albert Chan

2019 Capital Markets Day

The Coresight Research team attended Zalando’s 2019 Capital Markets Day in Berlin. Here are the three themes that stood out:

Source: Company reports[/caption]

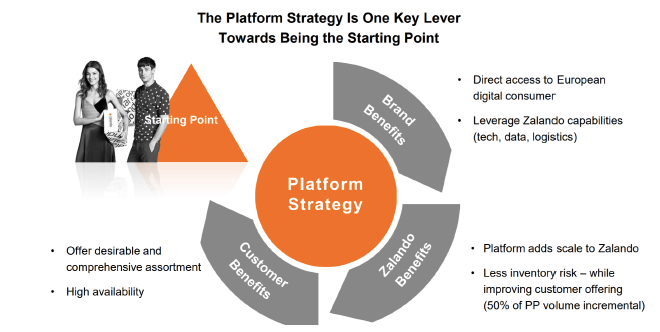

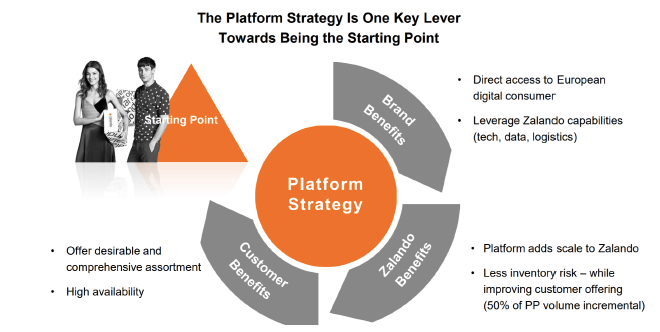

To become the dominant fashion platform, Zalando wants to attract more brands onto its Partner Program — its marketplace offering that allows brands to sell directly to consumers on Zalando sites. It also wants to convert more of those partner retailers to Zalando Fulfilment Solutions (ZFS) clients, under which Zalando holds and ships stock on behalf of the brand. Further, Zalando hopes to grow these brands’ use of Zalando Media Solutions (ZMS), the company’s marketing services business.

This services strategy boosts Zalando’s scale and lowers its exposure to inventory risk, Ritter said. The growth of higher-margin ZFS and ZMS will also grow profits. For customers, these platform services mean more choice, better availability, and more convenience. For example, with ZFS orders of multiple items from multiple sellers are consolidated into in one parcel instead of being sent separately by different merchants. For brands, it means exposure to Zalando’s substantial customer base, access to some of its data, and the opportunity to leverage Zalando’s infrastructure: For example, consolidating customer orders via ZFS cuts shipment costs per item by an average 50%.

[caption id="attachment_78540" align="aligncenter" width="660"]

Source: Company reports[/caption]

To become the dominant fashion platform, Zalando wants to attract more brands onto its Partner Program — its marketplace offering that allows brands to sell directly to consumers on Zalando sites. It also wants to convert more of those partner retailers to Zalando Fulfilment Solutions (ZFS) clients, under which Zalando holds and ships stock on behalf of the brand. Further, Zalando hopes to grow these brands’ use of Zalando Media Solutions (ZMS), the company’s marketing services business.

This services strategy boosts Zalando’s scale and lowers its exposure to inventory risk, Ritter said. The growth of higher-margin ZFS and ZMS will also grow profits. For customers, these platform services mean more choice, better availability, and more convenience. For example, with ZFS orders of multiple items from multiple sellers are consolidated into in one parcel instead of being sent separately by different merchants. For brands, it means exposure to Zalando’s substantial customer base, access to some of its data, and the opportunity to leverage Zalando’s infrastructure: For example, consolidating customer orders via ZFS cuts shipment costs per item by an average 50%.

