Nitheesh NH

Our Beauty Insights series explores prominent or emerging themes and trends in the global beauty market. In this report, we assess the potential impact of the coronavirus on the beauty sector, focusing on global public companies that have a presence in China—including Estée Lauder, L'Oréal, LVMH (Sephora), and Shiseido. We discuss the size of the China beauty market for these companies and how their primary retail channels—online, offline and travel—are being affected by the outbreak.

The coronavirus—officially named COVID-19—is affecting every aspect of civilian and commercial life in China. The Chinese population has not been functioning at full capacity since the first case of the virus was diagnosed on December 31, 2019. It has so far claimed more than 1,370 lives, and over 66,000 individuals have been infected. In retail, the coronavirus has impacted the entire supply chain, including manufacturing and distribution, physical retail, e-commerce and travel retail.

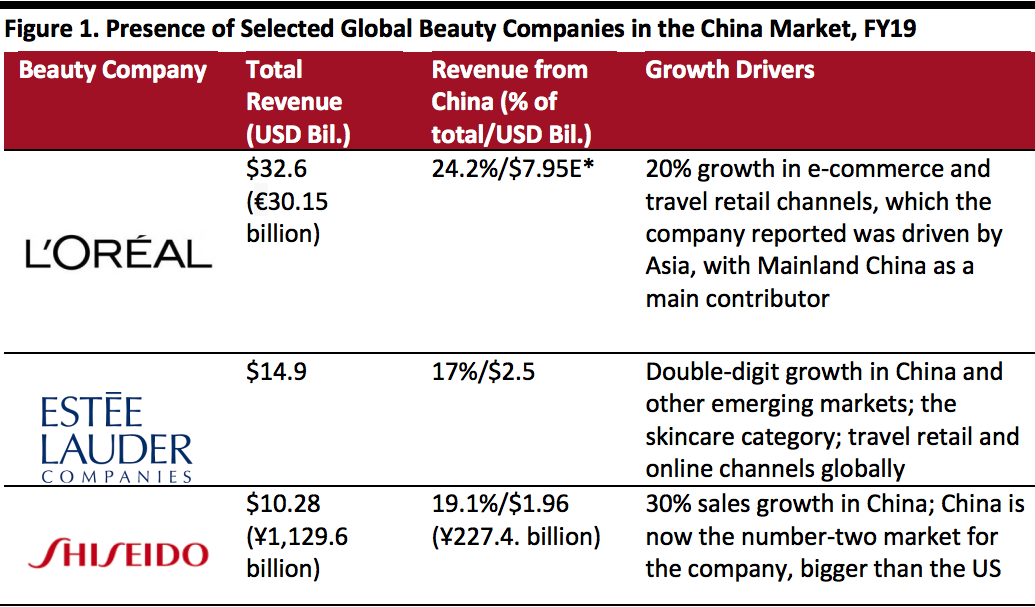

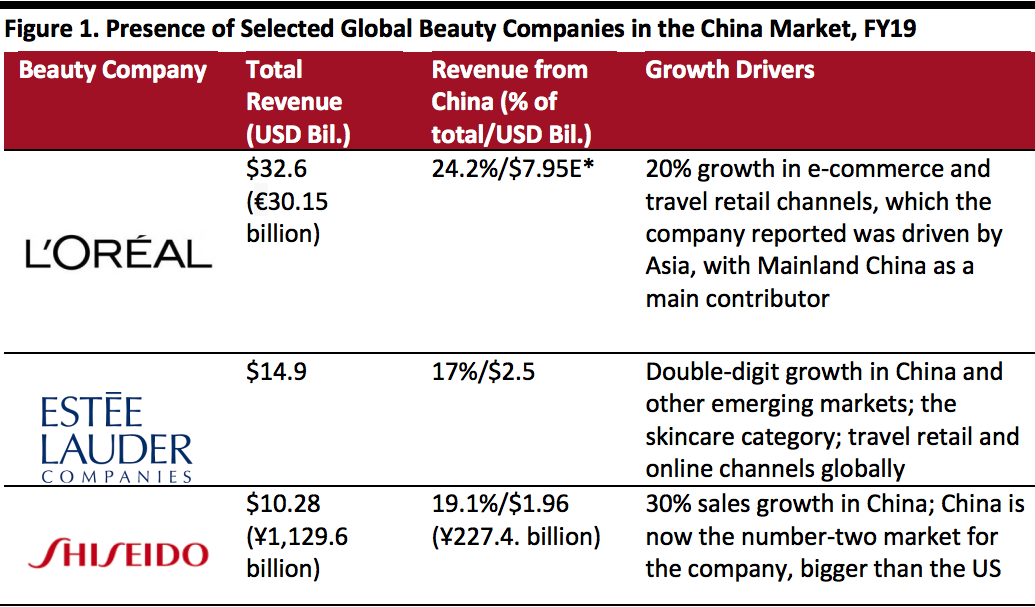

*Company does not break out China-only revenue; Coresight Research estimate based on China representing 75% of Asia-Pacific revenue (includes China, South Korea, India, Indonesia and Malaysia), which amounted to nearly $10.6 billion (€9.7 billion)—32.3% of L'Oréal’s total FY19 revenue.

*Company does not break out China-only revenue; Coresight Research estimate based on China representing 75% of Asia-Pacific revenue (includes China, South Korea, India, Indonesia and Malaysia), which amounted to nearly $10.6 billion (€9.7 billion)—32.3% of L'Oréal’s total FY19 revenue.

