DIpil Das

Approximately 64.3 million Americans (19% of the population) used hair coloring products last year, according to Statista estimates based on US Census Bureau data and a Simmons National Consumer Survey published in August 2019. The research study found that four in five US consumers used professional salons at least once over the course of the year. However, the coronavirus pandemic has increased the penetration of at-home hair care and hair coloring in particular, as the lockdowns have caused salons to temporarily close for around two months across most of the US.

In the first quarter of 2020, social media has been flooded with tutorials, chats and video content related to DIY home color experiences, from both consumers and key opinion leaders. This has almost become a “we are in this together” environment, where consumers across the US are supporting one other.

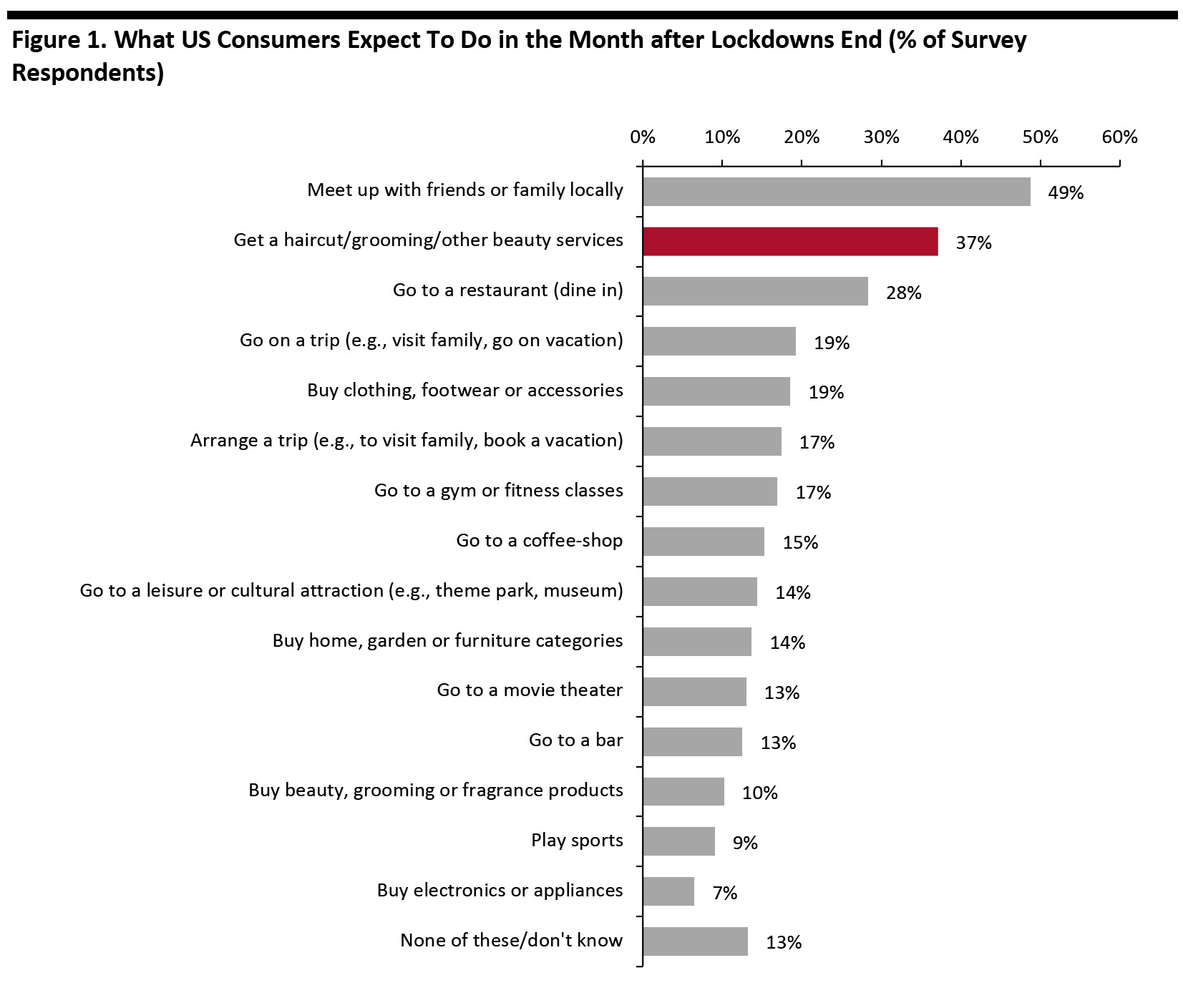

Grooming and Beauty Services Are a Priority for Consumers Post Lockdown

As salons reopen, 37% of US consumers plan to prioritize their spending on visiting a salon within the first month after lockdown, according to a recent Coresight Research survey. As shown in Figure 1, “getting a haircut, grooming or other beauty service” was the most popular consumer response after “meet up with friends and family locally.” For comparison purposes, just 19% of consumers plan to buy footwear, accessories or clothing in the month after lockdowns end. Coupled with the popularity of the “go to a restaurant option,” these findings suggest that services and experiences are proving to be more important to consumers, at least in the short term, than transactional products.

[caption id="attachment_110315" align="aligncenter" width="700"] Base: 431 US Internet users aged 18+, surveyed on May 13, 2020

Base: 431 US Internet users aged 18+, surveyed on May 13, 2020 Source: Coresight Research[/caption] Surging Home Hair Color Product Usage, with Virtual Try-On and Tutorials Beauty brands have had to reinvent how they deliver brand content to consumers during coronavirus-led retail shutdowns, including tutorials, online consultations and virtual try-ons. Brand have used these techniques to reach consumers that are first-time at-home hair colorists. Some data suggest that up to 80% of consumers who color their hair had never done so themselves at home, so this was a previously untapped opportunity.

