DIpil Das

What’s the Story?

The two biggest beauty retailers in the US, Sephora and Ulta Beauty, have recently announced partnerships with Kohl’s and Target, respectively. The partnerships expand their physical and online beauty network—one within a department store and the other within a big-box retailer.Why It Matters

With the Covid-19 pandemic having greatly impacted brick-and-mortar retail through 2020—resulting in temporary and permanent physical store closures, as well as reduced store traffic at open stores—the announcement of two beauty retailers expanding their physical retail presence is significant. In-mall retail versus off-mall retail, and essential versus nonessential stores, are important considerations now more than ever. Retailers are collaborating to quickly gain new customers, realize category growth and drive store traffic.Beauty Partnerships: In Detail

An Overview of the Retailers: Kohl’s, Sephora, Target and Ulta Beauty The two biggest beauty retailers in the US, Sephora and Ulta Beauty, have recently announced partnerships with Kohl’s and Target, respectively. In Figure 1, we present an overview of each of the four retailers.Figure 1. Retailer Overview: Kohl’s, Sephora, Target and Ulta Beauty [wpdatatable id=652 table_view=regular]

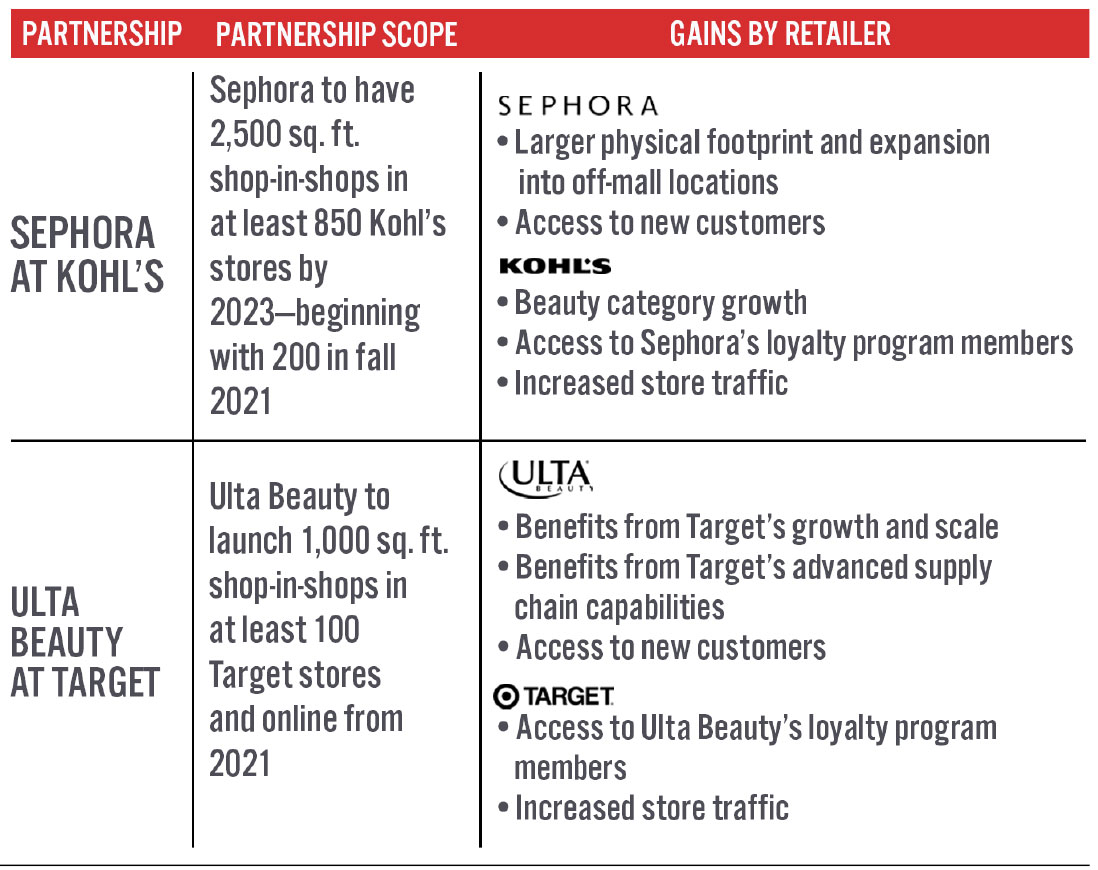

*Estimated by Coresight Research **Target’s beauty and personal care category, which also includes baby gear, cleaning, paper products and pet supplies, totaled 26% of the companies’ sales fiscal year 2019. Together, baby gear and pet sales totaled approximately $3.1 billion; after removing these from the category, this totaled $17.5 billion. Source: Company reports/Coresight Research An Overview of the Partnerships On November 11, 2020, Target and Ulta Beauty announced a partnership to bring 100 Ulta Beauty shop-in-shops to Target from 2021, and Ulta Beauty products will also be made available online via Target’s website. On December 1, 2020, Kohl’s and Sephora announced a partnership to bring 200 Sephora shop-in-shop locations to Kohl’s department stores from fall 2021, with products available online too. The partnership will total an expected 850 physical locations by 2023. Sephora previously had a beauty partnership with JCPenney, with nearly 660 shop-in-shop locations and a presence online. Due to JCPenney’s bankruptcy filing on May 15, 2020, the companies have been in dispute, with Sephora wanting to exit its contract agreement four years early in May 2020. With JCPenney still in negotiations, it is unclear where the Sephora partnership stands; however, Sephora is proceeding with its new partnership with Kohl’s. Both Sephora and Ulta Beauty are offering shop-in-shop experiences as part of the new partnership arrangements.

