Nitheesh NH

This report is part of our Beauty Insights series, which explores prominent or emerging themes and trends in the global beauty market. In this report, we assess how global beauty brands are tapping growth in the airport retail market.

Data based on actual and estimated retail sales

Data based on actual and estimated retail sales

Source: Generation Research[/caption] Only selected product categories are shown

Only selected product categories are shown

Base: 900 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: Coresight Research[/caption] Source: L’Oréal[/caption]

Estée Lauder is seeing its travel retail business gaining traction, with a growth rate of 25-30% over the past few years, according to the company’s CEO Fabrizio Freda. Travel retail contributes over 20% of Estée Lauder’s total growth, half of which is generated from Chinese consumers. Chinese shoppers are therefore driving one-quarter of the company’s total sales, said CFO Tracey Thomas Travis at the Barclays Global Consumer Staples Conference in September. The company expects its travel retail business to remain a catalyst for growth, although it estimates that the growth rate will moderate in the near future.

To boost its travel retail business, Estée Lauder has been experimenting with innovative products and concepts. In August, the company introduced Advanced Night Repair Intense Reset Concentrate, an overnight treatment for irritated and stressed skin, across its travel retail locations worldwide. Estée Lauder claims that the treatment can remove the visible signs of skin irritation in just one hour and keep the skin nourished and hydrated for 24 hours, which may prove appealing for travelers.

According to Freda, only around 9% of Chinese citizens currently have a passport, and this is expected to increase to 20% in the next few years. He expects that this higher number of Chinese travelers will result in sales growth of Estée Lauder products in the coming years. The company has shifted its merchandise to pivot toward the preferences of Chinese consumers.

LVMH’s perfume and makeup brand Guerlain began investing in the travel retail business about three years ago. In 2018, Guerlain saw 34% growth in the travel retail sales category, which was more than double the brand’s overall growth rate. The brand expects travel sales growth to reach 32% in 2019, according to Elise Vanden Brande, worldwide director for Guerlain Travel Retail.

In December 2017, Guerlain launched its Guerlain Perfumeur pop-up store at Charles de Gaulle Airport in Paris. The brand then opened a permanent Guerlain Perfumeur store at the Beijing Capital International Airport in February 2019. To promote its fragrance portfolio, Guerlain is aiming to open 150 Guerlain Perfumeur stores in airports by 2025.

[caption id="attachment_99068" align="aligncenter" width="700"]

Source: L’Oréal[/caption]

Estée Lauder is seeing its travel retail business gaining traction, with a growth rate of 25-30% over the past few years, according to the company’s CEO Fabrizio Freda. Travel retail contributes over 20% of Estée Lauder’s total growth, half of which is generated from Chinese consumers. Chinese shoppers are therefore driving one-quarter of the company’s total sales, said CFO Tracey Thomas Travis at the Barclays Global Consumer Staples Conference in September. The company expects its travel retail business to remain a catalyst for growth, although it estimates that the growth rate will moderate in the near future.

To boost its travel retail business, Estée Lauder has been experimenting with innovative products and concepts. In August, the company introduced Advanced Night Repair Intense Reset Concentrate, an overnight treatment for irritated and stressed skin, across its travel retail locations worldwide. Estée Lauder claims that the treatment can remove the visible signs of skin irritation in just one hour and keep the skin nourished and hydrated for 24 hours, which may prove appealing for travelers.

According to Freda, only around 9% of Chinese citizens currently have a passport, and this is expected to increase to 20% in the next few years. He expects that this higher number of Chinese travelers will result in sales growth of Estée Lauder products in the coming years. The company has shifted its merchandise to pivot toward the preferences of Chinese consumers.

LVMH’s perfume and makeup brand Guerlain began investing in the travel retail business about three years ago. In 2018, Guerlain saw 34% growth in the travel retail sales category, which was more than double the brand’s overall growth rate. The brand expects travel sales growth to reach 32% in 2019, according to Elise Vanden Brande, worldwide director for Guerlain Travel Retail.

In December 2017, Guerlain launched its Guerlain Perfumeur pop-up store at Charles de Gaulle Airport in Paris. The brand then opened a permanent Guerlain Perfumeur store at the Beijing Capital International Airport in February 2019. To promote its fragrance portfolio, Guerlain is aiming to open 150 Guerlain Perfumeur stores in airports by 2025.