[caption id="attachment_78540" align="aligncenter" width="660"] Source: Company reports[/caption]

New Five-Year Ambitions

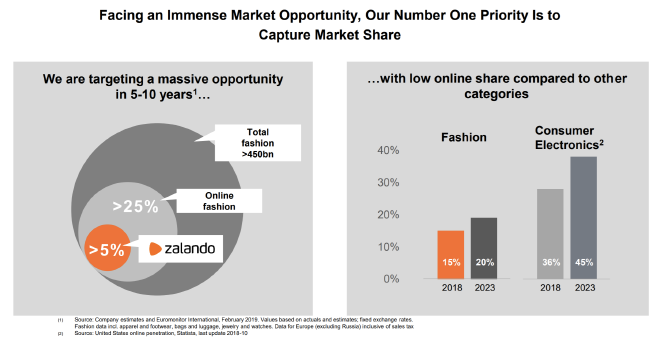

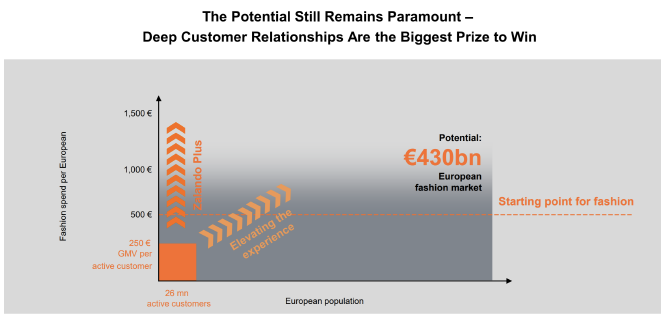

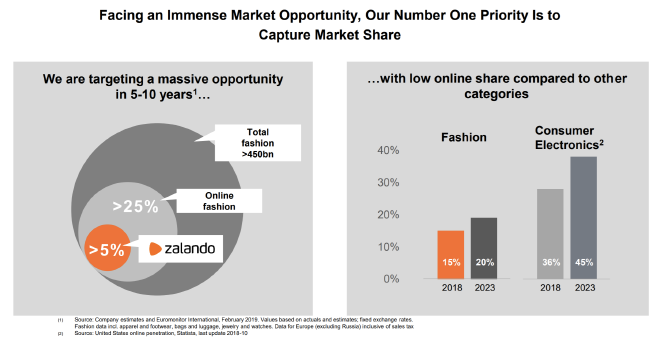

Growing market share remains Zalando’s #1 priority, and Ritter reaffirmed Zalando’s long-standing aim of capturing one-fifth of Europe’s online fashion market; with that online market in turn estimated to be 25% of the total Europe fashion market in the next 5-10 years, Zalando therefore continues to target a 5% share of Europe’s total fashion market (online and offline).

[caption id="attachment_78541" align="aligncenter" width="664"]

Source: Company reports[/caption]

New Five-Year Ambitions

Growing market share remains Zalando’s #1 priority, and Ritter reaffirmed Zalando’s long-standing aim of capturing one-fifth of Europe’s online fashion market; with that online market in turn estimated to be 25% of the total Europe fashion market in the next 5-10 years, Zalando therefore continues to target a 5% share of Europe’s total fashion market (online and offline).

[caption id="attachment_78541" align="aligncenter" width="664"] Source: Company reports[/caption]

