DIpil Das

Introduction

The definition of beauty is expanding into wellness, self-care, health, supplements, medicine and food. For a growing number of consumers, beauty is viewed as way of life – from the inside out: How one feels is how one looks, so the concept is coming to encompass more than products to put on the skin, to include feeling healthy – mentally and physically – eating well and staying fit.The Global Beauty Market is Expanding to Include Mind and Body

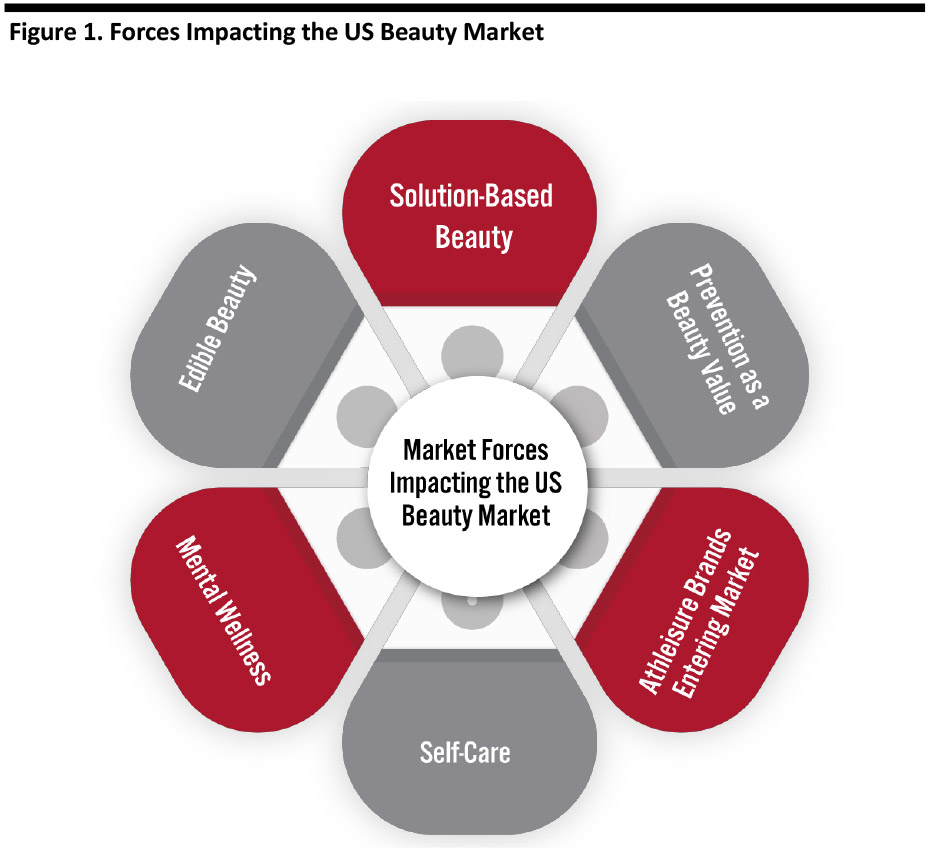

Consumers are Choosing Beauty, Health and Wellness as a Holistic Lifestyle, to Now Include Prevention, Nutrition and Mental Wellbeing Major beauty players and new brands are evolving to take a more holistic approach to beauty that includes a scientific approach to mind and body with formulations and apps to support health and wellness. While traditional beauty color cosmetics are still relevant, the beauty market is expanding and offering opportunities for new beauty entrants that focus on products in solution-based skin care products, prevention, self-care, mental health and ingestibles. [caption id="attachment_95234" align="aligncenter" width="700"] Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

The Global Skin Care Market is Evolving as Consumers Prioritize Skin Health and Beauty Wellness

Consumers around the world are increasingly focusing on beauty products that integrate health and wellness aspects, such as anti-aging properties, sun protection, protection against the effects of pollution and overall skin care. Increasingly, consumers are realizing their skin is a living, breathing organ that needs care just as the rest of their bodies do.Consumers are Turning to Solution-Based Beauty Products, Also Known as Dermo-Cosmetics

Increasingly, consumers are turning to beauty and skin care products recommended by a dermatologist or medical professional. This has prompted a rise in dermocosmetics: Brands that offer healing, relief, or medical treatment of skin ailments. The products include claims from experts, are endorsed by dermatologists or other professionals. There are two major implications:- Beauty companies are collaborating with, and acquiring, health labs and research firms to make the most of the expertise they offer.