[caption id="attachment_99068" align="aligncenter" width="700"] Moët Hennessy travel retail boutique at Paris Charles de Gaulle Airport, France

Moët Hennessy travel retail boutique at Paris Charles de Gaulle Airport, France

Source: LVMH[/caption] Japan-based Shiseido Group witnessed a 20% increase in its travel retail sales in the second quarter of 2019, driven by its Shiseido and Clé de Peau Beauté beauty brands, makeup brand Nars and sunscreen brand Anessa. Shiseido Group has been innovating with pop-up stores. In early 2018, the company launched the Nars Lip Gallery pop-up at airports in China, Japan and Thailand. Nars Lip Gallery offers various gamification features, such as mobile augmented-reality features, interactive motion sensors and beauty demonstrations. The Nars Lip Gallery activation garnered more than 45 million impressions and 430,000 mobile click-throughs in 2018, according to Philippe Lesné, President and CEO of Shiseido Travel Retail.

Introduction: The Beauty Travel Retail Market Is Worth $32 Billion

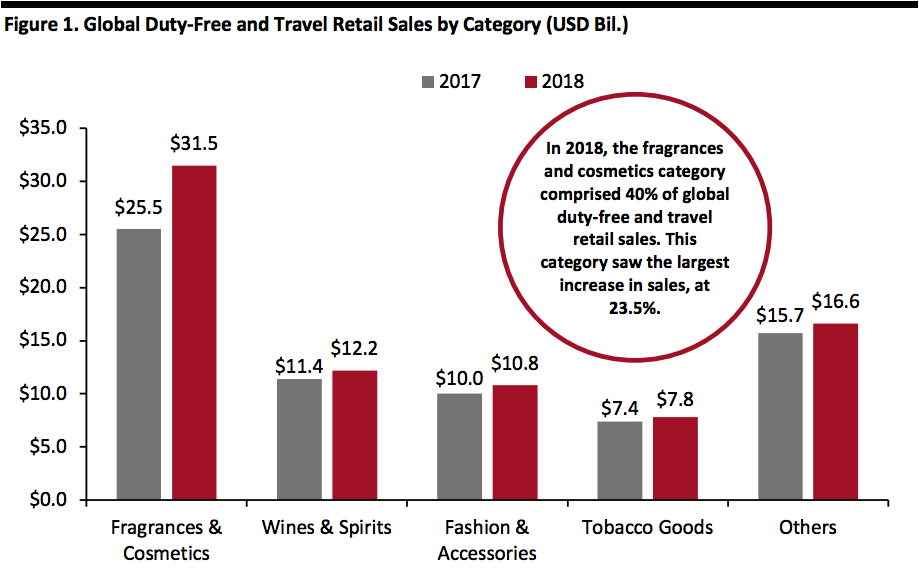

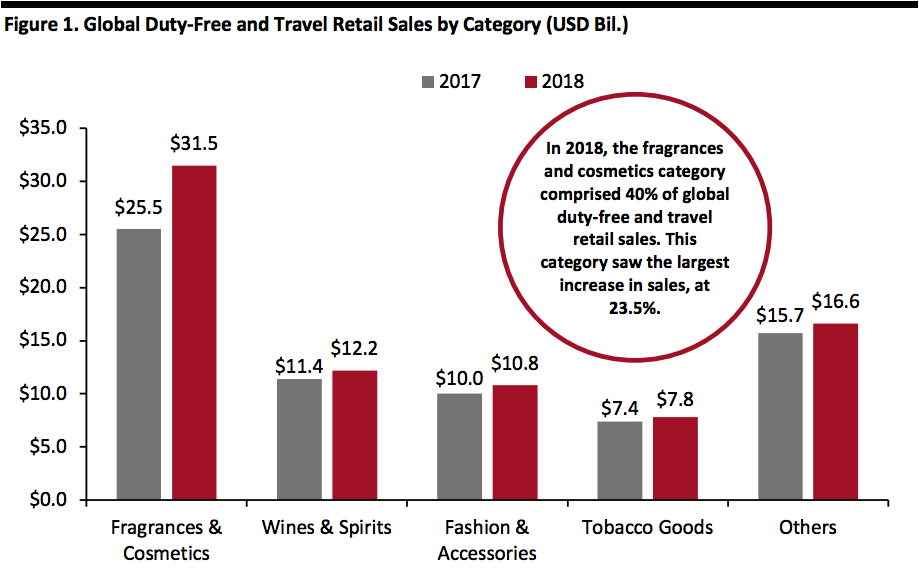

The global duty-free and travel retail market is witnessing robust growth, with sales increasing 12.9% year over year in 2018 to $78.96 billion, according to the travel retail statistics provider Generation Research. Last year, fragrances and cosmetics comprised the largest category, which was valued at $31.5 billion—40% of total sales. This category saw the biggest increase in sales, at 23.5%, primarily driven by 37% year-over-year growth in Asia. In addition, the fragrances and cosmetics category saw growth of over 15% in downtown and border duty-free stores (where travelers are required to show proof of travel to make a purchase, excluding shops at airports and on ferries).- Airport shop sales grew 9.3% year over year in 2018, contributing about 53% of global duty-free and travel retail sales. Other shops’ sales, which includes downtown and border duty-free stores, accounted for 41% of global sales, with the growth of 19.3% year over year. Airlines and ferries each amounted to 3% global sales.

- Duty-free and travel retail growth in Asia Pacific outperformed other regions, with sales growing at 23.3%, followed by the Middle East (6.2%), Europe (5%), Africa (3.7%) and Americas (2.2%).

Data based on actual and estimated retail sales

Data based on actual and estimated retail salesSource: Generation Research[/caption]