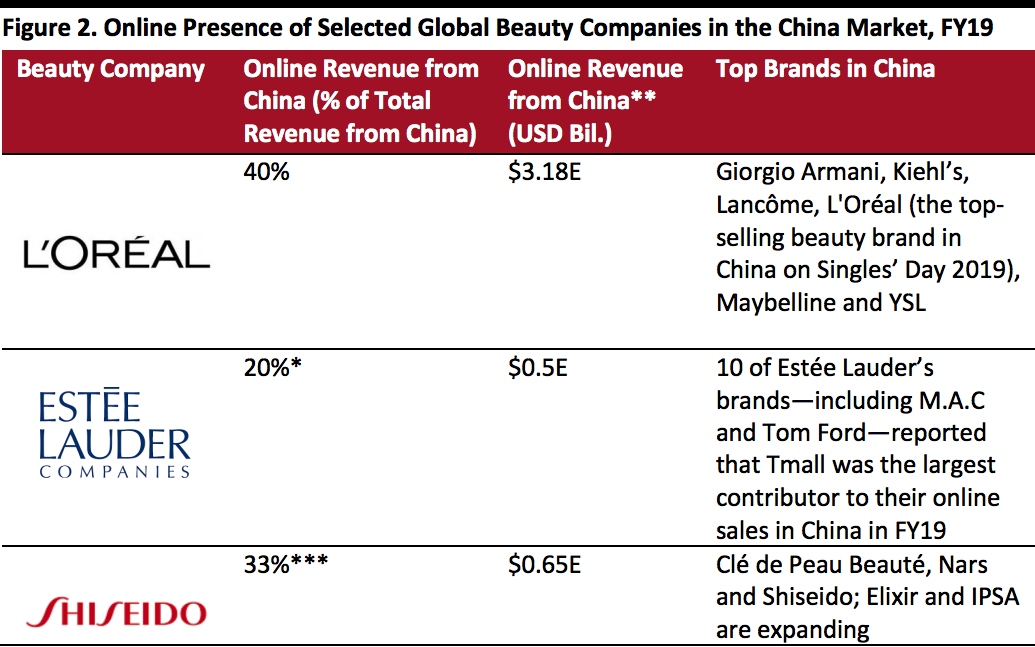

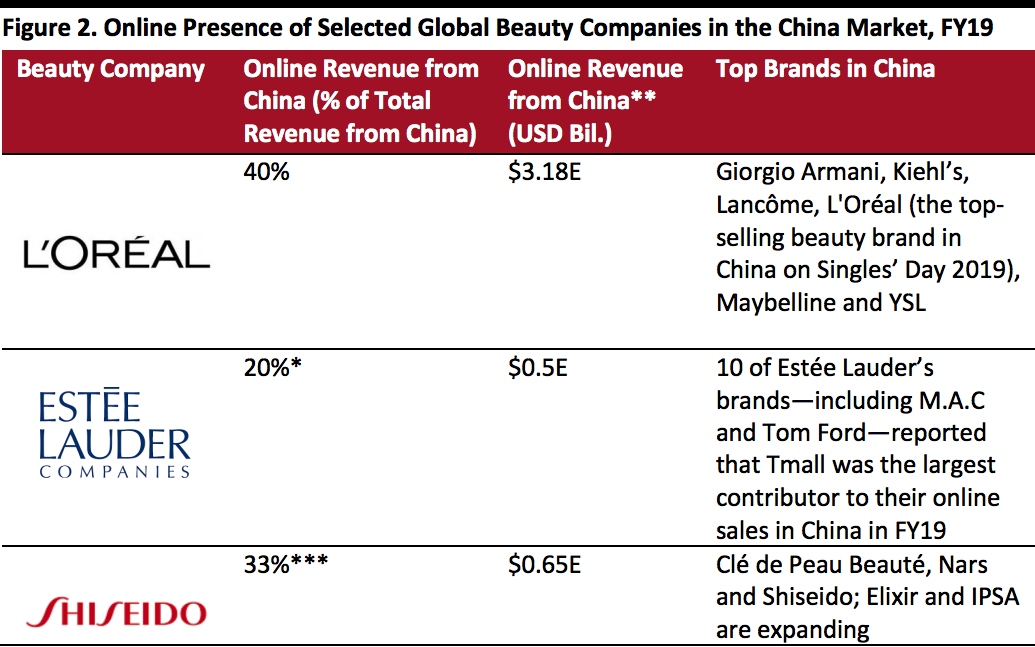

Source: Company reports/Coresight Research[/caption] *Company reported “double digits”; Coresight Research estimate based on brand exposure in China and peer estimates

*Company reported “double digits”; Coresight Research estimate based on brand exposure in China and peer estimates

**Coresight Research calculations based on online revenue from China as a percentage of total revenue from China (shown in figure 1)

Source: Company reports/CNBC/Coresight Research[/caption] The Detrimental Effect on the Beauty Travel Retail Segment in the Near Term Travel in and out of China has been heavily restricted by governments worldwide due to the coronavirus outbreak, which will have significant impacts for travel retail and tourism. Beauty travel retail is an estimated $32 billion industry according to statistics provider Generation Research. In 2019, Asian travelers boosted growth in global travel retail, with over with 74% of Chinese tourists purchasing fragrances and beauty products on overseas trips, according to a Coresight Research survey.

The Potential Overall Impact of the Coronavirus for Selected Global Beauty Companies For each of the three beauty companies discussed above, China represents between $1.96 billion and $7.95 billion of sales, based on fiscal year 2019 revenues, equivalent to approximately 17–24% of their global total revenues. E-commerce is driving sales for a number of brands under the umbrellas of Estée Lauder, L’Oréal and Shiseido, with China sales averaging between 20% to 40% of total revenue. With China therefore being such a key market for major beauty companies, these retailers could take a significant hit in both physical retail and online from restrictions and changing consumer behaviors due to the coronavirus outbreak. However, it is conceivable that online and in-store traffic will spike once normal activity has resumed, as has occurred in other epidemics. That said, if the coronavirus outbreak worsens and continues for an extended period of time, beauty companies will need to consider workaround solutions for their supply chain, workforce and marketing strategies. Travel retail represents the biggest opportunity for beauty retailers in the China market, growing between 19% and 25% year over year. The coronavirus is likely to have “spill-over” effects in this sector, meaning that once the epidemic is over, there will be a period of time when some citizens will still choose to not travel, which will negatively impact sales in this channel.