- Traditional health labs, medical, and research companies are entering the beauty space with their own products.

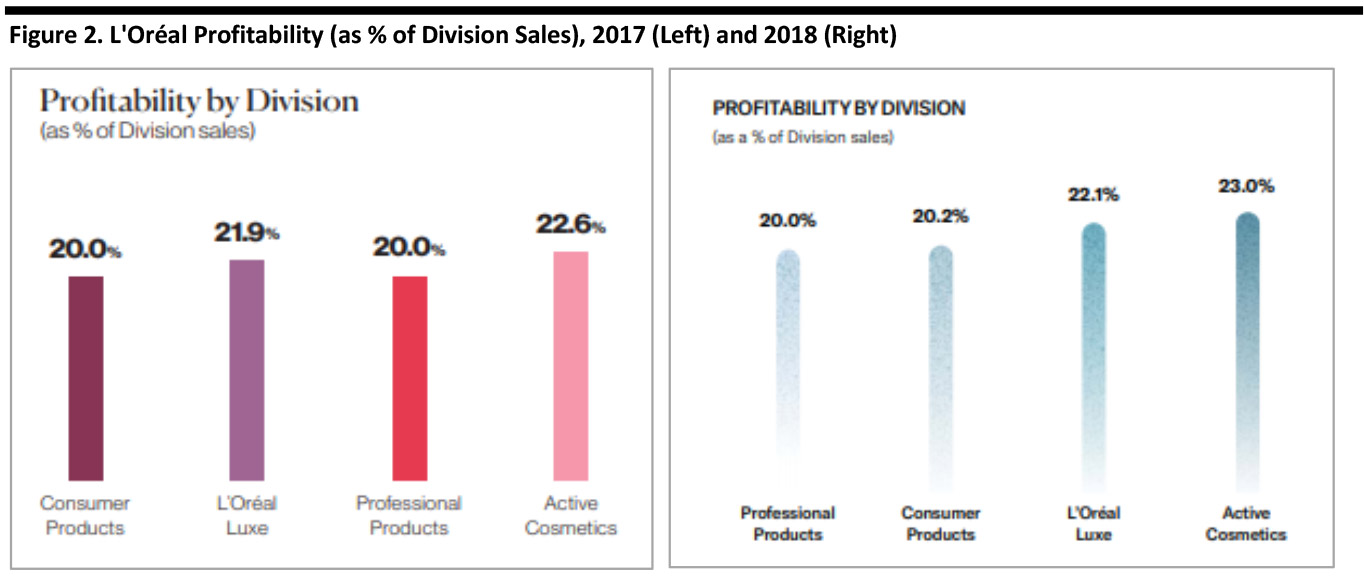

- L'Oréal has a division devoted to “Active Cosmetics” which includes brands La Roche-Posay, Vichy, SkinCeuticals, CeraVe and Roger & Gallet. Its Active Cosmetics division “meets a range of different skin care needs from normal to blemish-prone. Its brands are developed and endorsed by health professionals - dermatologists, pediatricians, cosmetic doctors.” In 2018, the company reported that its Active Cosmetics Division “outperformed the market in every country and on every continent, particularly in the United States and in Asia.” In North America, the company reported growth of over 20%.

- The company stated that more widely, consumers are looking for safer products that are well-tolerated, with proven efficacy – and that consumers increasingly want advice on beauty routines. In 2018, its Active Cosmetics division contributed 8.4% of total sales, up from 8.0% in 2017, according to company reports. The company says the division is also the most profitable, growing its margin from 22.6% in 2017 to 23% in 2018.

Source: Company reports [/caption]

Source: Company reports [/caption]

- In March 2019, L'Oréal announced a partnership with uBiome, a microbial genomics company. The partnership is to help L’Oréal’s research into the skin microbiome: the trillions of bacteria that live on, and provide an important barrier to, your skin. This collaboration bridges L’Oréal’s expertise in the science of skin care with uBiome’s leadership in microbiome research. Through this partnership, the two companies will conduct new research on the skin’s bacterial ecosystem to discover deeper insights to the skin for uBiome’s global community and future product development at L’Oréal.

