albert Chan

This is the first report in our Beauty Insights series, which explores prominent or emerging themes and trends in the global beauty market. In this report, we examine the reasons why apparel brands are looking to launch into the beauty sector.

Over the past year, we have seen an increase in the number of apparel retailers that are launching beauty, personal care, health and wellness brands. While the apparel industry is larger, it is growing more slowly than the core beauty categories of cosmetics and skincare in the US, according to Statista.

Apparel brands are turning to the beauty, personal care, health and wellness industry as a vehicle to grow sales and to generate interest for their entire brand portfolio. This report highlights six ways in which apparel retailers are leveraging beauty and personal care products to grow their customer base and increase revenue.

[caption id="attachment_97817" align="aligncenter" width="700"] Source: Coresight Research[/caption]

1. Beauty products are a gateway to other luxury products in a brand’s portfolio.

Source: Coresight Research[/caption]

1. Beauty products are a gateway to other luxury products in a brand’s portfolio.

Luxury brands are extending into the beauty category to appeal to new customers that can be introduced to a brand for the first time in an accessible way. With affordable price points, beauty products and small accessories act as a gateway into the luxury segment for many consumers who may then explore a brand’s wider portfolio of products. For example, luxury brand Gucci launched a lipstick line under designer Alessandro Michele in May 2019, comprising 58 lipsticks retailing at $38 each. The company sold 1 million lipsticks in the first month alone, which sets the line’s revenue launch total to approximately $38 million. One highlight of this success was that Gucci sold 33,000 lipsticks in a single day at one store in Asia, according to Coty CEO Pierre Laubie.

[caption id="attachment_97807" align="aligncenter" width="300"] Source: Gucci.com[/caption]

Source: Gucci.com[/caption]

Other luxury brands—including Rebecca Minkoff, Thom Browne and Victoria Beckham—also announced launches into skincare, clean beauty and fragrance.

- In August 2019, accessible luxury brand Rebecca Minkoff announced the launch of a fragrance under a multiyear partnership that will eventually extend to other realms of beauty such as makeup and wellness.

- In September 2019, luxury brand Thom Browne launched its first fragrance line, with six scents geared to both men and women.

- In September 2019, luxury brand Victoria Beckham launched VB Beauty, a clean, digital-first skincare, wellness and perfume line.

2. Traditional brands are leveraging already-established customer trust, as well as their influence and reputation, to increase revenue through extension beauty products.

Apparel brands are using their competitive advantage to establish new products in the beauty category that build on existing customer trust, thus increasing revenue potential. Due to the competitiveness of the segment with an increasing number of new entrants, consumers are looking for products that are effective and differentiated.

On October 1, 2019, American Eagle announced the launch of MOOD, a genderless wellness and personal care product line that features hemp-derived CBD products. The MOOD collection comprises 45 personal care products including body lotion, hand cream, face oil, aromatherapy oil, pillow mist, muscle balm and lip salve, as well as bath essentials such as bath bombs, sugar scrubs and foaming face wash. American Eagle’s Global Brand President, Chad Kessler, said that the product line was inspired by its customers and “their interest in this exciting new category. We see this as a perfect extension of the AE brand.”

In June 2019, athletic retailer Lululemon launched a dual-gender brand called Selfcare, which it claims is designed by athletes for athletes. The Selfcare line includes four products: dry shampoo, deodorant, face moisturizer and lip balm. The upcoming launch of the line was announced in April 2019 at the company’s analyst day: Management said at the time that customers trust Lululemon and look to the retailer as the expert authority on sweat. The company therefore introduced Selfcare products as a natural extension of this relationship of trust with its customers.

[caption id="attachment_97809" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

✓ An extension beauty product is beneficial for the retailer and the consumer because trust in the brand has already been established.

3. The necessity for consumers to replenish their beauty, personal care and skincare products can help to ensure loyalty, as customers are inclined to visit stores and websites more often.

