DIpil Das

What’s the Story?

Why It Matters

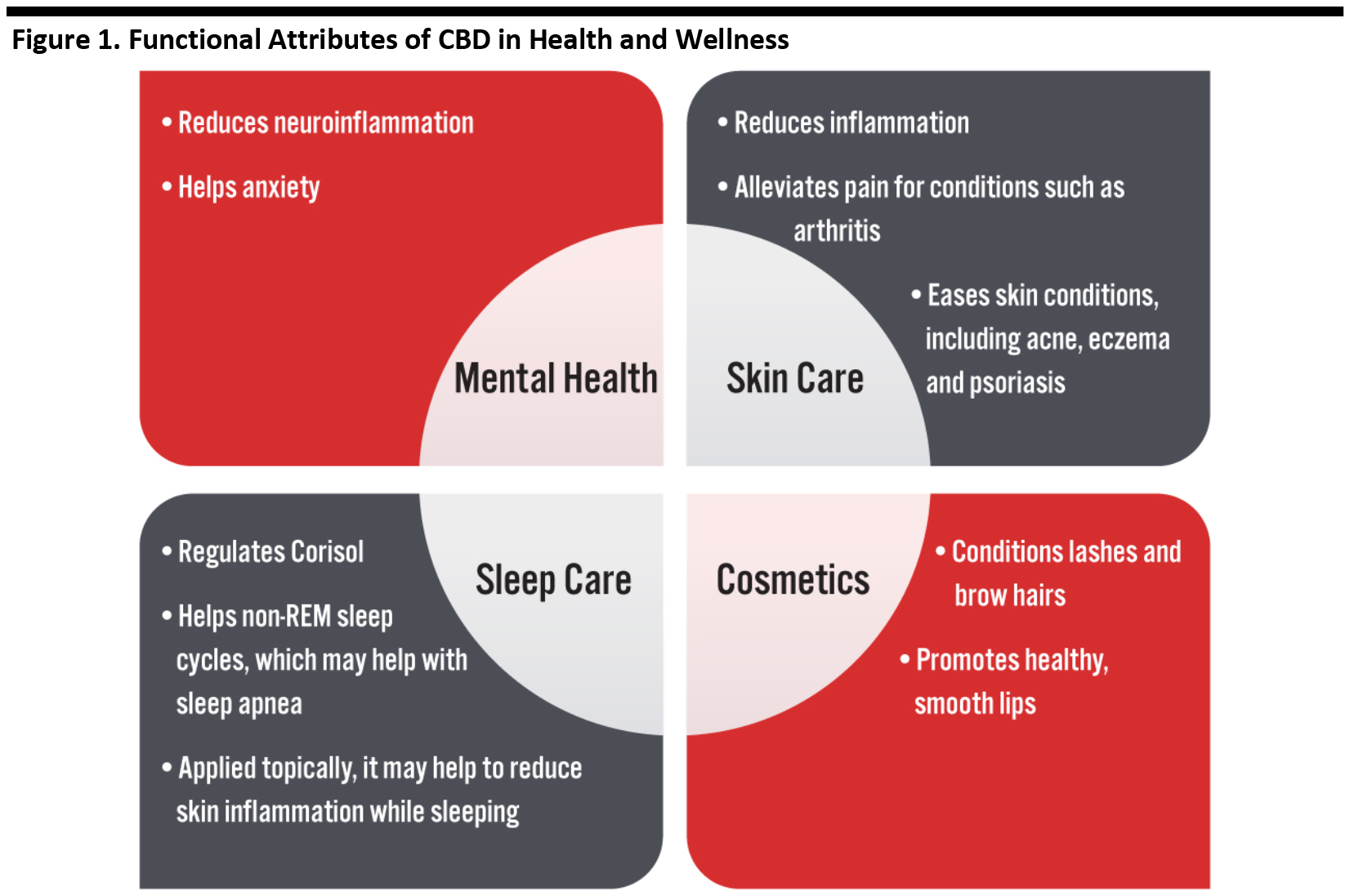

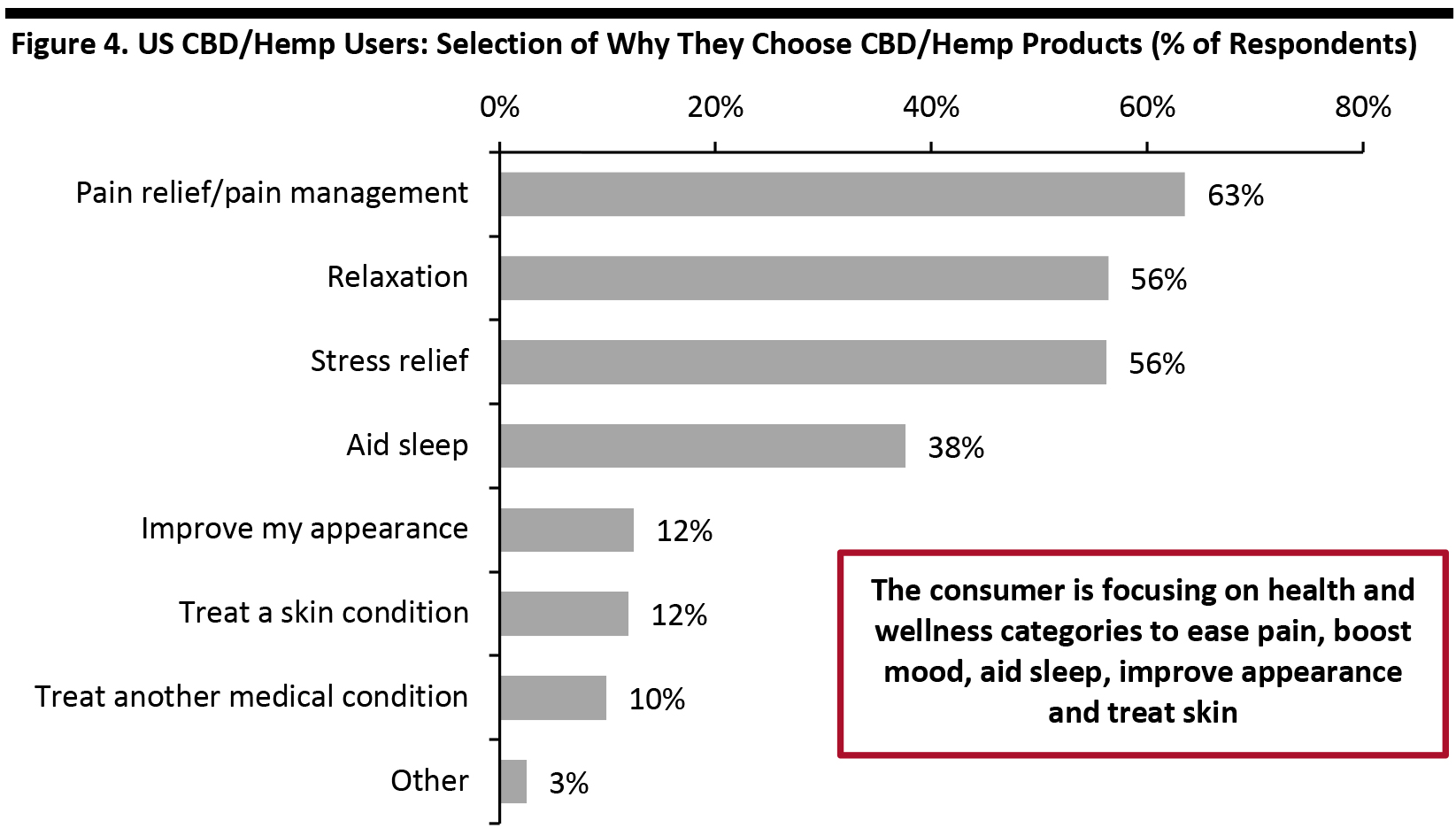

Due to the growth of health and wellness in beauty, there is an opportunity for brands and retailers to leverage CBD to enter the market or expand into more categories, due to the functional benefits that consumers are seeking in sleep care, skin care, beauty and even mental health. There are three primary reasons why CBD is one of biggest trends in beauty right now:- CBD is one of the fastest growing industries. There is an opportunity to educate all consumers on the product’s functional benefits, which span health and wellness product categories. Surveys suggest that consumers who use CBD products select it to ease pain/boost mood, aid sleep, improve appearance and treat skin.

