Introduction

What’s the Story?

Major players in the US department store sector are increasingly seeking to grow their beauty departments—in part due to the Covid-19 pandemic, which has driven department stores to become less reliant on apparel as the main driver of their portfolios’ revenues and therefore to diversify by growing other categories or entering new ones. In beauty, we are seeing department stores offer new products and services, enhancing the customer experience, entering partnerships and leveraging technology to gain a competitive advantage.

We explore these trends, with notable examples from major US department stores. We also present an overview of the market, covering physical stores and e-commerce, as well as key metrics for selected players.

Why It Matters

The beauty category is typically prominently located on the first floor of a department store, making it the first department that consumers encounter when they walk through the store.

Since 2015, beauty sales at department stores have declined due to two major factors: competition from e-commerce and competition from rival store-focused channels, including mass market retailers and beauty specialty retailers. Consumers have many different and convenient options to buy beauty today, so it is important for department stores to look at different ways to revive their beauty departments to excite consumers, driving them to shop the category through department stores, both in-store and online.

- There is an opportunity for department stores to recapture lost in-store sales in color cosmetics, fragrance and skin care, as well as to grow newer categories such as men’s grooming.

- In the digital channel, department stores can leverage virtual selling and livestreaming to connect with shoppers and boost brand awareness.

- In order to attract a wider consumer base, department stores can add inclusive beauty products, spanning hair care, skin care and color cosmetics.