Source: Pierre Fabre website [/caption]

Traditional Health Labs, Dermatologists and Research Companies are Entering the Beauty Space

As the definition of beauty expands and consumers look for products to solve for eczema, psoriasis, skin pigmentation, acne, dry skin and aging – there is a growing opportunity for non-traditional beauty professionals to enter the market with science-based products.

Here are a few examples:

Source: Pierre Fabre website [/caption]

Traditional Health Labs, Dermatologists and Research Companies are Entering the Beauty Space

As the definition of beauty expands and consumers look for products to solve for eczema, psoriasis, skin pigmentation, acne, dry skin and aging – there is a growing opportunity for non-traditional beauty professionals to enter the market with science-based products.

Here are a few examples:

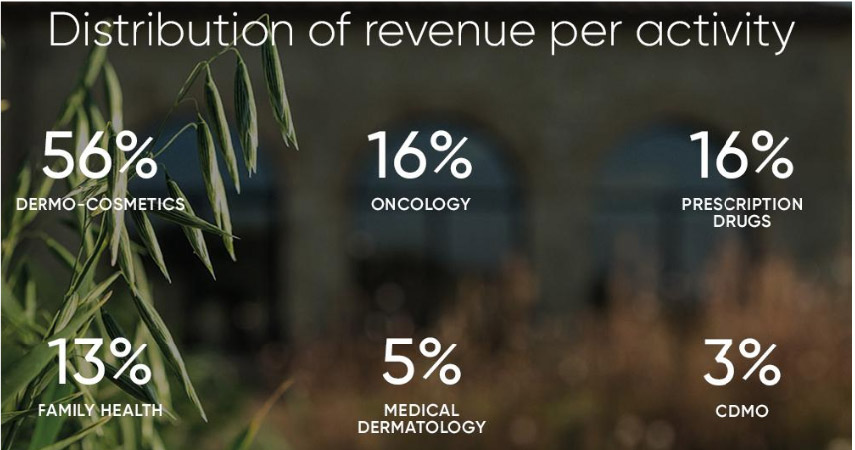

- Pierre Fabre is a global research company based in France with revenues of €2.3 billion in 2018. It is the second largest dermo-cosmetics laboratory in the world: In 2018, 61% of revenue was derived from dermo-cosmetics,38% from pharmaceuticals and 1% from other activities. The company’s skin care brands primarily focus on sensitive skin and hair, but others focus on cancer and chronic diseases.

Source: Pierre Fabre website [/caption]

Source: Pierre Fabre website [/caption]

- Dermatologists are entering the beauty market with their own branded products. For example, Dr. Heather Rogers combined scientific research with clinical expertise to create skin care products that use plant-based ingredients. Doctor Rogers’ Restore products are made with only hypoallergenic, biodegradable ingredients to promote skin health without irritation. She created a healing balm to reduce redness and swelling while hastening healing after a dermatological procedure such as lasering.

Source: Doctor Rogers website [/caption]

Source: Doctor Rogers website [/caption]

