Nitheesh NH

Bath & Body Works, Inc.

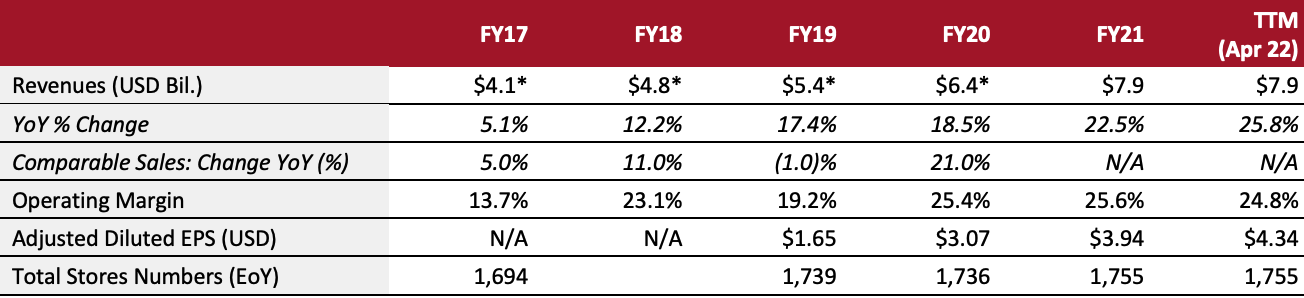

Sector: Specialty retail Countries of operation: Canada and the US Key product categories: Beauty, home goods and personal care Annual Metrics [caption id="attachment_150371" align="aligncenter" width="700"] Fiscal year ends on January 30 of the following calendar year

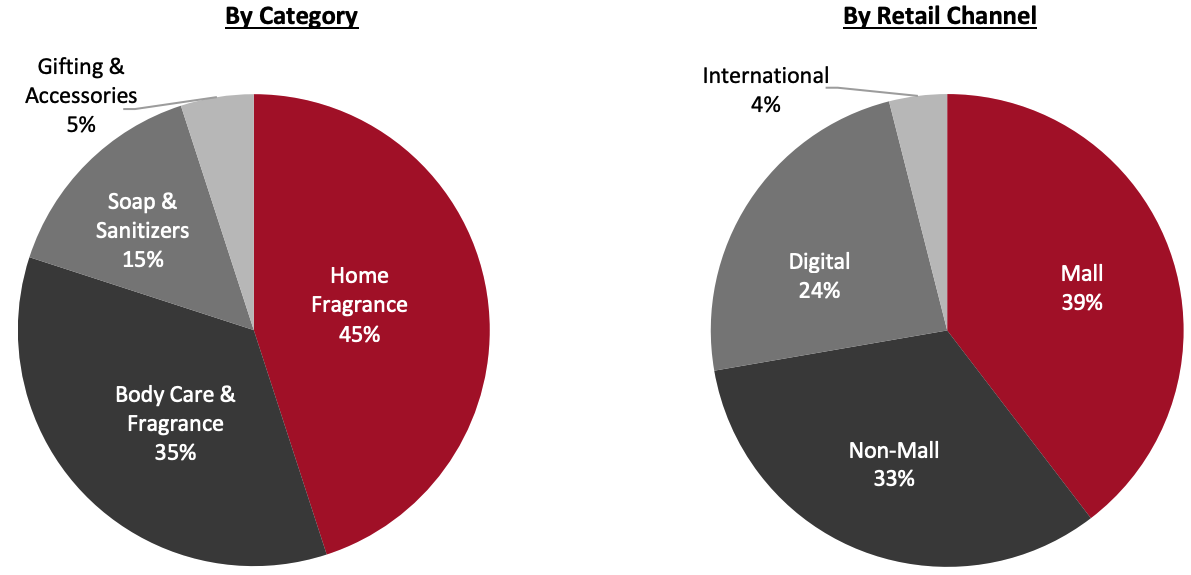

Fiscal year ends on January 30 of the following calendar year*Total Bath & Body Works revenues as a part of L Brands, Inc.[/caption] Summary Founded in 1963 in Columbus, Ohio, Bath & Body Works, Inc. (BBW)—previously known as L Brands Inc.—has evolved from an apparel-based specialty retailer to a category leader focused on home fragrance, body care products and soaps and sanitizer products operating under the BBW and White Barn brands, among others. On August 2, 2021, the company completed the spin-off of its Victoria’s Secret business, which included the Victoria’s Secret and PINK brands, into an independent publicly traded company. BBW offers merchandise through 1,755 company-operated specialty retail stores in Canada and the US as of January 29, 2022. Its stores are both mall-based and off-mall, with a roughly 50/50 split. The company also sells its products through 338 franchised locations and 27 e-commerce sites in more than 35 countries worldwide, operating under franchise, license and wholesale arrangements. Company Analysis Coresight Research insight: BBW experienced outstanding growth in fiscal 2021, despite navigating pandemic disruptions and the spin-off of Victoria’s Secret, as consumer demand in its key categories increased during the crisis—including beauty, home, personal care and sanitization. BBW grew its active customer file to over 60 million customers in the same year, a 13% gain vs. pre-pandemic levels. It simultaneously increased average spending and witnessed a retention rate of over 60%. We see the recent Victoria’s Secret spin-off as a plus for BBW, allowing it to focus on its home, body care, fragrance and soap and sanitizer businesses. In categories like these, product newness every four to six weeks creates frequent store visits and a replenishment business model. With 80% of its product sourced in the US and strategic, long-term supplier relationships, BBW is well-positioned to continue to launch 6,000 new stock-keeping units (SKUs) annually across its channels, including 250 new fragrances, and to chase product when necessary.

