Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

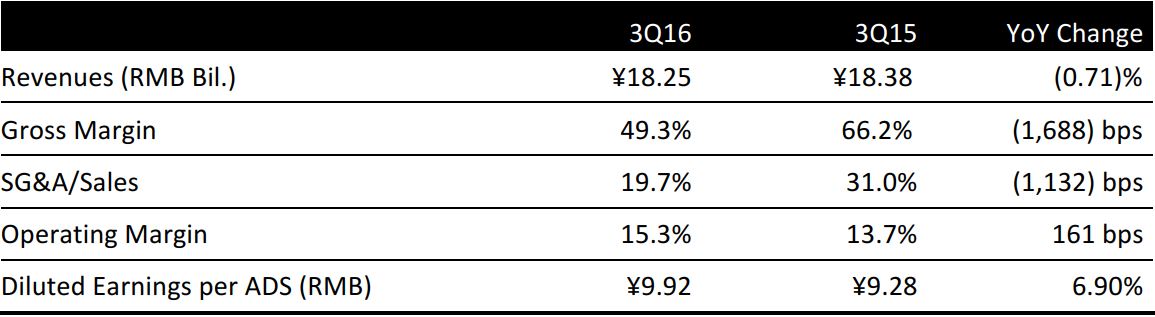

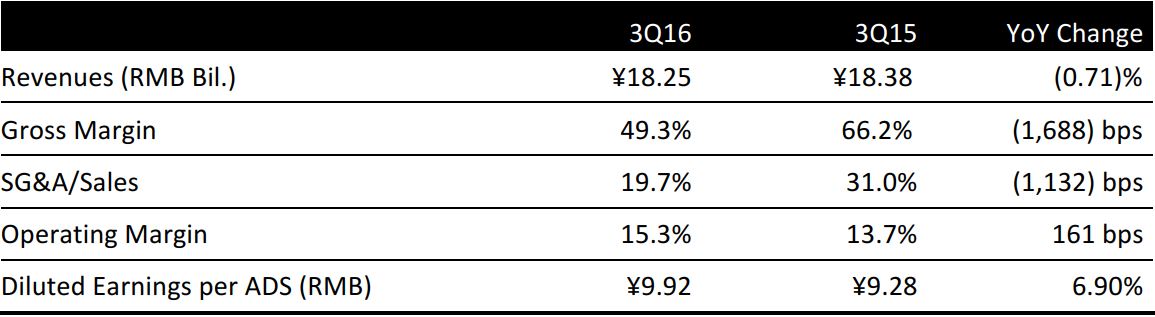

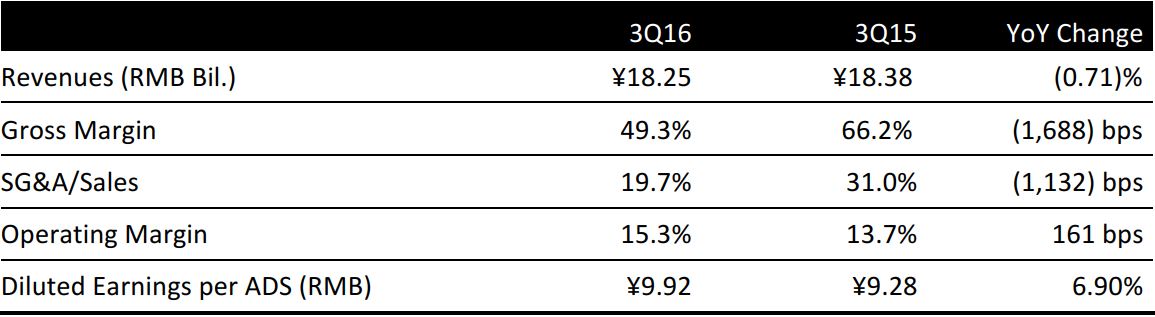

Baidu reported 3Q16 revenues of ¥18.25 billion (US$2.74 billion), a 0.7% decrease over the corresponding period in 2015. Mobile’s contribution to revenue rose to 64% from 54% in the year-ago period.

The transaction services businesses reduced the company’s non-GAAP operating margin by 21.4 percentage points in the quarter and online video service iQiyi further reduced it by another 7.7 percentage points. New regulations on medical-related search advertising continue to impact the company’s revenue.

Baidu had about 524,000 active online marketing customers in the quarter, a decrease of 15.9% from the same period in 2015. Revenue per online marketing customer was approximately ¥31,300 (US$4,694), an increase of 10.6% year over year. Non-GAAP diluted EPS was ¥9.92 (US$1.49) compared to ¥9.28 a year ago.

GUIDANCE

Baidu expects to generate total 4Q16 revenues of ¥17.84–¥18.38 billion (US$2.68–US$2.76 billion), representing a 1.7–4.6% year-over-year decrease. Excluding Qunar, the guidance represents growth of (2.0) –0.9% year over year. The company deconsolidated Qunar’s financials after October 26, 2015, following the exchange of Qunar shares with Ctrip. The current consensus estimates for 4Q16 revenue is US$2.89 billion.

During the 3Q16 earnings call, management noted that it expects the negative impact of the new advertising law to be most pronounced in 4Q16, followed by a recovery early next year after the re-registration of advertisers is complete. The company has begun the monetization process of the news feed service, and expects a meaningful revenue contribution for next year. Baidu will continue to develop artificial intelligence, which will help improve user experience and stickiness across its product lines, as well as drive future growth areas such as digital assistant Duer and autonomous cars.