Baidu Forms Strategic Partnership with PayPal to Tap Overseas Mobile Payment Market

The strategic partnership between PayPal and Baidu will enable roughly 17 million PayPal merchants to accept payment from Baidu Wallet users before the end of 2017. That means Chinese consumers can pay using their Baidu Wallet and PayPal at merchants outside of China. Given the multitude of options Chinese consumers have to buy from PayPal merchants in the US, the partnership will eventually expand PayPal's entire global merchant base outside of China and drive demand in cross-border trade over the PayPal platform.

Our Take: The Partnership Could Benefit Baidu More Than PayPal

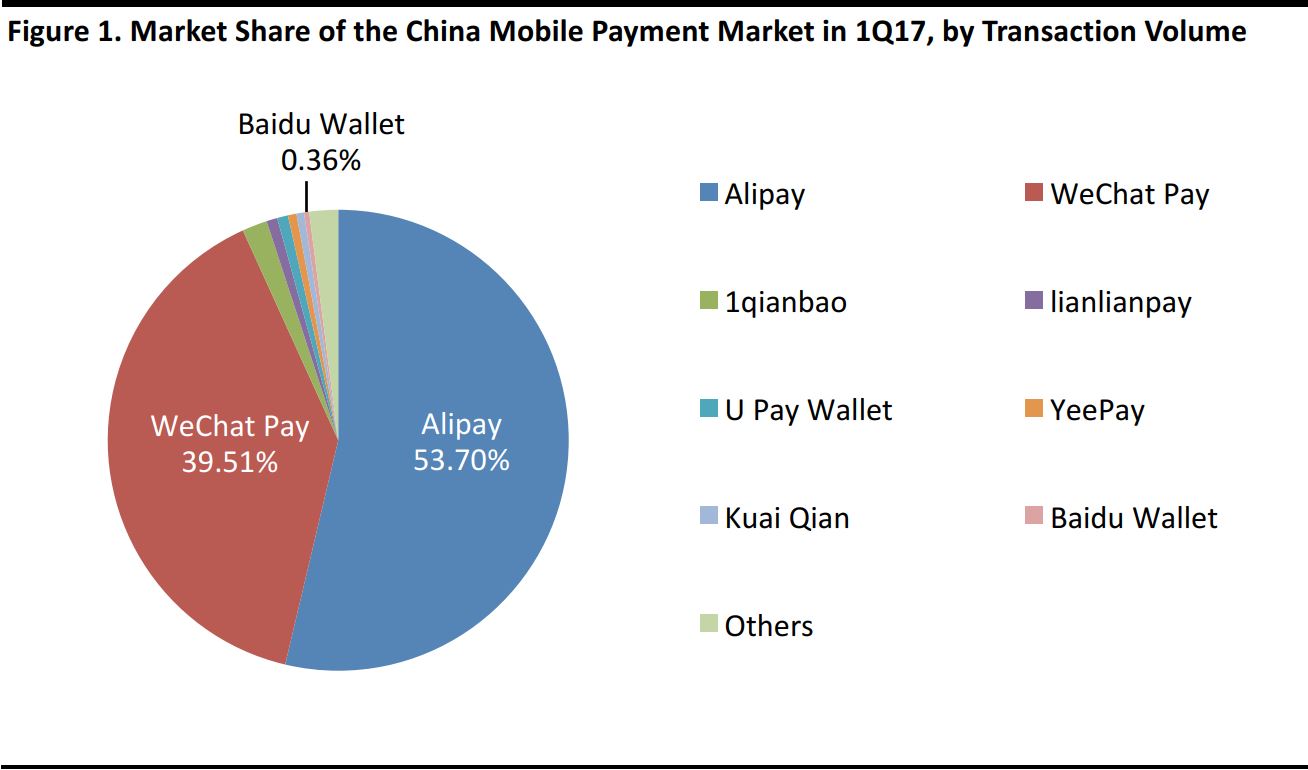

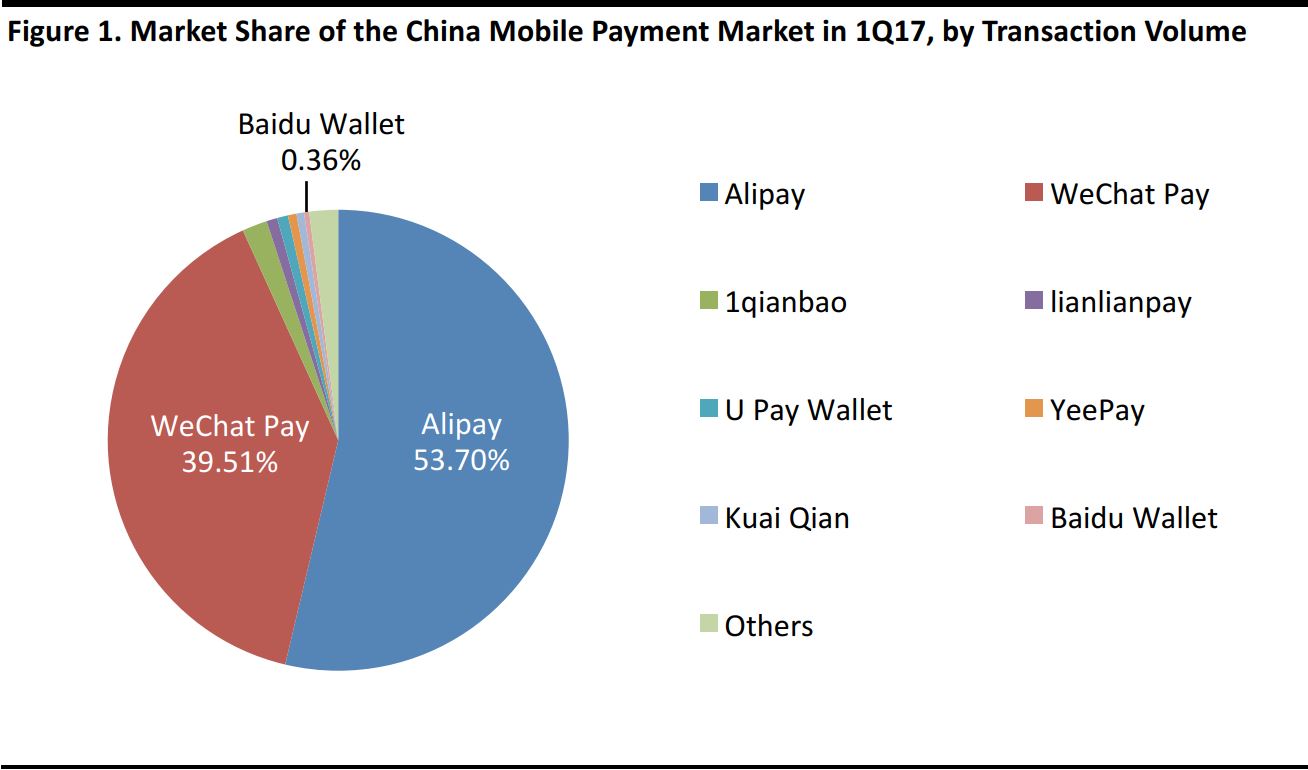

Partnering with PayPal on technology and product innovation should enhance the cross-border consumer experience for Baidu Wallet users. We view this strategic move as positive, as it will allow Baidu Wallet to catch up with the leaders in the domestic market, Tencent’s WeChat Pay and Ant Financial’s Alipay. The 100 million monthly active users (MAU) of Baidu Wallet only accounted for 0.36% of China’s mobile payment market by transaction volume in the first quarter of 2017.

As PayPal had already partnered with UnionPay last year to allow global merchants to accept payments from Chinese customers, this new partnership should further increase PayPal’s appeal to global merchants and broaden the relevance of PayPal’s platform.

Catch-Up Time for Baidu Wallet, Both Domestically and Overseas

Baidu Wallet trails behind Tencent’s WeChat Pay and Ant Financial’s Alipay, both at home and overseas.

