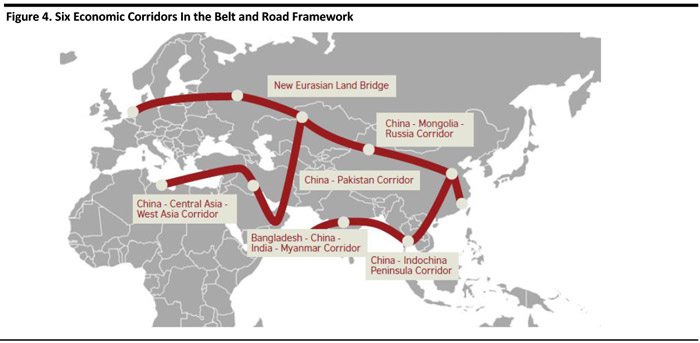

Economic Corridors In the Belt and Road Framework

As illustrated in Figure 4, the land-based Silk Road Economic Belt and the ocean-going 21

st-Century Maritime Silk Road will form six transnational China-centric economic corridors, including a new Eurasian land bridge of freight trains connecting the port of Lianyungang in Jiangsu province to Rotterdam; a Mongolia-Russia corridor; a Central Asia-West Asia corridor; an Indochina peninsula corridor; a Pakistan corridor; and, a Bangladesh-China-India-Myanmar corridor.

[caption id="attachment_91018" align="aligncenter" width="700"]

Source: China-British Business Council

Source: China-British Business Council[/caption]

Finance Mechanisms in One Belt One Road

The BRI focuses mainly on infrastructure development in developing countries in the regions and on removing non-tariff barriers to trade.

There are three key financing mechanisms that have been established to fund BRI infrastructure projects: the Asia Infrastructure Investment Bank, the Silk Road Fund and the New Development Bank, which are all backed by China.

[caption id="attachment_91019" align="aligncenter" width="700"]

Source: AIIB/Silk Road Fund/NDB/Hong Kong Trade Development Council

Source: AIIB/Silk Road Fund/NDB/Hong Kong Trade Development Council[/caption]

Since its inception in January 2016, AIIB has provided financing in loans and other lending modalities to businesses inside and outside of China, with commitments totaling close to $7.5 billion (as of the end of 2018) for power, transportation and urban investments, including a number of projects outside Asia. AIIB hopes to approve projects worth another $4 billion in 2019. In total, between 2013 and 2018:

- China’s trade in goods with countries along BRI routes exceeded $5 trillion.

- China has invested over $60 billion in these countries.

- China has also built 82 economic and trade cooperation zones along the routes, contributing $2.2 billion in tax and fees to host countries, and created over 200,000 jobs locally.

[caption id="attachment_91020" align="aligncenter" width="700"]

Source: China Banking and Insurance Regulatory Commission/ AIIB/National Development and Reform Commission/Export Import Bank of China/ China UnionPay/ Xinhua News Agency/ People’s Daily/General Administration of Customs of China/ State Council Information Office of China/Ministry of Transport of China/Ministry of Commerce/Ministry of Education/Coresight Research

Source: China Banking and Insurance Regulatory Commission/ AIIB/National Development and Reform Commission/Export Import Bank of China/ China UnionPay/ Xinhua News Agency/ People’s Daily/General Administration of Customs of China/ State Council Information Office of China/Ministry of Transport of China/Ministry of Commerce/Ministry of Education/Coresight Research[/caption]

[caption id="attachment_91021" align="aligncenter" width="700"]

Source: National Development and Reform Commission/Hong Kong Trade Development Council/Coresight Research

Source: National Development and Reform Commission/Hong Kong Trade Development Council/Coresight Research[/caption]

Source: Hong Kong Trade Development Council[/caption]

Source: Hong Kong Trade Development Council[/caption]

Source: China Banking and Insurance Regulatory Commission/ AIIB/National Development and Reform Commission/Export Import Bank of China/ China UnionPay/ Xinhua News Agency/ People’s Daily/General Administration of Customs of China/ State Council Information Office of China/Ministry of Transport of China/Ministry of Commerce/Ministry of Education/Coresight Research[/caption]

Source: China Banking and Insurance Regulatory Commission/ AIIB/National Development and Reform Commission/Export Import Bank of China/ China UnionPay/ Xinhua News Agency/ People’s Daily/General Administration of Customs of China/ State Council Information Office of China/Ministry of Transport of China/Ministry of Commerce/Ministry of Education/Coresight Research[/caption]

Source: National Development and Reform Commission/Hong Kong Trade Development Council/Coresight Research[/caption]

However, some countries are seeking to either cancel or scale back BRI projects.

Sierra Leone decided to cancel a $400 million Chinese-funded project to build a new airport outside the capital Freetown in October 2018. Sierra Leone’s decision is just the latest setback, as politicians and economists in an increasing number of countries that once courted Chinese investments have now publicly expressed fears that some of the projects are too costly and would saddle them with too much debt.