Beauty and personal care products offer opportunities for retailers to build a loyal customer base. These types of products (such as deodorant, toner, moisturizer, lip balm and mascara, to name a few) tend to require more regular replenishment compared to apparel items.

What does it take for a brand to build loyalty for a beauty product? The answer is certainly more than just having a beauty product in its portfolio. Today’s consumer is discerning, and with so many beauty products available, retailers must look to “check many boxes” in order to ensure that consumers want to make repeat purchases.

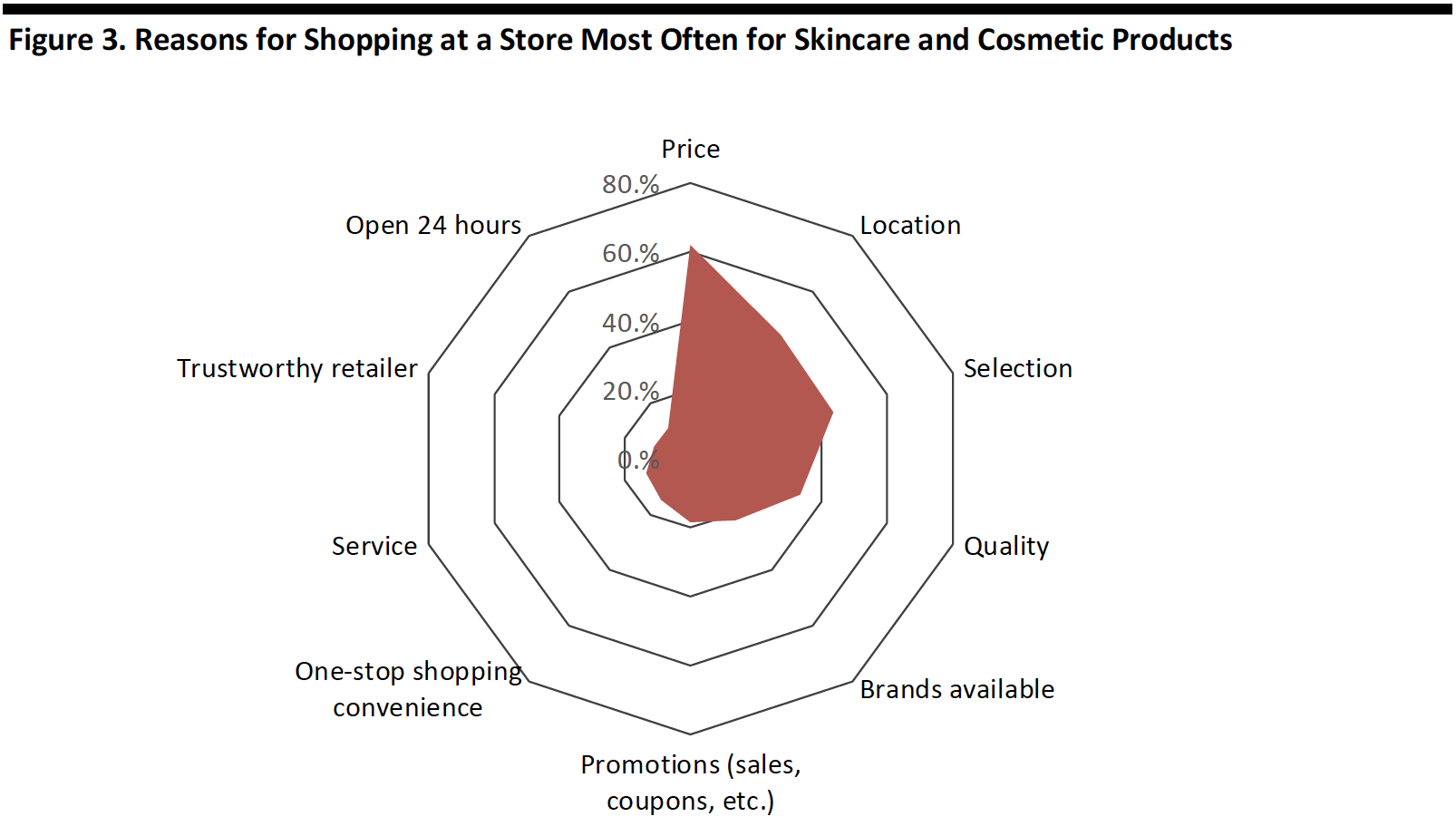

In a survey of US shoppers conducted in July 2019 by Prosper Insights & Analytics, it was found that today’s consumers emphasize price, location, selection and quality as top criteria in purchasing skincare products and cosmetics.

[caption id="attachment_97811" align="aligncenter" width="700"] Base: 7,660 US adults aged 18+

Base: 7,660 US adults aged 18+Source: Prosper Insights & Analytics[/caption]

The good news is that once consumers become loyal to a brand, they tend to stay loyal, according to CORRA, a digital agency. CoverGirl, founded in 1961, had the highest loyalty rating among a poll of 1,000 women, according to a 2018 survey conducted by CORRA. Over half of the CoverGirl customers surveyed had used its products for five years or more.

✓ Beauty, health and wellness, and personal care present opportunities for retailers and brands to obtain customer loyalty.4. Beauty products may help brands to increase customers’ average order value.

Small, affordable items can help to drive up a brand’s average order value, which is becoming increasingly important for retailers.