The Domestic Market

Baidu had a mere 0.36% of the Chinese mobile payment market in the first quarter of 2017, clearly behind the leaders—Alipay with 53.7% and WeChat Pay with 39.51%—according to market research firm Analysys. Owing to the large user base of the WeChat and QQ messaging platforms, Chinese consumers frequently use WeChat Pay for a wide array of daily payments, ranging from ride-hailing services to shopping. Alipay, on the other hand, is the key payment method for China’s largest e-commerce platform Taobao. Both WeChat Pay and Alipay are backed by solid platforms, while Baidu Wallet still lags far behind.

Source: Analysys/FGRT

Overseas Market

In terms of overseas expansion, Baidu is also lagging behind Ant Financial and Tencent.

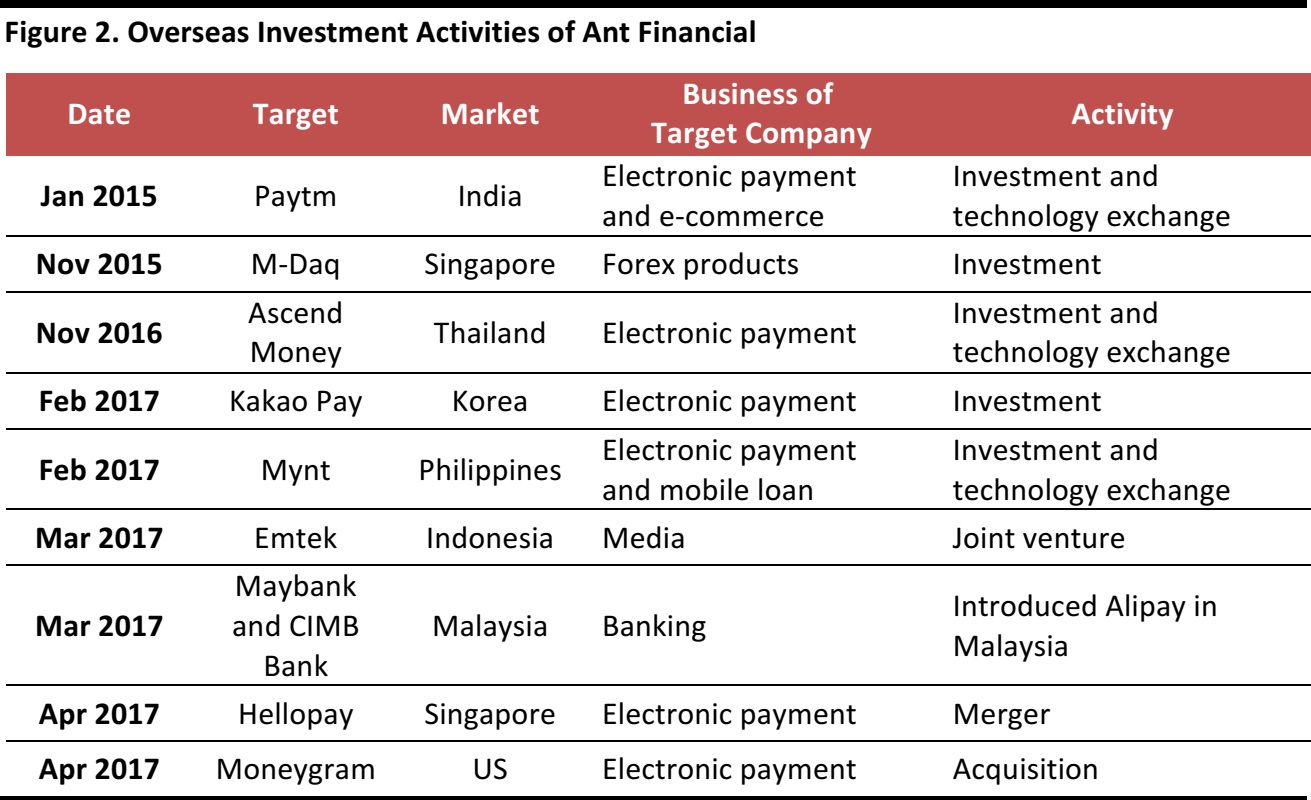