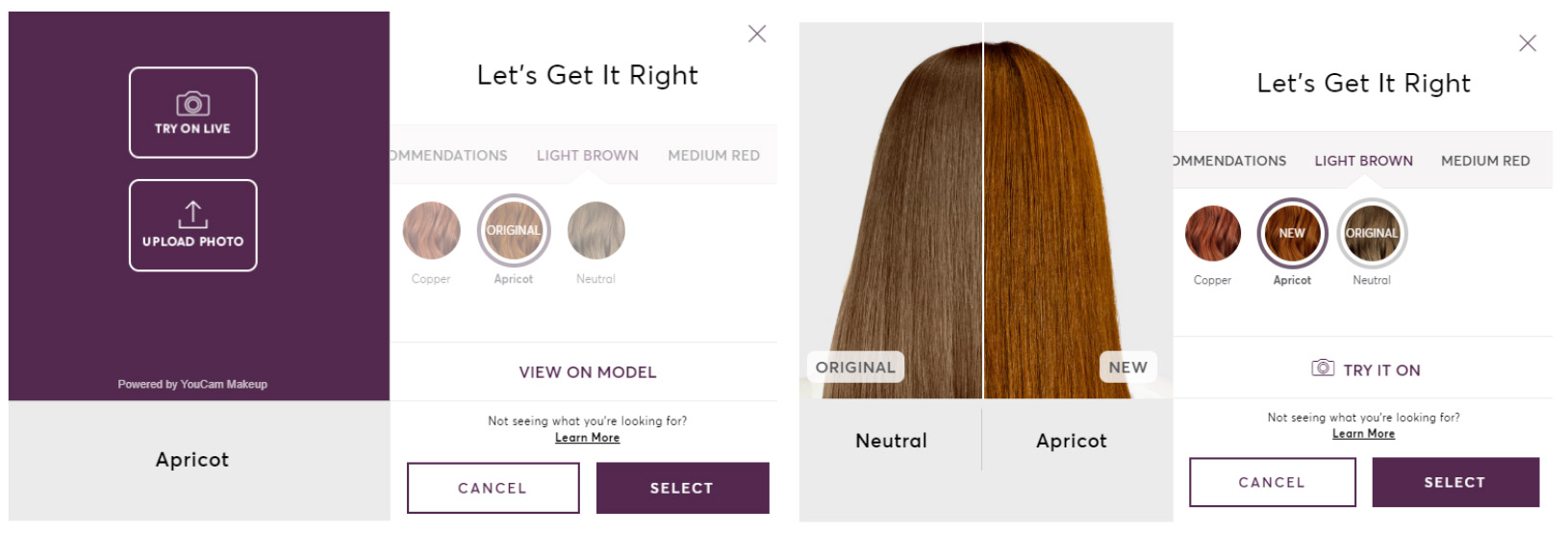

- Madison Reed’s CEO and Founder, Amy Errett reported to CBS News on April 26, 2020 that the company’s hair color online business has grown tenfold “almost since the day that lockdown started” (in the first week of March 2020). Madison Reed offers natural, at-home hair color products that are free from ammonia, parabens, resorcinol, PPD, phthalates, gluten, SLS and titanium dioxide. The brand’s tagline is, “Confident is the New Beautiful,” and Errett said that the company is leveraging the idea that women feel good, confident and care about themselves when their hair looks good, giving credence to the adage “good hair day.” The company uses an online personalized home hair color system, where the consumer answers a series of questions to identify the best color solution. Consumers can also get help from an online colorist. The personalized system includes multiple options to virtually try out hair colors—on a model or overlaid onto personal photos using the YouCam Makeup app. Madison Reed operates 15 salons, also known as color bars, across California, Georgia, Maryland, New York and Texas.

Source: Madisonreed.com [/caption]

Source: Madisonreed.com [/caption]