- The “Ulta Beauty at Target” partnership will include a 1,000-square-foot shop-in-shop experience with curated, prestige beauty brands and expert beauty consultants.

- The “Sephora at Kohl’s” partnership will include a 2,500-square-foot space prominently displayed at the front of each store.

Figure 2. Partnerships Overview: Sephora at Kohl’s vs. Ulta Beauty at Target [caption id="attachment_121081" align="aligncenter" width="700"]

Source: Company reports[/caption]

Benefits to the Beauty Retailers

Sephora: Expanding Off-Mall Physical Footprint

The scale of the Sephora at Kohl’s partnership is much bigger than Ulta Beauty at Target. In terms of size, Sephora’s partnership gives it a greater advantage than Ulta Beauty’s, with shop-in-shops that are 2.5 times the size of Ulta Beauty’s—2,500 square feet compared to 1,000 square feet.

Sephora’s 2020 shop-in-shops at Kohl’s in 2021 represent a 43% uplift in its current store base in North America. As shown in Figure 1, the majority of Sephora’s 460 North American stores are in malls: We estimate that less than 20% are off-mall locations—fewer than 100 stores. Its partnership with Kohl’s will see the beauty retailer gain an off-mall presence at an eventual 850 points of distribution, a 185% increase in its physical store footprint in North America. (This does not include Sephora’s footprint in 660 JCPenney stores; the agreement between these two companies is under discussion.)

Ulta Beauty’s 100 shop-in-shops at Target, on the other hand, represent an 8% increase over the beauty retailer’s current store base (1,262 stores as of the end of the third quarter of fiscal 2020). However, around 90% of Ulta Beauty’s stores are already off-mall locations.

An off-mall presence is becoming increasingly important due to the Covid-19 pandemic. As they wish to avoid enclosed spaces and use contact-light retail services for safety reasons, today’s consumers prefer to use BOPIS (buy online, pick up in store) and curbside-pickup services, which are more prevalent among off-mall locations. Recently, curbside pickup saw year-over-year growth of over 30% on Cyber Monday, according to Adobe Analytics.