Beauty at US Department Stores: Coresight Research Analysis

Market Overview

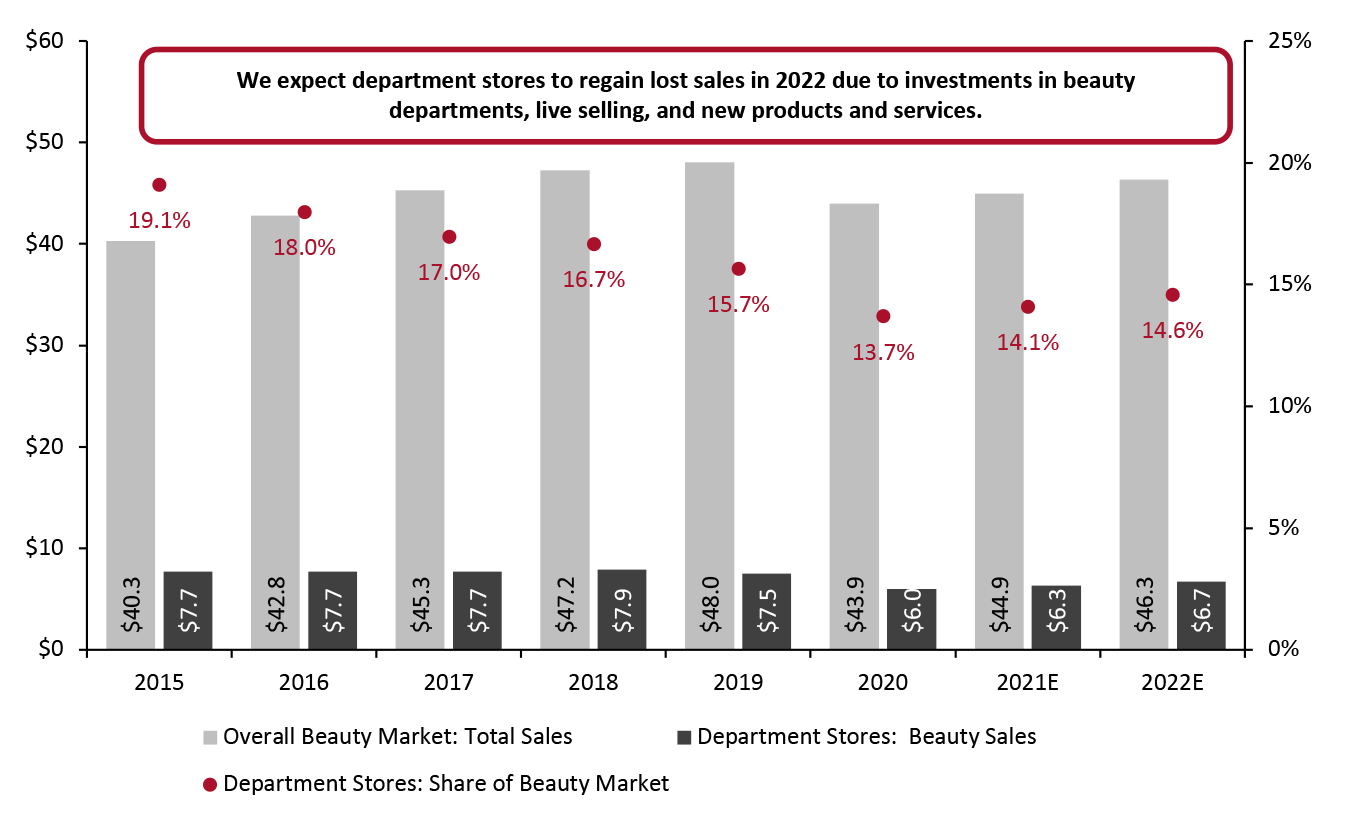

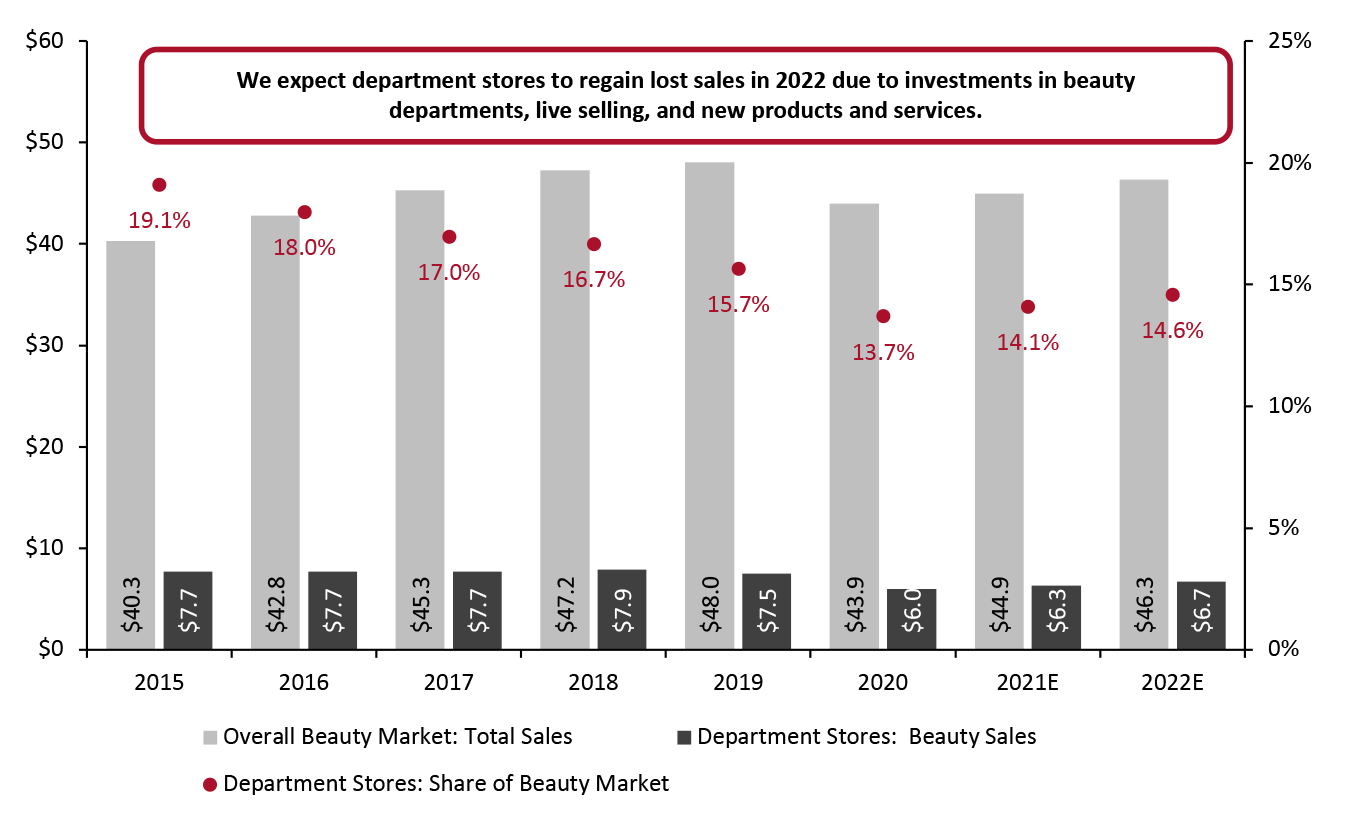

Coresight Research expects that, in 2022, US department stores will achieve $6.7 billion in beauty product sales—comprising the major categories of color cosmetics, skin care and fragrances—across the physical and digital channels. This would continue the sector’s recovery from pandemic-impacted 2020, with 6.3% year-over-year growth in beauty sales, although the total would still be down compared to several years earlier: We saw declining sales even pre-pandemic, at a CAGR of (0.6)% between 2015 and 2019. This aggressive growth prediction is based upon the sectors’ investments in its physical and online channels.

Department stores will account for a 14.6% share of total US beauty product sales in 2022, we estimate: The overall market is set to total $46.3 billion in 2022, up 3.1% from an estimated $44.9 billion in 2021, according to Euromonitor International data. This share would represent a decline of 4.6 percentage points from the department store sector’s share of 19.1% in 2015, we calculate.

We break down US beauty sales overall and at department stores by year in Figure 1.

Figure 1. US: Overall Beauty Sales vs. Beauty Sales at Department Stores (Left Axis; USD Bil.) and Department Stores’ Share of the Total Beauty Market (Right Axis; %)

[caption id="attachment_141739" align="aligncenter" width="700"]

The beauty market comprises color cosmetics, skin care and fragrances

The beauty market comprises color cosmetics, skin care and fragrances

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research [/caption]

The Brick-and-Mortar Channel

We estimate that the department store sector held an 11.4% share (amounting to $5.0 billion) of overall beauty sales at physical stores in 2020, down from 18.1% in 2015 ($7.3 billion) according to Euromonitor International estimates. We estimate that physical store beauty product sales in department stores were $5.1 billion in 2021 and will be $5.3 billion in 2022, also accounting for 11.4% of total beauty sales in physical retail.