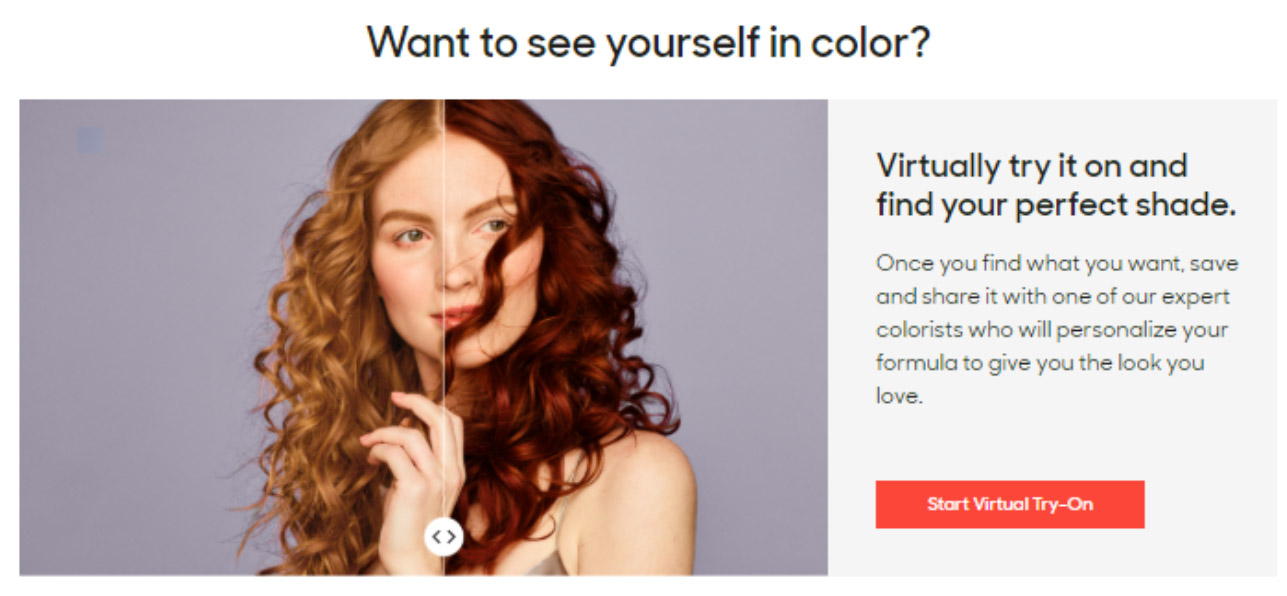

- L’Oréal USA CEO Stéphane Rinderknech highlighted that consumers are discovering color at home as they are no longer able to go to hair salons for their color, when he joined WWD’s Beauty Inc.’s webinar on April 27, 2020. L’Oréal’s Consumer Product Division is reinventing brand content to teach consumers how to color their hair at home with online beauty-at-home tutorials. The company has turned its efforts to digital engagement, consumer education and maximizing brand content. Rinderknech said that L’Oréal’s brands are reinventing content to entertain, teach or otherwise engage with consumers. For example, the Luxe Team is leveraging field team associates to livestream content. According to Rinderknech, the Consumer Product Division is leading the hair color category with over 50% market share, partly due to the hair color boom and L’Oréal’s strong presence online, offering beauty-at-home tutorials. For example, the company’s Color & Co is a personalized hair color system where consumers can take a color quiz or consult with a colorist online to find the correct color—offering one-time color or subscription boxes. Consumers can virtually try on the hair color to see how it will look.