According to CreditDonkey, a credit card research and comparison company, over 74% of online consumers in North America abandon their digital shopping carts altogether, and 55% cited the high add-on costs of shipping, taxes and other fees. Customers that are looking to meet free shipping thresholds may not want to add the cost of an additional apparel item in order to exceed the minimum order value, but could more easily reach that number by purchasing a smaller item such as a nominal beauty, personal care, health or wellness product.

In physical stores, beauty, health and wellness items can drive incremental purchases at the point of sale, where consumers may pick up the beauty and skincare products that are displayed by the checkout while waiting in line.

✓ Beauty products, which are typically smaller and less expensive items in a brand’s portfolio, can help retailers to increase customers’ average order value both online and in store.

5. The gifting of beauty products provides add-on sales opportunities for retailers.

Beauty, personal care, health and wellness items are all gifting opportunities. Consumers are turning to self-gifting, with 51% of Americans reporting that they planned to purchase something for themselves when they shopped for others in the holiday season last year—and 21% confirming that these would be beauty items—according to the Deloitte 2018 Holiday Survey.

The holiday season is a particularly lucrative opportunity for brands to use packaging to market products as gifts, but events through the year, such as birthdays and housewarmings can also be targeted.

✓ Beauty products are sought-after gifts, particularly with the emerging trend of self-gifting, and therefore present another selling opportunity for retailers.

6. By offering beauty products, retailers can reach an extended customer base through innovative marketing strategies on online media channels.

The beauty sector provides brands with another creative marketing avenue to explore, with YouTube and social media offering the chance to reach an extended customer base through makeup tutorials by influencers, for example. This may garner the attention of a younger demographic in particular.

