DIpil Das

On April 15, 2020, JCPenney elected not to pay a $12 million interest payment which was due on April 15, according to its 8-K securities filing. This came on the heels of the retailer being downgraded by Moody’s on April 13.

JCPenney Downgraded Due to Lack of Revenue from Physical Store Closures

While JCPenney’s cash position is adequate for a short time, store closures due to the coronavirus crisis are exerting pressure on the retailer. Moody’s stated: “Although JCPenney liquidity is adequate, the widespread store closures as a result of the coronavirus pandemic and the continued suppression of consumer demand is expected to pressure JCPenney's EBITDA, impede its turnaround strategy and weaken its leverage to unsustainably high levels."

The company reported on its fourth-quarter earnings call that more than 80% of its sales are generated in its physical stores. In 2019, the company’s revenues were $10.7 billion, implying at least $8.6 billion of sales were made in stores (or $713 million per month) and up to $2.1 billion of sales were made online (or $178 million per month).

The company had 846 stores at the end of 2019. JCPenney had $336 million in cash and $3.6 billion in long-term debt.

Men’s Apparel and Accessories Is Largest Category; Kohl’s and Amazon Could Benefit Should JCPenney Go Bankrupt

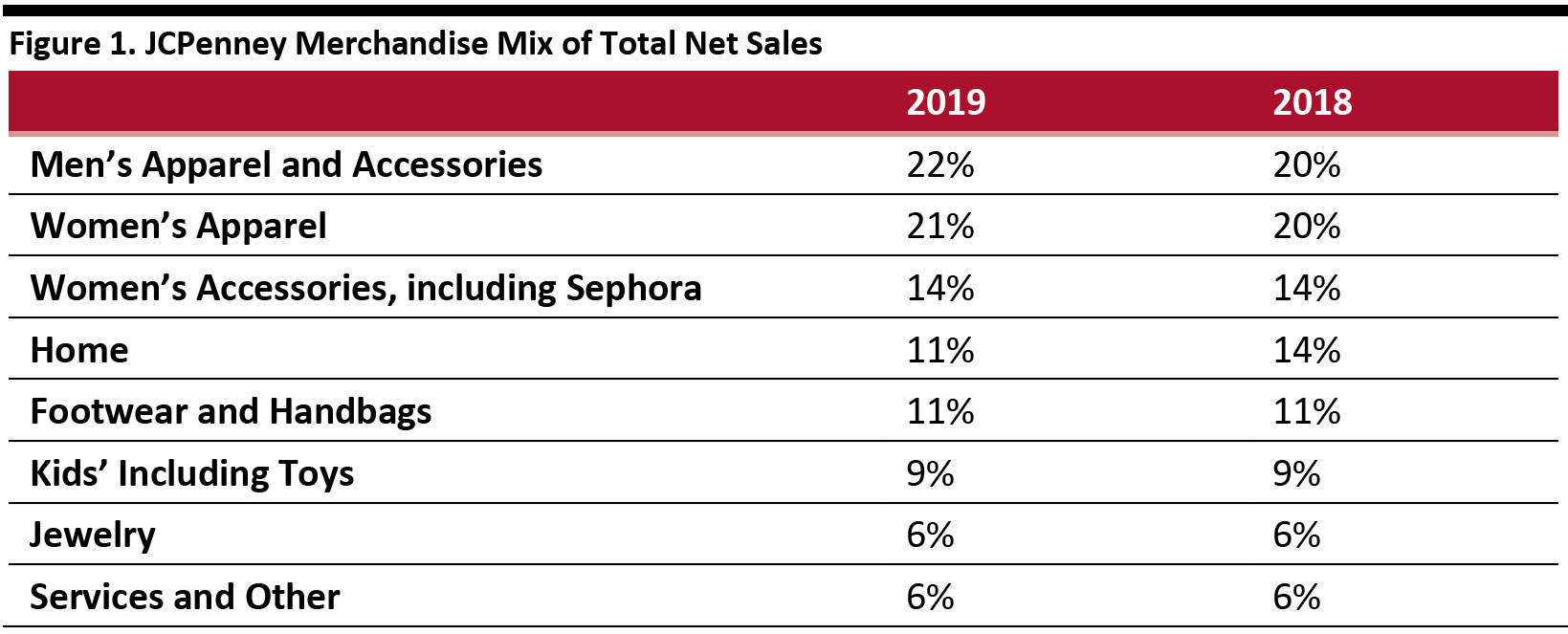

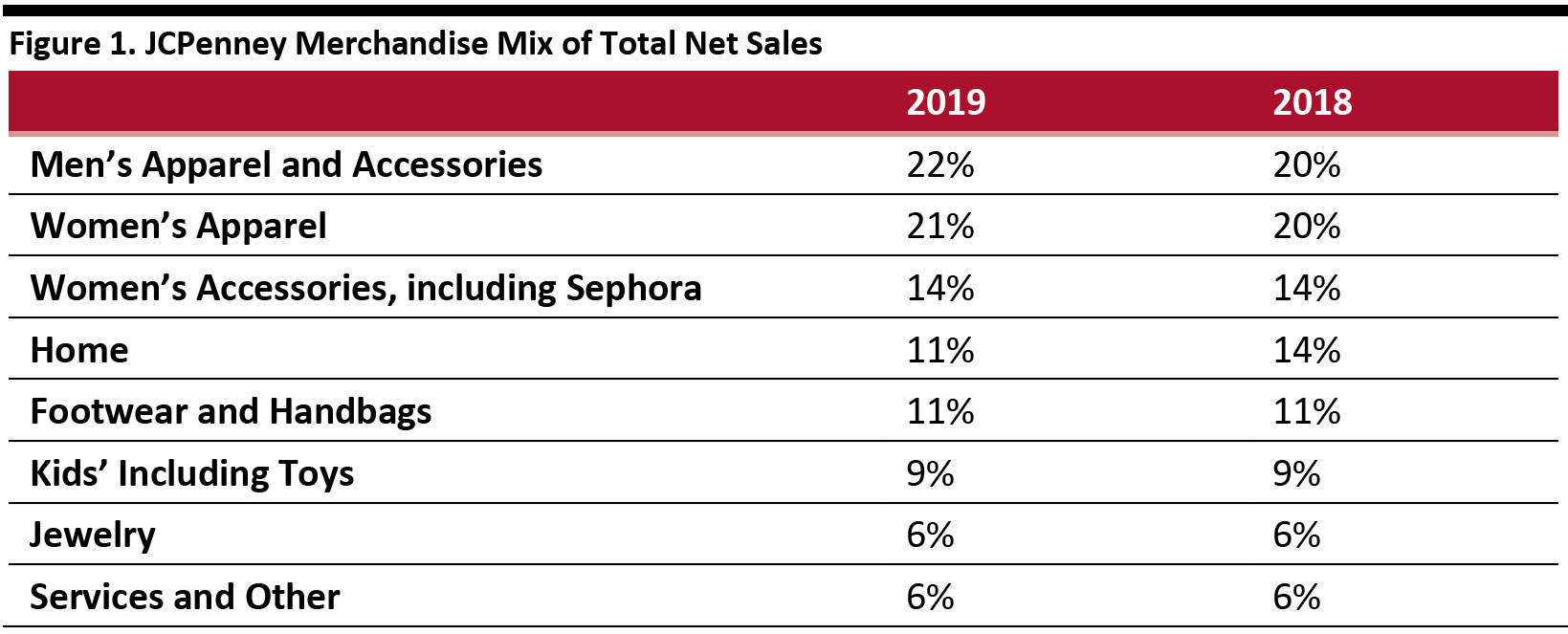

Men’s apparel and accessories is the top segment at JCPenney, accounting for 22% of revenue in 2019, up from 20% in 2018, as shown in Figure 1. Men’s apparel and accessories sales totaled approximately $2.35 billion in the latest year.

JCPenney sells straightforward, value-priced apparel with close competitors including Kohl’s and Amazon. Should JCPenney close its doors permanently, we expect Kohl’s and Amazon will be among those to benefit, as we expect many consumers will be particularly budget conscious due to the economic impacts of the coronavirus outbreak.

According to Coresight Research survey data:

Source: Company reports [/caption]

Source: Company reports [/caption]

- 74% of those who had bought apparel from JCPenney had also bought apparel on Amazon in the past year—well above the average rate of shopping on Amazon.com.

- 57% of those who had bought apparel from JCPenney had also bought apparel from Kohl’s in the past year—versus the 35% average for buying from Kohl’s.

- JCPenney shoppers also recorded higher-than-average rates of purchasing apparel from Walmart and Target.

Source: Company reports [/caption]

Source: Company reports [/caption]