Nitheesh NH

The BPC industry is one of the fastest-growing consumer product sectors in India, with increasing shelf space in retail stores and boutiques stocking beauty products from international brands. Salons, beauty parlors, spas and barber shops are important channels for beauty brands to leverage in India as they hold strong influence over the Indian beauty consumer. These channels employ more than 7 million professionals, of which nearly two-thirds are women. The Indian film industry, particularly Bollywood, also impacts on the nation’s concept of beauty, which varies from the ultra-modern to traditional. Furthermore, a significant part of urban India looks to social media beauty influencers, who are creating content such as beauty tutorials and hacks to engage with consumers.

Estimated before the impact of the coronavirus outbreak

Estimated before the impact of the coronavirus outbreak

Source: Statista[/caption] Source: Economic Survey of India 2019–20, Ministry of Finance/World Bank/IBHA/Deloitte/RAI[/caption]

[caption id="attachment_111698" align="aligncenter" width="700"]

Source: Economic Survey of India 2019–20, Ministry of Finance/World Bank/IBHA/Deloitte/RAI[/caption]

[caption id="attachment_111698" align="aligncenter" width="700"] Source: IBEF/Statista/KPMG/ASSOCHAM, India[/caption]

Below, we discuss the growth drivers in more detail:

Source: IBEF/Statista/KPMG/ASSOCHAM, India[/caption]

Below, we discuss the growth drivers in more detail:

Source: Company reports/Nielsen/Frederic Fernandez & Associates[/caption]

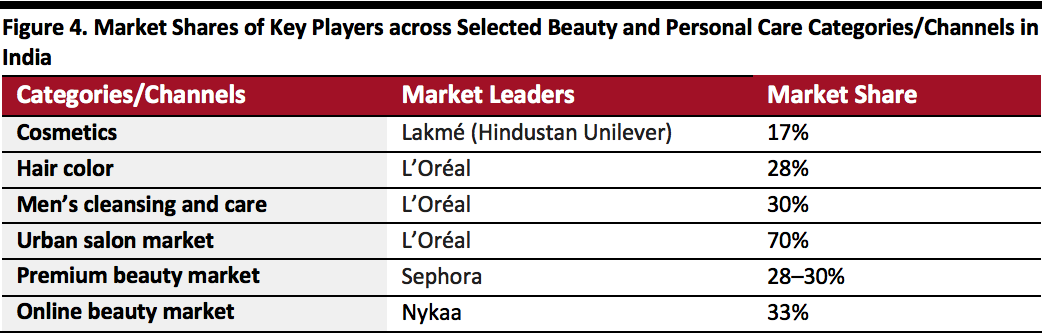

L’Oréal has been present in India since 1994, where it has grown at a CAGR of over 20% in the past 15 years. The brand registered comparable sales growth of 20% in 2018. Overall, it has the third-largest market share in the country, behind Hindustan Unilever and Colgate-Palmolive. L’Oréal is a leader in the hair color and men’s cleansing and care categories in India, with market shares of 28% and 30% respectively, according to the brand’s Chairman and CEO Jean-Paul Agon.

In the makeup category, L’Oréal holds the second position of largest market share behind Lakmé. According to L’Oréal, it is looking to gain share in India through innovation, digital play and communication rather than by lowering prices. Compared to Hindustan Unilever, L’Oréal’s distribution reach is narrow, it aims to engage with Indian consumers through online channels. Although its operations in India comprise only about 2% of the brand’s global business, the country has become its fastest-growing market. In the next five to 10 years, L’Oréal aims to double its number of customers in India, from about 100 million currently.

Estée Lauder has 586 stores across India, including 151 standalone stores plus shop-in-shops in partnership with Indian department-store chain Shoppers Stop. In March 2020, Estée Lauder-owned Smashbox launched the first India-exclusive lipstick Gula-Bae, a rose shade priced at ₹2,100 ($28) that was designed based on extensive market research to appeal to the personality, lifestyle and moods of the modern millennial Indian woman. Lipstick is the most regularly used makeup product by Indian women, making it a staple beauty category in India. Soon after the launch, India witnessed a total nationwide lockdown due to the coronavirus outbreak, so the Gula-Bae line is only now gaining exposure to the market as the lockdown eases and stores reopen. As part of the Gula-Bae lipstick campaign, Smashbox appointed its first brand ambassador in India, Sobhita Dhulipala, one of Netflix India’s most popular actresses. In November 2018, Estée Lauder appointed Bollywood actress Diana Penty as India’s first brand ambassador for the Estée Lauder brand, followed by Bollywood actress Radhika Apte for its Clinique brand in February 2019.

In an interview with WWD in May 2020, Rohan Vaziralli, General Manager and Country Head at The Estée Lauder Companies India, said, “While macro and nano influencers drive incredible engagement, mega influencers such as Bollywood celebrities are able to capture reach and drive deeper penetration and awareness at scale. To further accelerate our growth ambitions in [India], brand ambassadors are a strategic investment to drive brand awareness, deepen consumer coverage and drive desirability. The initial results have been very encouraging, with double-digit growth, increased consumer base and stronger regional penetration.”