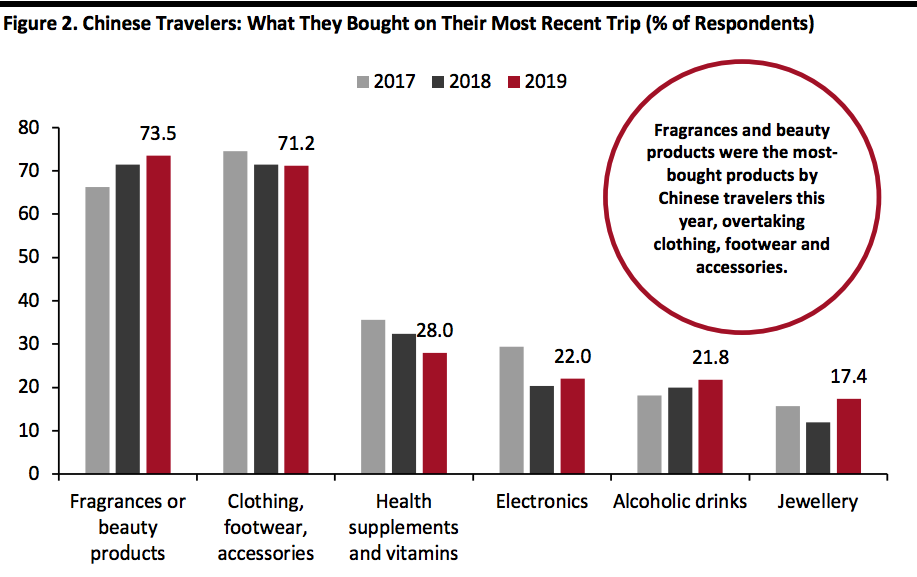

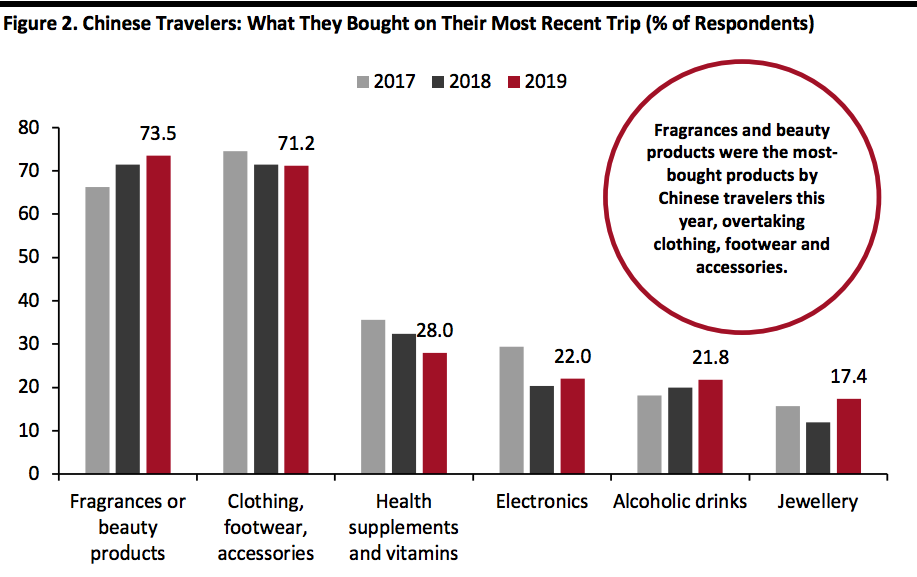

Chinese Travelers To Bolster Growth for Beauty Travel Retail Industry

Asian (particularly Chinese) travelers have helped to push travel retail to a new high, due to the growing middle-class demographic in China and the rising interest in travel among millennials. To cater to these travelers, low-cost airlines such as EasyJet and Ryanair have started additional flights to and from the region. We expect the number of outbound trips made by Chinese travelers to increase from 150 million in 2018 to 180 million in 2020. We estimate that Chinese tourists spent a total of $13 billion on beauty and wellness experiences (excluding products) in overseas markets in the 12 months ended August 2019. Our latest annual survey of the shopping behaviors and preferences of outbound Chinese tourists, published this week, found that fragrances and beauty products were the most-bought products by Chinese travelers on overseas trips in 2019, overtaking clothing, footwear and accessories. Around 73.5% of survey respondents said that they bought fragrances or beauty products on their most recent trip, while 71.2% had purchased clothing, footwear or accessories. As we can see in Figure 2, our annual survey has seen a consistent rise in the proportion of Chinese travelers buying beauty products over the past three years, unlike several other product categories. [caption id="attachment_99066" align="aligncenter" width="700"] Only selected product categories are shown

Only selected product categories are shownBase: 900 Internet users who had taken a trip outside Mainland China in the past 12 months

Source: Coresight Research[/caption]

Leading Beauty Brands Are Increasing their Presence in the Travel Retail Industry

L’Oréal offers 25 brands in the travel retail channel across Asia Pacific, Europe, the Middle East and North and South America. In 2018, the company posted €2.0 billion ($2.3 billion) in travel retail sales, which contributed to its best annual groupwide revenue growth in more than a decade. In the first half of 2019, L’Oréal’s travel retail sales increased 