The Importance of Chinese Consumers for Global Beauty Companies

Chinese consumers accounted for 17–24% of total annual revenue for selected global beauty companies in fiscal year 2019, thus representing a key regional demographic. Furthermore, these retailers are seeing double-digit year-over-year growth from Chinese consumers, which highlights their growing importance to major beauty companies and the potential reliance that might be placed on the China market by these global industry players. [caption id="attachment_103898" align="aligncenter" width="700"] *Company does not break out China-only revenue; Coresight Research estimate based on China representing 75% of Asia-Pacific revenue (includes China, South Korea, India, Indonesia and Malaysia), which amounted to nearly $10.6 billion (€9.7 billion)—32.3% of L'Oréal’s total FY19 revenue.

*Company does not break out China-only revenue; Coresight Research estimate based on China representing 75% of Asia-Pacific revenue (includes China, South Korea, India, Indonesia and Malaysia), which amounted to nearly $10.6 billion (€9.7 billion)—32.3% of L'Oréal’s total FY19 revenue.Source: Company reports/Coresight Research[/caption]

The Impact of the Coronavirus on Physical Store Locations and Online Operations

The coronavirus outbreak is negatively affecting the entire retail supply chain and sales infrastructure, because China’s citizens are unable to undertake normal daily activities such as working and shopping. Physical Stores Retailers are temporarily closing physical stores, as citizens are generally unable to leave their homes due to government restrictions and advice.- Estée Lauder reported that as of February 6, 2020, two-thirds of the department stores that sold its products had closed, because the malls had closed.

- LVMH operates approximately 235 Sephora stores across 74 cities in China; the company reportedly suspended or canceled its makeup services in these stores following the coronavirus outbreak.

- Estée Lauder reported that its ability to deliver products to consumers is suffering due to the coronavirus outbreak. For its most distributed brands—Estée Lauder and Clinique—the company ordinarily provides physical distribution to 123 cities in China, with less distribution coverage of other brands. The impact of the coronavirus outbreak on the retailer’s total revenues will therefore be significant, as Estée Lauder’s online business in China is expansive—it more than doubled in fiscal year 2019, elevated by well-integrated online and offline campaigns for Singles’ Day on November 11. Management emphasized that its Estée Lauder brand was among the best performers for the event on Alibaba’s online marketplace, Tmall. M·A·C, La Mer, Jo Malone London and Tom Ford Beauty also saw success over the shopping holiday.

- L'Oréal reported that 40% of its sales are made online in China, and it was the top-selling beauty brand on Tmall during Singles’ Day 2019, in terms of gross merchandise volume, and was just one of 15 brands to generate over ¥1 billion in sales. L'Oréal’s brands are effectively leveraging China’s online market to drive beauty sales. For example, L’Oréal used livestreaming with influencers on social media platforms to help drive sales on Singles’ Day. Over a period of 392 livestreaming hours, L’Oréal received over 10.3 million orders, which highlights the brand’s online presence in China.

- Shiseido, a Japan-based beauty company, is currently focused on sales in China, its second-biggest market. Shiseido’s online revenue from China is expected to reach 40% in fiscal year 2020, up from approximately 33% in fiscal year 2019, according to the company. In an effort to capitalize on China’s digital beauty market, Shiseido is working with Alibaba’s Tmall Innovation Center, an in-house product creation program, to co-create products that are specifically tailored to the Chinese consumer.