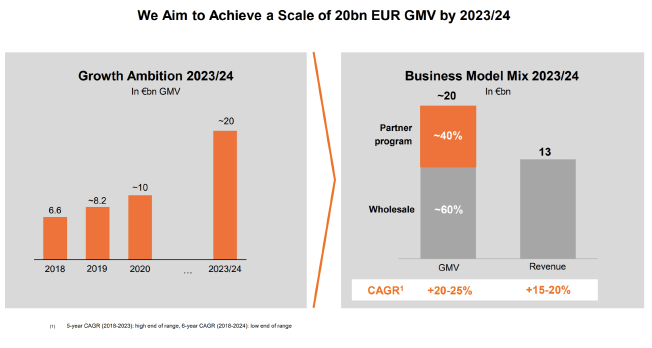

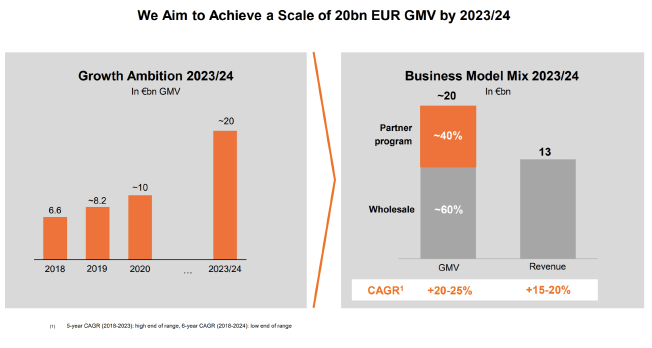

The company introduced new ambitions, too. By 2023/24, Zalando aims to report revenues of €13 billion, from €5.4 billion in 2018, a revenue CAGR of 15-20%. And it aims to grow gross merchandise volume (GMV) from €6.6 billion in 2018 to €20 billion by 2023/24, a CAGR of 20-25%. It plans a revenue mix of 60% wholesale and 40% from its Partner Program marketplace by 2023/24, as shown below.

More immediately, the company will begin reporting GMV quarterly. This figure represents the value of sales booked at the point of order and includes sales tax (revenue is booked on customer receipt and excludes sales tax).

[caption id="attachment_78542" align="aligncenter" width="652"]

Source: Company reports[/caption]

The company introduced new ambitions, too. By 2023/24, Zalando aims to report revenues of €13 billion, from €5.4 billion in 2018, a revenue CAGR of 15-20%. And it aims to grow gross merchandise volume (GMV) from €6.6 billion in 2018 to €20 billion by 2023/24, a CAGR of 20-25%. It plans a revenue mix of 60% wholesale and 40% from its Partner Program marketplace by 2023/24, as shown below.

More immediately, the company will begin reporting GMV quarterly. This figure represents the value of sales booked at the point of order and includes sales tax (revenue is booked on customer receipt and excludes sales tax).

[caption id="attachment_78542" align="aligncenter" width="652"] Source: Company reports[/caption]

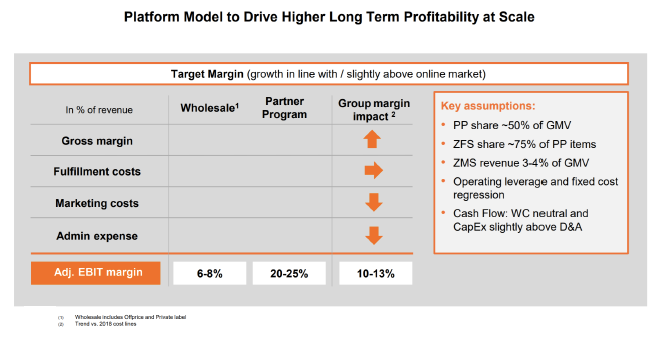

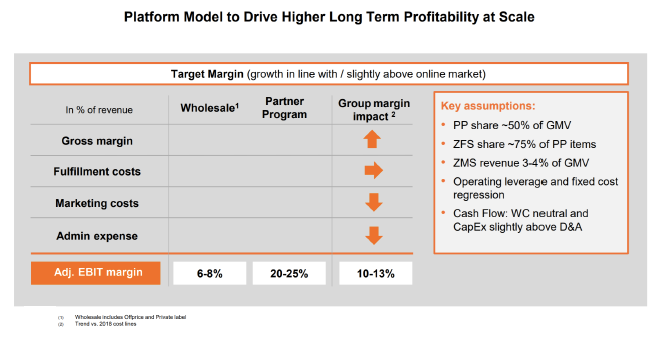

Long term, management expect to report a group adjusted EBIT margin of 10-13%, supported by higher margins of 20-25% in its expanding Partner Program. As detailed below, this assumes gross margins would rise, the fulfillment cost ratio would remain level, and the marketing cost ratio and administration costs as a percentage of sales would both fall compared to 2018. However, Ritter cautioned this target model is several years away: He noted that 2019-21 would be a period of transition, and the subsequent years would see growth rates moderate and margins increase, and it would hit its target model only in the years after that.

[caption id="attachment_78543" align="aligncenter" width="656"]

Source: Company reports[/caption]

Long term, management expect to report a group adjusted EBIT margin of 10-13%, supported by higher margins of 20-25% in its expanding Partner Program. As detailed below, this assumes gross margins would rise, the fulfillment cost ratio would remain level, and the marketing cost ratio and administration costs as a percentage of sales would both fall compared to 2018. However, Ritter cautioned this target model is several years away: He noted that 2019-21 would be a period of transition, and the subsequent years would see growth rates moderate and margins increase, and it would hit its target model only in the years after that.