21.2% year over year, driving the company to an overall comparable sales growth of 7.3%. At the same time, Asia Pacific, a stronghold for the company’s travel retail success, posted total sales growth of 24.3% to €4.6 billion, surpassing Western Europe, which reported sales of €4.2 billion. L’Oréal reported that China is maintaining its growth rate, while India, Indonesia, Malaysia and Vietnam are posting double-digit growth. L’Oréal has opened Armani Box, Armani Beauty’s traveling pop-up store, across Asia’s top travel retail destinations. In September 2018, the company launched Armani Box at Singapore Changi Airport. In October 2019, Armani Box was unveiled at Hong Kong International Airport, and the company plans to open a store at Incheon International Airport, South Korea, by the end of 2019. In September this year, L’Oréal launched its first Armani Beauty store in India at Indira Gandhi International Airport, Delhi. The company plans to open the second store in India in early 2020, at Chhatrapati Shivaji Maharaj International Airport, Mumbai. L’Oréal’s Armani Box pop-up stores engage traveling customers with a series of interactive games that reveal the brand’s most popular beauty products. The stores also offer virtual reality makeup consultations where travelers can customize their purchases, and a vending machine that rewards shoppers with a mini red lipstick for completing their personalized beauty experience at the Armani Box. [caption id="attachment_99067" align="aligncenter" width="700"] Source: L’Oréal[/caption]

Estée Lauder is seeing its travel retail business gaining traction, with a growth rate of 25-30% over the past few years, according to the company’s CEO Fabrizio Freda. Travel retail contributes over 20% of Estée Lauder’s total growth, half of which is generated from Chinese consumers. Chinese shoppers are therefore driving one-quarter of the company’s total sales, said CFO Tracey Thomas Travis at the Barclays Global Consumer Staples Conference in September. The company expects its travel retail business to remain a catalyst for growth, although it estimates that the growth rate will moderate in the near future.