Such services were already gaining traction pre-pandemic: Ulta Beauty CEO Mary Dillon highlighted at a company presentation on June 16, 2020 that curbside pickup was a competitive advantage for the retailer in the 2019 holiday season because consumers liked its efficiency and convenience. She said that over 1,100 of Ulta Beauty’s stores offer curbside pickup, as of June 2020. On Ulta Beauty’s earnings call for its third quarter of fiscal 2020, ended October 31, the company said it had updated its curbside-pickup offerings to include curbside customer alert notifications, curbside signage and dedicated parking spots; management highlighted that consumers had been responding well to the service. The company reported that BOPIS totaled 16% of e-commerce during its third quarter, approximately double the penetration from the third quarter of fiscal year 2019.

Sephora’s expanded off-mall presence through its new partnership will help the retailer to better compete with Ulta Beauty on contact-light fulfillment—a growing consumer requirement.

Ulta Beauty: Leveraging Target’s Status and Supply Chain

The Ulta Beauty at Target partnership will give the beauty retailer “essential retailer” status. In the event of store closures that may prevent nonessential retailers from remaining open—as we have seen at points during the Covid-19 pandemic—Ulta Beauty could remain open within Target stores. The beauty retailer will be able to defray some costs by continuing operations within the open stores and moving inventory during times of crisis, when otherwise its stores would remain closed.

Ulta Beauty will gain from Target’s growth, scale and investment into its digital supply chain. For the third quarter of fiscal year 2020, Target saw comparable sales growth of 20.7% and e-commerce growth of 153% year over year. The big-box retailer’s total revenue was $78.1 billion in fiscal year 2019, four times that of Kohl’s (see Figure 1). We estimate that Target’s beauty and personal care category comprised 22% of this revenue, totaling $17.5 billion. Target’s financial statements combine beauty and household essentials, so the category is overstated at 22% because it also includes cleaning and paper products; however, this still emphasizes Target’s scale and reach and the significance of the category, given it is more than double Ulta Beauty’s total revenue for fiscal year 2019.

Target has been investing in its supply chain capabilities and advanced operational model of fulfilling digital orders through its stores since 2017. In December 2017, Target acquired same-day delivery platform Shipt. Target management said approximately 75% of the retailer’s third-quarter 2020 digital sales were fulfilled by its stores, including same-day services via Shipt. Its curbside-pickup service grew more than 500% for the quarter; BOPIS increased by more than 50% for the quarter; and same-day delivery via Shipt was up 280% for the quarter, representing $200 million of incremental sales.

Access to New Customers—New to the Brands and New to Prestige Makeup

Kohl’s has 65 million consumers, 45 million (70%) of which are women, and Target reported there are 80 million members in its Target Circle rewards program. Sephora and Ulta Beauty will benefit from gaining access to new consumers and increasing their visibility to shoppers who may not have extensive experience of prestige makeup brands.

Source: Company reports[/caption]

Benefits to the Beauty Retailers

Sephora: Expanding Off-Mall Physical Footprint

The scale of the Sephora at Kohl’s partnership is much bigger than Ulta Beauty at Target. In terms of size, Sephora’s partnership gives it a greater advantage than Ulta Beauty’s, with shop-in-shops that are 2.5 times the size of Ulta Beauty’s—2,500 square feet compared to 1,000 square feet.

Sephora’s 2020 shop-in-shops at Kohl’s in 2021 represent a 43% uplift in its current store base in North America. As shown in Figure 1, the majority of Sephora’s 460 North American stores are in malls: We estimate that less than 20% are off-mall locations—fewer than 100 stores. Its partnership with Kohl’s will see the beauty retailer gain an off-mall presence at an eventual 850 points of distribution, a 185% increase in its physical store footprint in North America. (This does not include Sephora’s footprint in 660 JCPenney stores; the agreement between these two companies is under discussion.)

Ulta Beauty’s 100 shop-in-shops at Target, on the other hand, represent an 8% increase over the beauty retailer’s current store base (1,262 stores as of the end of the third quarter of fiscal 2020). However, around 90% of Ulta Beauty’s stores are already off-mall locations.