[caption id="attachment_111700" align="aligncenter" width="700"]

Source: Company reports/Nielsen/Frederic Fernandez & Associates[/caption]

L’Oréal has been present in India since 1994, where it has grown at a CAGR of over 20% in the past 15 years. The brand registered comparable sales growth of 20% in 2018. Overall, it has the third-largest market share in the country, behind Hindustan Unilever and Colgate-Palmolive. L’Oréal is a leader in the hair color and men’s cleansing and care categories in India, with market shares of 28% and 30% respectively, according to the brand’s Chairman and CEO Jean-Paul Agon.

In the makeup category, L’Oréal holds the second position of largest market share behind Lakmé. According to L’Oréal, it is looking to gain share in India through innovation, digital play and communication rather than by lowering prices. Compared to Hindustan Unilever, L’Oréal’s distribution reach is narrow, it aims to engage with Indian consumers through online channels. Although its operations in India comprise only about 2% of the brand’s global business, the country has become its fastest-growing market. In the next five to 10 years, L’Oréal aims to double its number of customers in India, from about 100 million currently.

Estée Lauder has 586 stores across India, including 151 standalone stores plus shop-in-shops in partnership with Indian department-store chain Shoppers Stop. In March 2020, Estée Lauder-owned Smashbox launched the first India-exclusive lipstick Gula-Bae, a rose shade priced at ₹2,100 ($28) that was designed based on extensive market research to appeal to the personality, lifestyle and moods of the modern millennial Indian woman. Lipstick is the most regularly used makeup product by Indian women, making it a staple beauty category in India. Soon after the launch, India witnessed a total nationwide lockdown due to the coronavirus outbreak, so the Gula-Bae line is only now gaining exposure to the market as the lockdown eases and stores reopen. As part of the Gula-Bae lipstick campaign, Smashbox appointed its first brand ambassador in India, Sobhita Dhulipala, one of Netflix India’s most popular actresses. In November 2018, Estée Lauder appointed Bollywood actress Diana Penty as India’s first brand ambassador for the Estée Lauder brand, followed by Bollywood actress Radhika Apte for its Clinique brand in February 2019.

In an interview with WWD in May 2020, Rohan Vaziralli, General Manager and Country Head at The Estée Lauder Companies India, said, “While macro and nano influencers drive incredible engagement, mega influencers such as Bollywood celebrities are able to capture reach and drive deeper penetration and awareness at scale. To further accelerate our growth ambitions in [India], brand ambassadors are a strategic investment to drive brand awareness, deepen consumer coverage and drive desirability. The initial results have been very encouraging, with double-digit growth, increased consumer base and stronger regional penetration.”

[caption id="attachment_111700" align="aligncenter" width="700"] Smashbox’s India-exclusive lipstick with new brand ambassador Sobhita Dhulipala

Smashbox’s India-exclusive lipstick with new brand ambassador Sobhita Dhulipala

Source: Sephora[/caption] LVMH-owned Sephora is growing its presence in the Indian beauty market. In 2018, the retailer’s revenues in the country grew by 70% year over year. As of November 23, 2019, the retailer operated 23 stores in India. Sephora aims to have 50 stores in India by 2022 and will then look to further expand its brick-and-mortar footprint to 75 locations within a few years. The retailer generates about 50% of its sales from metropolitan areas in India; however, it is planning to open its first boutiques in tier 2 and tier 3 cities, indicating that the appetite for premium beauty goes beyond the major and more affluent metropolitan areas. Sephora holds a 28–30% market share in the $1.2 billion Indian premium beauty market, according to Sephora India’s CEO Vivek Bali. Bali said that the premium category in India has grown at a CAGR of 18% over the last four years, while Sephora has registered a CAGR of 63% during the same period. A major chunk of the retailer’s customer base in the country comprises millennials and employed women. Sephora India has more than 470,000 followers on Instagram, representing its popularity, mainly among younger Indian audiences. [caption id="attachment_111701" align="aligncenter" width="700"] Source: Sephora/Instagram[/caption]

Source: Sephora/Instagram[/caption]