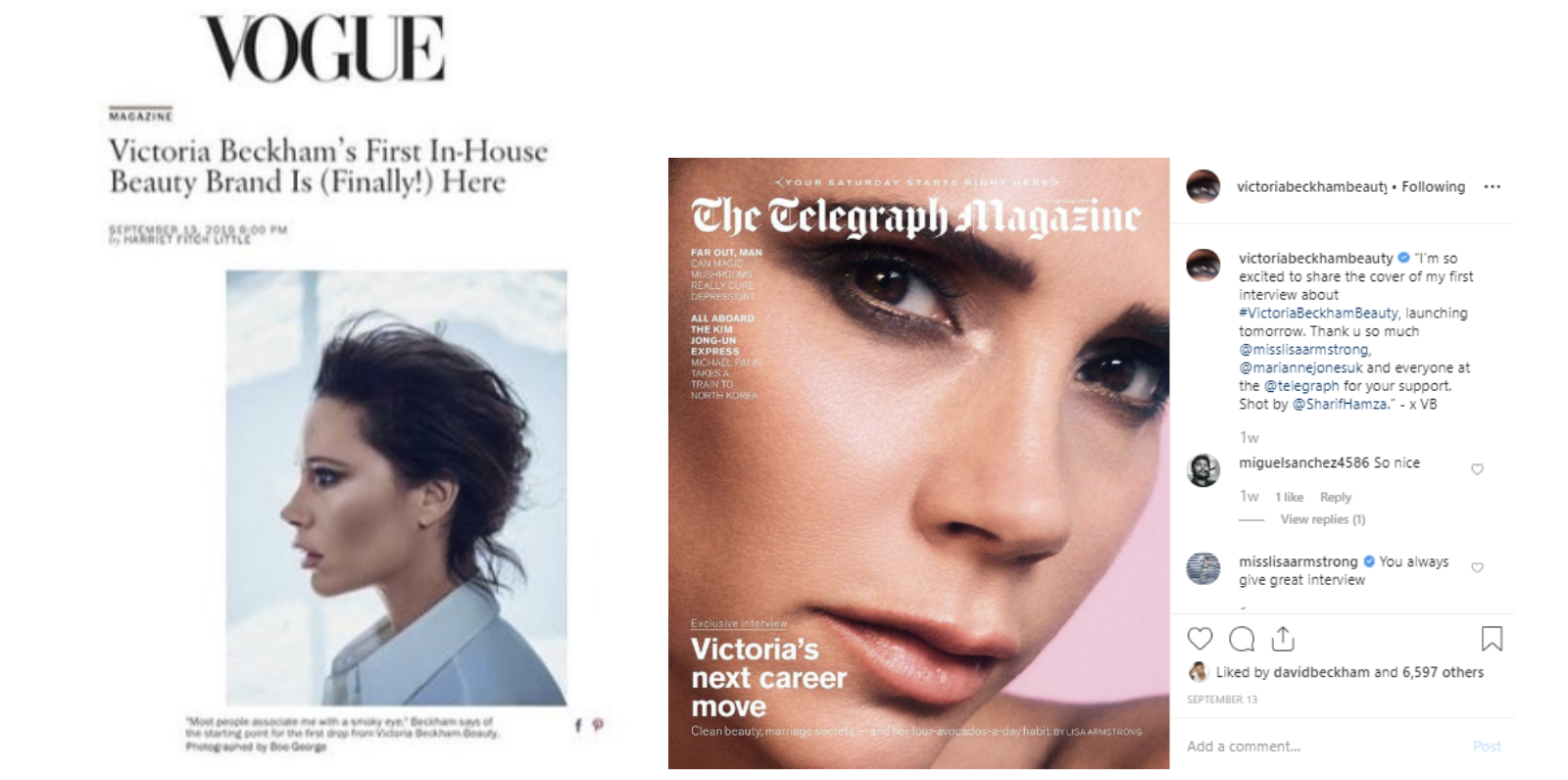

In September 2019, luxury brand Victoria Beckham announced the launch of VB Beauty, a clean, digital-first skincare, wellness and fragrance line. Beckham said that the line will comprise curated beauty essentials with recommendations from a variety of women. Beckham’s Instagram highlights the launch of the beauty brand and includes videos of beauty product applications from her new line—one showing her with a painted star over her eye for the brand’s launch and others of behind-the-scenes access into how the brand was created.

[caption id="attachment_97812" align="aligncenter" width="700"] Source: Victoria Beckham Beauty Instagram[/caption]

Source: Victoria Beckham Beauty Instagram[/caption]

✓ Beauty products can be promoted easily via social media, offering retailers an opportunity to extend their reach to new customers and increase brand awareness.