DIpil Das

Introduction

What’s the Story?

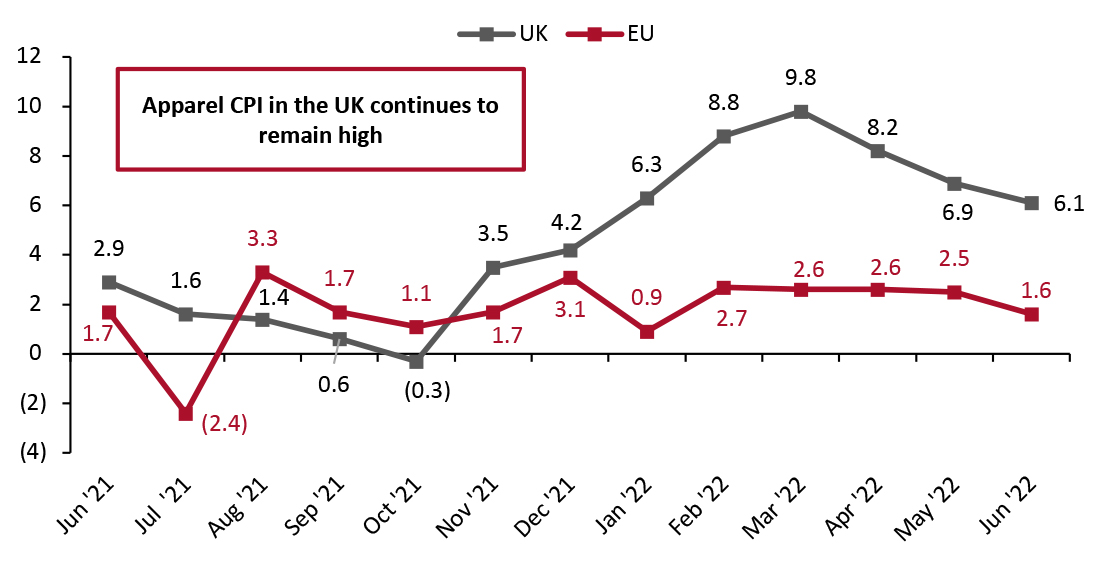

While European consumers are continuing their return to more normal ways of living, clothing and footwear shoppers are now grappling with high inflation in apparel and footwear, primarily in the UK, where it was at 6.1% in June 2022. This inflation has mainly been caused by supply chain bottlenecks. High inflation, including in input costs, is putting increasing pressure on retailers, especially in terms of handling high freight and raw material prices.

In this report, we discuss how European online and offline apparel and footwear retailers are addressing rising input costs, with a focus on ASOS, Boohoo, H&M, Inditex, JD Sports, Next, Primark and Zalando.

- Please also refer to our apparel inflation report, published in May 2022, which discusses how US apparel brands and retailers are addressing inflation costs and our retail inflation report, which analyzes US retailers’ (across sectors) strategies in light of rising costs due to inflation, published in June 2022.

Why It Matters

High overall inflation considerably impacts the sales of apparel and footwear retailers and creates more competition among them—because consumers are becoming more selective as they have less to spend on discretionary items, including clothing and footwear, since they are spending disproportionately more of their budget on essential goods. Furthermore, increasing input costs drive up retailers’ cost of goods sold and affect their gross margins and profitability.

Therefore, apparel and footwear retailers should consider consumers’ demands, preferences and insights when making their pricing and operational decisions to battle rising input costs. Retailers will also need to offer consumers more compelling and differentiating positions to continue to entice them in the current environment.

How European Apparel Retailers Are Combating High Input Costs: Coresight Research Analysis

In June, total UK inflation stood at 8.2%, accelerating from 7.9% in May, according to the Office for National Statistics (ONS). The inflation remained elevated despite recent interest rate hikes—on June 16, the Central Bank of England implemented its fifth interest rate hike since December.

The inflation in consumer prices of clothing and footwear remained high at 6.1% in June, although this was a deceleration from 6.9% in May. On the other hand, sales at UK clothing specialists rose by 12.0% from the previous year, decelerating from May’s 16.8% sales growth—indicating an overall decline in clothing and footwear sales volumes.

For the eurozone, consisting of 27 European countries (excluding the UK), total inflation was 9.6% in June 2022, up from 8.8% in May 2022, according to Eurostat. In contrast, against weak comparatives, the consumer price index of clothing and footwear was low in June 2022, at 1.6%.

