Nitheesh NH

What’s the Story?

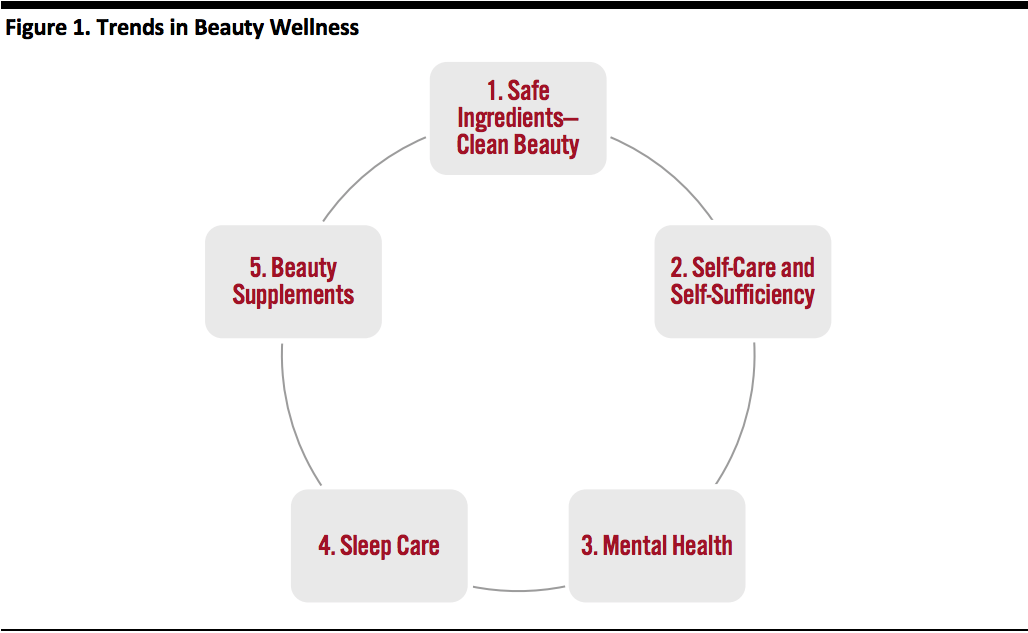

The Covid-19 pandemic has heightened consumer focus on good health as a sign of beauty wellness. Consumers are paying attention to the products and ingredients that they put on their skin, the foods that they eat and drink, their mental health and how they sleep. Beauty wellness encompasses the mind and body.Why It Matters

The global pandemic has changed the conversation on health and wellness, putting greater focus on the importance of good health and the fragility of life—for all demographics. Even prior to the crisis, is a fair to say that good health was deemed a sign of beauty and vitality; today more than ever, wellness and beauty are tied together, with the consumer prioritizing good health above all and emphasizing mental and physical wellness as a part of their beauty regimens. According to Statista, the US beauty and personal care market is projected to be $80.4 billion in 2020 and is expected to increase by a 4.4% CAGR to 2023. However, health and wellness are more directly influencing the beauty market, and these markets are becoming closer together and overlapping. This means two things for the future of beauty retail:- With the influence of health and wellness, we believe that beauty categories will expand to include other wellness categories, including sleep care and beauty supplements.

- We believe that the beauty and personal care market will become even larger, with retailers increasing their focus on the interconnectedness of the body—including mental health, sleep and nutrition—in addition to outer beauty, in order to support the beauty and skincare categories.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Consumers Are Seeking Safe Ingredients and Clean Beauty

Clean beauty is generally defined as products without harmful or toxic ingredients. While there is no official definition provided by the US Food and Drug Administration—or industry consensus on a definition—many brands provide transparent product labeling to outline ingredients, in order to build consumer trust. During Covid-19, consumers have been even more vigilant about ingredient safety in makeup and skincare products in particular. According to data gathered from payment company Klarna, Gen Z consumers have spent 26% more on clean beauty since the start of the pandemic. Some brands and retailers are now focusing on meeting interest in clean beauty as the trend gains momentum.- In August 2020, Sephora expanded its “Clean at Sephora” collection by adding makeup products. The retailer initially launched the line in 2018 as an affordable, clean beauty, private-label initiative: Its “Clean at Sephora” seal denotes that a product has been made without certain ingredients—such as parabens, sulfates, mineral oil, formaldehydes and coal tar. Sephora had also announced a partnership with a clean beauty retailer, Beautycounter, in June 2020, to offer a selection of its products on the Sephora website and in stores.

- In July 2020, Ulta Beauty announced the launch of “Conscious Beauty at Ulta,” reinforcing the retailer’s commitment to sustainability and transparency. The plan is set to launch this fall and will certify brands under five pillars: Clean Ingredients, Cruelty Free, Vegan, Sustainable Packaging and Positive Impact. Ulta Beauty also launched a partnership in June with Credo Beauty, a clean beauty retailer, which covers a collection of clean beauty brands.

