Nitheesh NH

Introduction

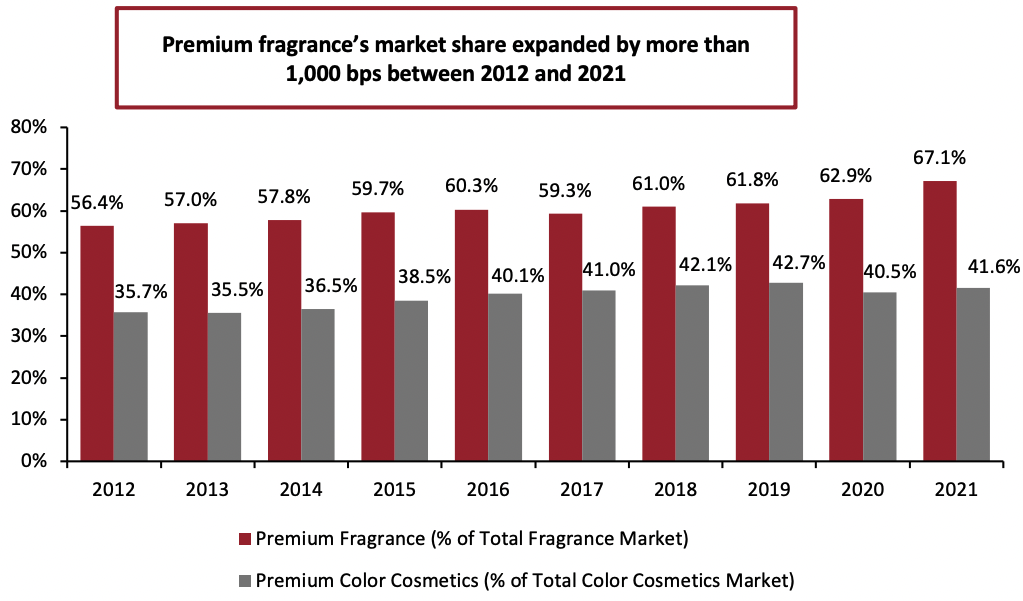

What’s the Story? Luxury brands can fulfill consumers’ dreams of superior products, providing a sense of status, culture and savoir faire. While luxury brands and fashion designers frequently create expensive, couture looks that many cannot afford, these looks still build brand awareness. This brand awareness is incredibly valuable and can be leveraged over multiple categories, including beauty and fragrance, to enhance brand value and profitability. Luxury products do not need to be expensive to be luxurious. Beauty and fragrance have lower price points than most luxury products but achieve many of the same goals, providing consumers with something intangible and ephemeral outside the physical product. Beauty and fragrance tap into consumers’ desire for a particular brand’s products—as well as luxury products overall—while expanding the brand’s offerings and acting as a pathway to its more expensive products. In this report, we explore how beauty and fragrance offerings can be used as an entry point for fashion brands seeking to transform into luxury brands. This report is sponsored by CEW, conversation leaders in the beauty industry and community. Why It Matters Fragrance and beauty are easily positioned as the first steps to luxury, given their aspirational pricing. In turn, this allows luxury brands to avoid the potential cognitive dissonance of a diffusion brand and the pitfalls of extending into another—potentially cannibalistic—fashion category. In luxury, the premium beauty and personal care category is second only to leather goods as a sales driver, growing faster than the US and global luxury markets between 2008 and 2021, according to Euromonitor International data. In the global beauty market, premium fragrances and color cosmetics have increased penetration of their respective categories, per Euromonitor International (see Figure 1).Figure 1. Market Shares of Premium Fragrances and Color Cosmetics (%) [caption id="attachment_153422" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

If done right, beauty and fragrance can also extend brand awareness, improve overall brand profitability and benefit from licensee marketing. Stretching a brand’s coverage from fashion to beauty and fragrance can enrich a luxury brand, giving it staying power and, therefore, making it more of a complete lifestyle.

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

If done right, beauty and fragrance can also extend brand awareness, improve overall brand profitability and benefit from licensee marketing. Stretching a brand’s coverage from fashion to beauty and fragrance can enrich a luxury brand, giving it staying power and, therefore, making it more of a complete lifestyle.