An off-mall presence is becoming increasingly important due to the Covid-19 pandemic. As they wish to avoid enclosed spaces and use contact-light retail services for safety reasons, today’s consumers prefer to use BOPIS (buy online, pick up in store) and curbside-pickup services, which are more prevalent among off-mall locations. Recently, curbside pickup saw year-over-year growth of over 30% on Cyber Monday, according to Adobe Analytics.

Such services were already gaining traction pre-pandemic: Ulta Beauty CEO Mary Dillon highlighted at a company presentation on June 16, 2020 that curbside pickup was a competitive advantage for the retailer in the 2019 holiday season because consumers liked its efficiency and convenience. She said that over 1,100 of Ulta Beauty’s stores offer curbside pickup, as of June 2020. On Ulta Beauty’s earnings call for its third quarter of fiscal 2020, ended October 31, the company said it had updated its curbside-pickup offerings to include curbside customer alert notifications, curbside signage and dedicated parking spots; management highlighted that consumers had been responding well to the service. The company reported that BOPIS totaled 16% of e-commerce during its third quarter, approximately double the penetration from the third quarter of fiscal year 2019.

Sephora’s expanded off-mall presence through its new partnership will help the retailer to better compete with Ulta Beauty on contact-light fulfillment—a growing consumer requirement.

Ulta Beauty: Leveraging Target’s Status and Supply Chain

The Ulta Beauty at Target partnership will give the beauty retailer “essential retailer” status. In the event of store closures that may prevent nonessential retailers from remaining open—as we have seen at points during the Covid-19 pandemic—Ulta Beauty could remain open within Target stores. The beauty retailer will be able to defray some costs by continuing operations within the open stores and moving inventory during times of crisis, when otherwise its stores would remain closed.

Ulta Beauty will gain from Target’s growth, scale and investment into its digital supply chain. For the third quarter of fiscal year 2020, Target saw comparable sales growth of 20.7% and e-commerce growth of 153% year over year. The big-box retailer’s total revenue was $78.1 billion in fiscal year 2019, four times that of Kohl’s (see Figure 1). We estimate that Target’s beauty and personal care category comprised 22% of this revenue, totaling $17.5 billion. Target’s financial statements combine beauty and household essentials, so the category is overstated at 22% because it also includes cleaning and paper products; however, this still emphasizes Target’s scale and reach and the significance of the category, given it is more than double Ulta Beauty’s total revenue for fiscal year 2019.

Target has been investing in its supply chain capabilities and advanced operational model of fulfilling digital orders through its stores since 2017. In December 2017, Target acquired same-day delivery platform Shipt. Target management said approximately 75% of the retailer’s third-quarter 2020 digital sales were fulfilled by its stores, including same-day services via Shipt. Its curbside-pickup service grew more than 500% for the quarter; BOPIS increased by more than 50% for the quarter; and same-day delivery via Shipt was up 280% for the quarter, representing $200 million of incremental sales.

Access to New Customers—New to the Brands and New to Prestige Makeup

Kohl’s has 65 million consumers, 45 million (70%) of which are women, and Target reported there are 80 million members in its Target Circle rewards program. Sephora and Ulta Beauty will benefit from gaining access to new consumers and increasing their visibility to shoppers who may not have extensive experience of prestige makeup brands.

- The Sephora at Kohl’s space will be prominently displayed at each store entrance and will include Sephora’s prestige products, including Clean. The space will include over 100 curated brands.

- Each Ulta Beauty at Target shop-in-shop space will be located next to Target’s existing beauty section that offers emerging and prestige brands.

- Sephora has not recently provided exact figures but reported in 2019 that Beauty Insider program members account for nearly 80% of sales.