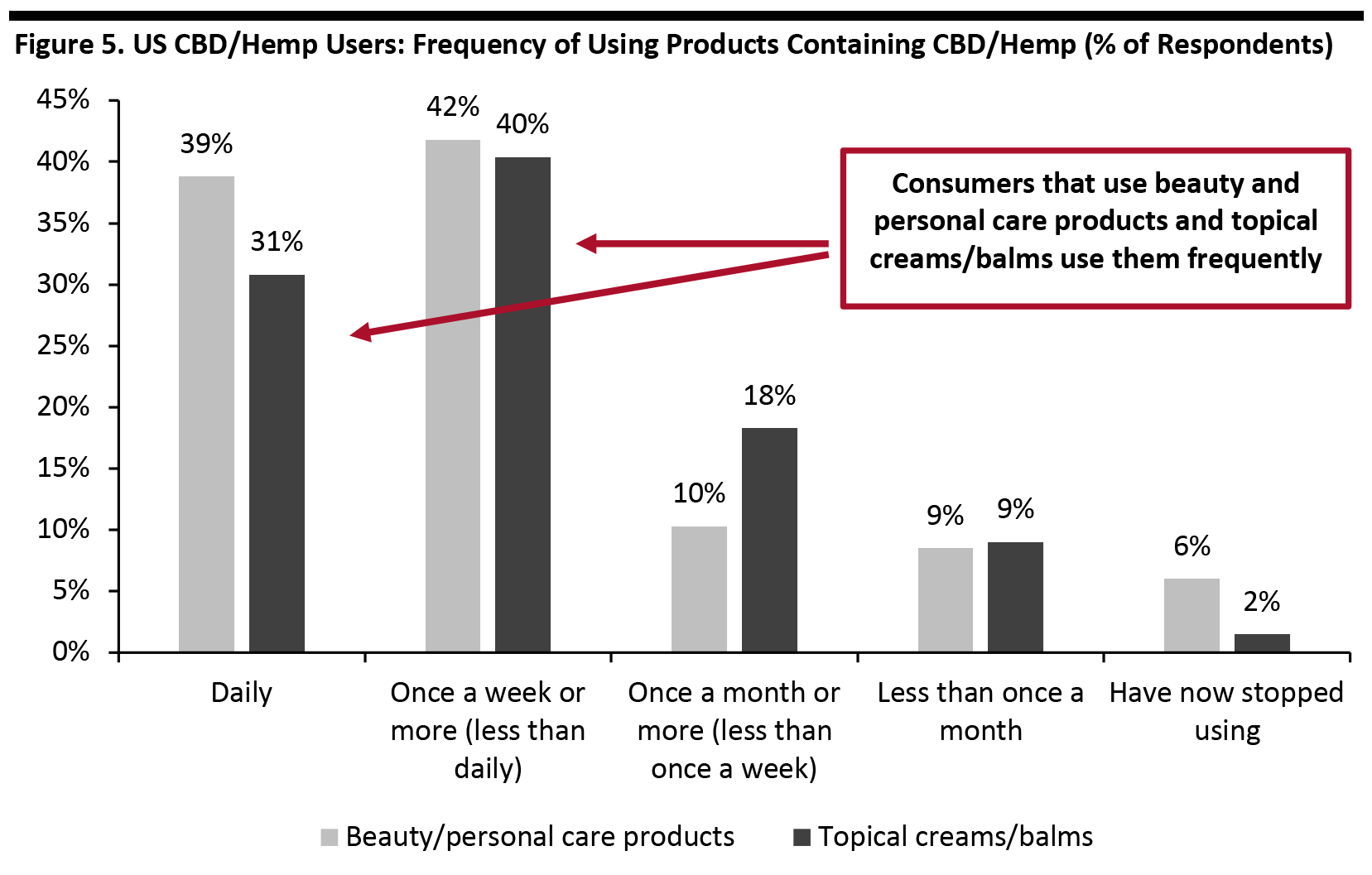

- The consumers that use CBD beauty and personal care products and topical cream/balms are frequent users. The opportunity for brands and retailers is therefore in educating the beauty consumer on the benefits of these products to attract new users, with data suggesting that consumers who are introduced to such products will use them regularly.

- Consumers are seeking CBD products from trusted retailers. There is a lot of white space for growth, with 2019 being an inaugural year for many major retailers in the market due to the passing of the Farm Bill in December 2018 (which we discuss later). This are still many opportunities for brands and retailers to enter the market—and the health and wellness space in particular.