Department stores have been experiencing increasing competition from beauty store specialty retailers, which saw an 8.3% CAGR in physical retail sales between 2015 and 2019 (pre-pandemic). In 2020, specialty beauty retailer sales comprised 15.3% of the market, exceeding the department store sector’s share. In 2021 and 2022, we expect that specialty stores’ brick-and-mortar sales will bounce back to the high teens, in percentage terms, in market share. In addition, hypermarkets, drugstores and grocery stores have maintained a steady presence in the beauty market in recent years with a combined market share of over 20% in 2020.

E-Commerce

The most significant growth in beauty sales recently has been through the e-commerce channel. The beauty market saw online revenues increase at a 20.0% CAGR between 2015 and 2020, from $5.3 billion to $13.1 billion. Online beauty sales comprised 29.8% of the total market in 2020, up from 13.0% in 2015. Coresight Research estimates that, in 2022, beauty e-commerce will grow at a high-single-digit or low-double-digit rate in percentage terms, to total approximately $18 billion and account for approximately one-third of total beauty sales.

Overall beauty e-commerce includes online sales by department stores, which we estimate totaled approximately $1 billion in 2020—equating to 20% of the department store sector’s total beauty sales. As consumers are increasingly shopping online, e-commerce presents an opportunity for department stores to connect with consumers online and increase the sector’s share of the beauty market—through virtual stores, livestreaming and personalized tools.

The Beauty Category at Major US Department Stores: Key Metrics

Beauty comprises one of the smallest portfolio categories across the major department stores (with the exception of Macy’s). Although beauty sales across the companies declined by an average of nearly 25% amid Covid-19 in 2020, apparel declines were deeper and beauty was cited as one of the stronger rebound categories in the first and second quarters of fiscal 2021.

We present key beauty sales metrics for major department store retailers in Figure 2.

- At Kohl’s, management reported at the Goldman Sachs Global Retailing Conference in September 2021 that beauty represented “low, low” single digits in percentage terms (as a proportion of total sales) in fiscal 2020.

- Macy’s categorizes its beauty sales together with other categories and its Bluemercury banners and Bloomingdale’s banners, so its beauty sales for fiscal 2020 were skewed by 162 standalone Bluemercury beauty stores and 55 Bloomingdale’s stores. Macy’s includes its beauty portfolio sales under the “Women's Accessories, Intimate Apparel, Shoes, Cosmetics and Fragrances” category, which totaled $7.2 billion in fiscal 2020—comprising 42% of the department store retailer’s total sales and making it the largest portfolio category by far for Macy’s.

Figure 2. Major US Department Stores: Beauty Category Revenue Metrics

[wpdatatable id=1718 table_view=regular]