The Indian BPC Market Is Worth $26 Billion

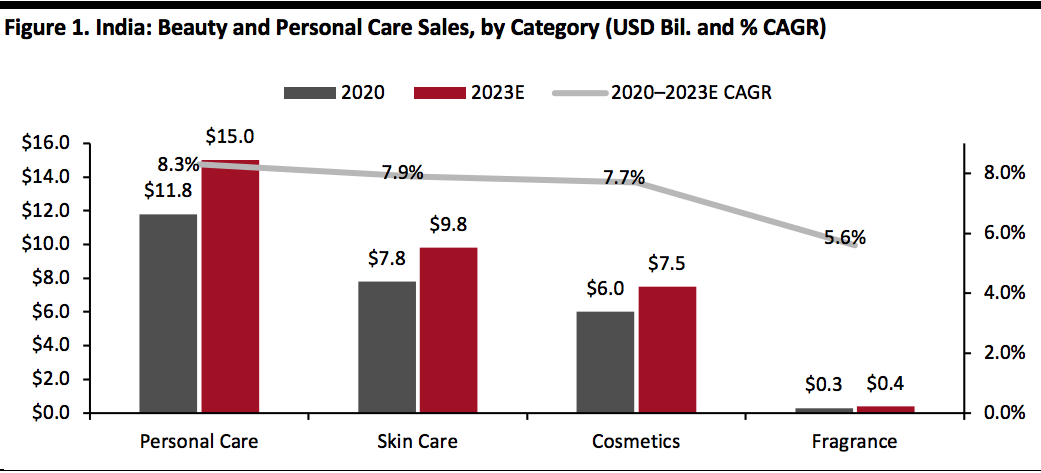

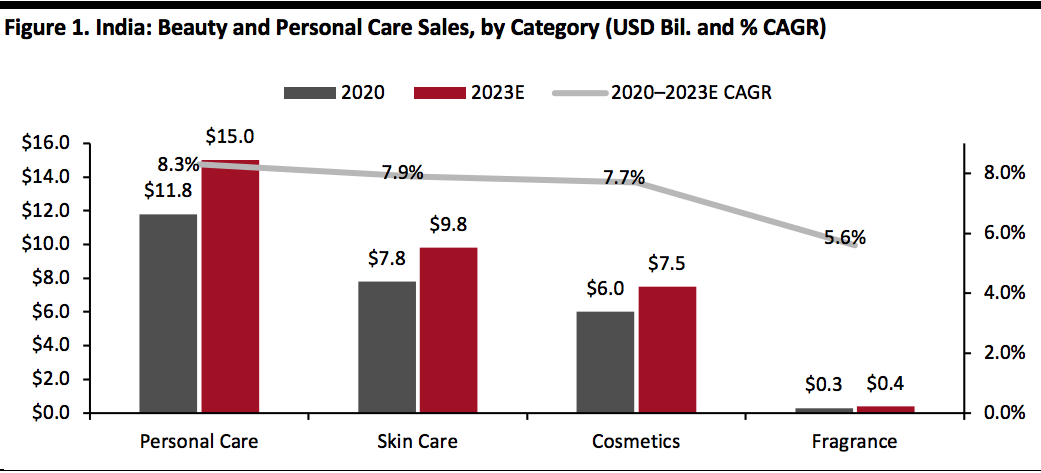

The Indian BPC market will amount to an estimated $25.9 billion in 2020 and is projected to reach $32.7 billion by 2023, representing a CAGR of 8.1%, according to Statista. The data show that the Indian beauty market is growing almost twice as fast as that of the US, which is projected to grow at a CAGR of 4.4% during 2020–2023.- Personal care remains the largest category in the Indian beauty market, valued at $11.8 billion or 46% of total sales. This category is expected to reach $15.0 billion by 2023, growing at a CAGR of 8.3%.

- Skin care and cosmetics are valued at $7.8 billion and $6.0 billion respectively, as of May 2020. Sales of skin care are expected to grow at a CAGR of 7.9% to 2023, while sales of cosmetics will increase at a 7.7% CAGR in the same timeframe.

- The fragrance category accounts for a very small proportion of India’s overall BPC market, amounting to just $0.3 billion in 2020. By comparison, the fragrance category in the US is set to be worth $7.9 million this year, but it will see only a 3.5% CAGR during 2020–2023. The Indian fragrance segment, on the other hand, is projected to grow at a CAGR of 5.6%—indicating a substantial opportunity in India.

Estimated before the impact of the coronavirus outbreak

Estimated before the impact of the coronavirus outbreakSource: Statista[/caption]