CBD and Beauty

CBD’s Functional Attributes Support Consumer Prioritization of Health and Wellness in Beauty Health and wellness are becoming intertwined with beauty, and for a growing number of beauty shoppers, external beauty is seen as a reflection of internal good health—such as through healthy hair and a healthy complexion. Beauty has become as much about how one feels physically and mentally through nutrition, sleep and mental health as it is about products that help external appearance, such as makeup. This has been brought to light amid the Covid-19 pandemic, and consumers are prioritizing good health now more than ever. CBD is a chemical compound from the Cannabis sativa plant. It is a naturally occurring substance that is used in skin care, oils and edibles. It does not make consumers high (like THC does, which is found in marijuana). CBD has grabbed headlines for its claimed functional benefits on the skin, sleep and on one’s mood:- CBD is credited with helping with skin conditions due to its calming effects, and it may help reduce pain caused by inflammatory skin conditions; CBD is used for acne, psoriasis, skin dryness and eczema.

- Its antioxidant properties may help to counteract aging.

- Studies have shown that CBD may help to regulate cortisol, a stress hormone, which has an impact on non-REM sleep cycles. A case series review found that CBD is beneficial for anxiety-related disorders and enhances sleep.

- According to Mental Health Daily, CBD can help to improve mood, as neuroinflammation is linked with neuropsychiatric and mood disorders. Studies demonstrate that CBD improves mood, anxiety and cognitive function by helping to reduce this neuroinflammation.

- In June 2018, the US Federal Drug Administration approved the first drug that uses CBD for the treatment of seizures caused by two forms of epilepsy.

Source: Coresight Research[/caption]

There Is an Opportunity for Mainstream Retailers and Brands To Increase CBD Offerings