2. The Rise of Consumer Self-Care Treatments and Self-Sufficiency

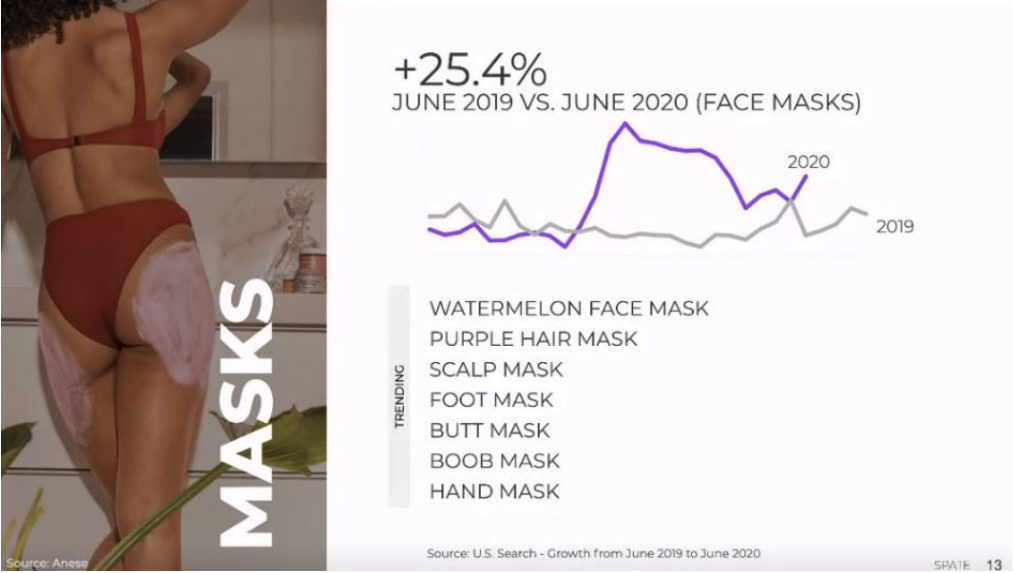

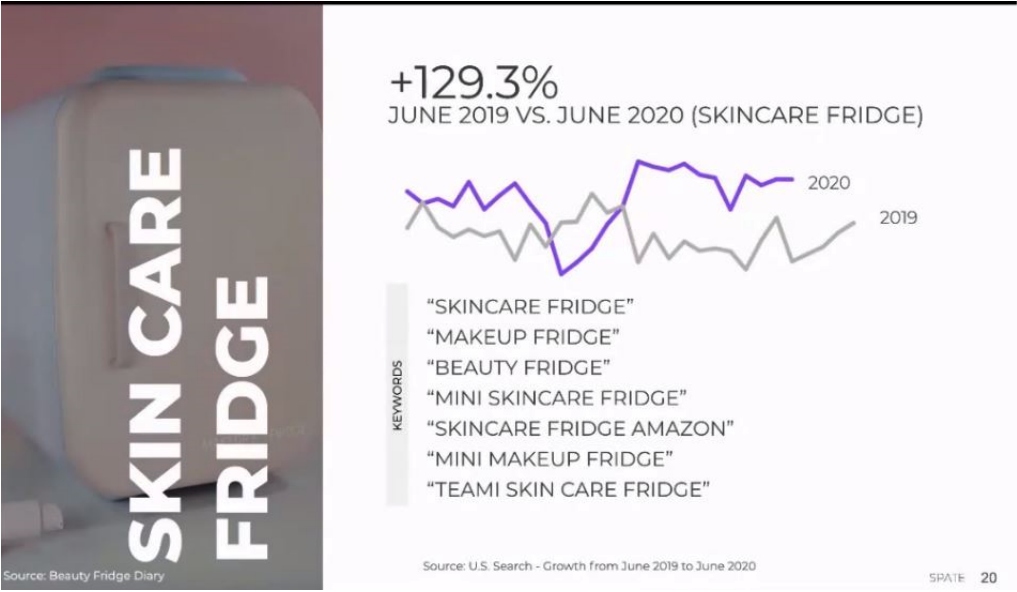

Consumers are taking beauty into their own hands, fueled by the pandemic. They are performing treatments at home that were once relegated for spas in their homes, and have become more comfortable with at-home hair color, masking, manicures and pedicures, as well as facials and skincare services and even waxing. While some salons have now reopened, many consumers are continuing with the self-sufficiency trend due to social distancing and financial reasons—plus, some spas are not offering full services yet, with restrictions on facial waxing in some states, for example.- At the Cosmetic Executive Women annual conference on July 21, 2020, data analysis company Spate presented its results from tracking over 10 billion online search signals in beauty and wellness to isolate consumer trends. The company identified the self-sufficiency trend (meaning consumers’ desire to take care of themselves) and found that the consumer is searching for beauty products and accompanying at-home equipment that would normally be utilized in a spa or salon—such as facial steamers, derma rollers (dual-purposed as beard enhancers) and skin-care fridges. Consumer searches for at home spa-related products, such as masks, also increased during the pandemic, as shown in the images below. These searches, Spate suggests, are evidence that the consumer is seeking to become more self-reliant in beauty at home.