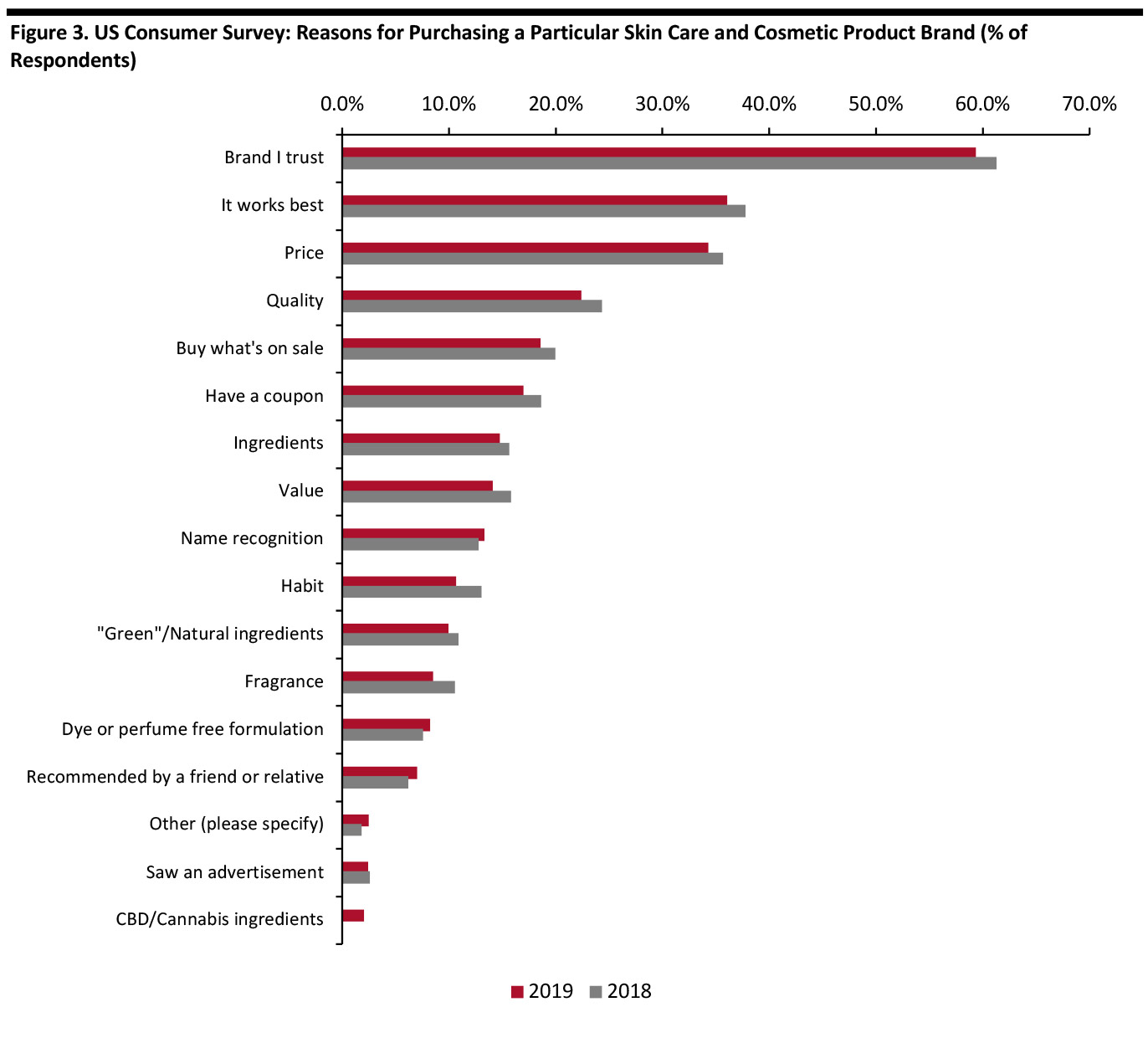

Consumers Today are Choosing Quality Skin Care and Cosmetic Products from Brands They Trust, and that Work

The beauty space is becoming increasingly crowded, with new products launching and competing for consumer attention. The good news for established brands is that consumers are loyal to trusted brands they see as effective, according to 2018 and 2019 Prosper Insights & Analytics surveys. “Brand I trust” was the number one reason women chose a particular skin care and cosmetic brand in both 2019 and in 2018, at 61.3% in 2018 and 59.4% in 2019; “it works best” was the number two reason at 36.0% in 2019 and 37.8% in 2018. [caption id="attachment_95239" align="aligncenter" width="700"] Base: 4,022 female Internet users aged 18+ (2019); 3,963 female Internet users aged 18+ (2018)

Base: 4,022 female Internet users aged 18+ (2019); 3,963 female Internet users aged 18+ (2018) Source: Prosper Insights & Analytics [/caption] This further highlights that in today’s beauty market, consumers are seeking functional skin care products and if a consumer believes a product is performing effectively, the product may have a better chance of a repeat purchase.