*Estimated based on company reports

**Beauty category includes revenues from Bluemercury and Bloomingdale’s banners

Source: Company reports/Coresight Research

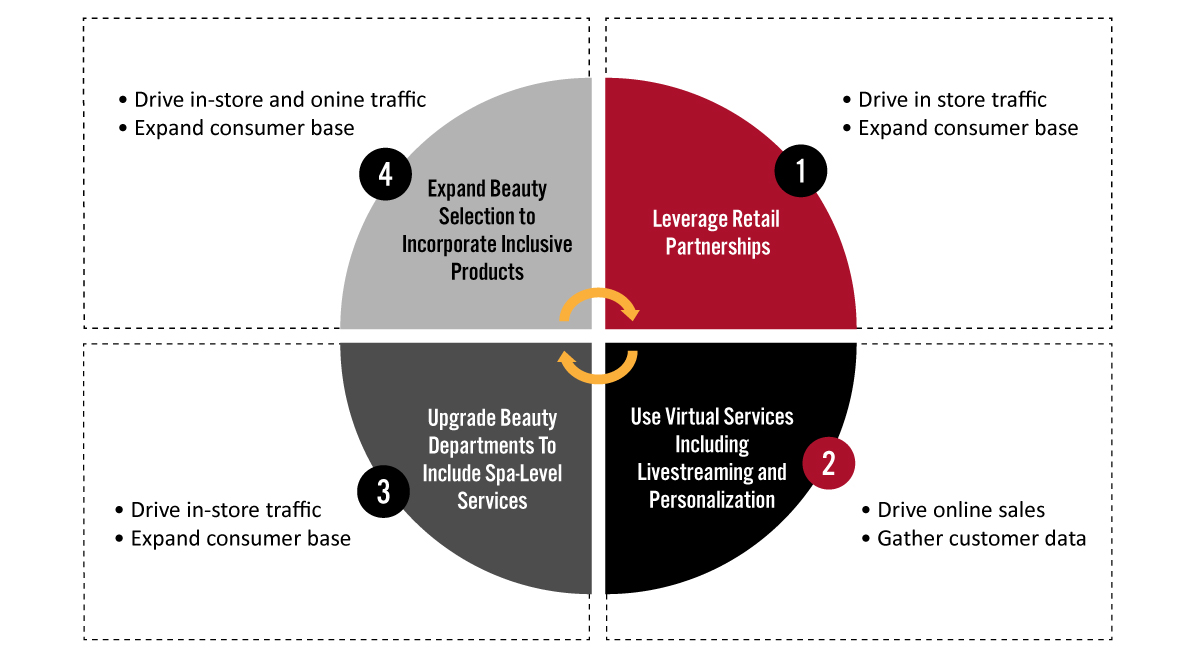

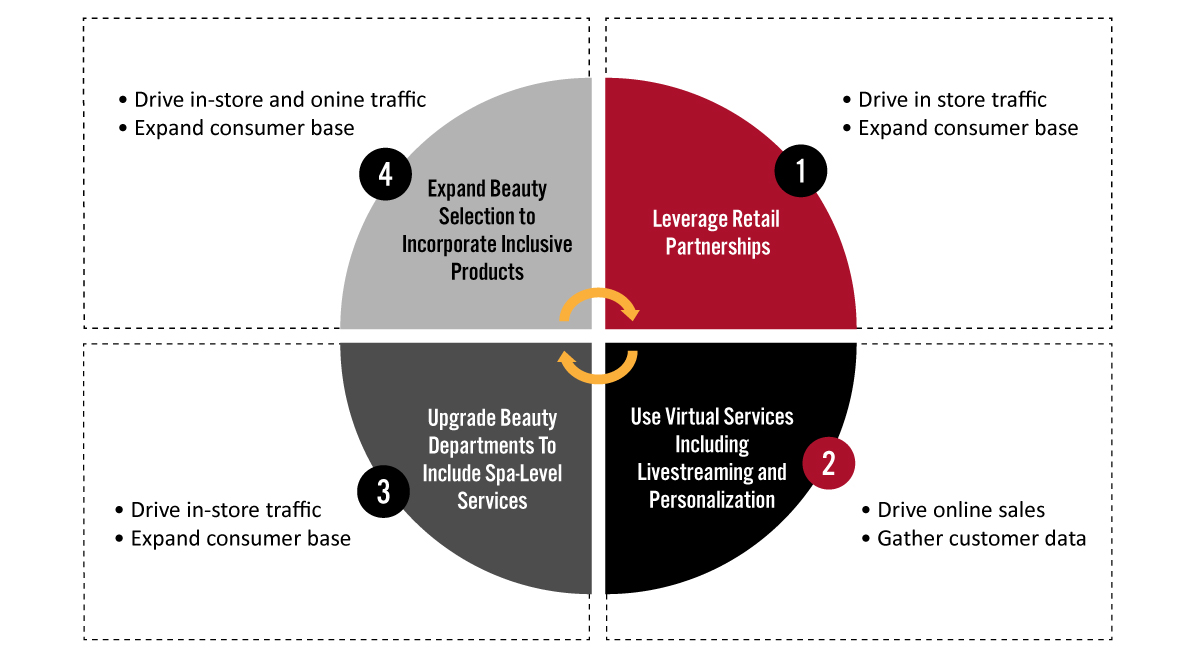

Four Key Focus Areas for Growth

In order to drive beauty traffic in brick-and-mortar stores and online, department stores are focusing on growing the category through retail partnerships, technology, and new products, services, and experiences. We outline these focus areas in Figure 3 and explore each in detail below, with notable examples of strategies by major department store retailers.

Figure 3. Four Ways Department Stores are Focusing on Growing Beauty

[caption id="attachment_141742" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research [/caption]

1. Retail Partnerships

Department stores are leveraging retail partnerships and shop-in-shops to expand the beauty category and their customer base.

Kohl’s has been making the biggest moves to bolster its beauty category, with the addition of its

Sephora shop-in-shops. The partnership was announced on December 1, 2020, and Kohl’s opened the first 200 shop-in-shops in the third quarter of fiscal year 2021. The company plans to open 400 Sephora shop-in-shops in 2022. The company also announced it will add six prestige beauty brands to its assortment in the spring of 2022: Murad, Clarins, Jack Black, Living Proof, Versace and Voluspa. Kohl’s plans to open 250 shop-in-shops in 2023; the partnership is set to have 850 physical locations in total.

Kohl’s has placed the Sephora shop-in-shops prominently at the front of its stores. At the conference, management said that it sees the Sephora partnership as a traffic driver for its beauty category, bringing in new shoppers that do not typically overlap with the department store’s existing customer base. Kohl’s reported that initial results of the Sephora shop-in-shops are exceeding expectations, with the customer shopping across all price points across skin care, hair care and makeup.

Although a concession and revenue-sharing model may not see Kohl’s directly grow its beauty revenue initially, the addition of Sephora will help the retailer increase beauty traffic and improve its positioning as a beauty destination.

The retailer announced in July 2021 that it would open shop-in-shops in October that year with Thirteen Lune, a beauty and wellness e-commerce platform designed to inspire the discovery of beauty brands created by Black and Brown founders and other inclusive brands.

JCPenney has an existing beauty partnership with Sephora in 574 stores, according to the company website. Sephora and JCPenney were in dispute, as Sephora wanted to exit its contract agreement early due to JCPenney’s bankruptcy filing on May 15, 2020. The parties resolved the dispute, but according to company reports, Sephora will be exiting JCPenney in 2023 and so the department store retailer is embarking on a new beauty program.

On September 30, 2021, the company announced additional details on its retail strategy and product offerings for JCPenney Beauty, and then opened its first 10 JCPenney Beauty locations in mid-October. Products became available online on October 15, 2021. JCPenney Beauty features more than 170 beauty brands, including customer favorites, indie finds and BIPOC (Black, Indigenous and People of Color)-founded brands, spanning makeup, skin care, hair care, styling tools, fragrance, nail care, and bath and body products, at varying price points.

The Thirteen Lune shop-in-shop partnership is part of JCPenney Beauty. Of the 170 brands at JCPenney Beauty, 39 are from Thirteen Lune, including Buttah Skin, Bossy Cosmetics, Mischo Beauty, Pholk Beauty, Prados Beauty, Sara Happ, Spraise, Vernon François and Wander Beauty.

