Source: Company reports

4Q15 Results

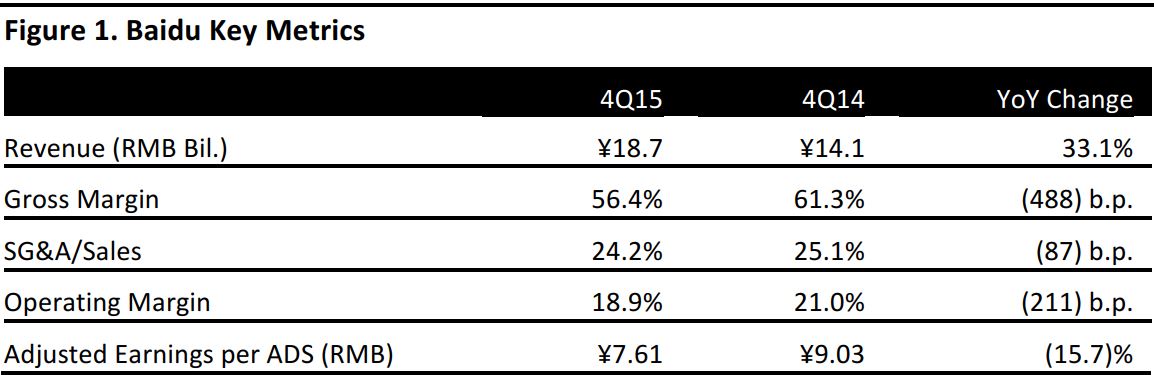

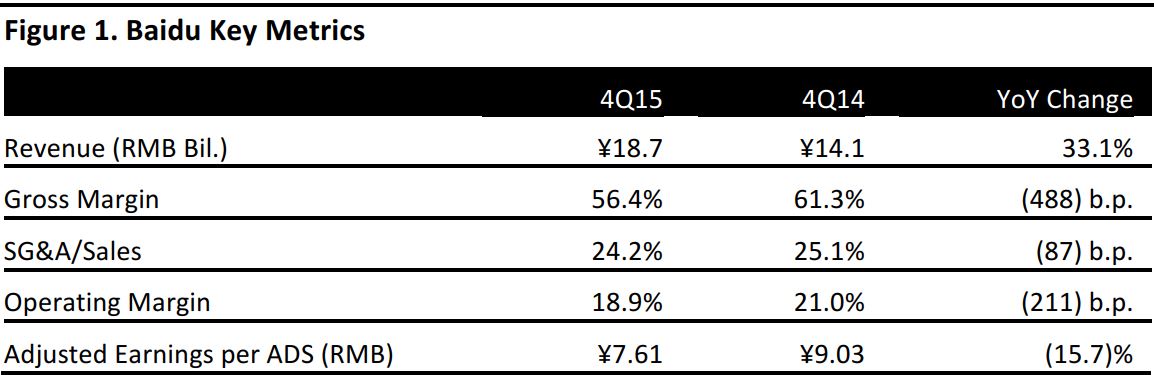

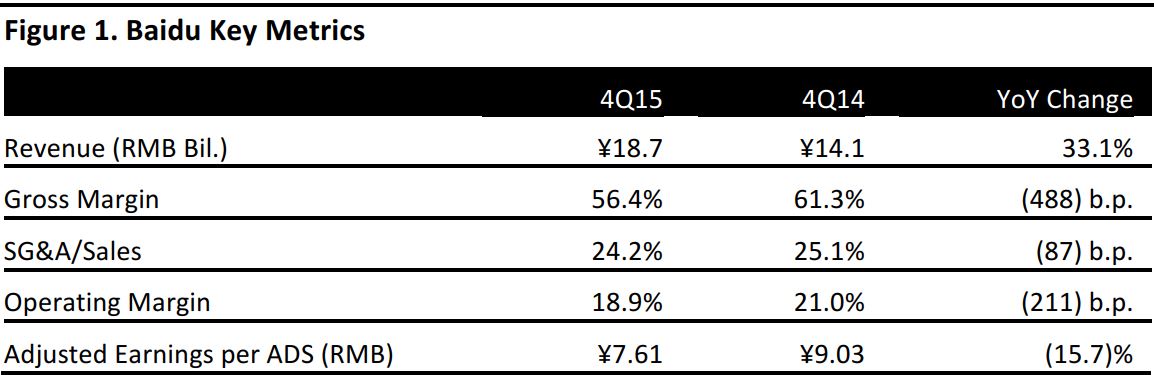

In the quarter, Baidu’s total revenues reached ¥18.7 billion (US$2.9 billion), a 33.1% increase over the corresponding period in 2014 and slightly ahead of the consensus estimate of ¥18.5 billion. Mobile’s contribution to revenue rose to 56% from 42% in the year-ago period.

The transaction services businesses reduced non-GAAP operating margins by 24.9 percentage points and online video service iQiyi reduced them by another 5.9 percentage points in the quarter.

Baidu had about 555,000 active online marketing customers in the quarter, an increase of 6.1% from the same period in 2014. Revenue per online marketing customer for the quarter was approximately ¥31,000 (US$4,786), an increase of 17.4% year over year and up 9.5% over the third quarter.

Adjusted EPS of ¥7.61 excludes a gain for the exchange of Qunar shares with Ctrip, compared to the consensus estimate of ¥7.78.

2015 Results

For the full year, total revenues rose by 35.3%, to ¥66.4 billion (US$10.2 billion). Mobile’s contribution to total revenues increased to 53%, from 37% in 2014.

Baidu had about 1,049,000 active online marketing customers in 2015, representing a 29.0% increase from 2014. Revenue per online marketing customer for 2015 was ¥60,500 (US$9,340), an increase of 1.9% from 2014.

The company deconsolidated Qunar’s financials after October 26, 2015, following the exchange of Qunar shares with Ctrip.

Guidance

Baidu expects to generate total revenues of ¥15.4–¥16.0 billion (US$2.4–US$2.5 billion) for the first quarter of 2016, representing an increase of 21.1%–25.5% year over year. Excluding Qunar, the guidance represents an increase of 27.8%–32.5% year over year.

The current consensus estimates for Q1 are revenues of ¥16.1 billion and EPS of ¥6.89.

The company said it plans to further build out its online marketing and transaction services platform in 2016.