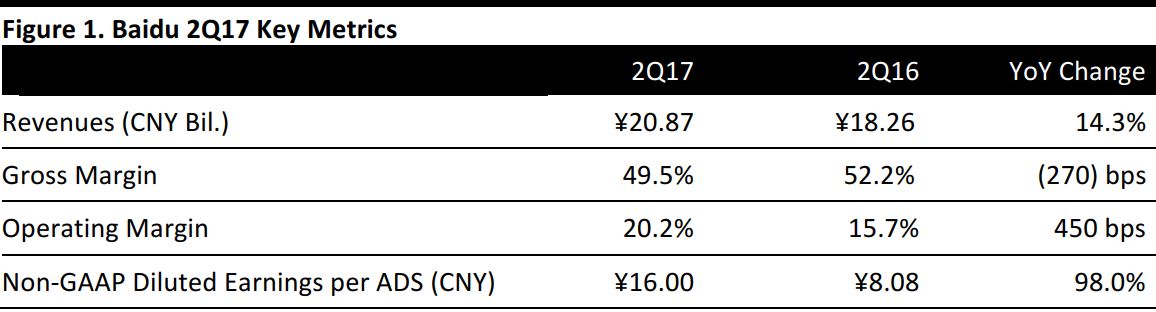

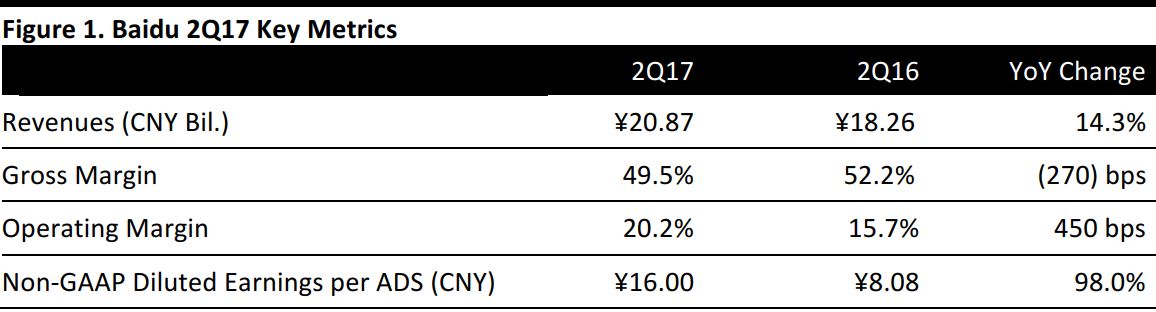

Source: Company reports/FGRT

Baidu reported 2Q17 revenues of ¥20.9 billion, a 14.3% year-over-year increase and broadly in-line with consensus. Non-GAAP diluted earnings per ADS was ¥16.00 in 2Q, beating the consensus estimate of ¥10.13, primarily driven by cost control in sales and marketing spend, as well as a tax-rate reduction.

2Q17 Results Review

Revenues: Total revenues in 2Q17 were ¥20.9 billion, a 14.3% increase from 2Q16. Mobile revenues represented 72% of total revenues, up from 62% in 2Q16.

- Online marketing revenues for 2Q17 saw a rebound, increasing 5.6% year over year to ¥17.9 billion. Baidu had approximately 470,000 active online marketing customers in 2Q17, a decline of 20.9% from 2Q16.

- Revenue per online marketing customer for 1Q17 was approximately ¥37,500, up 32.0% year over year.

Selling, general and administrative expenses were ¥2.9 billion, a decrease of 30.1% from the corresponding period in 2016, primarily due to a decrease in promotional spending.

Operating profit increased by 46.9% year over year to reach ¥4.2 billion.

Income tax expense for the quarter was ¥564 million, compared to ¥793 million in 2Q16. The effective tax rate for the second quarter of 2017 was 11.3%, compared to 24.8% for 2Q16. The decrease in the effective tax rate was due to the preferential tax status that was granted to certain PRC subsidiaries in 2Q17.

Non-GAAP net income attributable to Baidu in 2Q17 was ¥5.6 billion, an increase of 98.4% year over year. Non-GAAP diluted earnings per ADS was ¥16.00, beating the consensus estimate of ¥10.13.

Outlook and Strategy

Baidu expects 3Q17 revenues to be in the ¥23.13–¥23.75 billion range, representing a year-over-year increase of 26.7%–30.1% and a quarter-over-quarter increase of 10.8%–13.8%.

The company is at a transition stage of its core development strategy, with a focus on AI. The company plans to use AI as a driver to elevate its current core business, specifically the core products of Mobile Baidu, search and feed. In parallel, Baidu will continue to build out the newer AI-enabled initiatives through an open platform and ecosystem approach to capture long-term economic opportunity.