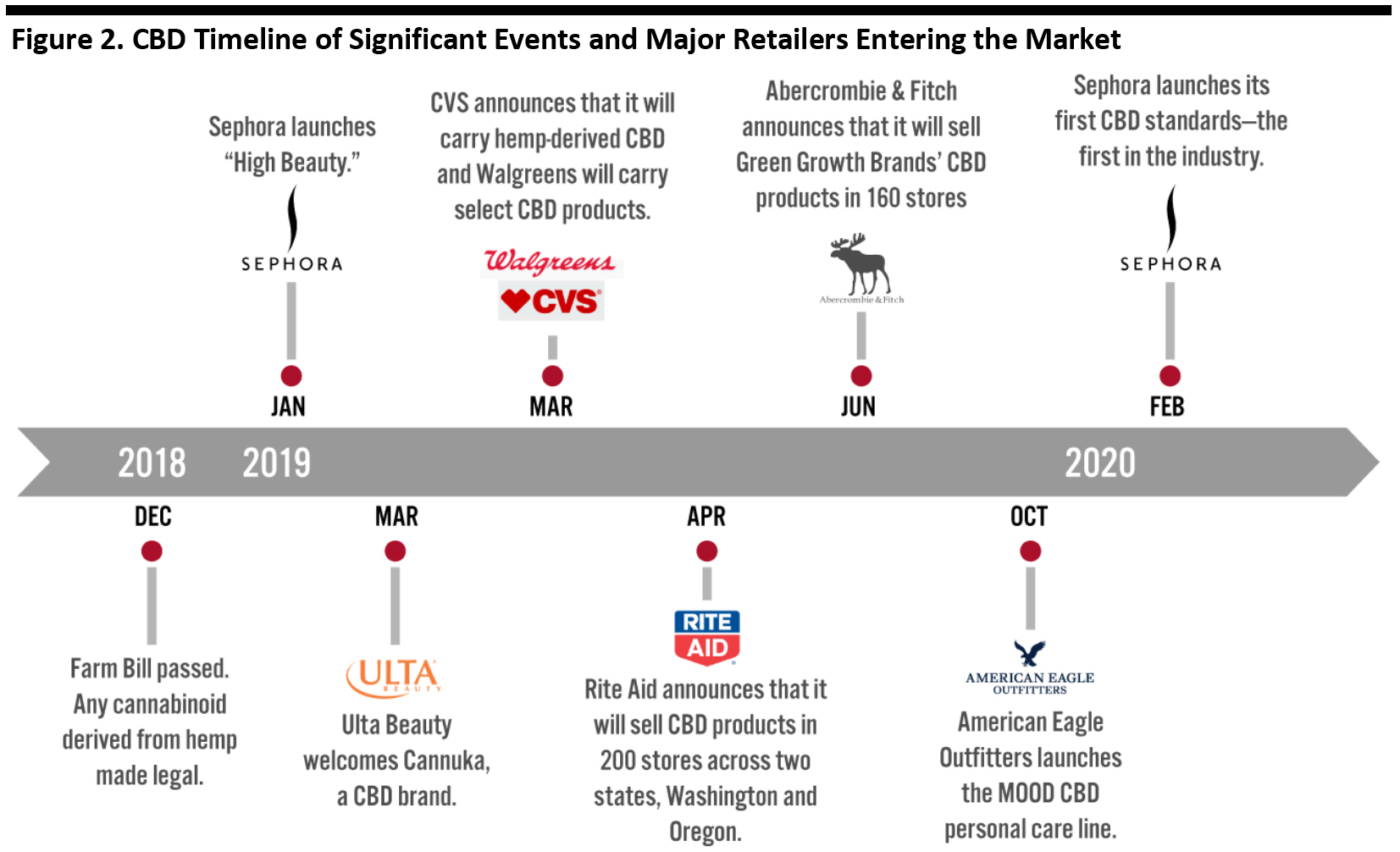

Over the past few years, there has been an increase of CBD products on the market, and mainstream retailers began to get in on the CBD beauty trend in 2019. The passage of the Farm Bill in December 2018 helped to open the door for retailers and brands to sell CBD products, because the bill legalized hemp and removed its designation as a Drug Enforcement Administration Schedule I controlled substance. (This applies to any part or derivative of the Cannabis sativa L. plant containing less than 0.3% tetrahydrocannabinol by weight. This definition includes hemp plants that produce the concentrated liquid extract known as cannabidiol (CBD) oil.)

The timeline below highlights key events that have impacted the CBD market, including the entry of major beauty retailers and drugstores. Sephora and Ulta Beauty each entered the CBD market in early 2019. In February 2020, Sephora launched the first industry CBD standards, which requires that the CBD products that it sells include only full-spectrum or broad-spectrum CBD, not isolate; source CBD from US-grown hemp; and be tested three times for quality and purity.

Major drugstores including CVS, Rite Aid and Walgreens entered into the market in 2019, but Target and Walmart are still not selling CBD. While the timeline does not designate their market entry, nearly all major department stores are also selling CBD products, including Bloomingdales, Macy’s, Nordstrom and Saks Fifth Avenue.

[caption id="attachment_116502" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

There Is an Opportunity for Mainstream Retailers and Brands To Increase CBD Offerings

Over the past few years, there has been an increase of CBD products on the market, and mainstream retailers began to get in on the CBD beauty trend in 2019. The passage of the Farm Bill in December 2018 helped to open the door for retailers and brands to sell CBD products, because the bill legalized hemp and removed its designation as a Drug Enforcement Administration Schedule I controlled substance. (This applies to any part or derivative of the Cannabis sativa L. plant containing less than 0.3% tetrahydrocannabinol by weight. This definition includes hemp plants that produce the concentrated liquid extract known as cannabidiol (CBD) oil.)

The timeline below highlights key events that have impacted the CBD market, including the entry of major beauty retailers and drugstores. Sephora and Ulta Beauty each entered the CBD market in early 2019. In February 2020, Sephora launched the first industry CBD standards, which requires that the CBD products that it sells include only full-spectrum or broad-spectrum CBD, not isolate; source CBD from US-grown hemp; and be tested three times for quality and purity.

Major drugstores including CVS, Rite Aid and Walgreens entered into the market in 2019, but Target and Walmart are still not selling CBD. While the timeline does not designate their market entry, nearly all major department stores are also selling CBD products, including Bloomingdales, Macy’s, Nordstrom and Saks Fifth Avenue.

[caption id="attachment_116502" align="aligncenter" width="700"] Source: Company reports[/caption]

While retailers have begun to offer CBD products, consumers are seeking more. According to Coresight Research’s survey of US CBD users in October/November 2019, 44% of respondents would like to see more CBD/hemp products from mainstream retailers, and 41% said that they prefer to buy CBD/hemp from trusted brands. There is an opportunity to educate the consumer on this growing category, as many do not fully understand CBD or its benefits and recommended usage. Underscoring this, Stephen Letourneau, Chief Brand Officer of luxury and honey-based CBD brand Cannuka, said at Cosmoprof 2019 that the most common question he receives from consumers is whether the products will make them high. He noted that consumer education is still one of the biggest opportunities for the industry.