Source: L’Oréal’s Colorandco.com[/caption]

Salons Reopen across the US with New Restrictions; “New Reality” To Impact Operations

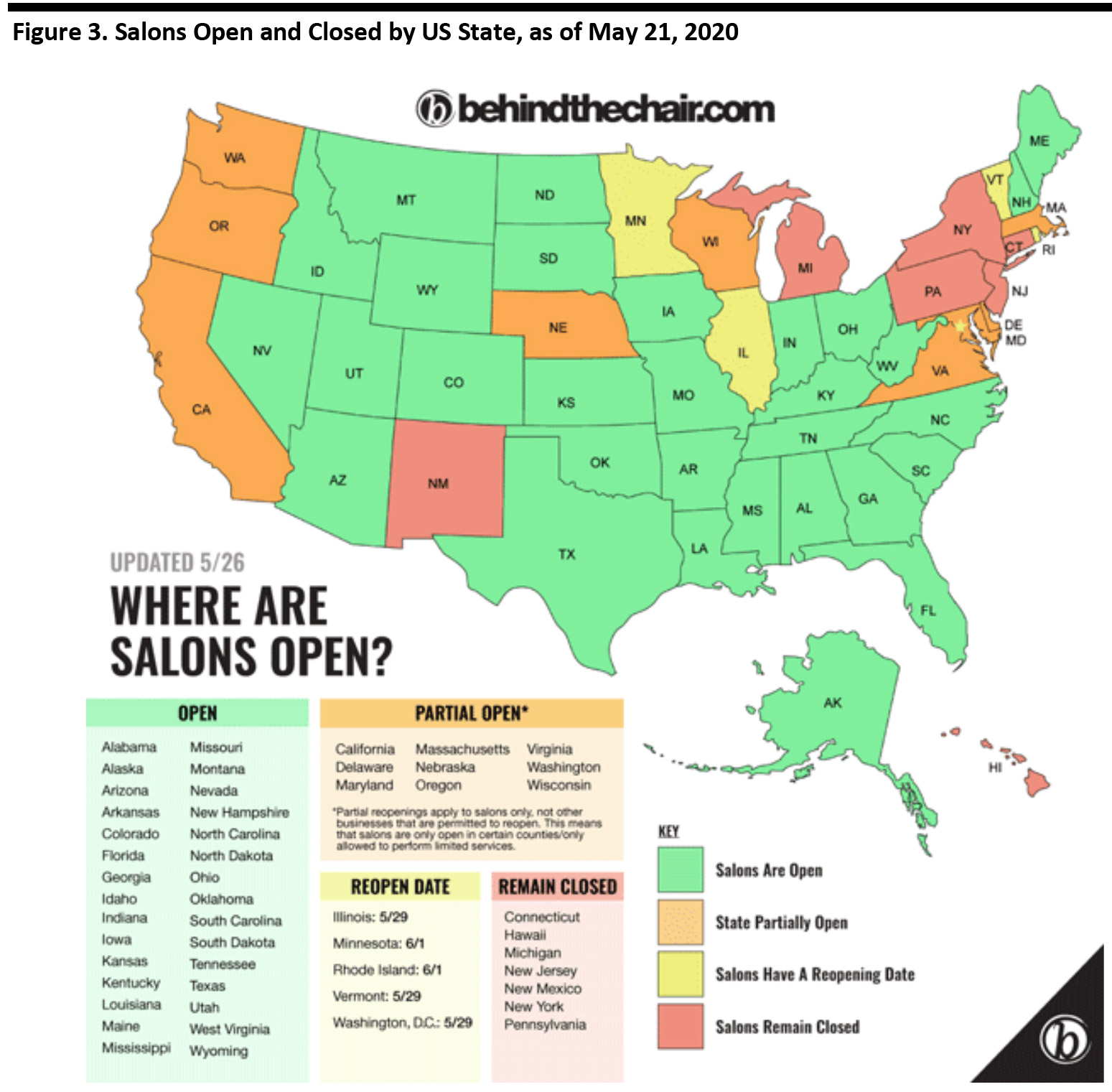

Salons are beginning to reopen across the US. Some 70% of states have allowed salons to reopen at least partially as of May 20, 2020: 29 states have allowed salons to reopen and six states have certain counties that are allowing salons to reopen, as shown in Figure 3.