On November 3, 2021, Thirteen Lune received $3 million in funding from Fearless Fund, a venture capital firm that invests in women of color, created by women of color. According to company reports, the funding will be used to develop Thirteen Lune’s private-label beauty brand, improve its supply chain and build out the company’s executive team.

2. Virtual Services

Macy’s, Nordstrom and Saks Fifth Avenue have launched virtual services, including livestreaming, personalization and virtual try-on.

Macy’s reported on its earnings call in May 2021 that it is focusing on digital experiences in three areas: immersive categories, expanding its shopping channels and redesigning its overall digital experience. Management said that in terms of immersive categories, the company is “doubling down” on beauty and building out experiences to enhance its makeup, skin care and fragrance businesses, such as virtual try-on. Customers are able to access Macy’s beauty experiences through its social media channels, including Instagram. The company also that reported it is developing live-video shopping with the goal of making online shopping as fun as in-person.

On October 6, 2021, Macy’s announced that it had redesigned its mobile app to include Macy’s Live, a new live shopping experience where consumers can explore trends and products, and share items with friends and family. Through the live shopping events, consumers can interact with hosts and Macy’s stylists via chat, view featured products in more detail, read reviews and recommendations, and shop. Following the broadcasts, each live shopping event is archived on the company’s website to watch and shop on demand.

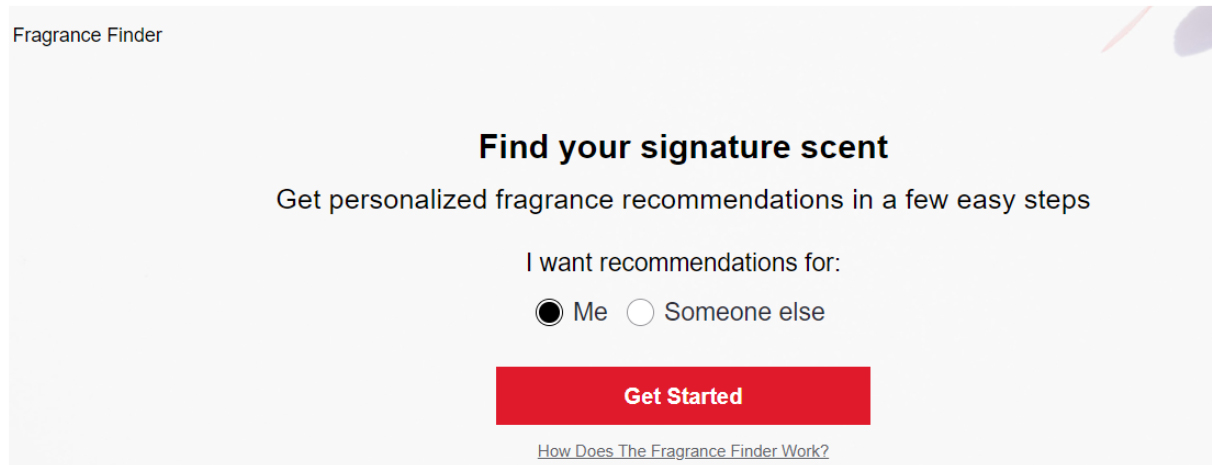

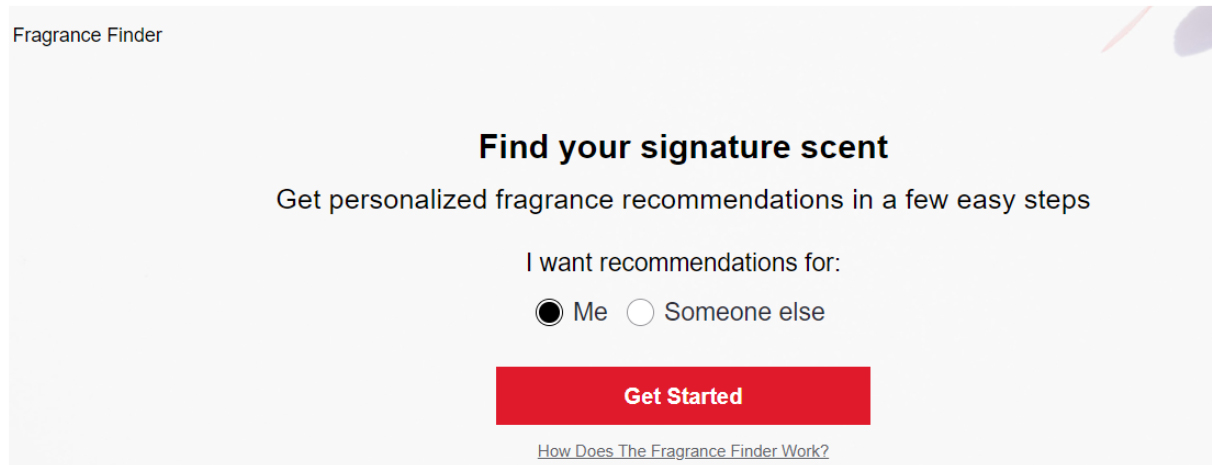

Macy’s also launched its online Fragrance Finder personalization tool, through which consumers can discover a scent to give as a gift or find a new scent for themselves. The tool provides customers with customized recommendations based on their preferences and desired scent profiles, creating an easy way for shoppers to discover new fragrances. Consumers are also able to learn about scent families, ingredients and other fragrance attributes through the Fragrance Finder.