The US CBD Health and Wellness Market Is Set To Grow to $1.0 Billion by 2025

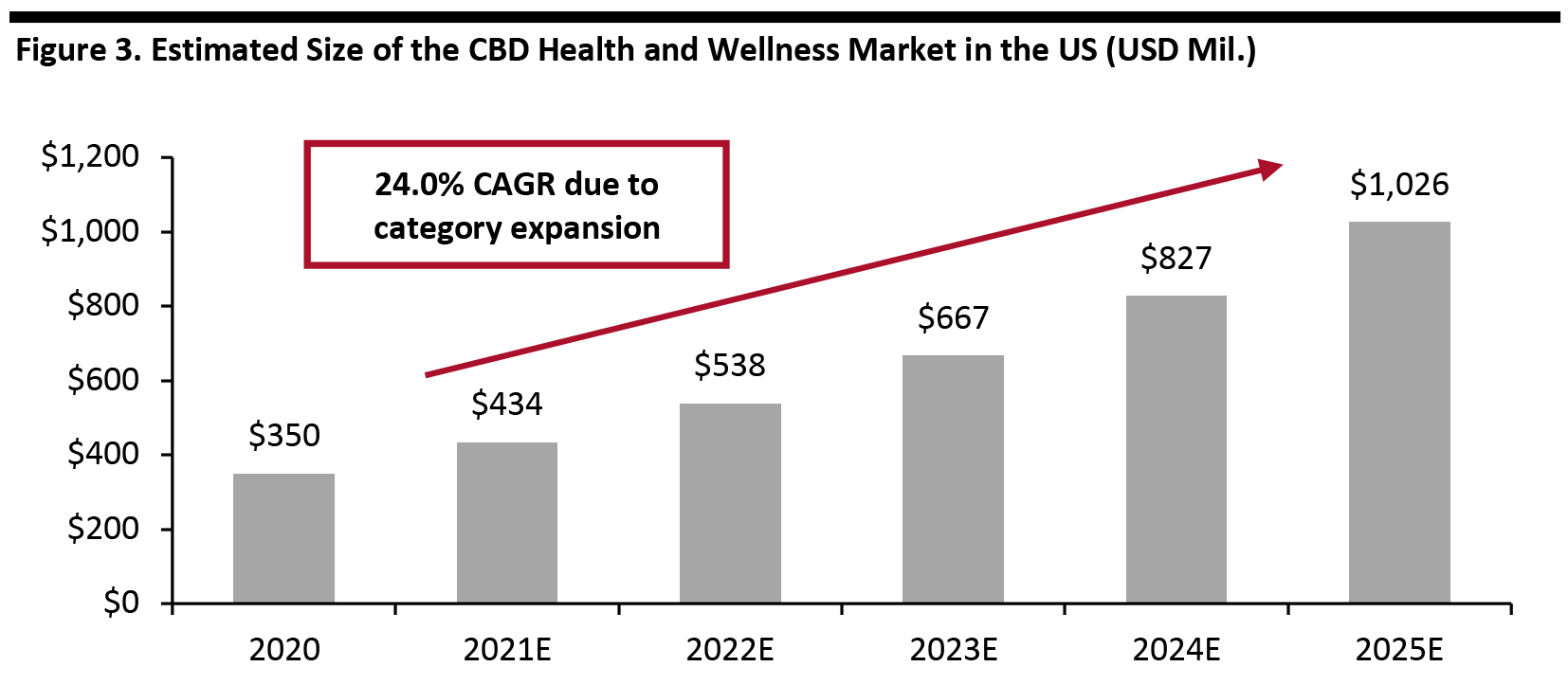

We expect CBD sales in the US beauty health and wellness market to increase from $350 million in 2020 to $1.0 billion by 2025 at a 24.0% CAGR, spanning the categories of skin care, cosmetics, sleep, nutrition and supplements. As health and wellness becomes more intertwined with beauty, we expect that consumers will continue to seek holistic approaches and products beyond traditional beauty products to ones that are solution-based and may help to ease physical symptoms.