| Tailwinds | Headwinds |

|

|

- Grow existing categories

- Continue to innovate with new products, including new fragrances, repackaging best-selling fragrances, upgrading formulas and container and vessel concepts in candles and soaps

- Launch new products every four to six weeks

- Grow in new and adjacent categories

- Launch products in new and adjacent categories, such as cleanser, moisturizer and men’s hair care, beard care and shave

- Expand its men’s antiperspirant and deodorant line to all stores in 2022, up from one-third currently

- Increase the entirety of its men’s collection, the fastest growing of BBW’s body care assortment during 2021

- Grow direct channel offerings

- Improve its websites, mobile app and text message marketing

- Increase speed to customers by investing in a company-operated direct channel fulfillment center to complement six permanent third-party operated direct channel fulfillment centers

- Expand buy online, pick-up in-store (BOPIS) to 250 more stores (at approximately 550 locations as of January 29, 2022)

- Launch a customer loyalty program, which will increase retention rates and sales, as well as provide in-depth customer data

- Grow international business

- Open 70 to 100 new international stores in 2022, on top of the 338 operating at the beginning of fiscal 2022

- Upgrade digital components of BBW’s international business, including country-specific web platforms tailored to local languages and preferences

- Grow store network

- Expand North American square footage by a low-single-digit, while limiting exposure to vulnerable mall locations and increasing off-mall penetration

- Continue with 150 planned real estate projects—100 new off-mall stores and 50 White Barn redesigns—these will be offset by about 40 to 50 mall closures, yielding expected square footage growth of approximately 6%

Company Developments

Company Developments

| Date | Development |

| July 20, 2022 | BBW updates its second fiscal quarter and full year 2022 guidance. The company now expects second-quarter sales to decline 6%–7% compared to last year and its previous guidance of a low-single-digit percentage increase. Meanwhile, it now expects second-quarter diluted EPS from continuing operations to be $0.40–$0.42, compared to the company’s previous guidance of $0.60–$0.65. For the full year, sales are now expected to decline by a mid- to high-single-digit versus last year and BBW’s previous guidance of a low-single-digit percentage increase. The company expects its annual operating income rate (as a percentage of sales) to be in the mid-teens. |

| May 18, 2022 | BBW reports $1.5 billion first fiscal quarter sales, a 1% decline reflected a 9% drop in online sales. |

| March 28, 2022 | Alessandro Bogliolo and Juan Rajlin join BBW’s Board of Directors, adding extensive global expertise as BBW seeks to expand internationally. |

| February 23, 2022 | BBW announces CEO succession, with Andrew Meslow planning to step down in May. Executive Chair Sarah E. Nash will serve as Interim CEO after Meslow departs. |

| August 3, 2021 | BBW completes the separation of Victoria’s Secret, which includes Victoria’s Secret Lingerie, PINK and Victoria’s Secret Beauty. BBW common stock starts trading under a new ticker symbol: “BBWI.” |

| May 19, 2021 | L Brands announces that upon completing the Victoria’s Secret spin-off, Wendy Arlin, current Senior Vice President of Finance and Controller for L Brands, will become BBW CFO. L Brands’ current CFO, Stuart Burgdoerfer, will retire. |

| May 11, 2021 | L Brands’ Board of Directors unanimously approves a plan to separate BBW and Victoria’s Secret through a tax-free spin-off of Victoria’s Secret to L Brands’ shareholders. The company expects the spin-off to be complete in August 2021. |

| December 21, 2020 | L Brands announces key leadership appointments at BBW: Julie Rosen joins as President immediately, while Deon Riley joins as Chief Human Resources Officer, effective December 2020. BBW also announces internal promotions: Chris Cramer is promoted to COO; Danielle Demko is promoted to EVP and General Manager of Direct Channels; George Arenschield is promoted to EVP, Merchandise, Planning and Allocation; and Ron Ford is promoted to EVP and Head of Stores and Sales. |

- Sarah E. Nash—Executive Chair and Interim CEO

- Wendy Arlin—CFO

- James Bersani—President, Real Estate

- Chris Cramer—COO

- Julie Rosen—President

Source: Company reports/S&P Capital IQ