Beauty Prevention and Skin Protection are Beauty Values

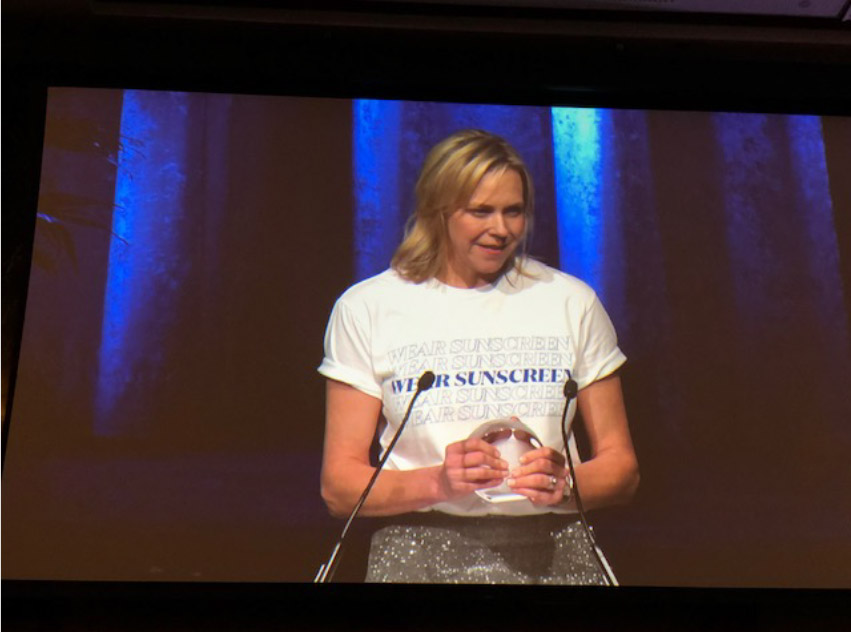

Consumers are increasingly turning to skin care routines to lessen sun damage, reduce the impact of pollution and prevent premature aging. Sunscreen, once a used at the pool or beach, is now working its way into everyday products as consumers value prevention and protection against the sun’s rays. According to the NPD Group, within prestige beauty, the amount spent on skin care with SPF increased 29% in 2018. The prestige beauty market saw a 29% surge in dollars spent on skincare with SPF last year Below are brand and retailer highlights in sun care:- In 2007, sun care brand Supergoop launched with a mission to stop the epidemic of skin cancer and reimagine what SPF could be. The brand is the first prestige skin care line that includes UV protection in all its products, ranging from creams, mousses, powders, sprays, oils to bars. The company is heralded for innovations such as a powder sunscreen which is vegan, cruetly free, contains vitamin E and vitamin C. The company has won multiple Cosmetic Executive Women (CEW) awards, including its most recent for its Unseen Sunscreen.

Holly Thaggard, Founder and CEO of Supergoop! accepts CEW award for Unseen Sunscreen

Holly Thaggard, Founder and CEO of Supergoop! accepts CEW award for Unseen Sunscreen Source: CEW 2019 Beauty Awards [/caption]

- On Ulta’s March Q419 earnings call, management reported that its sun care delivered double digit comps, including products that “weren't in the assortment a year ago.”

- L'Oréal launched a beauty tech device called My Skin Track UV by La Roche-Posay which monitors exposure to environmental conditions that affect the skin, such as UV rays, pollution, pollen, heat and humidity. The device provides personalized recommendations, clips onto clothing or can be worn as jewelry.

Skin Track UV

Skin Track UV Source: laroche-posay.us [/caption]

- Elta MD is a skin care and sunscreen product that has been used by physicians and medical professionals in hospitals, burn centers, rehabilitation clinics, long- and short-term care centers for over 25 years, according to the company’s website. EltaMD broad-spectrum sunscreens provide broad-spectrum ultraviolet (UV) protection, which helps prevent sunburn. The company’s sunscreen products include a variety of products for face, face and body, full body, and lip – including oil-free, untinted, tinted and water-resistant.