Figure 1. UK and European Union: Consumer Price Index of Clothing and Footwear (YoY % Change) [caption id="attachment_152638" align="aligncenter" width="700"]

Source: Eurostat/Bureau of Labor Statistics/Coresight Research[/caption]

Source: Eurostat/Bureau of Labor Statistics/Coresight Research[/caption]

The substantial rise in prices of raw materials, elevated transportation costs, including higher air and ocean freights, and wage inflation are adding significant cost pressures for apparel and footwear retailers across Europe.

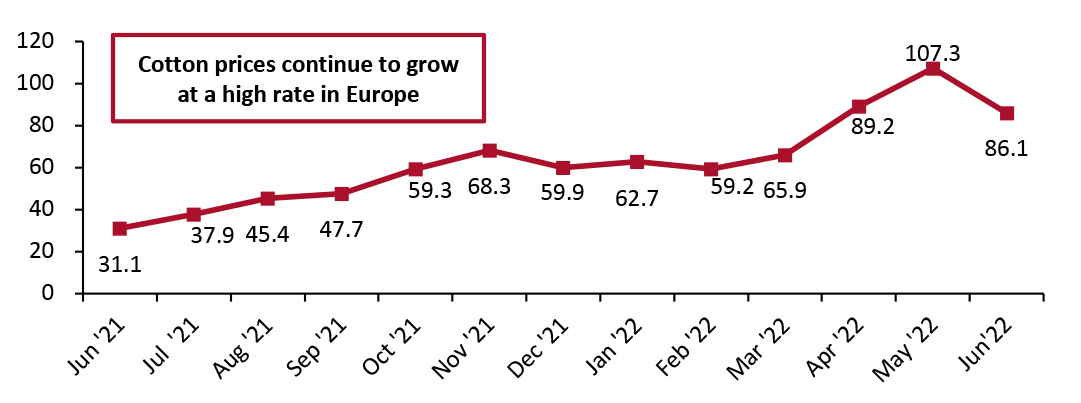

Increasing Cotton Prices

Cotton is the most-used textile fabric in the world and comprises about 75% of the world’s apparel products, including 60% of women’s clothing and 75% of men’s clothing, according to Cotton Inc. Cotton prices remain at high levels, with prices of cotton in Europe growing by 86.1% year over year in June 2022—although this is a deceleration from 107.3% growth in May 2022, according to IndexMudi’s collation of data from Cotton Outlook, International Cotton Advisory Committee, Liverpool Cotton Services and World Bank. The surge in cotton prices is driving apparel inflation substantially and impacting the overall costs of apparel retailers.

Figure 2. Europe: Monthly Cotton Prices Per Kg (YoY % Change) [caption id="attachment_152639" align="aligncenter" width="700"]

Source: Cotton Outlook/International Cotton Advisory Committee/Liverpool Cotton Services/World Bank[/caption]

Source: Cotton Outlook/International Cotton Advisory Committee/Liverpool Cotton Services/World Bank[/caption]

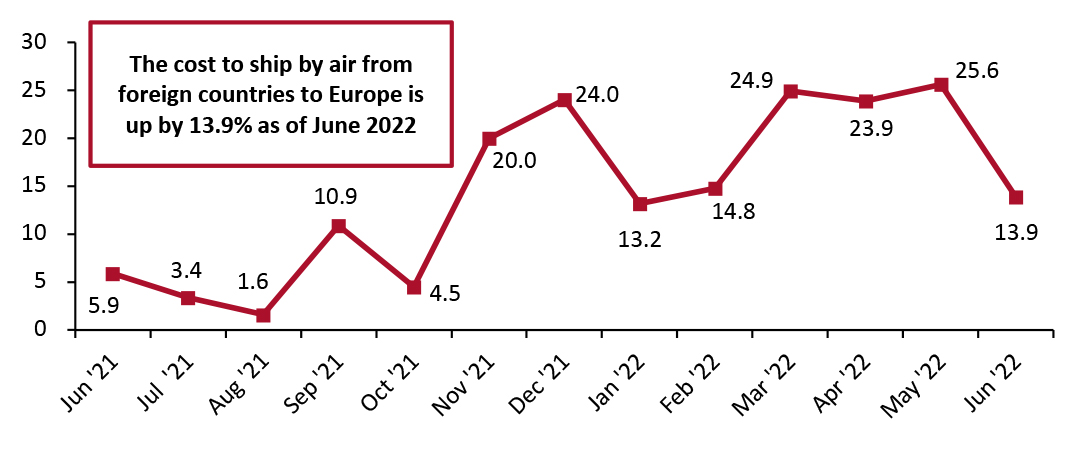

Rising Air Freight Rates

The significant increase in air freight rates has been driving up costs for retailers over the past year. The inbound air freight price index—which measures the monthly price changes of air freight flown from foreign countries, such as from China, into Europe on both European and foreign carriers—increased by 13.9% year over year in June 2022 against strong comparatives, although this is a deceleration from 25.6% growth in May 2022, according to Bureau of Labor Statistics data.