[caption id="attachment_141622" align="aligncenter" width="700"]

Macy’s Fragrance Finder is a personalization tool on its website which walks consumers through a series of questions, helping them to select a fragrance based on preferences

Macy’s Fragrance Finder is a personalization tool on its website which walks consumers through a series of questions, helping them to select a fragrance based on preferences

Source: Company website [/caption]

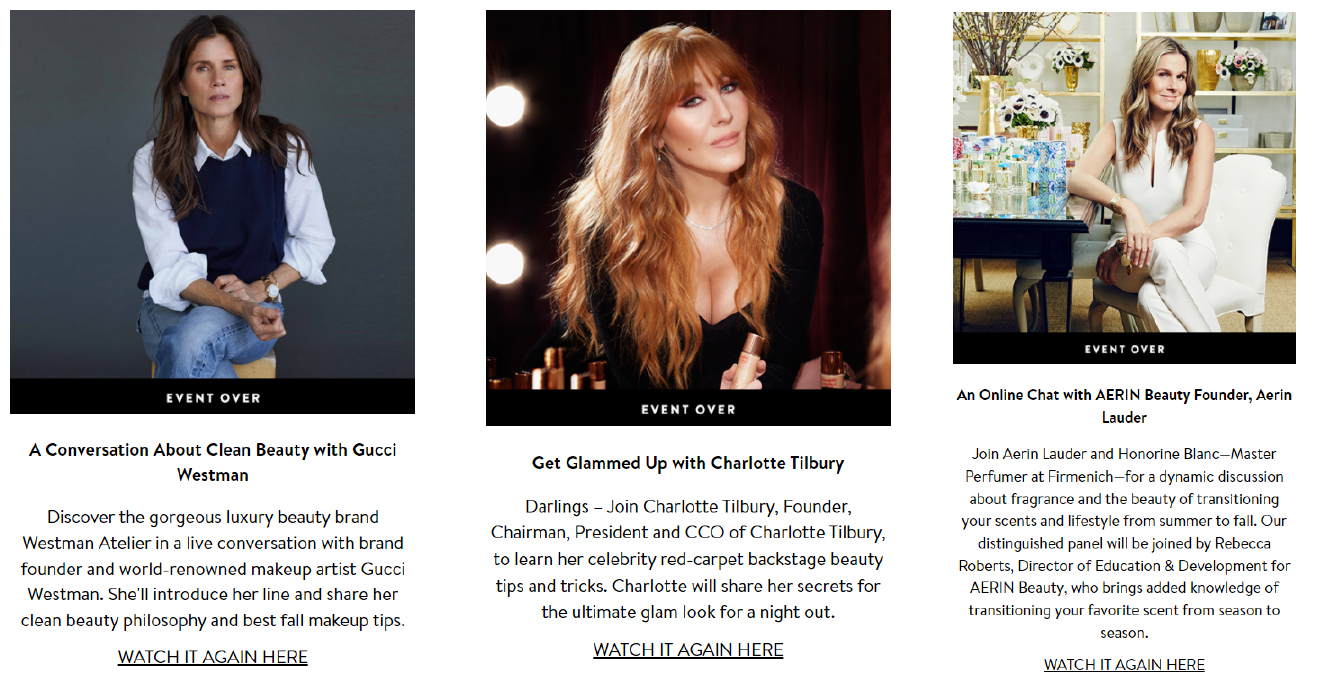

Nordstrom launched “Nordstrom Live” on its website in 2021, a channel devoted to livestreaming content. The sessions are available to watch and shop after the live recordings are over. Many Nordstrom Live sessions are devoted to beauty and include sessions from beauty brand founders, makeup artists, influencers and Nordstrom stylists. According to Nordstrom, it continues to experiment with the format and learn more about its customers, who are engaged during the sessions and even after the sessions are over.