*Company reported “double digits”; Coresight Research estimate based on brand exposure in China and peer estimates

*Company reported “double digits”; Coresight Research estimate based on brand exposure in China and peer estimates**Coresight Research calculations based on online revenue from China as a percentage of total revenue from China (shown in figure 1)

Source: Company reports/CNBC/Coresight Research[/caption] The Detrimental Effect on the Beauty Travel Retail Segment in the Near Term Travel in and out of China has been heavily restricted by governments worldwide due to the coronavirus outbreak, which will have significant impacts for travel retail and tourism. Beauty travel retail is an estimated $32 billion industry according to statistics provider Generation Research. In 2019, Asian travelers boosted growth in global travel retail, with over with 74% of Chinese tourists purchasing fragrances and beauty products on overseas trips, according to a Coresight Research survey.

- Estée Lauder's travel retail business will be “most impacted” by the coronavirus, management stated on February 6, 2020. This is because consumers may be postponing or canceling travel plans, flights are being canceled or suspended and businesses are minimizing travel—all of which reduces airport traffic and tourism. Estée Lauder’s travel retail business has been growing by 25–30% over the past few years. Its top eight brands saw double-digit growth—with particular success in skin care and fragrance—aided by expanded distribution in the market and innovative pre-retail campaigns: The company employs its “pretail” concept—where customers buy ahead of time and pick products up at the airport—to engage with consumers before they travel in order to build brand equity and drive conversion. When tourism and travel resume following containment of the coronavirus, Estée Lauder will resume its pretail activities.

- L’Oréal’s travel retail sales spanning all divisions, delivered 25% growth, with travel retail representing approximately 9% of L’Oréal’s sales worldwide. the company reported on February 3, 2020. Management reported that it expected travel retail Asia to be impacted by the coronavirus epidemic but said it was too early to assess the overall impact.

- Shiseido has experienced travel retail growth of 19.4% year over year—representing the fastest-growing of the company’s eight segments, totaling 9% of its overall global business. This growth has been driven by travel-retail exclusives and limited-edition product lines. In a press conference on February 6, 2020, Shiseido President Masahiko Uotani said sales to tourists in Japan were down 40% in the last week of January 2020.

- Estée Lauder: The company anticipates the greatest negative sales impact to occur in the third quarter of fiscal year 2020, followed by a gradual recovery in the fourth quarter, management reported during the second quarter earnings call on February 6, 2020.

- L'Oréal: The company estimates that (given its experience with other epidemics) after a period of disturbance, consumption will resume stronger than before. “We are confident in our capacity [in 2020] to outperform the market and achieve another year of growth in both sales and profit,” management stated in its 2019 annual results, dated February 7, 2020.

- Shiseido: The company expects comparable growth for fiscal year 2020 to be 7%, with travel retail growing at a rate of 14%, but this excludes “the unquantifiable impact of the coronavirus epidemic,” according to management.

The Potential Overall Impact of the Coronavirus for Selected Global Beauty Companies For each of the three beauty companies discussed above, China represents between $1.96 billion and $7.95 billion of sales, based on fiscal year 2019 revenues, equivalent to approximately 17–24% of their global total revenues. E-commerce is driving sales for a number of brands under the umbrellas of Estée Lauder, L’Oréal and Shiseido, with China sales averaging between 20% to 40% of total revenue. With China therefore being such a key market for major beauty companies, these retailers could take a significant hit in both physical retail and online from restrictions and changing consumer behaviors due to the coronavirus outbreak. However, it is conceivable that online and in-store traffic will spike once normal activity has resumed, as has occurred in other epidemics. That said, if the coronavirus outbreak worsens and continues for an extended period of time, beauty companies will need to consider workaround solutions for their supply chain, workforce and marketing strategies. Travel retail represents the biggest opportunity for beauty retailers in the China market, growing between 19% and 25% year over year. The coronavirus is likely to have “spill-over” effects in this sector, meaning that once the epidemic is over, there will be a period of time when some citizens will still choose to not travel, which will negatively impact sales in this channel.