Beauty and Fragrance as an Entry Point to Luxury: Coresight Research Analysis

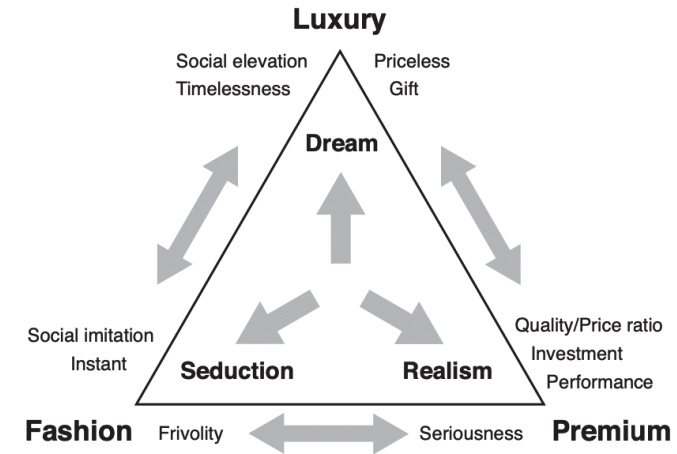

Luxury—More Than Just Price In the fashion space, designer products may carry high prices typically associated with luxury brands—but a high price does not necessarily mean that something is luxurious: expensive products are simply expensive. Luxury products consist of much more than a hefty price tag; they connote quality, heritage, cultural relevance and timelessness. In a flattened world without social markers to stratify the population, luxury products are used to signal wealth, status and taste—in short, the dreams of many consumers. While some fashion purchases also signal status, luxury differentiates itself by living in the mind of the consumer and building lifetime relationships with them. Fragrance, with its sensory experience, fits squarely within the realm of luxury, as many brands have demonstrated throughout history. In 1921, 10 years after Coco Chanel started her career as a hat designer, she debuted what would become the world’s leading fragrance, Chanel No. 5—the first fragrance to bear its designer’s name. It would be another four years until she introduced her iconic suits and the “little black dress.” Today, Chanel is a $15.6 billion business (according to its annual report), of which we estimate 35%–40% is from beauty, and one of the few haute couture businesses making money. Christian Dior was quicker to launch his premiere fragrance, Miss Dior. He did so in 1948, just a year after the opening of his shop and his first runway show in 1947, following Miss Dior up with many other fragrances in the years since. Dior did not follow what was to become a luxury brand strategy—minimizing licensing in favor of greater control. Instead, he used multiple licenses to quickly expand and monetize the brand. While the strategy led to success, it also diluted the Christian Dior brand for decades, with the company only recently regaining its luxury status. Managing a luxury brand instead requires developing a timeless, cohesive brand culture, story and heritage, while protecting consumers’ aspirations and product quality and exclusivity. The image below, from the book The Luxury Strategy: Break the Rules of Marketing to Build Luxury Brands by Vincent Bastien and Kapferer, showcases the factors that distinguish fashion, premium and luxury. Fashion is fleeting and of the moment, while premium positioning rationally depends on the quality and price equation. Luxury is beyond rationale; its quality and status make it priceless and timeless. Given the sensory nature of the category, beauty products—notably fragrance—have the ability to evoke feelings within a consumer, which, along with marketing, can create a pathway to participating in the luxury industry. [caption id="attachment_153423" align="aligncenter" width="420"] Source: The Luxury Strategy by J.N. Kapferer and V. Bastien[/caption]

Why Fragrance?

Fragrance is typically the first beauty category employed by fashion brands. While the rest of beauty is known for efficacy, fragrance is a lifestyle. Chanel said it best: “No elegance is possible without perfume. It is the unseen, unforgettable, ultimate accessory.”

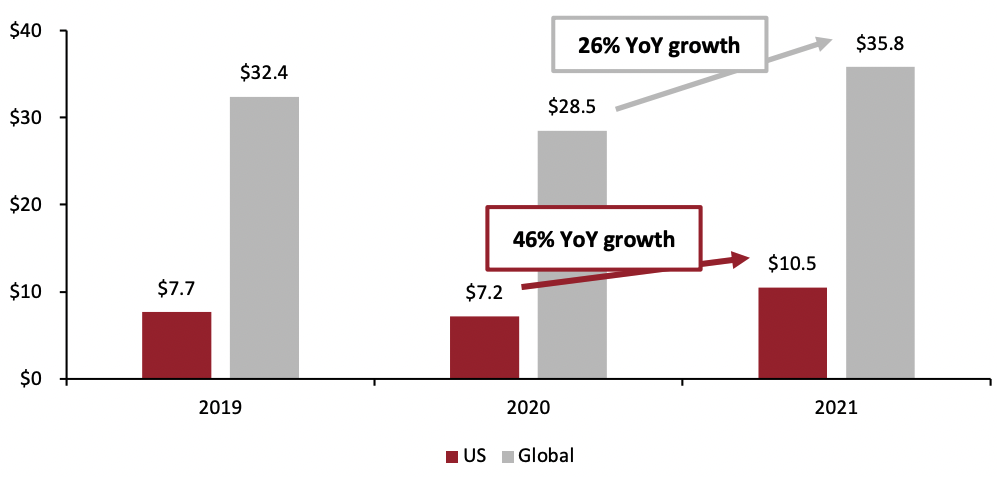

Most luxury brands have now debuted at least one fragrance despite some previously considering fragrance a low-growth category compared to skincare. However, those opinions, once held by the likes of luxury expert Erwan Rambourg, are now changing, given the double-digit year-over-year growth that the global and US premium fragrance markets experienced in 2021 (see Figure 2).

Source: The Luxury Strategy by J.N. Kapferer and V. Bastien[/caption]

Why Fragrance?