[caption id="attachment_116503" align="aligncenter" width="700"]

Source: Company reports[/caption]

While retailers have begun to offer CBD products, consumers are seeking more. According to Coresight Research’s survey of US CBD users in October/November 2019, 44% of respondents would like to see more CBD/hemp products from mainstream retailers, and 41% said that they prefer to buy CBD/hemp from trusted brands. There is an opportunity to educate the consumer on this growing category, as many do not fully understand CBD or its benefits and recommended usage. Underscoring this, Stephen Letourneau, Chief Brand Officer of luxury and honey-based CBD brand Cannuka, said at Cosmoprof 2019 that the most common question he receives from consumers is whether the products will make them high. He noted that consumer education is still one of the biggest opportunities for the industry.

The US CBD Health and Wellness Market Is Set To Grow to $1.0 Billion by 2025

We expect CBD sales in the US beauty health and wellness market to increase from $350 million in 2020 to $1.0 billion by 2025 at a 24.0% CAGR, spanning the categories of skin care, cosmetics, sleep, nutrition and supplements. As health and wellness becomes more intertwined with beauty, we expect that consumers will continue to seek holistic approaches and products beyond traditional beauty products to ones that are solution-based and may help to ease physical symptoms.

[caption id="attachment_116503" align="aligncenter" width="700"] Market includes skin care, cosmetics and sleep

Market includes skin care, cosmetics and sleep Source: Coresight Research [/caption] Consumers Are Choosing CBD Products for Its “Calming” Properties, Spanning Mental Health, Sleep Care, Skin Care and Cosmetics In Coresight Research’s survey, we asked respondents why they used CBD/hemp products. We found that the US CBD consumer is choosing CBD for a variety of reasons, with the common denominator being its “calming” benefits—including easing pain, boosting mood, relieving stress, aiding sleep and treating skin, as shown in Figure 4. This underscores the opportunity within the health and wellness space: 63.5% of respondents use CBD products for pain relief/pain management, 56.4% for relaxation and 56.2% for stress relief. Our findings suggest that consumers are seeking the “lift” that CBD gives them both by easing pain and relieving stress and anxiety. There are therefore growth opportunities for products geared towards mental/emotional health. In addition, 37.6% of respondents reported that they are using CBD/hemp products to aid with sleep. As reported in a previous Beauty Insights report, sleep care is a growing market within the beauty retail space, as consumers are learning that good sleep has an impact on the skin’s appearance and helps to boost immune health. Finally, 12% of consumers are using CBD for their appearance and 12% to treat a skin condition—both of which support the growing CBD beauty and skincare categories. [caption id="attachment_116504" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: 920 US Internet users aged 18 and above who had used CBD/hemp in the past 12 months, surveyed in October/November 2019

Source: Coresight Research [/caption] Consumers That Use CBD Beauty Products Are Frequent Users; An Opportunity To Educate a Potentially High-Performing Consumer We asked US CBD consumers which categories they have used in the past 12 months: 18% had used beauty/personal care products, and 36% had used topical cream/balms. Of the users of beauty and personal care products containing CBD/hemp, 39% used the products daily and 42% used them once a week or more. This high-frequency usage is also true for topical creams and balms, with 31% of users reporting daily use and 40% reporting weekly use. While usage among consumers is relatively low, the frequency of usage by CBD consumers is high, which is important for two reasons. First, it means that this is a potential growth opportunity for retailers to attract new customers to the category through education. Secondly, our survey research indicates that consumers who are introduced to the product are using it regularly, making them high-value customers. [caption id="attachment_116505" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: 920 US Internet users aged 18 and above who had used CBD/hemp in the past 12 months, surveyed in October/November 2019

Source: Coresight Research [/caption] During the pandemic, beauty companies and retailers including Estee Lauder and Ulta Beauty are reporting that consumers are prioritizing skin care, with an increased emphasis on serums. Below, we present a few examples of CBD products within the beauty and personal care market that have high potential for frequent use:

- Lab to Beauty Quick Fix Serum is designed for the face and aims to reduce inflammation and smooth skin while tightening and firming. Its ingredients include hemp-derived CBD among other natural ingredients. It is vegan, cruelty-free, non-GMO and free from sulfates, phthalates, fragrances, silicones and gluten. Lab to Beauty participated in Alibaba’s Global 11.11 Pitch Fest on September 15, 2020 for a chance to sell on Tmall on Singles’ Day 2020. All judges said “yes” to the brand.

- Cannuka CBD Skin Balm is a face and body balm that claims to soothe skin and calm and correct extremely dry skin. Its ingredients include a combination of CBD and Manuka honey with rosehip oil and orange-peel butter.