Key Growth Drivers and Segments in the Indian BPC Market

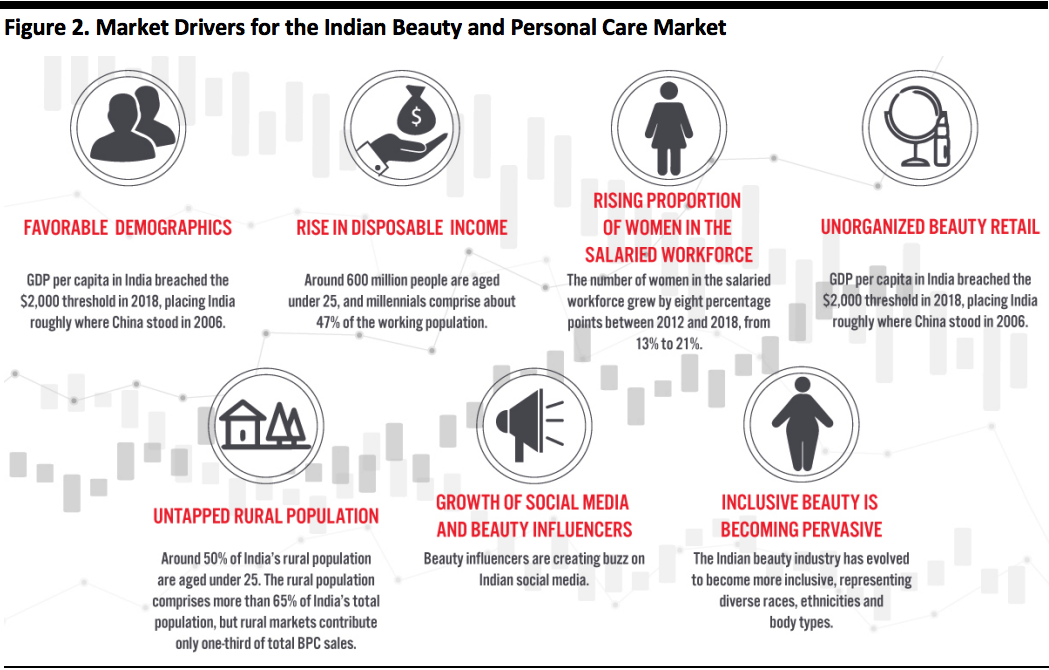

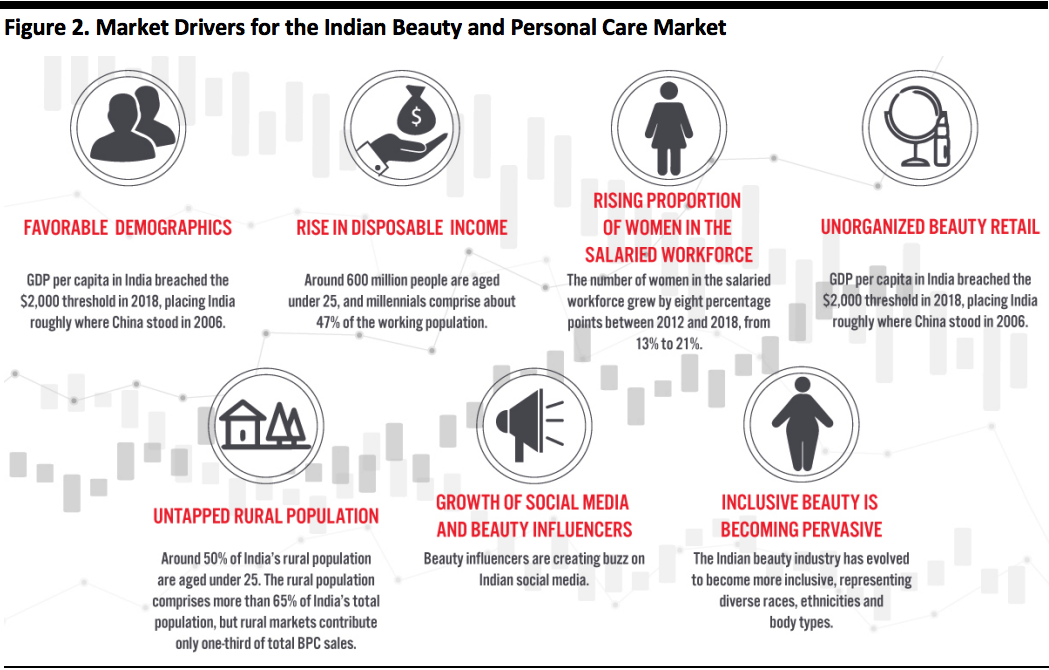

We believe that the growth in the Indian BPC industry will be driven by a number of factors, as shown in Figure 2. [caption id="attachment_111697" align="aligncenter" width="700"] Source: Economic Survey of India 2019–20, Ministry of Finance/World Bank/IBHA/Deloitte/RAI[/caption]

[caption id="attachment_111698" align="aligncenter" width="700"]

Source: Economic Survey of India 2019–20, Ministry of Finance/World Bank/IBHA/Deloitte/RAI[/caption]

[caption id="attachment_111698" align="aligncenter" width="700"] Source: IBEF/Statista/KPMG/ASSOCHAM, India[/caption]

Below, we discuss the growth drivers in more detail:

Source: IBEF/Statista/KPMG/ASSOCHAM, India[/caption]

Below, we discuss the growth drivers in more detail:

- Favorable Indian demographic and a rise in disposable income—India has the world’s largest youth population, with nearly 600 million people aged under 25, and millennials comprise about 47% of the working population, according to a 2018 report from Deloitte and the Retailers Association of India. The rise in the income of the Indian middle-class population has propelled demand for beauty products. GDP per capita in India breached the $2,000 threshold in 2018, placing India roughly where China stood in 2006. Between 2006 and 2018, China’s GDP grew at a CAGR of 13%, reaching $9,770 in 2018, according to the World Bank national accounts data. As was the case in China, India’s new middle class is quickly taking to premium beauty. Although India’s per capita spend on BPC is significantly lower than many developed nations—such as China, the UK and the US—it remains in line with India’s GDP growth, according to the Indian Beauty & Hygiene Association (IBHA). The average revenue per capita in the Indian BPC market amounts to $18.81 in 2020, which is projected to increase to $23.03 by 2023, according to Statista.