Troubling for many was the high-profile handover of Sri Lanka’s newly built Hambantota Port to China after the local government was unable to keep up with payments.

Myanmar has decided to scale back plans for a Chinese-backed deepwater port in Kyauk Pyu on the western tip of Myanmar’s Rakhine state in August 2018, sharply reducing the cost of the project after concerns it could leave the Southeast Asian nation heavily indebted, according statements from a top government official to Reuters. The revised cost would be “down from $7.3 billion to around $1.3 billion, something that’s much more plausible for Myanmar’s use,” said Sean Turnell, economic advisor to Myanmar’s civilian leader, Aung San Suu Kyi.

It should be noted, however, that despite the attention-grabbing Sri Lanka example, in most cases China has either forgiven debts or renegotiated terms to enable projects to continue as originally planned.

Source: National Development and Reform Commission/Hong Kong Trade Development Council/Coresight Research[/caption]

However, some countries are seeking to either cancel or scale back BRI projects.

Sierra Leone decided to cancel a $400 million Chinese-funded project to build a new airport outside the capital Freetown in October 2018. Sierra Leone’s decision is just the latest setback, as politicians and economists in an increasing number of countries that once courted Chinese investments have now publicly expressed fears that some of the projects are too costly and would saddle them with too much debt.

Troubling for many was the high-profile handover of Sri Lanka’s newly built Hambantota Port to China after the local government was unable to keep up with payments.

Myanmar has decided to scale back plans for a Chinese-backed deepwater port in Kyauk Pyu on the western tip of Myanmar’s Rakhine state in August 2018, sharply reducing the cost of the project after concerns it could leave the Southeast Asian nation heavily indebted, according statements from a top government official to Reuters. The revised cost would be “down from $7.3 billion to around $1.3 billion, something that’s much more plausible for Myanmar’s use,” said Sean Turnell, economic advisor to Myanmar’s civilian leader, Aung San Suu Kyi.

It should be noted, however, that despite the attention-grabbing Sri Lanka example, in most cases China has either forgiven debts or renegotiated terms to enable projects to continue as originally planned.

Source: China-British Business Council[/caption]

Finance Mechanisms in One Belt One Road

The BRI focuses mainly on infrastructure development in developing countries in the regions and on removing non-tariff barriers to trade.

There are three key financing mechanisms that have been established to fund BRI infrastructure projects: the Asia Infrastructure Investment Bank, the Silk Road Fund and the New Development Bank, which are all backed by China.

[caption id="attachment_91019" align="aligncenter" width="700"]

Source: China-British Business Council[/caption]

Finance Mechanisms in One Belt One Road

The BRI focuses mainly on infrastructure development in developing countries in the regions and on removing non-tariff barriers to trade.

There are three key financing mechanisms that have been established to fund BRI infrastructure projects: the Asia Infrastructure Investment Bank, the Silk Road Fund and the New Development Bank, which are all backed by China.

[caption id="attachment_91019" align="aligncenter" width="700"] Source: AIIB/Silk Road Fund/NDB/Hong Kong Trade Development Council[/caption]

Since its inception in January 2016, AIIB has provided financing in loans and other lending modalities to businesses inside and outside of China, with commitments totaling close to $7.5 billion (as of the end of 2018) for power, transportation and urban investments, including a number of projects outside Asia. AIIB hopes to approve projects worth another $4 billion in 2019. In total, between 2013 and 2018:

Source: AIIB/Silk Road Fund/NDB/Hong Kong Trade Development Council[/caption]

Since its inception in January 2016, AIIB has provided financing in loans and other lending modalities to businesses inside and outside of China, with commitments totaling close to $7.5 billion (as of the end of 2018) for power, transportation and urban investments, including a number of projects outside Asia. AIIB hopes to approve projects worth another $4 billion in 2019. In total, between 2013 and 2018:

Source: China Banking and Insurance Regulatory Commission/ AIIB/National Development and Reform Commission/Export Import Bank of China/ China UnionPay/ Xinhua News Agency/ People’s Daily/General Administration of Customs of China/ State Council Information Office of China/Ministry of Transport of China/Ministry of Commerce/Ministry of Education/Coresight Research[/caption]

[caption id="attachment_91021" align="aligncenter" width="700"]

Source: China Banking and Insurance Regulatory Commission/ AIIB/National Development and Reform Commission/Export Import Bank of China/ China UnionPay/ Xinhua News Agency/ People’s Daily/General Administration of Customs of China/ State Council Information Office of China/Ministry of Transport of China/Ministry of Commerce/Ministry of Education/Coresight Research[/caption]

[caption id="attachment_91021" align="aligncenter" width="700"] Source: National Development and Reform Commission/Hong Kong Trade Development Council/Coresight Research[/caption]

Source: National Development and Reform Commission/Hong Kong Trade Development Council/Coresight Research[/caption]