[caption id="attachment_78543" align="aligncenter" width="656"] Source: Company reports[/caption]

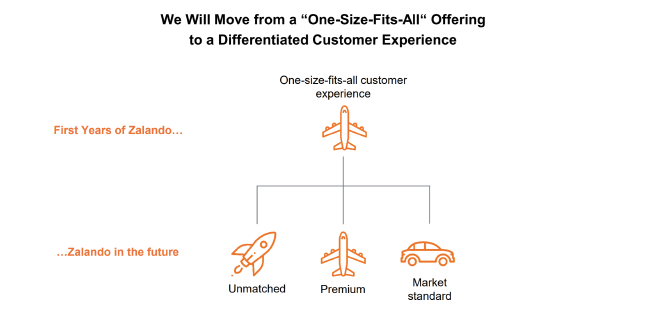

No More “One Size Fits All”

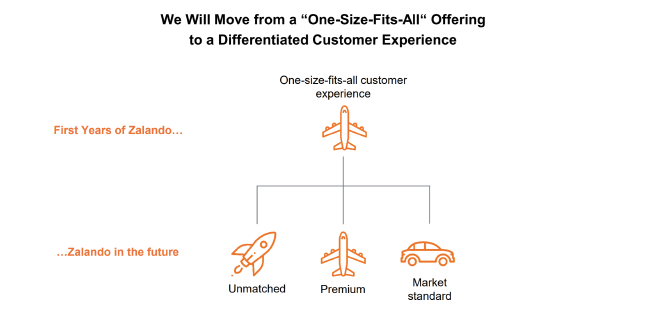

Zalando will move away from a generalist, one-size-fits-all approach. Co-CEO Robert Gentz noted that in its early years, the company needed to convert shoppers to e-commerce with simple messages such as free shipping. Now, it feels it can — and should — take a more nuanced approach. In particular, the company wants to deepen relationships with its best customers, which are defined as those who spend a higher-than-average share of their fashion budget with Zalando. Gent noted a possible future segmentation of its offering into “market standard” (the most basic tier), “premium” and “unmatched” (its top tier) — though the company did not specify how the segments would be defined.

[caption id="attachment_78544" align="aligncenter" width="656"]

Source: Company reports[/caption]

No More “One Size Fits All”

Zalando will move away from a generalist, one-size-fits-all approach. Co-CEO Robert Gentz noted that in its early years, the company needed to convert shoppers to e-commerce with simple messages such as free shipping. Now, it feels it can — and should — take a more nuanced approach. In particular, the company wants to deepen relationships with its best customers, which are defined as those who spend a higher-than-average share of their fashion budget with Zalando. Gent noted a possible future segmentation of its offering into “market standard” (the most basic tier), “premium” and “unmatched” (its top tier) — though the company did not specify how the segments would be defined.

[caption id="attachment_78544" align="aligncenter" width="656"] Source: Company reports[/caption]

Management did, however, point to two recent measures to “de-average” the customer relationship:

Source: Company reports[/caption]

Management did, however, point to two recent measures to “de-average” the customer relationship:

Source: Company reports[/caption]

Source: Company reports[/caption]

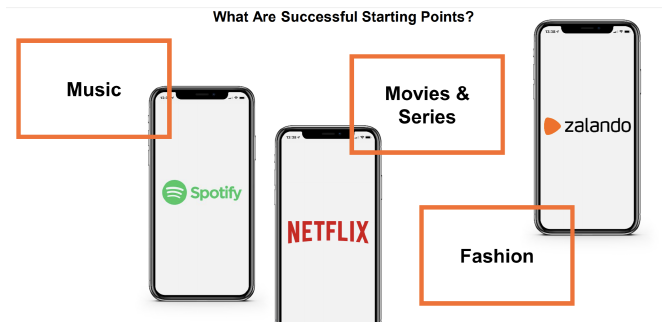

- Zalando’s platform strategy is to become the “starting point for fashion.”

- The company set new targets for 2023/24.

- Zalando will move away from a “one size fits all” approach.