Source: Spate[/caption]

[caption id="attachment_115536" align="aligncenter" width="600"]

Source: Spate[/caption]

[caption id="attachment_115536" align="aligncenter" width="600"] Source: Spate[/caption]

Source: Spate[/caption]

3. Growing Public Dialogue on Mental Health; Brands and Organizations Are Responding

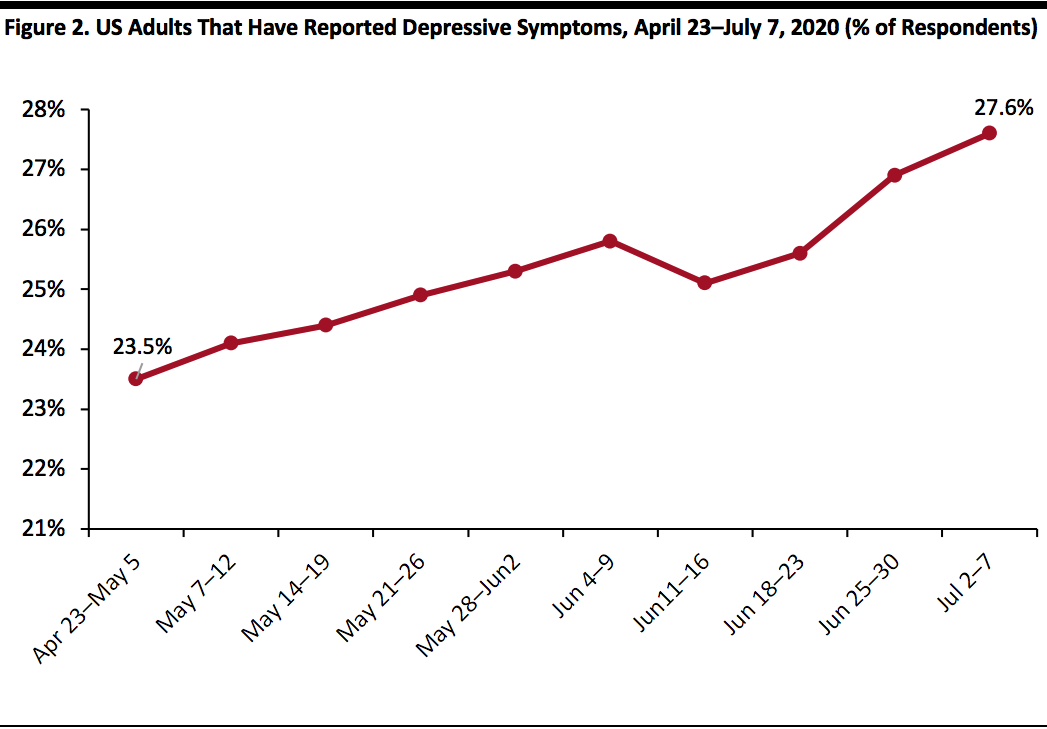

Consumers are recognizing the link between beauty and mental and emotional health: When we look good, we feel good. Mental health, a topic once kept private, is being destigmatized in today’s society due to a convergence of factors. The coronavirus pandemic has helped to further push mental health into the spotlight, with consumers expressing the impact of the crisis through public opinion polls and candid conversations, and celebrities are speaking out publicly on the topic through social media platforms. For example, in August 2020, former First Lady Michelle Obama expressed that she was experiencing “low-grade” depression. Around one in four American adults have reported depressive symptoms from April 23, 2020 through July 7, 2020, with the proportion steadily increasing over that period, according to a US Census Bureau survey (see Figure 3). [caption id="attachment_115537" align="aligncenter" width="700"] Base: 83,960 US Internet users aged 18+, surveyed April 23–July 7, 2020

Base: 83,960 US Internet users aged 18+, surveyed April 23–July 7, 2020Source: NCHS/US Census Bureau[/caption] Other celebrities are speaking out about their own challenges to help raise mental health awareness. Many influencers have cited their work with different organizations on the subject of mental health, including #wethriveinside with The Child Mind Institute (Emma Stone, Margot Robbie), The Mental Health Fund (Demi Lovato) and the BeyGOOD Initiative (Beyonce Knowles-Carter). Beauty and personal care brands are also making efforts to promote mental health, some of which we outline below:

- Selena Gomez, Founder of Rare Beauty, is launching a Rare Impact Beauty Fund to donate $100 million to help fight mental health problems associated with loneliness. The fund is projected to launch late summer 2020 and will last 10 years. It is to be funded by 1% of Rare Beauty sales in addition to outside partner funding. The company has also created the Rare Beauty Mental Health Council, which will help to guide its strategy. The council is composed of advisors from universities, organizations and companies focused on mental health. The Rare Beauty makeup brand is expected to launch on September 3, 2020 at Sephora and online at its brand website.