- A rise in the salaried female workforce—More women are joining the workforce in India’s metropolitan areas and cities. The proportion of female employees in the salaried employees/regular wage category grew by eight percentage points between 2012 and 2018, from 13% to 21%, according to the Economic Survey 2019–20 conducted by the Indian government in early 2020. The use of beauty products has grown among working women who spend more of their time outside the home. As they are becoming more self-sufficient, they are not shying away from spending on higher-priced and good-quality beauty products. This is driving growth in the prestige cosmetics and fragrances subsector in India, which is projected to see a revenue CAGR of 8.4% during 2020–2023, according to Statista.

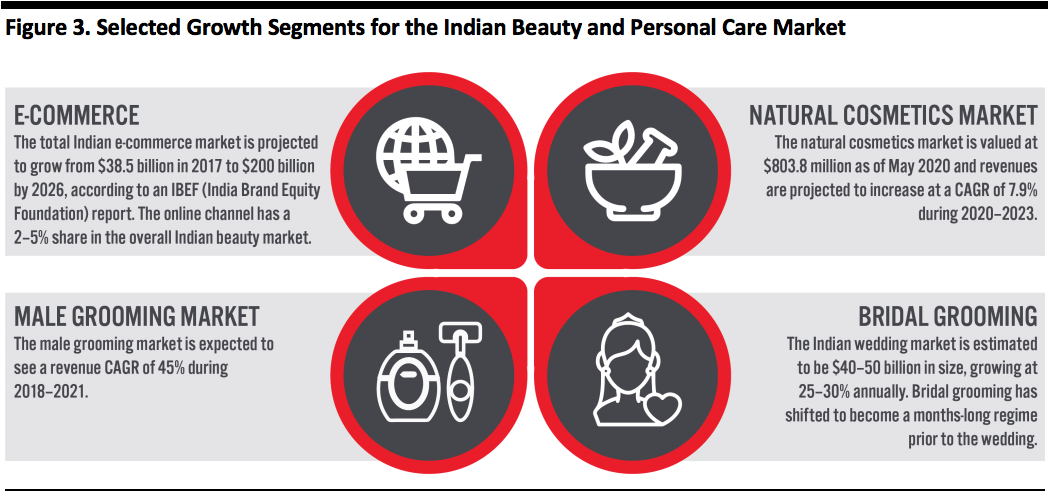

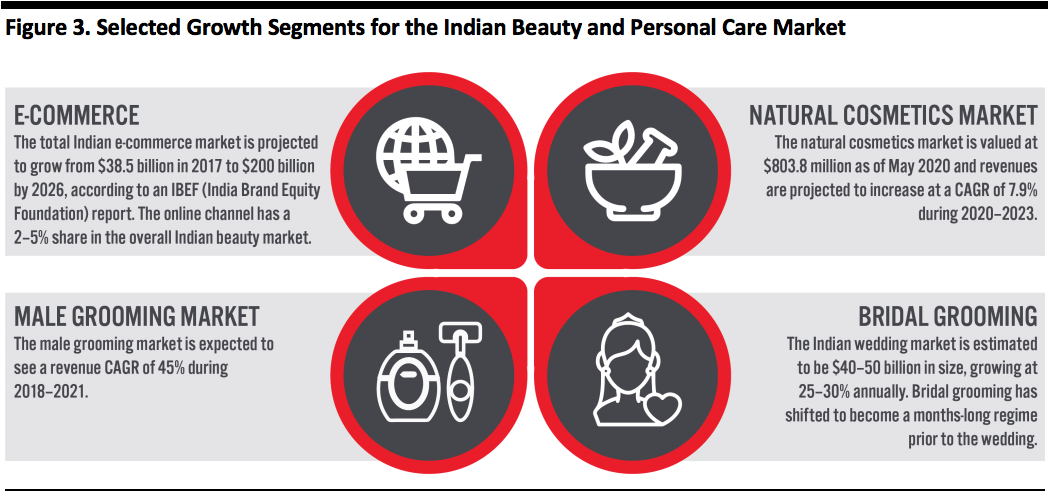

- E-commerce growth—India’s total e-commerce market is projected to grow from $38.5 billion in 2017 to $200 billion by 2026, according to an IBEF report. Much of that growth is being triggered by increasing Internet and smartphone penetration, with online beauty stores gradually becoming popular shopping destinations. The online channel has a 2–5% share of India’s beauty market, according to India-based consulting firm Redseer. However, this could grow rapidly in the near future, driven by increased Internet penetration in the country, growing demand for exclusive products and greater authenticity, as well as increased reliability in the supply chain. In 2018, the Indian BPC products category crossed $400 million in Internet sales, up from $100 million in 2014, according to Euromonitor International data cited by Livemint. India-based digitally native beauty retailer Nykaa owns a 33% share of the Indian online beauty market, with 3 million active users, according to Switzerland-based consulting firm Frederic Fernandez & Associates—which reported that Nykaa’s annual revenues increased from $10 million in fiscal year 2016 to $157 million in fiscal year 2019. The beauty retailer’s closest competitor is India-based direct-to-consumer beauty retailer Purplle, but by comparison, Nykaa offers a broader product range and has more followers, higher incoming traffic and higher annual revenues.Following in the footsteps of Nykaa, many e-commerce players, such as Amazon and Walmart-owned Flipkart, have recently entered India’s beauty market. In 2018, fashion e-tailer Myntra also entered the beauty sector. To penetrate tier 2 and tier 3 cities and towns, Myntra—as well as other online beauty players—have partnered with Kirana neighbourhood retail stores to act as delivery points. Furthermore, Alibaba-backed online grocery startup BigBasket entered the segment with a beauty private label in 2018.During L’Oréal’s earnings conference held in February 2020, global CEO Jean Paul Agon said, “Distribution for us in India was always a pain point, always a difficulty. We couldn't go as deep as some of our competitors could. E-commerce is changing everything. Now, with e-commerce in India, any Indian lady in any part of the country… can order [a beauty product] online, and it will be delivered to her. So, for us, it's a fantastic revolution. It changed completely the paradigm of deep distribution that was always a limitation to our business.”

- A rise in male grooming—The Indian male grooming industry is expected to see a revenue CAGR of 45% during 2018–2021, according to a 2018 report by the Associated Chambers of Commerce and Industry of India (ASSOCHAM). This represents a strong opportunity for brands and retailers.