[caption id="attachment_110318" align="aligncenter" width="700"]

Source: L’Oréal’s Colorandco.com[/caption]

Salons Reopen across the US with New Restrictions; “New Reality” To Impact Operations

Salons are beginning to reopen across the US. Some 70% of states have allowed salons to reopen at least partially as of May 20, 2020: 29 states have allowed salons to reopen and six states have certain counties that are allowing salons to reopen, as shown in Figure 3.

[caption id="attachment_110318" align="aligncenter" width="700"] Source: behindthechair.com[/caption]

While salons are reporting different experiences and implementing varied safety protocols when reopening, operational changes are typically including increased social distancing between chairs, mask-wearing, temperature checks at the door, customers waiting outside salons for appointments, increased sanitation and a change/increase in operating hours.

Rinderknech said consumers began booking appointments as soon as salons started reopening, with one chain in the Midwest (that L’Oréal is working with) seeing 3,000 reservations for hair color when it reopened.

Rinderknech predicted that there will be a new reality impacting salons for the next six to 12 months, in which everyone will be expected to make adjustments. For example, consumers may be encouraged to shampoo their hair before visiting a salon to help speed up each appointment. L’Oréal is working with salons to determine sanitation protocols, social distancing rules and mask requirements. The company is supporting salons and stylists and offering relief to small businesses by freezing payments until their salon resumes operations. L’Oréal has also been offering online education programs during salon closures.

Home Hair Color Brands Will See Increased Sales Persist in the Medium Term

Although consumers will begin to visit salons again for professional colors services post lockdown, Coresight Research expects that sales in the home hair color category will remain slightly elevated over the next six months compared to pre-coronavirus levels. There are a number of reasons for this:

Source: behindthechair.com[/caption]

While salons are reporting different experiences and implementing varied safety protocols when reopening, operational changes are typically including increased social distancing between chairs, mask-wearing, temperature checks at the door, customers waiting outside salons for appointments, increased sanitation and a change/increase in operating hours.

Rinderknech said consumers began booking appointments as soon as salons started reopening, with one chain in the Midwest (that L’Oréal is working with) seeing 3,000 reservations for hair color when it reopened.

Rinderknech predicted that there will be a new reality impacting salons for the next six to 12 months, in which everyone will be expected to make adjustments. For example, consumers may be encouraged to shampoo their hair before visiting a salon to help speed up each appointment. L’Oréal is working with salons to determine sanitation protocols, social distancing rules and mask requirements. The company is supporting salons and stylists and offering relief to small businesses by freezing payments until their salon resumes operations. L’Oréal has also been offering online education programs during salon closures.

Home Hair Color Brands Will See Increased Sales Persist in the Medium Term

Although consumers will begin to visit salons again for professional colors services post lockdown, Coresight Research expects that sales in the home hair color category will remain slightly elevated over the next six months compared to pre-coronavirus levels. There are a number of reasons for this:

- Many consumers used at-home color products for the first time during the coronavirus pandemic. As shown on social media, consumers experimented with different colors, shades and highlights. Enjoying the experience, some consumers will continue to use at-home color post coronavirus.

- Digital advances such as virtual try-on color services and tutorials will help consumers to feel more at ease with DIY color. The digital content that brands are creating will also help consumers to feel confident with their color choices.

- Salons may have difficulty initially servicing the pent-up demand, and coronavirus-related safety rules may reduce their ability to service clients.

- Consumers will have less discretionary income—20.5 million Americans were unemployed as of April 30, 2020 (14.7% of the population). Many consumers will therefore be looking for creative ways to stretch their dollars, and at-home hair color products offer a less-expensive alternative to salon services.