Consumers are Eating and Drinking Beauty Benefits

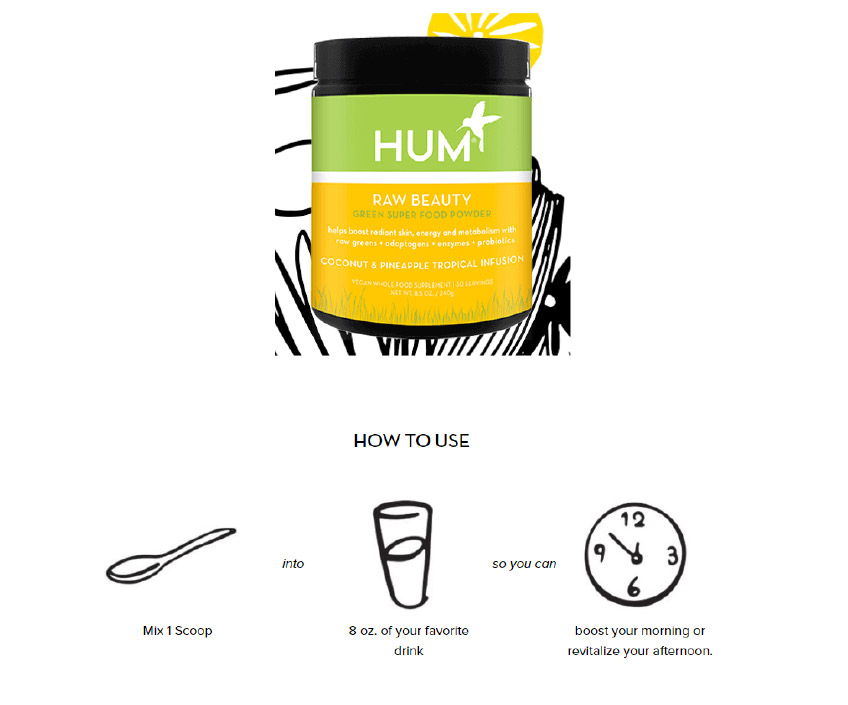

In the spirit of feeling healthy and looking radiant from the inside out, consumers are eating and drinking powders and supplements to try to attain healthier skin, hair and bodies. According to a Mintel study in 2017, 41% of US women aged 18-34 use an oral supplement to enhance their appearance. Research and Markets estimated the global beauty supplements market accounted for $3.5 billion in 2016 and the market is expected to reach $6.8 billion by the end of 2024, a CAGR of 8.6%. According to Research and Markets, Asia Pacific accounted for the highest share of the global beauty supplements market and is expected to continue to dominate the market to the end of 2024. Japan is the largest of them, followed by China and Korea – due in large part to rising male interest in beauty supplements. Europe has a more than 25% share of the global beauty supplements market, with Western European countries such as France, Germany and the UK accounting for a major share. The Europe beauty supplements market is driven by rising concerns over health, according to the study. Europe is closely followed by North America, due to similar disposable income levels and celebrity endorsement. These are a few innovative brands in the beauty edible/ingestible space: Beauty supplements/drinks:- HUM Nutrition’s motto is “Beauty Starts from Within,” and the company offers products such as vitamins, supplements, powders, and cleanses that claim to help dry skin, blemishes and acne, detox, weight loss, hair and nails, and anti-aging. Hum Raw Beauty Green Super Food Powder claims to improve energy, support radiant skin and boost metabolism.

Source: Hum.com [/caption]

Source: Hum.com [/caption]

- Moon Juice’s Beauty Dust is a product the company says is a “beautifying adaptogenci blend of Schisandra, Amla, Ashwagandha, Rehmannia, Goji & Pearl that targets stress and is known to combat accelerated aging, help protect from free radicals, and improve skin clarity.” The company lists benefits such as avoidning skin oxidative stress, hydrating to promote clarity, reducing the impact of accelerated aging and skin health, nourishing and calming skin, replenishing skin essence, as well as cooling and antioxidant properties. Moon Juice offers recipes for ots powder including a Beauty Dust Matcha – mixing the powder with milk, matcha and honey and combining in a blender.

Source: Moonjuice.com [/caption]

Beauty Chocolate:

Source: Moonjuice.com [/caption]

Beauty Chocolate:

- Ceramiracle’s Ageless Delight Beauty Chocolate supplement bar claims to “improve the skin’s hydration, this unique chocolate supplement helps to iron out the wrinkles and fine lines, while delivering a potent dose of antioxidants.”

Source: Ceramiracle[/caption]

Source: Ceramiracle[/caption]

- Sakara offers organic meals and products including detox powders, teas, waters and chocolates. Sakara also offers Beautyfood Beauty Chocolate in monthly packages and claims the chocolate is clinically proven to improve skin moisture, texture and elasticity in two weeks, using a plant-based collagen boost with one gram of sugar. The product was voted the #1 beauty supplement by CEW in 2018.