Source: Company reports[/caption]

To become the dominant fashion platform, Zalando wants to attract more brands onto its Partner Program — its marketplace offering that allows brands to sell directly to consumers on Zalando sites. It also wants to convert more of those partner retailers to Zalando Fulfilment Solutions (ZFS) clients, under which Zalando holds and ships stock on behalf of the brand. Further, Zalando hopes to grow these brands’ use of Zalando Media Solutions (ZMS), the company’s marketing services business.

This services strategy boosts Zalando’s scale and lowers its exposure to inventory risk, Ritter said. The growth of higher-margin ZFS and ZMS will also grow profits. For customers, these platform services mean more choice, better availability, and more convenience. For example, with ZFS orders of multiple items from multiple sellers are consolidated into in one parcel instead of being sent separately by different merchants. For brands, it means exposure to Zalando’s substantial customer base, access to some of its data, and the opportunity to leverage Zalando’s infrastructure: For example, consolidating customer orders via ZFS cuts shipment costs per item by an average 50%.

[caption id="attachment_78540" align="aligncenter" width="660"]

Source: Company reports[/caption]

To become the dominant fashion platform, Zalando wants to attract more brands onto its Partner Program — its marketplace offering that allows brands to sell directly to consumers on Zalando sites. It also wants to convert more of those partner retailers to Zalando Fulfilment Solutions (ZFS) clients, under which Zalando holds and ships stock on behalf of the brand. Further, Zalando hopes to grow these brands’ use of Zalando Media Solutions (ZMS), the company’s marketing services business.

This services strategy boosts Zalando’s scale and lowers its exposure to inventory risk, Ritter said. The growth of higher-margin ZFS and ZMS will also grow profits. For customers, these platform services mean more choice, better availability, and more convenience. For example, with ZFS orders of multiple items from multiple sellers are consolidated into in one parcel instead of being sent separately by different merchants. For brands, it means exposure to Zalando’s substantial customer base, access to some of its data, and the opportunity to leverage Zalando’s infrastructure: For example, consolidating customer orders via ZFS cuts shipment costs per item by an average 50%.

[caption id="attachment_78540" align="aligncenter" width="660"] Source: Company reports[/caption]

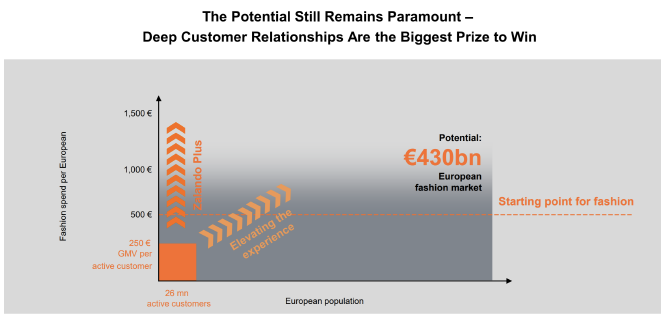

New Five-Year Ambitions

Growing market share remains Zalando’s #1 priority, and Ritter reaffirmed Zalando’s long-standing aim of capturing one-fifth of Europe’s online fashion market; with that online market in turn estimated to be 25% of the total Europe fashion market in the next 5-10 years, Zalando therefore continues to target a 5% share of Europe’s total fashion market (online and offline).

[caption id="attachment_78541" align="aligncenter" width="664"]

Source: Company reports[/caption]

New Five-Year Ambitions

Growing market share remains Zalando’s #1 priority, and Ritter reaffirmed Zalando’s long-standing aim of capturing one-fifth of Europe’s online fashion market; with that online market in turn estimated to be 25% of the total Europe fashion market in the next 5-10 years, Zalando therefore continues to target a 5% share of Europe’s total fashion market (online and offline).

[caption id="attachment_78541" align="aligncenter" width="664"] Source: Company reports[/caption]

The company introduced new ambitions, too. By 2023/24, Zalando aims to report revenues of €13 billion, from €5.4 billion in 2018, a revenue CAGR of 15-20%. And it aims to grow gross merchandise volume (GMV) from €6.6 billion in 2018 to €20 billion by 2023/24, a CAGR of 20-25%. It plans a revenue mix of 60% wholesale and 40% from its Partner Program marketplace by 2023/24, as shown below.

