Source: Company reports

2Q16 RESULTS

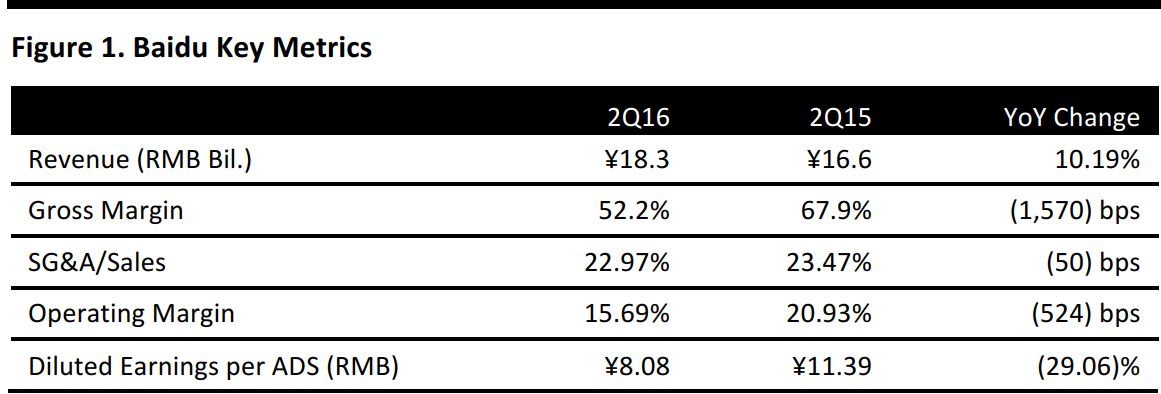

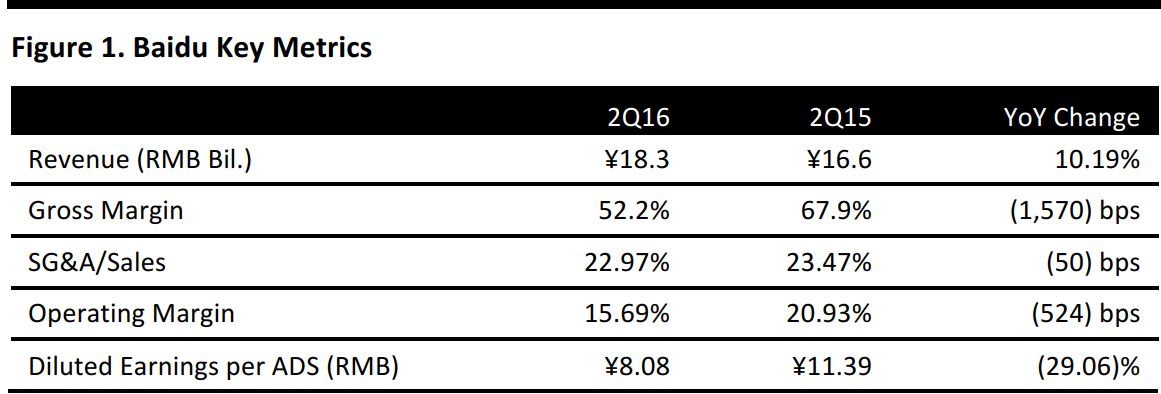

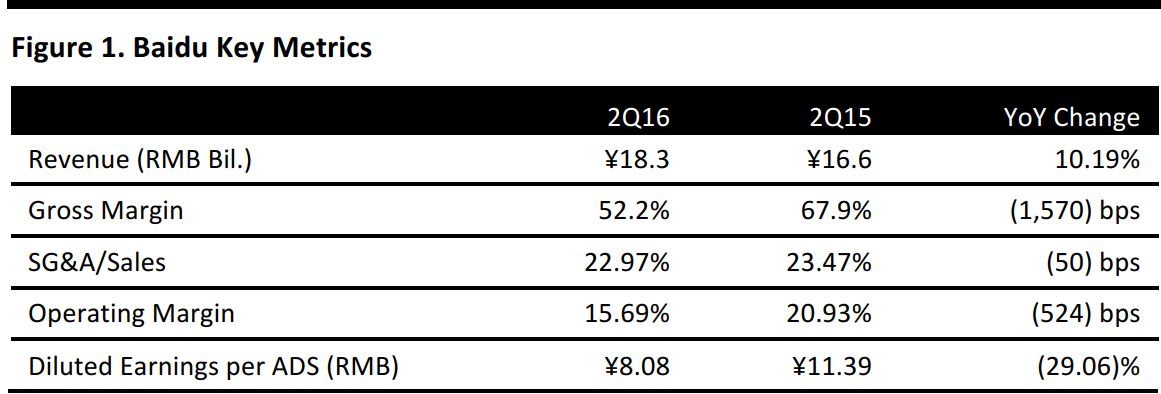

In 2Q16, Baidu’s total revenues reached ¥18.3 billion (US$2.7 billion), a 10.2% increase over the corresponding period in 2015. Mobile’s contribution to revenue rose to 62% from 50% in the year-ago period.

The transaction services businesses reduced the company’s non-GAAP operating margin by 25.4 percentage points in the quarter and online video service iQiyi reduced it by another 5.5 percentage points. New regulations on online advertising by healthcare companies have resulted in fewer ads from Baidu’s medical customers, according to a company statement released on June 13, 2016.

Baidu had about 594,000 active online marketing customers in the quarter, an increase of 0.7% from the same period in 2015. Revenue per online marketing customer was approximately ¥28,400 (US$4,273), an increase of 3.6% year over year. Non-GAAP diluted EPS was ¥8.08 compared to ¥11.39 a year ago.

GUIDANCE

Baidu expects to generate total 3Q16 revenues of ¥18.0–¥18.6 billion (US$2.7–US$2.8 billion), representing year-over-year growth of (1.9)%–1.1%. Excluding Qunar, the guidance represents an increase of 5.4%–8.6% year over year. The company deconsolidated Qunar’s financials after October 26, 2015, following the exchange of Qunar shares with Ctrip.

The current consensus estimates for 3Q16 call for revenues of ¥19.8 billion and normalized EPS of ¥9.32.

On the 2Q16 earnings call, management stated that the company’s strategy is to further build out its online marketing business and transaction services platform and to develop AI and machine learning–based technology. The company will manage the impact of the new regulations on Internet advertising on its operations. According to the new rules issued by the State Administration for Industry and Commerce on the classification of Internet ads, paid searches will be classified as Internet advertising for the first time, and that revenue is subject to an additional 3% tax.