Source: Sakara.com [/caption]

Source: Sakara.com [/caption]

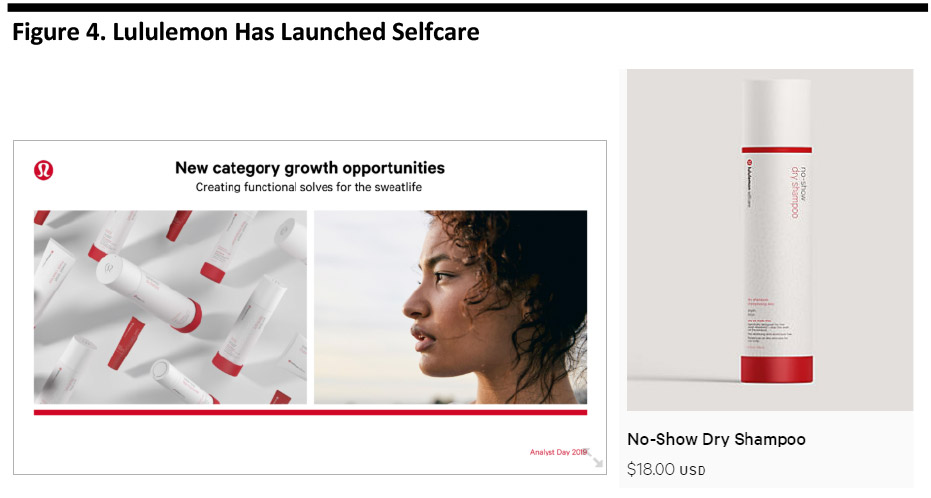

Athletic Brands and Retailers are Extending into Beauty and Wellness Space Through Self Care

Self care sits at the intersection of beauty and wellness, and has been defined in the Oxford English Dictionary as “the practice of taking an active role in protecting one's own well-being.” And “The practice of taking an active role in protecting one's own well-being and happiness, in particular during periods of stress.” In terms of beauty, self care has become an industry buzzword which encompasses mind, body, beauty and health. Retailers are embracing the term as an umbrella term for health, beauty and personal care and wellness products. Athletic Companies are Expanding into Beauty and Wellness In June, 2019, Lululemon launched Lululemon Selfcare, a gender-neutral beauty line consisting of four products: facial moisturizer, two spray-on deodorants in different scent offerings, a dry shampoo and a lip balm. The line promises “to solve some of life’s sweatiest problems.” At the company’s 2019 analyst day, management reported it had tested Selfcare in four markets over the past year and that they believe the customer “trusts Lululemon” as a provider of these products and that initial feedback was positive. Lululemon said it used a “touch and feel” approach to develop the new products, using soft packaging. Management said the lip balm has a different feel that others currently available. [caption id="attachment_95246" align="aligncenter" width="700"] Source: Lululemon Investor Day Slides/company website [/caption]

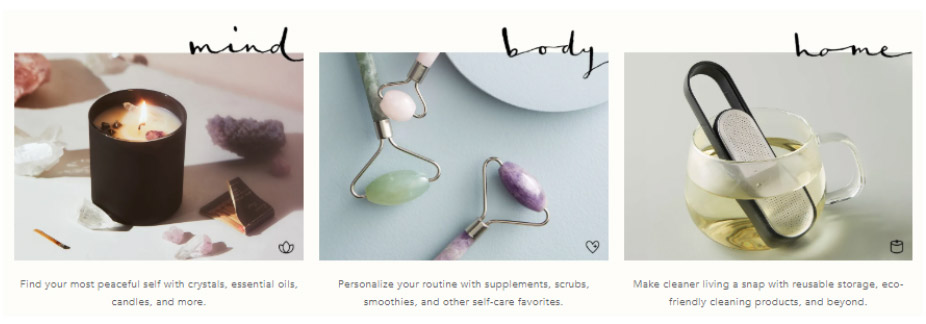

Anthropologie, the apparel and lifestyle company, has created a “Wellness Shop” in its stores. The health and wellness shop includes products ranging from fitness apparel and equipment to superfood supplements and room mists to help consumers to “lead a balanced lifestyle.” The company’s self-care line features sleep products including eye masks, bath soaks, facial rollers, sculpting tools, balms, toothpastes and towlettes.