To boost its travel retail business, Estée Lauder has been experimenting with innovative products and concepts. In August, the company introduced Advanced Night Repair Intense Reset Concentrate, an overnight treatment for irritated and stressed skin, across its travel retail locations worldwide. Estée Lauder claims that the treatment can remove the visible signs of skin irritation in just one hour and keep the skin nourished and hydrated for 24 hours, which may prove appealing for travelers.

According to Freda, only around 9% of Chinese citizens currently have a passport, and this is expected to increase to 20% in the next few years. He expects that this higher number of Chinese travelers will result in sales growth of Estée Lauder products in the coming years. The company has shifted its merchandise to pivot toward the preferences of Chinese consumers.

LVMH’s perfume and makeup brand Guerlain began investing in the travel retail business about three years ago. In 2018, Guerlain saw 34% growth in the travel retail sales category, which was more than double the brand’s overall growth rate. The brand expects travel sales growth to reach 32% in 2019, according to Elise Vanden Brande, worldwide director for Guerlain Travel Retail.

In December 2017, Guerlain launched its Guerlain Perfumeur pop-up store at Charles de Gaulle Airport in Paris. The brand then opened a permanent Guerlain Perfumeur store at the Beijing Capital International Airport in February 2019. To promote its fragrance portfolio, Guerlain is aiming to open 150 Guerlain Perfumeur stores in airports by 2025.

[caption id="attachment_99068" align="aligncenter" width="700"]

Source: L’Oréal[/caption]

Estée Lauder is seeing its travel retail business gaining traction, with a growth rate of 25-30% over the past few years, according to the company’s CEO Fabrizio Freda. Travel retail contributes over 20% of Estée Lauder’s total growth, half of which is generated from Chinese consumers. Chinese shoppers are therefore driving one-quarter of the company’s total sales, said CFO Tracey Thomas Travis at the Barclays Global Consumer Staples Conference in September. The company expects its travel retail business to remain a catalyst for growth, although it estimates that the growth rate will moderate in the near future.

To boost its travel retail business, Estée Lauder has been experimenting with innovative products and concepts. In August, the company introduced Advanced Night Repair Intense Reset Concentrate, an overnight treatment for irritated and stressed skin, across its travel retail locations worldwide. Estée Lauder claims that the treatment can remove the visible signs of skin irritation in just one hour and keep the skin nourished and hydrated for 24 hours, which may prove appealing for travelers.

According to Freda, only around 9% of Chinese citizens currently have a passport, and this is expected to increase to 20% in the next few years. He expects that this higher number of Chinese travelers will result in sales growth of Estée Lauder products in the coming years. The company has shifted its merchandise to pivot toward the preferences of Chinese consumers.

LVMH’s perfume and makeup brand Guerlain began investing in the travel retail business about three years ago. In 2018, Guerlain saw 34% growth in the travel retail sales category, which was more than double the brand’s overall growth rate. The brand expects travel sales growth to reach 32% in 2019, according to Elise Vanden Brande, worldwide director for Guerlain Travel Retail.

In December 2017, Guerlain launched its Guerlain Perfumeur pop-up store at Charles de Gaulle Airport in Paris. The brand then opened a permanent Guerlain Perfumeur store at the Beijing Capital International Airport in February 2019. To promote its fragrance portfolio, Guerlain is aiming to open 150 Guerlain Perfumeur stores in airports by 2025.

[caption id="attachment_99068" align="aligncenter" width="700"] Moët Hennessy travel retail boutique at Paris Charles de Gaulle Airport, France

Moët Hennessy travel retail boutique at Paris Charles de Gaulle Airport, FranceSource: LVMH[/caption] Japan-based Shiseido Group witnessed a 20% increase in its travel retail sales in the second quarter of 2019, driven by its Shiseido and Clé de Peau Beauté beauty brands, makeup brand Nars and sunscreen brand Anessa. Shiseido Group has been innovating with pop-up stores. In early 2018, the company launched the Nars Lip Gallery pop-up at airports in China, Japan and Thailand. Nars Lip Gallery offers various gamification features, such as mobile augmented-reality features, interactive motion sensors and beauty demonstrations. The Nars Lip Gallery activation garnered more than 45 million impressions and 430,000 mobile click-throughs in 2018, according to Philippe Lesné, President and CEO of Shiseido Travel Retail.