- Rural markets remain untapped—The rural population comprises more than 65% of India’s total population. Despite rural markets witnessing the fastest growth in India (7.4% from 2014 to 2016), they contribute only one-third of the nation’s total BPC sales, according to a 2017 report from IBHA. However, rural consumers have started mirroring the urban lifestyle, bringing about a shift in preferences from homemade solutions to branded products. Furthermore, around 50% of the rural population is aged under 25—a large youth population that makes rural markets an attractive opportunity for beauty brands and retailers.

- Growth of beauty wellness—The Indian beauty market is evolving as consumers prioritize skin health and beauty wellness, with a focus on beauty ingredients and sourcing. The natural cosmetics market was valued at $803.8 million as of May 2020 and is projected to grow at a CAGR of 7.9% during 2020–2023, according to Statista. Natural, herbal and ayurvedic beauty brands are seeing strong growth. For example, luxury ayurvedic skincare and beauty brand Forest Essentials (a 40% stake of which is owned by Esteé Lauder) saw revenues increase at a CAGR of 28% during 2015–2018.

- Bridal grooming is a big market—The Indian wedding market is estimated to be $40–50 billion in size, growing at 25–30% annually, according to a KPMG report in 2017. In India, bridal grooming has shifted to a months-long regime prior to the wedding. Furthermore, apart from the bride and groom, their families, relatives and friends also willingly spend considerable time and money on grooming.

- Inclusive beauty is becoming more pervasive—The Indian beauty industry has evolved to become more inclusive, representing diverse races, ethnicities and body types. In February 2020, the Ministry of Health and Family Welfare drafted a Drugs and Magic Remedies (Objectionable Advertisements) (Amendment) Bill, 2020, which bans advertisements promoting skin-whitening creams and remedies of premature hair greying, among others. This marks huge progress, not only on a legislative front but also as an indicator of ongoing change in the beauty sector.

- Social media and beauty influencers—Beauty influencers are creating a buzz on Indian social media. For example, beauty YouTuber Shruti Arjun Anand, who posts makeup tutorials, has more than 7 million subscribers to her channel. UK-based Indian YouTuber Kaushal has more than 2 million subscribers on her channel and directs her content mainly towards Indian consumers; Kaushal’s Kylie Jenner-inspired makeup look posted in 2014) has gained over 11.1 million views on YouTube to date. The strong growth opportunities in the Indian BPC sector are luring numerous international brands and retailers, but entering the market is not without challenges. Firstly, India has a very diverse consumer base—every state in the country experiences niche product demand and sub-trends. Indian consumers are also value-conscious and extremely demanding with regard to quality and experience. While they are willing to experiment, they tend to stick to a brand that works well for them. Furthermore, international beauty brands and retailers looking to enter India must compete with well-established domestic brands that have a large online following. For example, Nykaa’s “Beauty Book” blog features beauty tutorials and has over 339,000 followers; the retailer’s YouTube channel has more than 900,000 subscribers.