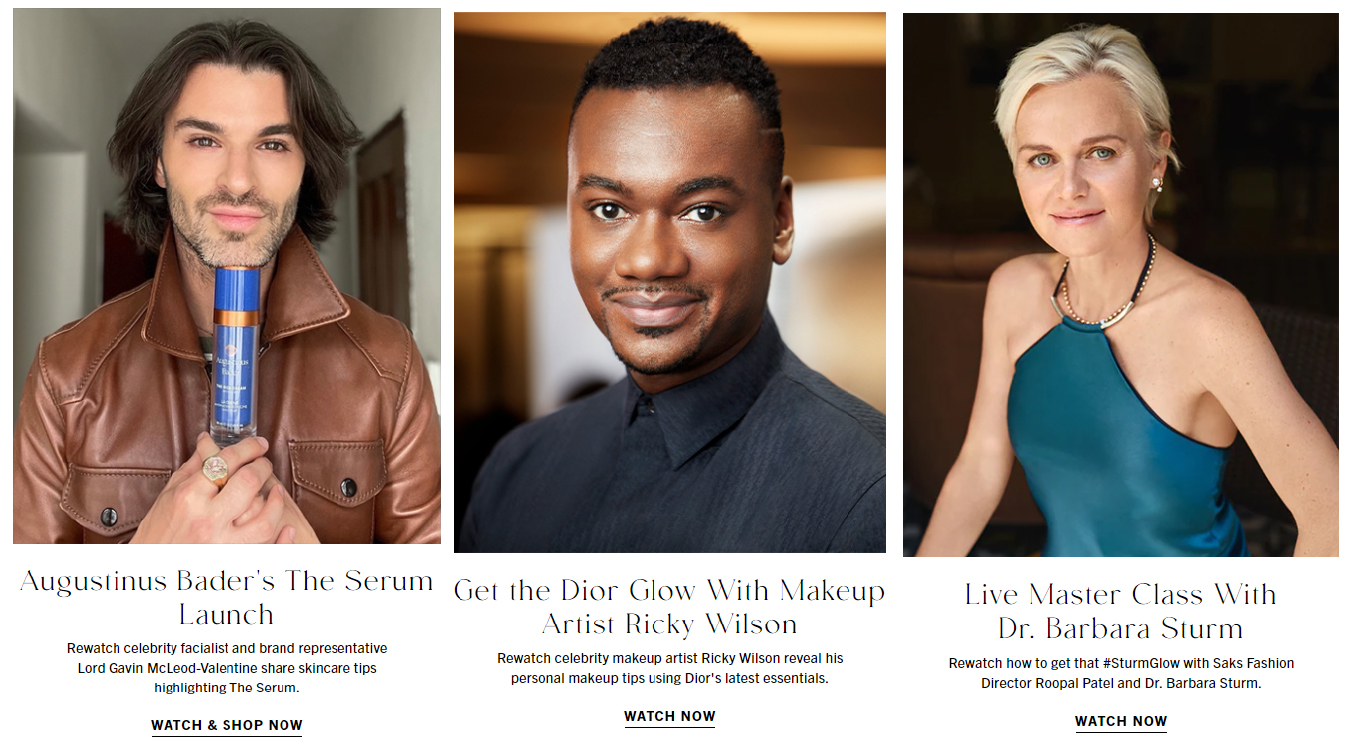

[caption id="attachment_141623" align="aligncenter" width="700"]

Nordstrom Live is a dedicated site on Nordstrom.com for livestreaming content

Nordstrom Live is a dedicated site on Nordstrom.com for livestreaming content

Source: Company website [/caption]

Saks launched its own virtual events platform, Saks Live, on its website in 2021 and had hosted 42 events by November 2, 2021, according to a company press release. Saks hosts virtual experiences and shoppable content while providing lifestyle, shopping and fashion advice from industry leaders across categories including fashion, beauty and wellness, shoes and handbags, and jewelry. The hosts interact with viewers both by speaking directly to them and also through a chat function, helping them to shop as they watch. The sessions are available to watch and shop after the live recordings are over.

The events focused on beauty and wellness include masterclasses on fitness, skincare and makeup routines, beauty launches, tips from makeup artists, and regimen tutorials. Saks Live hosted biweekly livestreams for the holiday season, from November 2 to December 16, 2021, centered around gift-giving and dressing for holiday celebrations. Two of the livestream events focused on beauty: “November 26: Holiday Gifting with La Mer,” and “December 15: Holiday Glam Beauty with Ash Walker.”

[caption id="attachment_141624" align="aligncenter" width="700"]

Saks Live is a dedicated site on Saksfifthavenue.com for live event content

Saks Live is a dedicated site on Saksfifthavenue.com for live event content

Source: Company website [/caption]

3. Spa-Level Services

Bloomingdale’s, Nordstrom and Saks Fifth Avenue have been upgrading selected department stores to include spa-level beauty services, including massages, facials, waxing, laser hair removal, manicures and meditation.

- In September 2021, Saks Fifth Avenue announced that it was partnering with Blo Blow Dry Bar for five weeks in the American Dream Mall. Customers could visit the Blo Blow Dry Bar for customized blowouts through October 25, 2021.

- In September 2021, Bloomingdale’s opened its renovated Bloomingdale’s South Coast Plaza store, the largest shopping center on the West Coast. In its beauty department, in addition to adding dedicated brand shops from Clarins, Cle de Peau Beaute, La Mer and Valentino Beauty, Bloomingdale’s added spa services by La Prairie and La Mer and facial treatment services in new spa treatment rooms.

- In October 2019, Nordstrom opened its seven-level women’s store in New York City, with two levels devoted to beauty. One floor is devoted to makeup counters, while the floor above is the Nordstrom Beauty Haven department, which houses beauty services including Base Coat manicures, Sisley and Heyday facials, blowouts by Dry Bar, eyebrow shaping by Anastasia Beverly Hills, eyebrow threading by Blink Brow Bar, St. Tropez spray tans, The Light Salon light therapy, and injectables with Kate Sommerville. The department store has a beauty concierge that offers a spa and personal styling sessions.

- In May 2018, Saks Fifth Avenue renovated its New York City beauty department with a focus on experiences. The retailer moved its beauty department to the second floor to focus on experiences; the floor is 40 percent larger and includes 15 new spa rooms along with services such as medi-spa treatments, facials, massages, manicures, brow services, and a flower shop. Specific treatments and experiences that Saks Fifth Avenue offers include: FaceGym, a non-invasive facial workout; dedicated spa rooms for Chanel, Clé de Peau Beauté, Dior, Kiehl's Since 1851, La Mer, La Prairie, Martine de Richeville, SKINNEY MedSpa and Sisley Paris; Brow and lash styling by Blink Brow Bar London, CoolSculpting and laser hair removal by SKINNEY MedSpa and manicures and meditation by Sundays; and Martine de Richeville's slimming, deep-tissue massage, Rémodelage.