Fragrance is typically the first beauty category employed by fashion brands. While the rest of beauty is known for efficacy, fragrance is a lifestyle. Chanel said it best: “No elegance is possible without perfume. It is the unseen, unforgettable, ultimate accessory.”

Most luxury brands have now debuted at least one fragrance despite some previously considering fragrance a low-growth category compared to skincare. However, those opinions, once held by the likes of luxury expert Erwan Rambourg, are now changing, given the double-digit year-over-year growth that the global and US premium fragrance markets experienced in 2021 (see Figure 2).

Figure 2. Premium Fragrance Market Sizes: US and Global (USD Bil.) [caption id="attachment_153424" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

The Covid-19 pandemic brought new meaning to fragrance for many consumers. Fragrance, in all its forms—including traditional eau de parfum, eau de toilette, potpourri and candles—became a path to serenity, self-care and wellness. Now, fragrance has been woven more intricately into consumers’ lives. For many, it is no longer indulgent but has become a necessary luxury. Of course, daily fragrance use also builds a stronger relationship between the brand and the consumer. The global fragrance market’s 26% year-over-year growth in 2021 reflects this increased adoption and consumers’ changing attitudes.

As Uche Okonkwo stated in her book Luxury Fashion Branding: Trends, Tactics, Techniques:

Source: Euromonitor International Limited 2022 © All rights reserved[/caption]

The Covid-19 pandemic brought new meaning to fragrance for many consumers. Fragrance, in all its forms—including traditional eau de parfum, eau de toilette, potpourri and candles—became a path to serenity, self-care and wellness. Now, fragrance has been woven more intricately into consumers’ lives. For many, it is no longer indulgent but has become a necessary luxury. Of course, daily fragrance use also builds a stronger relationship between the brand and the consumer. The global fragrance market’s 26% year-over-year growth in 2021 reflects this increased adoption and consumers’ changing attitudes.

As Uche Okonkwo stated in her book Luxury Fashion Branding: Trends, Tactics, Techniques:

Perfumes in particular play an important role in consumer relationships with the brand. It is considered the easiest point-of-entry product into the luxury market and has the fastest growth rate. It also generates high publicity, does not consume high capital, is a source of fast profits and has a long shelf-life and rapid stock turnover.

Fragrance—and, more broadly, the beauty category overall (as we discuss below)—is the natural first step for a fashion brand to take as it evolves from a high-priced clothing house that fleetingly makes customers feel special to an enduring brand that has staying power beyond a single season. Why Beauty? As a new category for a fashion brand to extend into, beauty is unlikely to be cannibalistic to the company’s existing lines. Meanwhile, beauty products typically have lower price points, allowing brands to attract wider audiences without eroding their high-end designer positioning. As Coco Chanel discovered over 100 years ago, the relatively strong product margins of beauty offerings are a viable path to profits for many fashion brands—a fact that remains true today. Moreover, fashion brands can use a licensing model to extend into beauty by allowing an established beauty company, such as L’Oréal or Estée Lauder, to create, manufacture, distribute and market the products. Afterward, the beauty company pays the fashion brand a royalty of 7%–10%. As long as the product is good and the distribution is brand appropriate, the fashion brand benefits from growing visibility and increased demand for its products. Many designers, including Donna Karan, Issey Miyake (who passed away shortly before we published, on August 5, 2022), Michael Kors, Vera Wang and Yves Saint Laurent, have used this strategy to move beyond the vicissitudes of the fashion business into a more stable and reliable business. The way consumers use beauty products is based on both a product’s efficacy and how it makes one feel. For instance, a woman might feel attractive wearing a branded lipstick, but if it runs and doesn’t wear well, the magic of the brand disappears. Beauty products must both work and make one feel special—leading to repeat purchases and word-of-mouth recommendations—to be successful and profitable. Quality is table stakes in luxury, the foundation of the category, just as product efficacy is the foundation of cosmetics. Fashion brands using beauty to elevate themselves to luxury must ensure their branded cosmetics work well, fulfilling consumers’ dreams of superior products.What We Think

Beauty and fragrance are natural stepping stones in the creation of a luxury brand. Similar to luxury, what compels beauty and fragrance purchases is a consumer’s emotional response to the product. With lower price points and virtually no cannibalization, beauty and fragrance add to a brand’s offering, increase potential discovery touchpoints and allow many more consumers to access luxury at a significantly lower cost. Implications for Brands/Retailers- Fashion brands should leverage the power of their consumer base when launching a fragrance, ultimately capturing a greater market share. In doing so, they lessen their dependence on the trendy and cyclical fashion category and expand their market opportunities.

- Fashion brands that extend their brand into beauty should look to sell to different retailers and departments, thus increasing consumer touchpoints and brand visibility.

- Fashion brands should look to work with a known beauty company, such as Coty, Estée Lauder, L’Oréal or Puig, to develop and distribute fragrance and beauty products.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved

Related Coresight Research Reports