[caption id="attachment_95247" align="aligncenter" width="700"]

Source: Lululemon Investor Day Slides/company website [/caption]

Anthropologie, the apparel and lifestyle company, has created a “Wellness Shop” in its stores. The health and wellness shop includes products ranging from fitness apparel and equipment to superfood supplements and room mists to help consumers to “lead a balanced lifestyle.” The company’s self-care line features sleep products including eye masks, bath soaks, facial rollers, sculpting tools, balms, toothpastes and towlettes.

[caption id="attachment_95247" align="aligncenter" width="700"] Source: Anthropologie.com Wellness Shop [/caption]

Fitish is a lifestyle, apparel, and fitness brand that offers a self-care line including “Dewing It” moisturizer, a cool down spray, lip therapy and makeup setting spray. The company’s Dewing It moisturizer ingredients include cannbadiol (CBD) oil that it claims promote calming effects on the skin.

[caption id="attachment_95248" align="aligncenter" width="640"]

Source: Anthropologie.com Wellness Shop [/caption]

Fitish is a lifestyle, apparel, and fitness brand that offers a self-care line including “Dewing It” moisturizer, a cool down spray, lip therapy and makeup setting spray. The company’s Dewing It moisturizer ingredients include cannbadiol (CBD) oil that it claims promote calming effects on the skin.

[caption id="attachment_95248" align="aligncenter" width="640"] Source: Fitish.com [/caption]

Source: Fitish.com [/caption]

Technology Apps and Beauty Videos Promote Mental Wellbeing with Self-Care Apps and Detox Videos

As the definition of beauty expands to include health and happiness from within, technology companies are launching apps to encourage users to incorporate routines that “detox” negative routines and replace them with positive ones. Self-care apps encourage consumers to reduce anxiety, feel calm and sleep well. Here are some examples:- YouTube video channel “Beauty Within” encourages viewers to “Detox their skin, body, and mind.” The channel “inspires young women to be better versions of themselves through beauty and wellness content that users can integrate into their daily lives.” For example, the channel includes skin care products and routines to solve for hyperpigmentation and discoloration, acne scars, breakouts, and techniques for improving texture and brightening skin.

- Calm and Headspace are apps that offer general meditation and more specific meditations on sleep, relationships, wellbeing or feeling calm. The Calm app had been downloaded over 52 million times as of July 2019, according to the New York Times, at $69.99 per year. The Headspace app is free, but with 31 million downloads in 2018 according to DMR Business Statistics, it trails Calm. Headspace offers additional meditations at additional cost.

Key Insights

- Consumers are choosing beauty health and wellness as a holistic lifestyle, encompassing prevention, nutrition, and mental wellbeing – offering new entrants to the category.

- Consumers are turning to solution-based beauty products, also known as dermo-cosmetics. L'Oréal stated consumers are looking for safer products that are well-tolerated, with proven efficacy and consumers want advice with beauty routines. In 2018, its Active Cosmetics division comprised 8.4% of the company’s overall sales, up from 8.0% in 2017.

- Prevention and skin protection are now beauty values. Consumers are increasingly turning to skin care routines that prevent sun damage, mitigate the effects of pollution and hamper premature aging. According to the NPD Group, the prestige beauty market saw a 29% increase in dollars spent on skin care with SPF in 2018.

- Today’s consumer is loyal to brands they trust and that they see as effective, according to 2018 and 2019 Prosper Insights & Analytics surveys. “Brand I trust” is the number one reason women choose a particular skin care and cosmetic brand.

- Consumers are eating and drinking powders and supplements for healthier skin, hair and bodies. This is drawing a new wave of entrants into the beauty space.

- Athletic brands and retailers such as Lululemon are extending into beauty and wellness by launching self-care products, which sit at the intersection of beauty and wellness.

- Technology companies are offering apps that encourage users to incorporate routines that “detox” negative routines and replace them with positive ones. Self-care apps help consumers reduce anxiety, feel calm and sleep well.