We expect elevated air freight costs to persist throughout 2022—adding to retailers’ input costs.Figure 3. Europe: Inbound Price Index of International Air Freight (YoY % Change) [caption id="attachment_152660" align="aligncenter" width="699"]

Source: Bureau of Labor Statistics[/caption]

Source: Bureau of Labor Statistics[/caption]

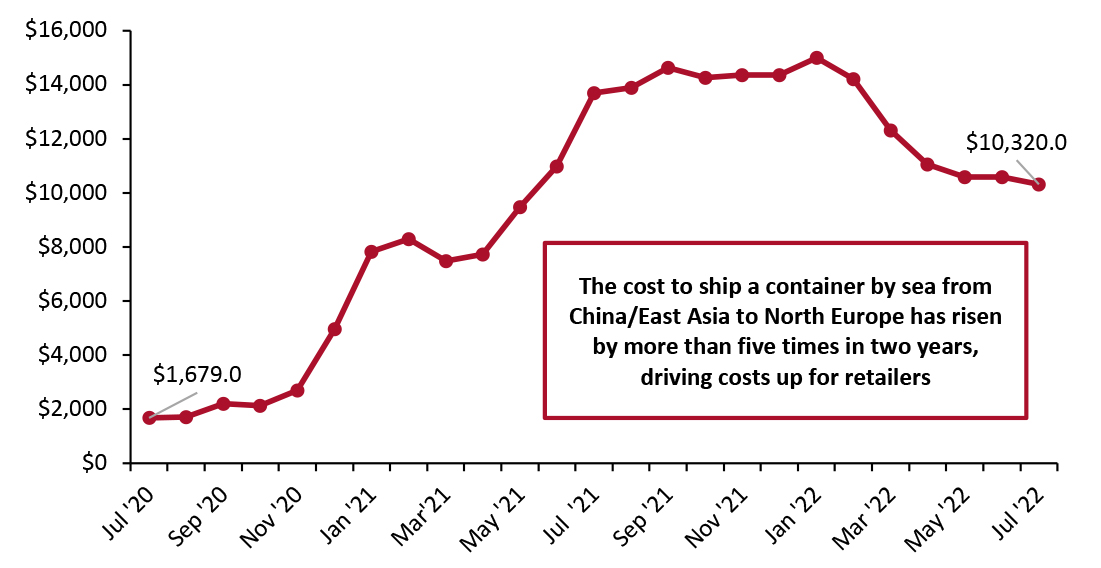

Higher Ocean Freight Rates

Ocean freight rates have surged in the past two years: As of July 2022, ocean freight costs of shipping a container from China/East Asia to North Europe, including the UK, have increased by more than five times since July 2020. Like air freight, we expect elevated ocean freight costs to persist throughout 2022, adding to retailers’ input costs.

Figure 4. Ocean Container Freight Rate Index from China/East Asia to North Europe (USD) [caption id="attachment_152641" align="aligncenter" width="700"]

Source: Drewry World Container Index/Macromicro.me[/caption]

Source: Drewry World Container Index/Macromicro.me[/caption]

In the next sections, we focus on European apparel and footwear specialists’ and online fashion platforms key initiatives to combat rising input costs.

Apparel and Footwear Specialty Retailers: Increased Retail Prices by 5%–10%

In the most recent quarter, we saw that most of our covered apparel and footwear specialists witnessed a year-over-year increase in their gross margins. We identify that many apparel retailers are increasing retail prices and raising the share of full-price sales to offset the impact of inflation on gross margins. On an average, European apparel and footwear specialty retailers have increased retail prices by 5%–10%. Furthermore, these retailers are taking several operational measures, such as growing private labels and expanding supply chain capabilities, to battle high inflation costs.

Figure 5. Selected European Apparel and Footwear Specialists: Key Pricing and Operational Strategies to Combat Increasing Input Costs

|

Retailers |

Pricing Strategies |

Operational Strategies |

|

H&M |

In the first half of fiscal 2022 earnings call held in June 2022, H&M noted that the company has raised prices in the first half of the year and would likely increase them throughout the rest of the year. Price hikes will vary among markets and depend on the competitive situation.