More immediately, the company will begin reporting GMV quarterly. This figure represents the value of sales booked at the point of order and includes sales tax (revenue is booked on customer receipt and excludes sales tax).

[caption id="attachment_78542" align="aligncenter" width="652"]

Source: Company reports[/caption]

The company introduced new ambitions, too. By 2023/24, Zalando aims to report revenues of €13 billion, from €5.4 billion in 2018, a revenue CAGR of 15-20%. And it aims to grow gross merchandise volume (GMV) from €6.6 billion in 2018 to €20 billion by 2023/24, a CAGR of 20-25%. It plans a revenue mix of 60% wholesale and 40% from its Partner Program marketplace by 2023/24, as shown below.

More immediately, the company will begin reporting GMV quarterly. This figure represents the value of sales booked at the point of order and includes sales tax (revenue is booked on customer receipt and excludes sales tax).

[caption id="attachment_78542" align="aligncenter" width="652"] Source: Company reports[/caption]

Long term, management expect to report a group adjusted EBIT margin of 10-13%, supported by higher margins of 20-25% in its expanding Partner Program. As detailed below, this assumes gross margins would rise, the fulfillment cost ratio would remain level, and the marketing cost ratio and administration costs as a percentage of sales would both fall compared to 2018. However, Ritter cautioned this target model is several years away: He noted that 2019-21 would be a period of transition, and the subsequent years would see growth rates moderate and margins increase, and it would hit its target model only in the years after that.

[caption id="attachment_78543" align="aligncenter" width="656"]

Source: Company reports[/caption]

Long term, management expect to report a group adjusted EBIT margin of 10-13%, supported by higher margins of 20-25% in its expanding Partner Program. As detailed below, this assumes gross margins would rise, the fulfillment cost ratio would remain level, and the marketing cost ratio and administration costs as a percentage of sales would both fall compared to 2018. However, Ritter cautioned this target model is several years away: He noted that 2019-21 would be a period of transition, and the subsequent years would see growth rates moderate and margins increase, and it would hit its target model only in the years after that.

[caption id="attachment_78543" align="aligncenter" width="656"] Source: Company reports[/caption]

No More “One Size Fits All”

Zalando will move away from a generalist, one-size-fits-all approach. Co-CEO Robert Gentz noted that in its early years, the company needed to convert shoppers to e-commerce with simple messages such as free shipping. Now, it feels it can — and should — take a more nuanced approach. In particular, the company wants to deepen relationships with its best customers, which are defined as those who spend a higher-than-average share of their fashion budget with Zalando. Gent noted a possible future segmentation of its offering into “market standard” (the most basic tier), “premium” and “unmatched” (its top tier) — though the company did not specify how the segments would be defined.

[caption id="attachment_78544" align="aligncenter" width="656"]

Source: Company reports[/caption]

No More “One Size Fits All”

Zalando will move away from a generalist, one-size-fits-all approach. Co-CEO Robert Gentz noted that in its early years, the company needed to convert shoppers to e-commerce with simple messages such as free shipping. Now, it feels it can — and should — take a more nuanced approach. In particular, the company wants to deepen relationships with its best customers, which are defined as those who spend a higher-than-average share of their fashion budget with Zalando. Gent noted a possible future segmentation of its offering into “market standard” (the most basic tier), “premium” and “unmatched” (its top tier) — though the company did not specify how the segments would be defined.

[caption id="attachment_78544" align="aligncenter" width="656"] Source: Company reports[/caption]

Management did, however, point to two recent measures to “de-average” the customer relationship:

Source: Company reports[/caption]

Management did, however, point to two recent measures to “de-average” the customer relationship:

- Zalando trialed minimum order values in Italy and more recently rolled this out to Spain, the UK and Ireland. This helps limit economically unfavorable small basket sizes by requiring shoppers to purchase above a certain amount to qualify for free delivery.

- Zalando Plus offers faster delivery, return pickups and fashion advice for an annual fee. Management claimed that it grows Zalando’s share of wallet, increases customer satisfaction and ups customer lifetime value.

Source: Company reports[/caption]

Source: Company reports[/caption]