Competitive Landscape

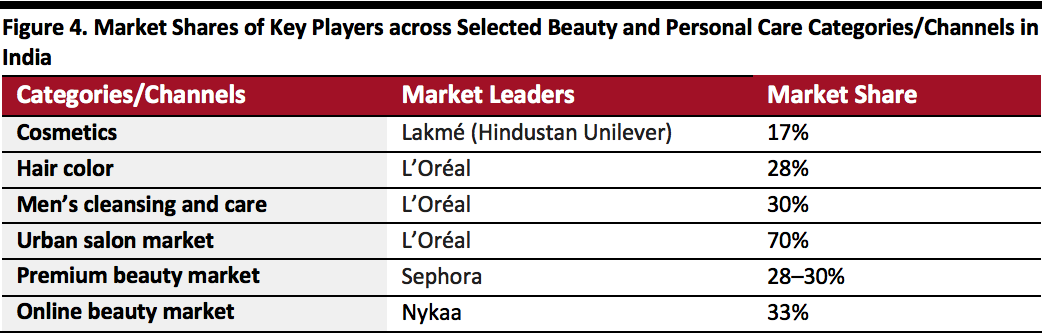

The Indian beauty retail industry has always been fragmented, be it online or offline. Nearly 70% of the sector remains unorganized, dominated by small Kirana or mom-and-pop stores. These Kirana stores are mainly used by Indian consumers to purchase daily care products such as soaps, shampoos, shaving kits and deodorants. Lakmé (owned by Hindustan Unilever, a subsidiary of Unilever) is the largest cosmetics brand in India, with annual revenues of more than $150 million. The brand has strong consumer reach, with about 25% of its stores located in tier 2+ cities in India. The spread of companies varies among India’s beauty categories. For example, international giants like Hindustan Unilever and Proctor & Gamble dominate generic categories such as hair care, bath and shower, and oral care, while the mass category is dominated by national and regional brands such as Axe, Colgate-Palmolive and Himalaya. The premium category primarily comprises international luxury brands and retailers, including Armani, Hugo Boss, L’Oréal and Sephora.International Beauty Brands and Retailers Look To Solidify Their Presence in India

India is increasingly adopting Western culture and cosmopolitanism. The presence of foreign brands and retailers is growing across products and services segments. The increased penetration of organized retail augurs well for the sales of foreign brands in India, which have introduced a range of customized products in recent years that meet the demand and skin types of Indian consumers. [caption id="attachment_111699" align="aligncenter" width="700"] Source: Company reports/Nielsen/Frederic Fernandez & Associates[/caption]

L’Oréal has been present in India since 1994, where it has grown at a CAGR of over 20% in the past 15 years. The brand registered comparable sales growth of 20% in 2018. Overall, it has the third-largest market share in the country, behind Hindustan Unilever and Colgate-Palmolive. L’Oréal is a leader in the hair color and men’s cleansing and care categories in India, with market shares of 28% and 30% respectively, according to the brand’s Chairman and CEO Jean-Paul Agon.

In the makeup category, L’Oréal holds the second position of largest market share behind Lakmé. According to L’Oréal, it is looking to gain share in India through innovation, digital play and communication rather than by lowering prices. Compared to Hindustan Unilever, L’Oréal’s distribution reach is narrow, it aims to engage with Indian consumers through online channels. Although its operations in India comprise only about 2% of the brand’s global business, the country has become its fastest-growing market. In the next five to 10 years, L’Oréal aims to double its number of customers in India, from about 100 million currently.

Estée Lauder has 586 stores across India, including 151 standalone stores plus shop-in-shops in partnership with Indian department-store chain Shoppers Stop. In March 2020, Estée Lauder-owned Smashbox launched the first India-exclusive lipstick Gula-Bae, a rose shade priced at ₹2,100 ($28) that was designed based on extensive market research to appeal to the personality, lifestyle and moods of the modern millennial Indian woman. Lipstick is the most regularly used makeup product by Indian women, making it a staple beauty category in India. Soon after the launch, India witnessed a total nationwide lockdown due to the coronavirus outbreak, so the Gula-Bae line is only now gaining exposure to the market as the lockdown eases and stores reopen. As part of the Gula-Bae lipstick campaign, Smashbox appointed its first brand ambassador in India, Sobhita Dhulipala, one of Netflix India’s most popular actresses. In November 2018, Estée Lauder appointed Bollywood actress Diana Penty as India’s first brand ambassador for the Estée Lauder brand, followed by Bollywood actress Radhika Apte for its Clinique brand in February 2019.

In an interview with WWD in May 2020, Rohan Vaziralli, General Manager and Country Head at The Estée Lauder Companies India, said, “While macro and nano influencers drive incredible engagement, mega influencers such as Bollywood celebrities are able to capture reach and drive deeper penetration and awareness at scale. To further accelerate our growth ambitions in [India], brand ambassadors are a strategic investment to drive brand awareness, deepen consumer coverage and drive desirability. The initial results have been very encouraging, with double-digit growth, increased consumer base and stronger regional penetration.”

[caption id="attachment_111700" align="aligncenter" width="700"]

Source: Company reports/Nielsen/Frederic Fernandez & Associates[/caption]

L’Oréal has been present in India since 1994, where it has grown at a CAGR of over 20% in the past 15 years. The brand registered comparable sales growth of 20% in 2018. Overall, it has the third-largest market share in the country, behind Hindustan Unilever and Colgate-Palmolive. L’Oréal is a leader in the hair color and men’s cleansing and care categories in India, with market shares of 28% and 30% respectively, according to the brand’s Chairman and CEO Jean-Paul Agon.