4. Inclusive Products

Department stores are expanding their beauty departments through a focus on

inclusivity, providing equal access for people who might otherwise be excluded or marginalized. Bloomingdale’s, Hudson’s Bay (Saks Fifth Avenue’s parent company), JCPenney, Macy’s and Nordstrom have all taken the “15 Percent Pledge.” Companies that sign up to the 15 Percent Pledge, created by Aurora James, Creative Director and Founder of luxury accessories brand Brother Vellies, commit to conducting an internal audit of their current spending power and contracts allocated to Black businesses, along with committing 15% shelf space to Black-owned brands.

As part of this commitment, JCPenney Beauty is increasing its Black-owned brand portfolio through its shop-in-shop partnership with Thirteen Lune, launched in October 2021 (as discussed earlier). In July 2021, Nordstrom announced its commitment to increasing its purchases from Black-owned and -founded brands by 10X by the end of 2030.

Department stores are growing their inclusive beauty brand portfolios to better represent the customers that they serve—across haircare, skincare and color cosmetics for women and men. We expect that by adding new brands, department store retailers will increase the breadth of their customer reach and boost sales from existing customers who may try new products.

Expanding their product range also enables retailers to grow in underpenetrated categories. For example, department store sector sales in haircare comprised less than 1% of total haircare sales in 2020, according to Euromonitor International data, but department stores are increasingly introducing inclusive haircare products such as natural hair oils, serums, hair masks and styling products that are specially formulated for textured hair—through brands including Bomba Curls, Brigeo, Curls, Maison 276, Ooli, Rucker Roots, Urban Hydration and Vernon Francois. In addition, men’s grooming is a growing category, but less than 1% of the category’s sales were from department stores in 2020—representing another opportunity for these retailers to grow their consumer base and category presence. Department store retailers are introducing skincare and haircare brands targeted at men of color, including Mantl, Solo Noir for Men and That’s Smooth.

Inclusive brand portfolios can incorporate a wide range of skincare products—including body souffles, body mists, body oils, sunscreen, cleansers, moisturizers and footcare—as well as color cosmetics such as color-matching foundations for melanin-rich skin tones and products with vegan formulations.

What We Think

With a sustained consumer shift to e-commerce following the impacts of the Covid-19 crisis, department store retailers need to provide compelling reasons for consumers to visit their stores—and beauty is set to be a key driver of traffic.

Two big winners for physical retail are likely to be Kohl’s and JCPenney, which are offering shoppers new products and retail experiences through shop-in-shop partnerships—boosting the stores’ positioning as go-to beauty destinations, particularly among young consumers. The shop-in-shops may also serve as a launchpad for Kohl’s to launch other beauty products and services in the future and for the retailer to reap long-term benefits in terms of cross-shopper traffic, too. We also expect that Nordstrom, Saks Fifth Avenue, and Bloomingdale’s beauty services’ floors will become department store “templates” that the sector will follow going forward as these will become industry standards.

We believe that offering beauty services will become the new normal for department stores and will be a game changer in terms of driving store traffic and sales. Services may be added through the extensive remodeling of beauty departments, as we have seen from Nordstrom’s Beauty Haven, or through pop-ups such as blow-dry bars. As beauty departments become bigger and more elaborate, we expect that more department stores are going to add high-level spa and wellness services such as facials, manicures, massages and even medical-level services like Botox and injectables.

Turning to the online channel, Macy’s and Nordstrom are leading the way in terms of department stores engaging with beauty consumers—not least through livestreaming, with the retailers hosting sessions through which consumers can interact with brands and shop products. We expect livestreaming to become well established in the wider retail landscape in 2022 and beyond, and department store retailers should leverage this powerful tool to engage beauty consumers with tutorials, trends and makeup sessions. We expect department stores to seek high levels of digital engagement with consumers and increasingly experiment with new personalization tools and virtual services.

We expect that department stores will continue to expand their product base with more inclusive products to better represent consumers and to expand into categories beyond traditional categories, including haircare, men’s grooming and ingestibles, for example. We anticipate that consumer feedback and results from initial rollouts will support new brand additions in the future. Coresight Research has identified inclusivity as a

key retail trend in 2022.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved

The beauty market comprises color cosmetics, skin care and fragrances

The beauty market comprises color cosmetics, skin care and fragrances  Source: Coresight Research [/caption]

1. Retail Partnerships

Department stores are leveraging retail partnerships and shop-in-shops to expand the beauty category and their customer base.

Source: Coresight Research [/caption]

1. Retail Partnerships

Department stores are leveraging retail partnerships and shop-in-shops to expand the beauty category and their customer base.

Macy’s Fragrance Finder is a personalization tool on its website which walks consumers through a series of questions, helping them to select a fragrance based on preferences

Macy’s Fragrance Finder is a personalization tool on its website which walks consumers through a series of questions, helping them to select a fragrance based on preferences  Nordstrom Live is a dedicated site on Nordstrom.com for livestreaming content

Nordstrom Live is a dedicated site on Nordstrom.com for livestreaming content  Saks Live is a dedicated site on Saksfifthavenue.com for live event content

Saks Live is a dedicated site on Saksfifthavenue.com for live event content