Source: Rareimpact.com[/caption]

Source: Rareimpact.com[/caption]

- British brand Rose & Caramel is launching a campaign to raise women’s self-esteem and mental health, “I TAN FOR ME.” The company was inspired by stories and photos from its fans of how its products have boosted individuals’ body confidence—such as by covering up skin blemishes caused by endometriosis. The campaign encourages customers to feel comfortable in their own skin and to be the best version of themselves. A social media campaign will be launched that prompts consumers to share before and after photos of using the product with their social networks. For each post shared, Rose & Caramel will donate £5 ($6.60) to mental health charity MIND.org.

4. Sleep Care Is a Growing Opportunity

Consumers are striving for a good night’s sleep—recognizing its benefits for mental acuity, performance, health and wellbeing. In beauty in particular, the restorative powers of a good night’s sleep are thought to decrease signs of aging, and can increase consumers’ satisfaction with their appearance; retailers are educating consumers about the benefits of sleep to restore collagen (a protein that helps skin keep its shape and health). We all produce less collagen after the age of 30, and environmental factors can also damage skin structure. Brands are getting into the beauty sleep market by launching products to support good sleep and increase collagen production.- Moon Juice is a brand that offers adaptogen blends, which are herbs and mushrooms formulated to combat stress. Moon Juice uses plants to “feed beauty and body from the inside out.” The brand’s Dream Dust is designed to be consumed—consumers can add one teaspoon of the product to their tea.

- Hum Nutrition’s Mighty Night is a softgel product that helps overnight cell renewal for the skin and body, helping to improve signs of aging, according to the brand.

Moon Juice Dream Dust; Hum Nutrition Mighty Night

Moon Juice Dream Dust; Hum Nutrition Mighty NightSource: Moonjuice.com/Sephora.com[/caption]

5. Nutritional Health: Beauty Supplements Are an Untapped Market

Consumer focus on nutritional health is on the rise—a category that comprises vitamins, supplements and ingestibles for health and wellness. A beauty ingestible is defined as a diet supplement that may contain vitamins and minerals, collagen and co-enzymes. The underlying theory is that supplements are beneficial to skin, hair, nails, nutrition and weight management. Over the past few years, beauty nutrition has been gaining traction as consumers are looking to enhance health, wellness and, ultimately, beauty—from the inside out. Daniela Ciocan, CEO and Founder of Unfiltered Experience, an experiential beauty and fashion trade show, told Coresight Research that while ingestibles and supplements had a slow start a few years ago, today’s consumers understand them. She predicts these products will trickle down to the masses. We are seeing more retailers dedicate retail space to powders, pills and gummies that promote skin and health benefits.- Forma, parent company of makeup brand Morphe, is set to launch its Such Good Everything wellness line in September 2020. According to the company’s website, the gummies are vegan and were created for “people overwhelmed by endless wellness choices and information. These yummy vegan gummies make it easy to get the good stuff for a great price (under $20 for a 30-day supply).” The vegan gummies will be available for skin, sleep, belly and hair.

Such Good Everything

Such Good EverythingSource: Formabrands.com[/caption]

What We Think

The Covid-19 pandemic has accelerated health and wellness trends in beauty, further blurring the lines between the categories. It has created a fundamental shift to health as a top priority for all consumers globally. We see an expansion in the beauty category, focusing not just on exterior beauty but also on mental, emotional and nutritional well-being and their impacts on the body.- We estimate beauty health and wellness—which includes clean beauty, sleep care and beauty supplements—to be a $7 billion industry in 2020 and project that it will grow to around $9 billion by 2025.

- We expect that clean products will become the new normal and the consumer expectation going forward. This category will continue to expand.

- Retailers will seek opportunities to innovate in mental and emotional health and sleep care; these are newer areas of opportunity with untapped potential.

- As consumers recognize the benefits of nutritional supplements, we see this area growing rapidly, particularly in niche food-preference areas (such as vegan-friendly gummies).

- We expect beauty wellness to continue to expand rapidly. Helping the consumer to make the connection between health, wellness and beauty will be an important selling point for entrants into this market.