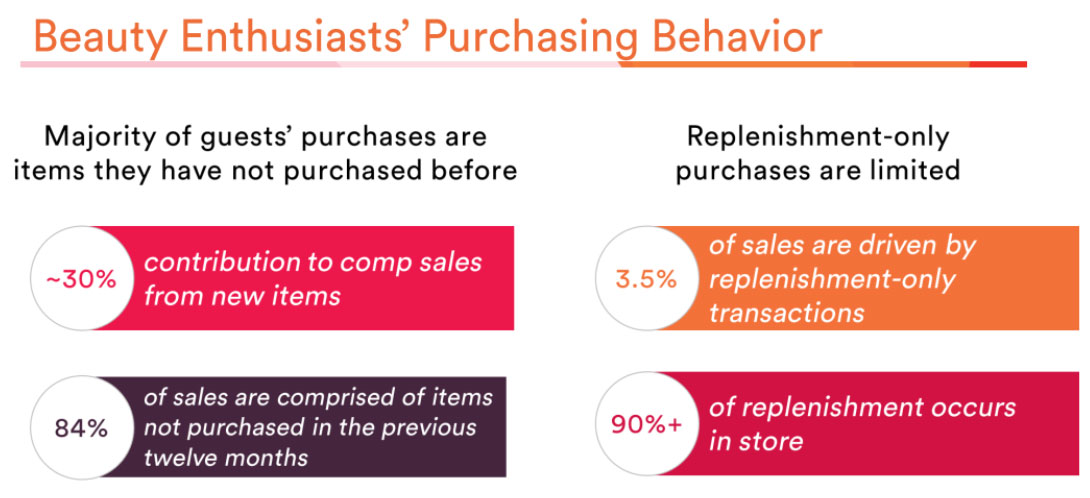

- In a company presentation in April 2019, Dillon reported that Ulta Beauty’s “Beauty Enthusiasts” account for 77% of beauty spending. As shown in the image below, Ulta Beauty highlighted that the majority of items bought by these customers are ones they have not purchased before, which means that they are eager to try new products. In terms of replenishment though, over 90% occurs in stores, according to the company, thus driving store traffic.

Ulta Beauty presented data on beauty enthusiasts’ purchasing behavior at The Future of the Consumer Conference on April 2, 2019

Ulta Beauty presented data on beauty enthusiasts’ purchasing behavior at The Future of the Consumer Conference on April 2, 2019 Source: Company reports [/caption] Increased Store Traffic The beauty partnerships will help to drive store traffic at Kohl’s and Target, which could potentially help to bring in new customers and grow sales in other categories. In terms of focus areas, Kohl’s is seeking to grow its activewear from 20% to 30% of its business and is devoting more floorspace to this category while also revamping its women’s category and introducing a new private-label athleisure brand in spring 2021 for men and women. Target reported in its third quarter that the home category was strong, with consumers shopping décor and kitchen products. Apparel growth was led by intimates and sleepwear, as well as men’s apparel.

What We Think

We believe that Ulta Beauty will gain an advantage from Target’s strength of scale and operational efficiency, which the big-box retailer achieves through supply chain investments and digital fulfillment strategies. Ulta Beauty also gains “essential” status by collaborating with Target; we expect this will help to strengthen the beauty company’s financial position. While Target’s beauty department is already robust, the retailer’s scale is allowing it to continually expand into new categories such as prestige makeup, in which it does not currently have a strong presence. Ulta Beauty’s strength in prestige and emerging brands will help Target to round out its beauty assortment, which is very strong in the mass market. We expect all retailers to benefit from increased customer access: Kohl’s and Target will have the added benefit of a potential increase of increased store traffic while Sephora and Ulta Beauty will gain exposure to consumers who are new to the retailers and who may not have experience of prestige makeup brands. We expect that this will be a learning experience for all retailers and will involve location-sensitive product marketing and store design strategies to personalize offerings based on consumer preferences. However, comparing the two partnerships, Sephora is the clear winner in terms of physical beauty expansion in three aspects:- Sephora will increase its store base by 185% by 2023 in North America (excluding its JCPenney shop-in-shops).

- The expansion will see the beauty retailer gain a foothold in off-mall beauty retail, which it does not have today.

- Sephora’s physical shop-in-shops at Kohl’s will be 2.5 times bigger than Ulta Beauty will have in its new partnership with Target, providing a larger channel to serve consumers.