|

H&M noted that it continues to invest in supply chain capabilities and innovative technologies to reduce transportation costs. The company is using data science and machine learning technologies to ensure precision in inventory management and pricing decisions. During late autumn, the company prolonged its purchasing lead times and saw favorable results in terms of getting garments to destinations earlier than intended. The company has flexibility in terms of rent costs as it has a very high share of sales-based and turnover-based rents and a strong setup with its mall landlords. |

|

Inditex (owner of Zara) |

Inditex has lifted its starting prices by 10% or more from a year ago each month since January 2022, according to Swiss investment bank UBS. In the first quarter of the fiscal 2022 earnings call held in June 2022, the company noted that it expects increased product pricing to contribute to 2022 Spring/Summer sales growth in the mid-single digits with no effect on sales volumes. |

The company plans to accelerate inventory inflows with its varying commitment levels to increase product availability amid the ongoing supply chain tensions. Inditex continues to capitalize on its unique business model: Zara, the company’s principal retail concept—which generates around two-thirds of its sales—operates a vertically integrated model with in-house design and production capabilities, helping the company to manage costs. |

|

JD Sports |

In the fiscal 2022 earnings call held in June 2022, JD Sports noted that, on an average, it has increased prices by mid-single digits for its own and partner brands. However, the company’s management said that consumer demand remains unimpacted despite the price increases. |

To mitigate rising costs, the company is expanding its private labels, such as DTLR, Finish Line and Shoe Palace, and increasing the owned-label mix of apparel within its business. The company also noted that its Derby warehouse will commence some limited fulfillment later this year—which will help the retailer to lower some of the logistic costs. |

|

Next |

In the earnings call held in March 2022, Next noted it plans to increase the prices of its apparel products by 6.5% and homeware products by 13.0% in the second half of 2022, an important step up from an overall 3.7% rise in prices in the first half of the year. |

Lauren House, Senior Assistant Company Secretary at Next, told Coresight Research in July 2022 that, under the company’s Total Platform, Next is expanding its Next Direct Dispatch service, where the product goes from its partners' warehouse directly to the consumer via a Next-nominated carrier. This is helping Next to deliver products cheaper than its logistics partners and have complete visibility of the items. Furthermore, House said that the company is investing in modernizing its core systems and warehouses, which will help Next to generate cost savings in the near term. |

|

Primark (owned by Associated British Foods) |

In June 2022, Primark announced that it will implement “selective price increases” across autumn/winter stock—from August to September. However, despite the price rise, Primark aims to maintain price leadership in its addressable market.

|

Primark is automating its Leicestershire warehouse and stores across the UK to minimize costs. It has made significant investments in digital, including the implementation of Oracle across all of its stores and distribution centers, as well as the rollout of its new electronic point-of-sale (POS) system in the store. Primark is also working with its suppliers for flexible procurement of inventory. |

Figure 6. Gross Margin Metrics of Selected European Apparel and Footwear Specialty Retailers

|

Company Name |

Earnings Quarter |

Total Gross Margin |

YoY Change (in basis points) |

Positive Drivers |

Negative Drivers |

|

H&M |

2Q22 |

54.8% |

90 |

Higher average selling prices, increased proportion of full-price sales and lower markdown rates |

Increase in raw materials and transportation costs

|

|

Inditex (owner of Zara) |

1Q22 |

60.1% |

20 |

Higher average retail prices, inventory optimization and favorable product mix |

Elevated product and supply chain costs |

|

JD Sports |

4Q21 |

49.7% |

Flat |

Charging higher retail prices, inventory optimization and less promotional activity |

Higher transportation costs |

|

Next |

4Q21 |

44.0% |

460 |

Tactical price increases and early receipt of merchandise |

Higher air freight surcharges |

|

Primark (owned by Associated British Foods)* |

1H22 |

11.7% (Adjusted operating margin) |

980 (Adjusted operating margin) |

Strong sales recovery, a higher proportion of full-price sales, inventory optimization and reduction in-store operating costs |

Higher raw materials and transportation costs |

Figure 7. Selected European Apparel E-commerce Platforms: Key Pricing and Operational Strategies to Combat Increasing Input Costs

|

Retailers |

Pricing Strategies |

Operational Strategies |

|

ASOS |

In the first half of the fiscal 2022 earnings call held in April 2022, ASOS noted that it has raised prices by low to mid-single-digits at its own brands and partner brands—with the dresses category witnessing more price hikes than casual wear. The company further stated that the overall price elasticity of demand remained favorable for its own brands and third-party brands.

|

ASOS noted that it is growing its private labels, such as ASOS, ASOS Design, Topman and Topshop, to reduce costs and preserve margins. The company has also integrated its procurement, design and merchandising and sourcing departments to save time and costs. Moreover, ASOS is reassessing its data capabilities and data strategy to drive inventory management, marketing and personalization. The company is also diversifying its supplier base and has successfully implemented cost savings initiatives across inventory procurement and technology spending. |

|

Boohoo |

In the first quarter of the fiscal 2022 earnings call held in June 2022, Boohoo noted that it had increased its product prices by double-digits, with a major price hike in the dresses category. Despite the price increases, conversion rates have been almost similar year over year, according to the company.