In the makeup category, L’Oréal holds the second position of largest market share behind Lakmé. According to L’Oréal, it is looking to gain share in India through innovation, digital play and communication rather than by lowering prices. Compared to Hindustan Unilever, L’Oréal’s distribution reach is narrow, it aims to engage with Indian consumers through online channels. Although its operations in India comprise only about 2% of the brand’s global business, the country has become its fastest-growing market. In the next five to 10 years, L’Oréal aims to double its number of customers in India, from about 100 million currently.

Estée Lauder has 586 stores across India, including 151 standalone stores plus shop-in-shops in partnership with Indian department-store chain Shoppers Stop. In March 2020, Estée Lauder-owned Smashbox launched the first India-exclusive lipstick Gula-Bae, a rose shade priced at ₹2,100 ($28) that was designed based on extensive market research to appeal to the personality, lifestyle and moods of the modern millennial Indian woman. Lipstick is the most regularly used makeup product by Indian women, making it a staple beauty category in India. Soon after the launch, India witnessed a total nationwide lockdown due to the coronavirus outbreak, so the Gula-Bae line is only now gaining exposure to the market as the lockdown eases and stores reopen. As part of the Gula-Bae lipstick campaign, Smashbox appointed its first brand ambassador in India, Sobhita Dhulipala, one of Netflix India’s most popular actresses. In November 2018, Estée Lauder appointed Bollywood actress Diana Penty as India’s first brand ambassador for the Estée Lauder brand, followed by Bollywood actress Radhika Apte for its Clinique brand in February 2019.

In an interview with WWD in May 2020, Rohan Vaziralli, General Manager and Country Head at The Estée Lauder Companies India, said, “While macro and nano influencers drive incredible engagement, mega influencers such as Bollywood celebrities are able to capture reach and drive deeper penetration and awareness at scale. To further accelerate our growth ambitions in [India], brand ambassadors are a strategic investment to drive brand awareness, deepen consumer coverage and drive desirability. The initial results have been very encouraging, with double-digit growth, increased consumer base and stronger regional penetration.”

[caption id="attachment_111700" align="aligncenter" width="700"] Smashbox’s India-exclusive lipstick with new brand ambassador Sobhita Dhulipala

Smashbox’s India-exclusive lipstick with new brand ambassador Sobhita DhulipalaSource: Sephora[/caption] LVMH-owned Sephora is growing its presence in the Indian beauty market. In 2018, the retailer’s revenues in the country grew by 70% year over year. As of November 23, 2019, the retailer operated 23 stores in India. Sephora aims to have 50 stores in India by 2022 and will then look to further expand its brick-and-mortar footprint to 75 locations within a few years. The retailer generates about 50% of its sales from metropolitan areas in India; however, it is planning to open its first boutiques in tier 2 and tier 3 cities, indicating that the appetite for premium beauty goes beyond the major and more affluent metropolitan areas. Sephora holds a 28–30% market share in the $1.2 billion Indian premium beauty market, according to Sephora India’s CEO Vivek Bali. Bali said that the premium category in India has grown at a CAGR of 18% over the last four years, while Sephora has registered a CAGR of 63% during the same period. A major chunk of the retailer’s customer base in the country comprises millennials and employed women. Sephora India has more than 470,000 followers on Instagram, representing its popularity, mainly among younger Indian audiences. [caption id="attachment_111701" align="aligncenter" width="700"]

Source: Sephora/Instagram[/caption]

Source: Sephora/Instagram[/caption]

How Has Coronavirus Impacted the Indian Beauty Industry?

The coronavirus disrupted both demand and supply in the Indian BPC industry. India imports beauty products, cosmetics and raw materials worth about $400 million every year from China, Germany, the UK and the US, among other markets. Lockdowns and order cancellations have disrupted this supply chain.- On the demand side, the sales of core personal care products—particularly hygiene products such as soaps, but also shampoos and facial cleansers—remained intact, but sales of cosmetics and fragrances dipped. Overall, the beauty and wellness segment saw revenues decline by about 75% year over year in May, according to the Retailers Association of India (RAI).

- Among the various beauty channels, the services sector—which includes salons, barber shops and spas—was hit the hardest by the pandemic. Salons and spas were forced by the government to temporarily close from March 21 onwards.

- As salons and spas begun to reopen in some parts of the country from early June, they are witnessing stronger-than-anticipated footfall: L’Oréal, which has a 58% share in the Indian salon segment, saw 70% of its pre-Covid revenues at reopened salons; India-based Enrich Salons witnessed 70–80% footfall compared to pre-crisis levels in the first 10 days of reopening; and another India-based salon chain, Green Trends, expects footfall to be equivalent to 60% of normal levels in the first month of reopening.

- During the lockdown, salon visits were among the top three activities that people missed the most, according to a May 2020 survey by India-based consulting and marketing research firm Redquanta. The survey found that 56% of female respondents expressed a keen interest in getting back to salons, while 57% of respondents said they would visit beauty salons post coronavirus as often as before.