- Milk Makeup’s Kush Mascara is a cosmetic product that the brand claims conditions and hydrates lashes. The formula includes cannabis seed oil and is also vegan, cruelty-free, gluten-free, talc-free and paraben-free.

Source: labtobeauty.com; cannuka.com; milkmakeup.com[/caption]

As more CBD beauty and personal care products are introduced to consumers across all health and wellness categories—including skin care, beauty, sleep care and mental wellness—they may incorporate these products into their daily and weekly routines. Our survey found that 55% of respondents reported benefits from using CBD/hemp products overall.

CBD Presents an Opportunity for Expansion into Sleep Care and Mental Health

Consumers are looking for more solution-based properties in their beauty products, and CBD could be an important growth category for beauty brands and retailers to expand laterally into health and wellness categories such as sleep care and mental health. Below, we highlight products from brands that are already in the CBD space in these categories:

Source: labtobeauty.com; cannuka.com; milkmakeup.com[/caption]

As more CBD beauty and personal care products are introduced to consumers across all health and wellness categories—including skin care, beauty, sleep care and mental wellness—they may incorporate these products into their daily and weekly routines. Our survey found that 55% of respondents reported benefits from using CBD/hemp products overall.

CBD Presents an Opportunity for Expansion into Sleep Care and Mental Health

Consumers are looking for more solution-based properties in their beauty products, and CBD could be an important growth category for beauty brands and retailers to expand laterally into health and wellness categories such as sleep care and mental health. Below, we highlight products from brands that are already in the CBD space in these categories:

- Uncle Bud’s Miss Bud’s CBD Night Time Nourishing Cream aims to revitalize and restore skin elasticity and energy during sleep. The product contains 60mg of CBD, hemp seed oil and is free from parabens and GMO. Uncle Bud’s participated in Alibaba’s Global 11.11 Pitch Fest on September 15, 2020 for a chance to sell on Tmall during Singles’ Day 2020. All judges said “yes” to the brand.

- Prima Night Magic Face Oil claims to soften, brighten and hydrate skin. It contains 300mg of CBD as well as phytonutrients and antioxidants including vitamins A, C and E, quecertin and zeatin. The product is part of the “Clean at Sephora” range and is vegan, cruelty-free, gluten-free, and comes in recyclable packaging.

- Charlotte’s Web CBD Gummies help to regulate sleep cycles as well as improve sleep quality, according to the brand. The gummies contain 10mg of CBD and 3mg of melatonin.

Source: unclebudshemp.com; charlottesweb.com; sephora.com[/caption]

Consumers are increasingly recognizing the link between mental health and beauty, and the coronavirus pandemic has helped to further push awareness of mental health. Consumers are seeking solutions to help ease anxiety, and beauty and personal care brands are promoting mental health. Preclinical evidence suggests that CBD may be a potential treatment for anxiety disorders, presenting a potential opportunity for brands and retailers to expand in the market and select CBD products that resonate with their brand’s image and customer base—such as CBD oils, drops, gummies or teas. Below, we present select examples in this category:

Source: unclebudshemp.com; charlottesweb.com; sephora.com[/caption]

Consumers are increasingly recognizing the link between mental health and beauty, and the coronavirus pandemic has helped to further push awareness of mental health. Consumers are seeking solutions to help ease anxiety, and beauty and personal care brands are promoting mental health. Preclinical evidence suggests that CBD may be a potential treatment for anxiety disorders, presenting a potential opportunity for brands and retailers to expand in the market and select CBD products that resonate with their brand’s image and customer base—such as CBD oils, drops, gummies or teas. Below, we present select examples in this category:

- Healist Calm Chews calm nerves, improve mood and optimize energy levels, according to the brand. The gummies are vegan, and ingredients include 20mg of CBD, organic ashwagandha, l-theanine and orange essential oil. They are all-natural, vegan, cruelty-free and non-GMO.

- Treaty Calm Tincture eases feelings of anxiety and enhances mood. The ingredients use hemp extract and terpenes such as limonene and myrcene.

- Prima Go-To Functional Powder helps activate and align the bodily systems that impact stress, mood, sleep and immunity. It is a dissolvable powder to be added to a drink. The product contains whole-plant hemp extract with naturally occurring CBD.

Source: standarddose.com; ourtreaty.com; standarddose.com[/caption]

Source: standarddose.com; ourtreaty.com; standarddose.com[/caption]