|

To mitigate costs, Boohoo has increased sourcing from nearshore markets in Europe and the company is gradually moving out of China. The company noted that it is capitalizing on the flexibility it has in its diverse supply base to decrease lead times and exposure to inbound freight costs. The company noted that managing inventory tightly is helping to reduce inbound freight cost pressures. Boohoo stated that the automation of its Sheffield distribution center will be completed by the end of 2022, which will deliver material cost savings and transform its delivery proposition in the UK. |

|

Zalando |

In its first quarter of fiscal 2022 earnings call held in May 2022, Zalando noted that it is passing through the fuel price surcharge that the company is seeing in logistics to its Zalando Fulfilment Solution (ZFS) brand partners—which is in line with the strategy of its cost-plus model. However, the company did not mention price increases for its own brands. Zalando sees a shift in demand—with low and high price points, products continued to grow quickly and witness higher demand, while the mid-segment is seeing contractions on its platform. |

The company is growing its supply chain capabilities to drive efficiencies and reduce costs. Zalando plans to expand its fulfillment capabilities substantially by 2023, through the addition of four new fulfillment centers to its existing network of 13 fulfillment centers, increasing the count to 17. Zalando is also ramping up the automation of its Lahr fulfillment center in Germany.

|

In the most recent quarter, we saw that all of our covered apparel and footwear e-commerce platforms witnessed a year-over-year decrease in their gross margins. To offset the impact of higher costs on gross margins, we are seeing that many fashion e-commerce platforms are increasing retail prices, lowering promotions and ensuring favorable channel or product mix shifts, as described in Figure 8 below.

Figure 8. Gross Margin Metrics of Selected European Apparel E-Commerce Platforms

|

Company Name |

Earnings Quarter |

Total Gross Margin |

YoY Change (in basis points) |

Positive Drivers |

Negative Drivers |

|

ASOS |

2Q22 |

43.1% |

(190) |

Higher average retail prices and inventory optimization |

Increased markdown and inflated wages, freight, warehousing and delivery costs |

|

Boohoo |

1Q22 |

52.8% |

(220) |

Charging higher retail prices and increasing the proportion of full-price sales |

Elevated inbound freight costs |

|

Zalando |

1Q22 |

38.7% |

(210) |

Strong sales in low- and high-priced segments and inventory optimization |

Increased price and marketing investments, higher logistics and fulfillment costs |

Our Insights on Apparel and Footwear Retailers’ Cost Mitigation Measures and Consumer Expectations

Figure 9. Summary: How European Apparel and Footwear Retailers Are Combating Higher Input Costs

| Retailers | Key Pricing and Operational Measures | Our Insights on Consumer Expectations |

| Apparel and footwear specialty retailers | Passing on the increased wholesaling costs to consumers, while using predictive analytics to inform price increases and improve inventory assortment and expanding vertically integrated supply chain facilities | Retailers with a strong consumer affinity, such as H&M and Inditex, will not have a problem raising prices; both retailers are seeing strong consumer demand and expect high-single digit to double-digit sales growth for fiscal 2022. |

| Online apparel and footwear platforms | Increasing retail prices, growing private labels, using flexible procurement models and diversifying supplier bases | Retailers providing values and strong cost savings are best positioned—including ASOS and Boohoo. |

What We Think

Increasing retail prices remains the main strategy deployed by European apparel specialists and fashion e-commerce platforms to recover high freight and raw material prices. While increasing prices is helping retailers to offset some of the impact of higher input costs on gross margins in the short term, we think that retailers’ recent operational measures are more significant in preserving and sustaining profitability in the medium term. These include expanding supply chain capabilities through automation of distribution centers, increasing sourcing from nearshore markets, enhancing in-house production capabilities and bolstering company-owned logistics facilities.

Implications for Brands/Retailers

- Growing private label penetrations, switching to low-cost suppliers, inventory optimization, automating distribution centers and bolstering and logistics services can help retailers and brands to mitigate rising input costs.

- Retailers and brands can use data analytics and machine learning capabilities across their businesses to understand their customers, improve inventory assortment and inform price increases while increasing merchandise margins.

- Apparel retailers with a strong brand affinity, such as ASOS, Boohoo, H&M and Inditex, are likely to continue to outperform. On the other hand, retailers without a strong differentiating position and brand purpose will struggle to compete in an inflationary environment.