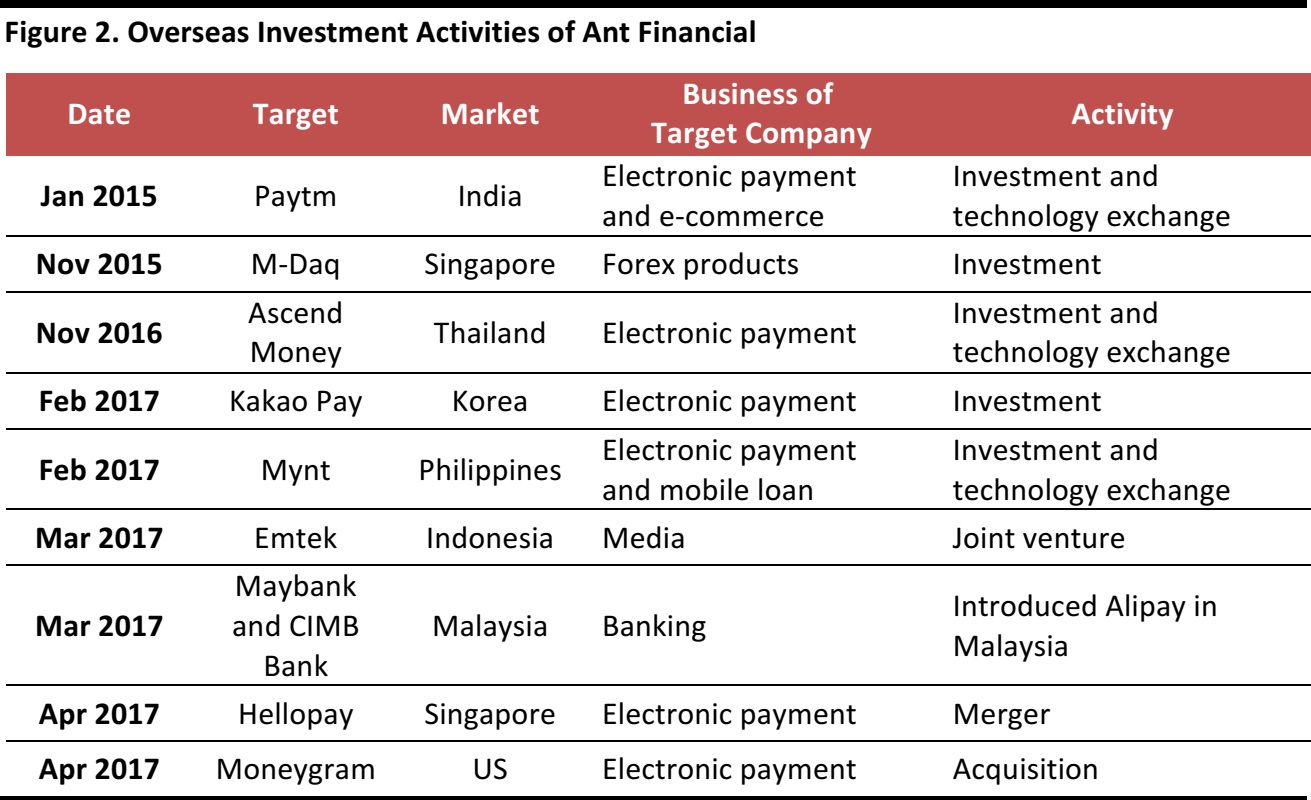

Ant Financial: The Alibaba Group affiliate has already purchased a number of payment firms globally, as shown in the chart below. Ant Financial’s globalization strategy is to provide Chinese tourists with the same seamless payment experience that they already have in the domestic market.

Source: antfin.com

Source: Techcrunch/Crunchbase/iresearch/Tech in Asia/FGRT

Tencent: WeChat Pay has also formed several partnerships with global payment firms. Tencent has invested in: Hike, a messaging platform; Flipkart, a leading e-commerce website in India; and partnered with Citcon in the US to enable merchants to accept payments from Chinese travelers. Most recently, Tencent applied for a Malaysian payments license earlier in July.

Source: tencent.com